5G

Indian telcos could capture over `5 lakh crore from private 5G by 2030!

Telecom sector is one of the most powerful engines available in India for the socio-economic development of the country. And, this engine is now being driven by the new and powerful fuel of 5G. 5G is becoming available in 2 avatars – a conventional public avatar and a more exclusive, lesser-known private or non-public version. The private avatar is far more relevant and important for India compared to the conventional public 5G. India needs to leverage private 5G heavily for its socio-economic transformation envisaged in Digital India. The benefits from this could be enormous not only for the telecom operators or telcos but also for several non-telecom verticals.

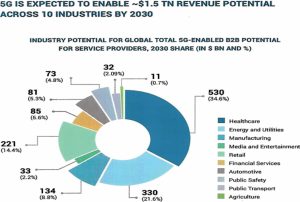

One needs to first appreciate that a private network is one which is not meant for the general public or the retail market, and is, strictly speaking, a closed network meant for the captive use of an entity/enterprise within the campus of that entity. The purpose of setting up such a closed or captive 5G network would be for achieving the digital transformation of various operations and functions within that enterprise or entity. Such actions could be like increased robotics/automation in the manufacturing line, more efficient digitally controlled transportation within the campus, remote surgeries/healthcare, real-time control and monitoring of critical operations, etc. The applications are endless and would give a tremendous boost to efficiency and cost reduction. Inarguably, these are direly needed by us to achieve and maintain global competitiveness. A NASSCOM Arthur D Little report indicates approximately USD 1.5 trillion revenue potential across 10 industries by 2030. With India already on a scorching pace of 5G rollout, it could hopefully capture a sizable portion of it.

It should be noted that telecom service providers (i.e., TSPs or telcos) have tremendous opportunities to leverage private 5G, which is also called captive non-public networks, or CNPNs, for growing their overall business aggressively. In fact, the relevant DoT stipulation in Clause 2.4 of the 5G spectrum NIA, based on the cabinet approval, clearly indicates four different ways in which private networks or CNPNs are permitted to be created – firstly, a TSP could provide CNPN as a service to an enterprise from its general public telecommunications network by resorting to techniques like network slicing, etc., or secondly, by the TSP specifically establishing a CNPN geared for the enterprise particularly but using its general IMT spectrum, or thirdly, by leasing out spectrum to the enterprise for the latter to set up its network itself. Only the fourth and the last way indicated by the government is for the enterprise to itself directly acquire the spectrum for its captive use and itself arrange to set up the network to meet its tight SLA requirements. Granted the very strong positions TSPs are in, one could expect that they have the regulatory advantage to capture at least 75 percent or more of India’s conservative share of 5 percent of the global market of USD 1.5 trillion. Simple arithmetical calculation would show that this could be over Rs 5 lakh crore!

It should be appreciated that while a small number of data plans are adequate to meet the requirements of a large and diverse retail consumer market, in the case of the enterprise sector, the use cases are invariably significantly different going from one enterprise to another, even though they may be in the same category of industry, i.e., Maruti Udyog could have entirely different service level requirements compared to a Toyota, which again would be different from Honda or TVS. Each one would need a tailor-made solution for its purpose. A one-size-fits-many approach, as used in the consumer or retail market, would be greatly suboptimal in the enterprise segment. This affords great business opportunities not only for private players or enterprises but also for telcos since the latter have tremendous experience with large infrastructure and resources.

While many small and medium enterprises could understandably prefer to have their special private network set up by the telcos or TSPs, it is quite logical to expect that large entities with domain knowledge and experience like Tata Group, L&T, Tech Mahindra, Infosys, Wipro, and many others would have the confidence and ability to set up their private networks themselves either with leased spectrum from the TSPs or procuring the spectrum directly from DoT. In fact, many of these large enterprises are already helping telcos to set up their networks. However, for reasons mentioned earlier, the telcos could be expected to garner a large chunk of the private 5G market. A recent Deloitte India survey finding indicates that nearly a third (32%) of enterprises in India stated that they would prefer to obtain airwaves from another company instead of directly purchasing spectrum from the government for 5G-based services. According to the report, 39 percent of the Indian enterprises are expected to invest anywhere between USD 10 million and USD 50 million for digital transformation for their organization. The finding also showed that India ranks second only to Japan among the nations surveyed in terms of investment planned on wireless networking.

There are, as per GSA, nearly 900 global deployments of private 5G or LTE networks. It is learnt that Analysys Mason issued a report that says private LTE and 5G network deployment are growing rapidly, to the point spending on them reach USD 7.7 billion in 2027, with a value growth at a compound annual growth rate (CAGR) of 48 percent between 2021 and 2027. As distinct from the value growth rate, Analysys Mason calculates the CAGR for network deployments to be 65 percent over the same period, reaching as high a number as 39,000 installations by 2027. Both GSA and Analysys Mason stated that manufacturing is the number-one venue for private 5G, and it has been leading early adoption of such networks. The global private 5G network size was valued around USD 1.38 billion in 2021, and it is expected to be around USD 6 billion by 2026. On the basis of its sheer size of geography, population and economy, India should be having at least 10 percent share of the global market for private networks, i.e., around 90 to 100 networks already. However, ground reality is that we do not have a single significant one. The business opportunity before telcos and private players is, therefore, simply humongous.

As in the global scenario, healthcare, energy and utilities, and manufacturing are expected to represent the top opportunity of private 5G in India. However, in contrast to the projected global scenario, we expect that India would offer very significant opportunities in the areas of agriculture and logistics/transportation. With yields in Indian agriculture being quite low, the scope for introduction of modern techniques in involving IoT and mechanized monitoring, etc., using private 5G, is quite large. For example, global biotech and agriculture major Bayer Ag is very confident of the potential for modern agricultural techniques in India as has been stated that they would be using a big chunk of their €2.6 bn R&D spends on digital farming in India. This demonstrates the big scope for business using private 5G for agriculture in India. As per the NASSCOM D Little report, “drone-led precision farming can reduce input costs by 18–20 percent, while enhancing yield by 30–100 percent.”

Similarly, in transportation and logistics, the Indian movement of goods could benefit from the improvement possible through 5G and automation. It is estimated that “5G can bring down the cost of logistics to 5 percent from 13–14 percent at present.” In a research study on the use of private 5G in ports, Prof. Rekha Jain, Visiting Professor at ICRIER and Former Chair of IIMA Telecom Centre of Excellence, estimated that through the use of private 5G, Jawaharlal Nehru Port (JNPT) could derive benefits in efficiency and RoI improvement up to 138 percent, and Chennai port could improve its RoI up to 76 percent.

Private 5G will represent the dawn of entirely new opportunities for the telecom service providers, the enterprises, and other private players, with resultant huge benefits for the economy and the common man. In fact, private 5G could be a powerful lever for fast tracking India’s competitiveness in the global arena. The key to success would be the working together of all players – the telcos, the enterprises, and other private players, in close collaboration and harmony. In private 5G or captive non public networks, the fruits from collaboration and coopetition would indeed be huge and remarkable.

The article is authored by TV Ramachandran, Hon. FIET (London) and President, Broadband India Forum. Views expressed are personal.

You must be logged in to post a comment Login