5G

Indian 5G auction — Why it is not ending?

We must all be surprised as to why the auction is going on even after the completion of a total of 37 rounds and has now spilled over to Day7. And that too when the reserve price is set reasonably high and plenty of spectrum available for all to take — a total of an astounding quantum of 72098 MHz! This quantum might look like a giant (31.2 x) compared to what was offered in the last auction of 2021 (only 2308 MHz). Given this fact, why the auction did not end on the 2nd day as the last auction did? This note is an attempt to answer this question.

Auction Design

In order to understand this enigma, we have to dive straight into the design of the auction. To a layman, this may appear quite complex, but I will try to simplify it as much as possible by referring to some simple examples.

Typical an auction (like the one that is currently on), runs into multiple rounds. Each round is mapped to a specific price and the power of declaration of such prices vests with the auctioneer. The bidder simply has the flexibility to either agree or disagree with the price. If he agrees, then it is called a positive bid, otherwise a no-bid. Now the bidder’s empowerment to bid in the next rounds depend on many factors. He simply can’t just decide to bid in the next round — in the same band/circle, or in some other. He can do so only when some conditions are fulfilled. What are these conditions? Let’s discuss this by going through an example.

Assume that there is a circle with 10 MHz of spectrum and 3 bidders are gunning for it. Let’s call these bidders A, B & C. In round no 1, the auctioneer declares a price of Rs 100 Cr for one block of 5 MHz. Now assume that A & B, and C bid 5 MHz each — taking the total demand for this circle to 15 MHz, which is more than the supply (10 MHz). Hence, in order to break the stalemate, the auctioneer will rank the bidders using some rules (defined in the NIA-clause 9.8.6, page 71). Bidders ranked 1 & 2 will get declared as PWB (Provisional Winning Bidder). Now Excess Demand (ED) is 5 MHz (Demand — Supply). This Excess Demand is used as a metric by the auctioneer to calculate the quantum of price increase in the next round. This increase kicks in when the ED≥0 (i.e demand-supply≥0). The proportion of this increase depends upon the magnitude of ED. The higher the magnitude, the more will the increase. But price increase does not happen if the ED<0, i.e negative. Since in this case ED>0, there will be a price increase, and let’s assume an increment of 2.5 %. This means that the next round’s price will now rise from Rs 100 Cr to 102.5 Cr.

Now as soon as the bidder opens up the auction to round №2 with that price, then all the three bidders will get placed differently in their ability to choose whether to bid or not bid in the next round. Since bidders A & B were PWBs in the earlier round, they can choose not to bid, but bidder C doesn’t have that option. He has to bid, or else his points will get exhausted. These points are allocated by the auctioneer to the bidder before the start of the auction and are in proportion to the EMD (Earnest Money Deposit) that the bidders had earlier submitted to the government. Now in order for bidder C to remain in the fray, it is necessary that he preserves his points throughout the auction. For that, he must submit bids in the next round or in every round when he is not a PWB. Else he cannot bid in the next round, i.e Round №3. Now, the above explanation will get a little tweaked by the “Activity Factor” when it is set to less than 100%. But let’s leave that discussion out for time being for the sake of simplicity and assume the Activity Factor is 100% — which resonates with the situation now case now as the auction has already reached a level of maturity.

UPE 1800 MHz Band

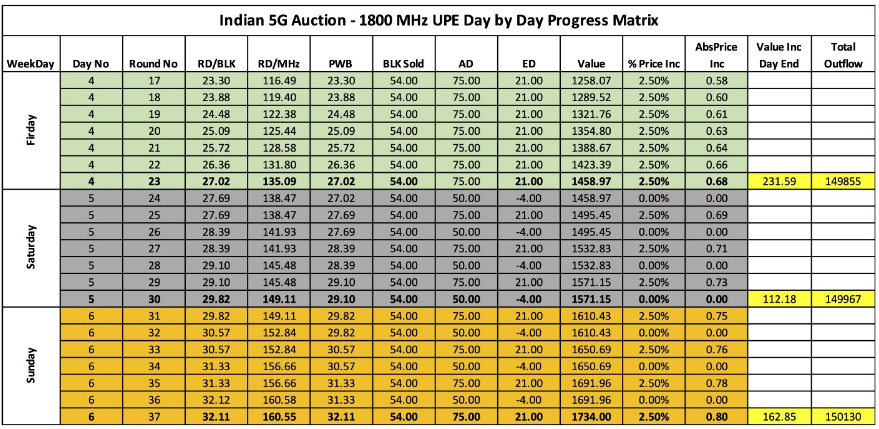

With this background, let’s try to visualize the situation in UPE. For that, you need to refer to the following picture. This chart captures the last 3 days of round-by-round auction in UPE for the 1800 MHz band.

Case 1 — Three Bidders (Each bidding 5 MHz)

We know that (based on EMD values) three bidders have the power and intent to bid in this band/circle. Now for the time being assume, all the three bidders are bidding 5 MHz each (ie 25 blocks of 0.2 MHz each). This shall lead to an Aggregated Demand (AD) of 75 blocks (15 MHz) and an ED (Excess Demand) of 21 (75–54). We have 54 blocks of 0.2 MHz each up for sale (10.2 MHz). Hence each round on Day4 there has been a price increase of 2.5%. Now, as per the earlier description, the first two bidders (ranked 1 & 2) need not bid in the next round, but they also bid along with the third bidder who is not a PWB. They do so in order to ensure that they are able to grab 10 MHz if one of them becomes lucky in case the other bidders decide to call it a day. Also, by bidding in the next round the bidder who is already a PWB in the earlier round will get ranked 1st and will be able to knock off the other PWB (in the earlier round who has bid 5 MHz) and can get full 10 MHz at the price of the earlier round. This is the motivation that keeps the PWBs keep bidding in the next round along with the non-PWB, thereby driving the AD to 75 (15 MHz, each bidding 5 MHz).

But what explains in a three-bidder scenario the case of alternate ED of -4 and 21? The only explanation is that each of the bidders is bidding 5 MHz and one of the PWB bidders decides not to bid in one of the successive rounds. This means that in the next round there are only 2 bidders, each bidding 5 MHz leading to an AD of 50 and ED of -4.

Case 2 — Two Bidders (One bidding 10 other 5 MHz)

The situation can be simulated with a two-bidder scenario as well. How? Let’s discuss. Let’s say of the two bidders one of them wants the full 10 MHz (spectrum offered for sale is 10.2 MHz), and he wants to ensure that he gets it by making sure that he is ranked 1 in every round. Hence, such a bidder will bid 10 MHz in every round (50 blocks), and if the other bidder bids 5 MHz (25 blocks), then this will lead to a situation of AD = 75 and ED = 21. This will result in a price increase of 2.5% in every round as we saw on Day4. But this will lead to price increases which will follow the exponential trajectory.

Hence, in order to dampen the price increase, the bidder bidding 10 MHz might decide to bid on 10 MHz in alternate rounds. Even by following this strategy, he might still win 10 MHz if the other bidder decides to quit. How? Let’s say in one of the rounds the bidder wanting 10 MHz bids 5 MHz, and the other bidder who is satisfied with 5 MHz bids 5. Hence, the total AD for that round is 50 and ED will be -4. Now in the next round, the same bidder (wanting 10 MHz) bids 10, and the other bidder bids 5. Then in this case AD=75, and ED=21. In both cases, the bidder wanting 10 MHz can get 10 MHz. How? Due to the following reasons— a) Round N, bidder 1 bids 10 MHz, and bidder 2 bids 5 MHz; b) Round N+1, bidder 1 bids 5 MHz and hoping the bidder 2 quits. In this situation, AD = 25, and ED = -29, and the auction will close in the next round. But bidder 2 doesn’t quit and bids 5 MHz in the next round and this keeps the auction running by following the same trajectory as seen in the daily charts.

Case 3 — Two Bidders (Both bidding 10 MHz)

This situation is very drastic and will drag the auction for an extended period of time. But from the figure above it doesn’t look that this is the case. The reason — if both bidders bid 10 MHz simultaneously in the same round we should have seen an AD of 100 in one of the rounds. We don’t see any symptoms of the same at the end-of-day report. Even if both are bidding 10 MHz, they are not doing so simultaneously in the same round.

Auction Closure

When will the auction close? The auction will close in the following situation — a) One bidder takes 10 MHz, and the other two decide to quit; b) Two bidders spit 10 MHz into 5 MHz each and the third decides to quit. The auction will not close if all three bidders are gunning for 5 MHz, one bidder is hell-bent on taking 10 MHz — leaving the other two with nothing. Looks like we haven’t reached that situation yet — driving the auction to the 37th round and to Day7.

UPE Valuation

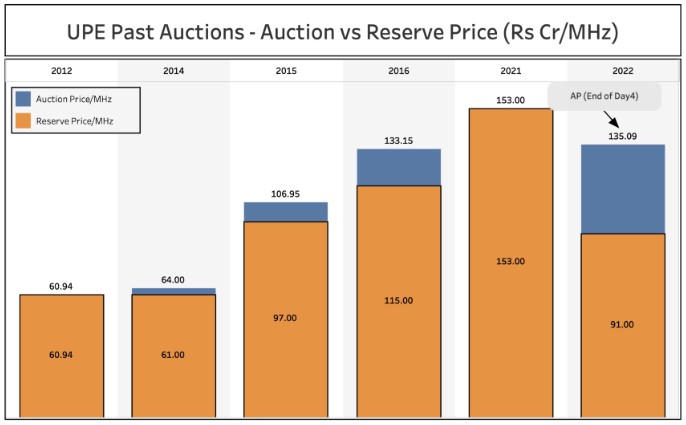

The following chart captures the valuation of UPE compared to the past years.

One can see that at the end of Day6, the valuation of UPW has gone above last year’s reserve price. Note, in the last auction of 2021, the UPE spectrum in the 1800 MHz band was sold at the reserve price.

Conclusion

Given the above explanation, the auction will continue for time till the bidders give up their claim of taking the full 10 MHz and decides in splitting the spoils to 5 MHz each. And of course, the third bidder has to give up his claim totally. Till that time the auction will continue to run and we all have to wait patiently for the results. Now, the question that can come to the reader’s mind is, of the 10 bands with 22 circles in each band why UPE has got singled out for the battle? This is due to the peculiar situation in UPE which has been explained in the note titled — Indian 5G Auction — The Battle of Uttar Pradesh (East). Readers interested can go through it. Let’s all hope the current stalemate gets resolved soon and we all move forward towards execution and roll out of 5G in India.

You must be logged in to post a comment Login