CT Stories

India readies for another round of spectrum auction

On March 1, the Department of Telecommunications will begin the single auction process for assigning 660 MHz spectrum in the 700 MHz band, 230 MHz in 800 MHz band, 98.8 MHz in 900 MHz band, 365 MHz in 1800 MHz band, 175 MHz in 2100 MHz band, 560 MHz in 2300 MHz band and 230 MHz in 2500 MHz band. The latter two are unpaired bands. Bids have been invited for a total of 2318.8 MHz of airwaves, the reserve price of all these bands together has been fixed at ₹3.92 lakh crore. MSTC has been selected to handle the spectrum auction.

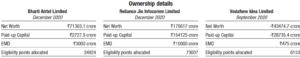

Indian telcos have spent nearly ₹3.7 lakh crore over six spectrum auctions since 2010. But this is the first time there are likely to be only three bidders, Bharti Airtel, Reliance Jio, and Vodafone Idea. While the NIA has clauses to factor in new entrants, including foreign players, it’s unlikely that any new player will join the fray, given the dire state of the industry with debt of over ₹8 lakh crore, and weak pricing power.

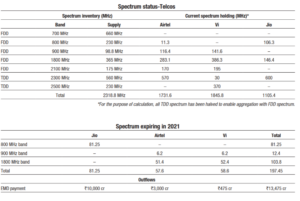

In the 3 bands, a total of 197.45 MHz of spectrum is expiring for the three telcos combined. Jio has 81.25 MHz of spectrum in the 800 MHz band expiring, including that from Reliance Communications. For Airtel, 51.4 MHz of spectrum expires in 1800 MHz band and 6.2 MHz in the 900 MHz band, and for Vi 52.4 MHz expires in the 1800 MHz band, and 6.2 MHz in the 900 MHz band. At the reserve price, Jio will need to shell out ₹28000 crore billion, Airtel ₹12900 crore and Vi ₹8300 crore for the expired spectrum.

Jio has deposited earnest money of ₹10,000 crore, Airtel ₹3000 crore and Vi ₹475 crore. This qualifies for Jio to buy spectrum for about ₹45000-₹66000 crore, Airtel for ₹15000-25000 crore and Vi for ₹3500 crore. The bidders can bid seven times their respective EMDs.

The high EMD indicates that the telcos may be purchasing more spectrum than required for renewal of its expiring spectrum, and Jio will likely be most aggressive. Airtel will be spending some amount of money, but nothing huge, while Vi will probably be the lowest spender, as it has adequate spectrum.

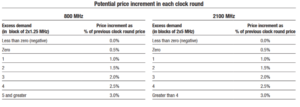

Going by the last auction, out of a total 2354.75 MHz, only 964.8 MHz (40 percent of the offered quantity) amounting to ₹65789 crore, 4 percent over the reserve price was purchased. This auction too, while a total of 2310.05 MHz is being auctioned, including 700 MHz spectrum, that is once again up for auction, albeit at a 43 percent lower reserve price, from ₹11,485 crore per MHz in 2016 to ₹6568 per MHz, for a pan-India 5 MHz block, it is unlikely that the situation will change much.

For the other bands, when compared to the October 2016 auction, the final reserve price for 800 MHz spectrum in the upcoming auction is 18.5 percent lower. In comparison, for 1800 MHz, the final reserve price for the upcoming auction is 14.5 percent higher and for 2300 MHz, the price is 17.5 percent higher than the last auction. These two bands are expected to witness relatively good demand as these are the next-best candidates after the 3300-3600 MHz bands earmarked for 5G services. Bulking up existing 4G spectrum will allow telcos to launch 5G services immediately in those bands, without waiting for sale of airwaves in the 3300-3600 MHz bands.

“Airtel’s bidding strategy in the spectrum sale next month would be calibrated to acquire pan-India holdings of sub-GHz spectrum that can be deployed for 5G. It would also go for renewals in the 1800 MHz band and mop up additional capacity spectrum in the 2300 MHz band.”

Gopal Vittal

Managing Director and Chief Executive Officer, Bharti Airtel-India and South Asia

Payment Terms

Successful bidders shall either make a full upfront payment within ten days of declaration of final price or pre-payment of one or more annual instalments OR opt for the deferred payment.

“Given the consolidation in the sector over the last decade, we hope telcos will say goodbye to the old irrational and desperate price bidding to acquire the limited available spectrum. We expect low competition intensity as there is sufficient spectrum, and different band usage and priorities of each player.

Bharti has a strong portfolio of 1,800 MHz spectrum, with an average 15 MHz in 15 circles and below 10 MHz in four circles. In Delhi, it does not have a high proportion of spectrum in 900 MHz and largely relies on 2,300 MHz for capacity. So, it could be keen to acquire spectrum in 1,800 MHz, which could entail an investment of ~₹22b for 5 MHz at the reserve price. RJio has an average 7 MHz in 1,800 MHz, so it could spend wherever sufficient 800 MHz spectrum is unavailable. In the 2,300 MHz band, both Bharti and RJio could look to top up their spectrum capacity. Bharti may choose to fill gaps in the three circles where it does not hold any spectrum. But with a healthy 2-4 blocks of 10 MHz available in 2,300 MHz, there could be lesser competition intensity.

With a FCF of ₹99b/₹215b in FY21E/FY22E (excluding spectrum renewal), Bharti should be comfortably placed. But it could reduce the company’s FY22E post interest FCF to ₹75b and increase its net debt to ₹882b (v/s ₹755b expected earlier). RJio has sufficient liquidity from the recent stake sale to fulfil its CapEx requirement, with a FCF of ₹132b/₹143b in FY21E/FY22E. VIL’s liquidity remains precarious and may choose not to renew its existing spectrum in most circles. We have factored in ₹130b/₹280b toward spectrum acquisition for Bharti/RJio.”

Motilal Oswal Financial Services

Some of the main conditions of the deferred payment are:

- An upfront payment of 50 percent in the case of 1800 MHz, 2100 MHz, 2300 MHz, & 2500 MHz bands, and 25 percent in case of 700 MHz, 800 MHz and 900 MHz bands of the final bid amount shall be made within ten calendar days of issue of demand notice of DoT. For spectrum becoming available at a later date, which will be assigned beyond one month of the close of this auction, the component of the 25 percent/50 percent upfront payment payable at the time of auction completion shall be 10 percent of the bid amount for sub-1 GHz bands, and 20 percent of the bid amount for other bands; and the balance component of upfront payment (total of which is 25 percent of sub-1 GHz and 50 percent for other bands) shall be made one month prior to the effective date.

- There shall be a moratorium of 2 years for payment of balance amount of one-time charges for the spectrum, which shall be recovered in 16 equal annual instalments.

- The first instalment of the balance amount shall become due on the third anniversary of the scheduled date of the first payment. Subsequent instalment shall become due on the same date of each following year. Prepayment of one or more instalments will be allowed on each annual anniversary date of the first upfront payment, based upon the principle that the Net Present Value of the payment is protected.

- Along with the upfront payment, the successful bidder will have to submit an FBG equal to the annual instalment which shall be valid for three years to DoT.

The interest rate has been dropped from 9.3 percent in the 2016 auction to 7.3 percent for the current auction.

The validity of spectrum awarded would be for 20 years, spectrum holding caps remain unchanged at 50 percent for sub-GHz (700, 800 and 900MHz), and 35 percent of total spectrum available in each circle; and DoT may carry frequency reconfiguration or rearrangement of spot frequencies resulting in contiguity of spectrum and improve spectrum efficiency.

The government has made a projection of getting almost ₹54,000 crore in revenue from the telecom sector in FY22, a fourth this fiscal itself, as upfront payment. This does not include proceeds from a 5G spectrum auction because no decision has been taken on holding such a sale.

“The government’s estimated receipts of USD 7.4 billion in FY22 comprise of USD 2.5 billion as upfront spectrum payments, USD 2 billion as licence fees collections, USD 900 million towards SUC and USD 1.9 billion as AGR-related payments. The inclusion of about USD 2.5 billion as upfront spectrum payments in the next fiscal year implies a follow-up auction of airwaves worth about USD 5 billion.

Either a 5G spectrum auction will not take place in FY22 or the price of 5G spectrum would be lowered in future, or else, operators would bid for spectrum only in a few circles” if 5G airwaves are at all auctioned.”

Jefferies

“We consider the upcoming spectrum auction to be an event which could help Jio and Bharti fortify their 5G positioning by acquiring good magnitude of 1800 and 2300 MHz (bands that could be used for 5G). Conversely, we do not expect Vodafone Idea to be in a position to bid for 5G bands given its weak balance sheet. Jio will also be under pressure to renew its 800 MHz spectrum.

While we do not expect material overbidding (except in select 1800/2300 MHz circles), we believe the larger quantum of spectrum acquired by Jio/Bharti may surprise the market. Senior management is likely to think long-term, but it could impact near-term share price performance.”

BofA Securities

“Reliance Jio is likely to not only renew the 44 MHz spectrum that it had bought from Reliance Communications, but to also bid for additional spectrum in the 55 MHz band owned by the latter in the upcoming auctions. It is expected to incur a total capital expenditure of ₹240 billion at reserve prices, and would require to make an upfront payment of nearly ₹60 billion, if it were to opt for the long term deferred payment plan.”

Credit Suisse

“Tariff hikes and upgradation of subscribers from 2G to 4G is expected to result in improvement in ARPU to around ₹220 in the medium term which will lead to growth in industry revenue by 11 to 13 percent over the next two years with operating margins expanding to nearly 38 percent for FY22.

The improvement in cash flow generation coupled with moderation in CapEx intensity will limit the dependence on incremental external borrowings for operations. However, the addition of AGR liabilities to debt and the next round of spectrum auctions will act as a dampener.”

ICRA Limited

“Spectrum auction in India has turned into a buyer’s market. We expect minimal competition, with operators picking up spectrum that provides best value for money instead of focusing on renewing all their expiring spectrum.”

Kunal Vora

Equities Research