5G

How analysts see the 5G spectrum auction panning out

Here’s how analysts see the 5G spectrum auction panning out now:

Morgan Stanley

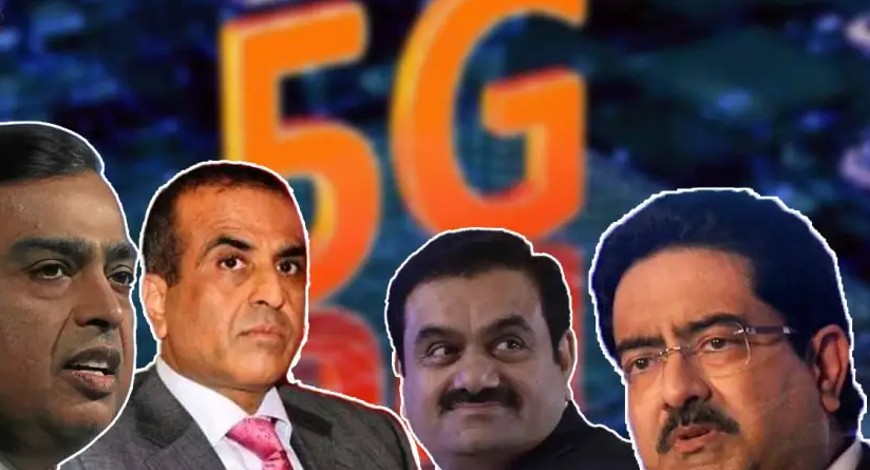

- EMD amount provides more comfort on the “intent” part and rules out any large-scale rollout of commercial services in the near term. Eligibility points allocated to the new applicant Adani Data Networks positions it to obtain spectrum amount of Rs 700-1,140 crore under different scenarios (spectrum wining price 8.0-9.2x of EMD amount).

- This is under the assumption that Adani Data Networks bids for 5G bands (3300 MHz or 26GHz) for few local service areas/circles. Based on the location of the group’s physical network of assets, it may be keen to bid for LSAs like Gujarat, Andhra Pradesh and Maharashtra.

- Given enough availability of spectrum, any sharp aggression or bidding higher than the reserve price appears unlikely. The highest amount of spectrum available per player for 5G bands on a pan-India basis would be worth Rs 48,900 crore. Assuming both Jio and Bharti Airtel bid to the maximum extent allowed, there would still be enough spectrum left to satisfy the maximum amount that the other two players can bid based on their EMD amounts.

- Reliance Jio’s EMD came in higher than indicated by media reports and materially higher than Bharti Airtel’s. This gives Jio flexibility to go beyond 5G bands (3300 MHz/26 GHz) and bid either for the existing bands it has (800MHz, 1800MHz and 2300MHz) and/or new bands (600 MHz, 700 MHz). The additional maximum amount of spectrum for other bands that Reliance Jio could go for would be Rs 54,500-73,600 crore.

- EMD amount suggests spectrum liability for Bharti Airtel could be higher than base-case estimates. The maximum potential spectrum that Bharti Airtel could bid for would be Rs 48,900 crore versus base-case estimate of Rs 19,180 crore in FY23. To that extent, there would be upside risks to our net capex and net debt forecasts.

- Given Airtel’s stock corrected by 4.6% against the Sensex gains of 0.1%, since Adani expected participation in auction was reported on July 8, there could be some pull back for the stock in the near-term. However, key trigger for the shares would still be tariff hikes, expected around November/December 2022.

Nomura

- Total EMD submitted for the upcoming auction is Rs 21,800 crore, with Jio contributing 64% of the overall EMD. Given adequate spectrum availability, Nomura estimates all the winning bids at the reserve prices with overall spectrum outlay of potentially Rs 1 lakh crore.

- Nomura believes that concerns of Adani group entry into the telecom sector has eased significantly after the group submitted a modest Rs 100 crore as EMD. That would likely bring Adani’s overall outlay to less than Rs 800-1,000 crore, restricting its participation to 2*50 MHz pan India spectrum in 26 GHz band largely for the group’s captive usage.

- Vodafone Idea submitted EMD of Rs 2,200 crore against a modest Rs 480 crore it submitted in 2021 auctions. That means Vi’s overall outlay is likely to be as high as Rs 18,400 crore, but could be offset by the annual spectrum usage charges savings. Nomura thinks Vi could bid for 11*50 MHz pan-India spectrum in 26 GHz spectrum band and 5*10 MHz spectrum in 3,300 MHz band in metros—Circle

- A and Circle B—accounting for nearly 95% of Vi’s access revenue.

Jio’s EMD appears significantly higher. However, Nomura notes that historically Jio has submitted much higher EMDs. The research firm estimates Jio’s potential outlay at Rs 40,500-60,000 crore. - Nomura assume in their base case for Jio to bid for pan-India 100 MHz spectrum in 3,300 MHz band, 22*50 MHz pan-India spectrum in the 26 GHz band and some spectrum top-ups in the 800 MHz band to complete at least 10 MHz pan-India spectrum in sub-GHz band.

- Despite the successive sharp cuts in the reserve price, 700 MHz spectrum band has not had any takers so far. Unless Jio were to turn very aggressive, Nomura doesn’t think 600/700 MHz band will attract takers in the upcoming auction.

- Thinks Bharti will likely bid for pan-India 100 MHz spectrum in 3,300 MHz band, 22*50 MHz pan India spectrum in the 26 GHz band, with an overall outlay of Rs 39,400 crore. With savings from zero SUC, Bharti’s net outgo on spectrum could be modest Rs 700 crore annually.

Given the nascent 5G ecosystem and evolving use cases, Nomura thinks 5G rollouts would likely be granular starting with metros and larger cities. - There is a potential for telcos to charge a premium for 5G. The tariff plans would be a key monitorable in the near-term, and 5G premium may provide the next leg of ARPU uptick for the telecom firms.

- With the 5G rollouts, Nomura sees Airtel and Jio gaining market shares at Vi’s expense. Thus, India is likely to see a virtual duopoly in its telecom market.

“Airtel remains our preferred pick among listed Indian telcos,” Nomura said in the report.

Motilal Oswal

- Earnest money deposit announced by the participants (typically the maximum auction participation is 8- 10x of the EMD), underscores sizeable 5G participation by each telco, except the Adani Group, but limits the possibility of a bidding war.

- Telcos have offered a sizeable EMD in a bid to create a reasonable war chest to combat any aggression ahead of the 5G auction.

- The Adani Group is not a contender. It may limit its bids to select circles (where it has an airport, port, logistic operations, and power assets) for possible 5G enterprise solutions.

- Considering it goes full throttle acquiring 5G spectrum across all bands (10MHz/100MHz/1000MHz quantity in the 700MHz/ 3300MHz/26GHz band), Jio will still require sub-Rs 80,000 crore at the current reserve price, way below the maximum allowance allowed under the EMD. Expect Jio to limit its spending to Rs 40,000-50,000 crore for 3500MHz in the 26GHz band, with limited participation in the high cost 700MHz band.

- Airtel’s EMD of Rs 5,500 crore should suffice for an investment of Rs 35,000-40,000 crore in the upcoming 5G auction, with 100MHz spectrum bid for in the 3300MHz band on a pan India basis. This is in line with our expectation and should be offset against the Rs 21,000 crore fund raise. (Rs 16,000 crore right call money and Rs 5,200 crore investment by Google)

- Vi’s EMD of Rs 2,200 crore may allow it to bid for over Rs 15,000-20,000 crore worth of spectrum. This may lead to a 50MHz spectrum bid in the 3300MHz band, with an annual payout of Rs 1,000 crore. With an Ebitda of a mere Rs 8,000 crore, its capex is much lower than peers. This can further impact its ability to invest in its network.

- No risk of overbidding. Unlike previous auctions, there is abundant spectrum; limited participants; and cap on spectrum bidding to limit the bidding space to three-to-four sizeable players across 5G bands.

- Unlike a 3G/4G technology upgrade, which pushed consumer mobility towards data usage, 5G may not materially move the needle in the near term.

- 5G auction remains a key overhang on telcos, particularly Airtel, as any aggressive investment, with limited near-term monetization possibilities, can add to their balance sheet woes. But EMD disclosure has partly addressed the overhang of aggressive bidding, particularly from new entrants.

- Expect Airtel to garner 18% Ebitda CAGR over FY22-24, even without building any earnings from forthcoming tariff hikes – a high probability in the next couple of quarters. Remains positive on Airtel.

Dolat Capital

- Lower EMD by Adani is a positive for the sector and Airtel/Jio and shall recede a major investor concern wrt entry of new player. However, high bids of Jio signals its intent of aggressive bidding.

- See limited need for Jio to ramp-up 4G spectrum holding. There is a possibility that Jio may buy additional 4G spectrum in current auctions and later re-farm it for 5G.

- Service usage charges, which currently stand at 3.5% of revenues is expected to decline to 0.3-0.5% of revenues. 300 basis points reduction in SUC shall lead to a benefit of Rs 2,500 crore for Jio, Rs 2,000 crore for Bharti and Rs 1,100 crore for Vodafone Idea on their current revenue.

- With stretched financials, the capability of Vodafone Idea to acquire any kind of spectrum is limited. But, Dolat foresees Vodafone Idea acquiring significant quantum of 26.5GHz band spectrum to lower the SUC charges. A 5G dark network and brand would be a severe dampener for it from future customer retention perspective.

- Globally, 5G use cases have been limited. Only USA, UK and China are rolling out 5G networks. Monetization is still away. In this backdrop, Dolat foresees limited monetization from 5G in India for next 2-3 years.

- Once 5G auctions get over it should lead to a relief from an event and overhang perspective. SUC benefits shall be add-on. Incremental capex/opex on 5G shall be limited and will be replacement of 2G/4G thereby limiting the impact on free cash flow, if any.

- Tariff hike in later part of 2022 will keep the investor interest high and positive. Remains positive on Bharti with a target price of Rs 843.

Bloomberg

You must be logged in to post a comment Login