5G

Govt becomes the largest shareholder in Vi

The government had asked for a part of the dues Vi owes to the exchequer to convert into equity in the government’s name.

“It is hereby informed that Ministry of Communications, Government of India has…[directed] the company to convert the NPV of the interest related to deferment of spectrum auction installments and AGR Dues into equity shares to be issued to the Government of India,” said the telco, in an exchange filing on February 3.

“It is hereby informed that Ministry of Communications, Government of India has…[directed] the company to convert the NPV of the interest related to deferment of spectrum auction installments and AGR Dues into equity shares to be issued to the Government of India,” said the company.

The total amount to be converted into equity shares is Rs 16,133.18 crore. The company has been directed to issue 16.13 crore equity shares of the face value of Rs 10 each at an issue price of Rs 10 each, it said.

On February 3, the stock ended the day at Rs 6.89.

The development comes after months of waiting after the company showed its willingness to convert the debt into equity. The final communication in this regard will do away with uncertainty and bring down the debt on the book of the company.

The total gross debt (excluding lease liabilities and including interest accrued but not due) as of September 30, 2022, stood at Rs 2,20,320 crore, comprising deferred spectrum payment obligations of Rs 1,36,650 crore (including Rs 17260 crore towards spectrum acquired in recent spectrum auction) and AGR liability of Rs 68,590 crore that is due to the Government, and debt from banks and financial institutions of Rs 15,080 crore.

Cash & cash equivalents were at Rs 190 crore while net debt stood at Rs 2,20,130 crore.

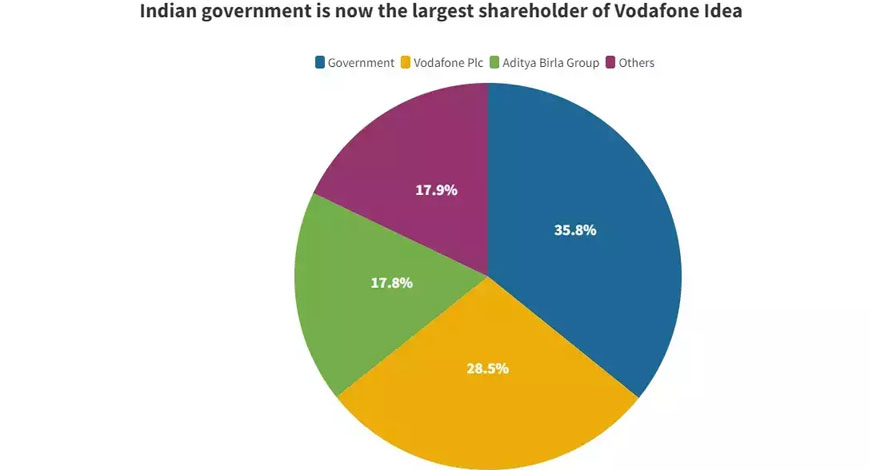

Once the debt gets converted into equity, the government will become the largest shareholder in the company. Moneycontrol

You must be logged in to post a comment Login