Headlines of the Day

Government stake in Vi signals more funds, long-term survival: Brokerages

Vodafone Idea Ltd (VIL) on Tuesday said its board approved conversion of the full amount of interest related to spectrum auction instalments and AGR dues into equity.

The Net Present Value (NAV) of the interest on spectrum auction and AGR are expected to be about Rs 16,000 crore. This conversion of interest amount to equity will imply dilution of all existing shareholders, including the promoters.

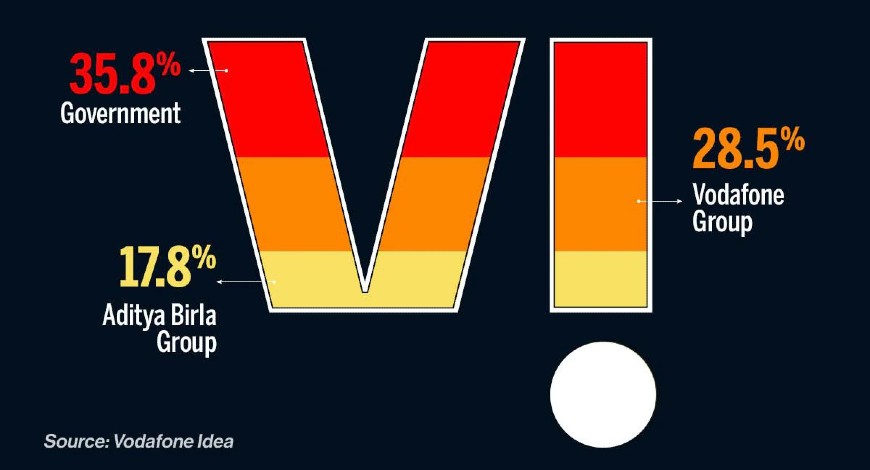

After this conversion, the government will hold around 35.8 percent in the cash-strapped telecom service provider. The promoter shareholding would be around 28.5 percent of Vodafone Group and 17.8 percent of Aditya Birla Group after the conversion.

“Vodafone Idea is a heavily indebted company. Only the AGR and spectrum dues have been converted to equity. The competition in the telecom space has heated up and Vodafone Idea has a heavy chunk of subscribers. It had 43.5 crore subscribers as of Q1FY19 which has reduced to 25.3 crore by Q2FY22. The challenge is uphill for Vodafone as it has to pay interest on its heavy debt and do CAPEX for the latest spectrum as well. Only the promoter has changed, the challenges for the company haven’t,” said Aditya Kondawar, Chief Operating Officer, Mumbai-based financial services firm JST Investments.

As of March 2021, the company’s total debt stood at Rs 1.80 trillion. The shares of Vodafone Idea cracked 14 percent in early deals on January 11.

“The governance and other rights of the promoter shareholders are governed by a shareholders agreement (SHA) to which the company is a party and are also incorporated in the Articles of Association of the Company,” Vodafone said in a notice to exchanges.

“The rights are subject to a minimum qualifying threshold of 21 percent for each promoter group, and in light of the conversion of interest into equity, the promoters have mutually agreed to amend the existing SHA for reducing the minimum qualifying threshold from 21 percent to 13 percent for the purpose of exercising certain governing rights such as appointment of directors and relating to appointment of certain key officials etc,” the company said.

The Vodafone Idea board has also taken note of the proposed changes to the existing SHA and, accordingly, authorised execution of the same and also recommended changes in the Articles of Association (AoA) to give effect to the changes in the SHA. The amendments to the AoA subject to approval of shareholders in the annual general meeting, the company said.

On October 14, 2021, the department of telecommunications had provided various options to service providers in connection with the telecom reforms package that includes deferment of spectrum auction payment due up to four years, one-time opportunity to opt for deferment of AGR related dues as determined by the Supreme Court by four years and a one-time opportunity to exercise the option of paying interest for the deferment period on the deferred spectrum instalments and AGR dues by way of conversion into equity.

“This was on expected line,” said Nitin Soni of Fitch Rating, adding that it does not see investors putting big money into the firm at least in the short term. The rating firm expects that it will be a challenge for the company to raise money from new investors.

Fitch also said that Vodafone Idea will need external funding to increase capex into the business and it will need more tariff hikes in the next 12-18 months. Moneycontrol

You must be logged in to post a comment Login