Trends

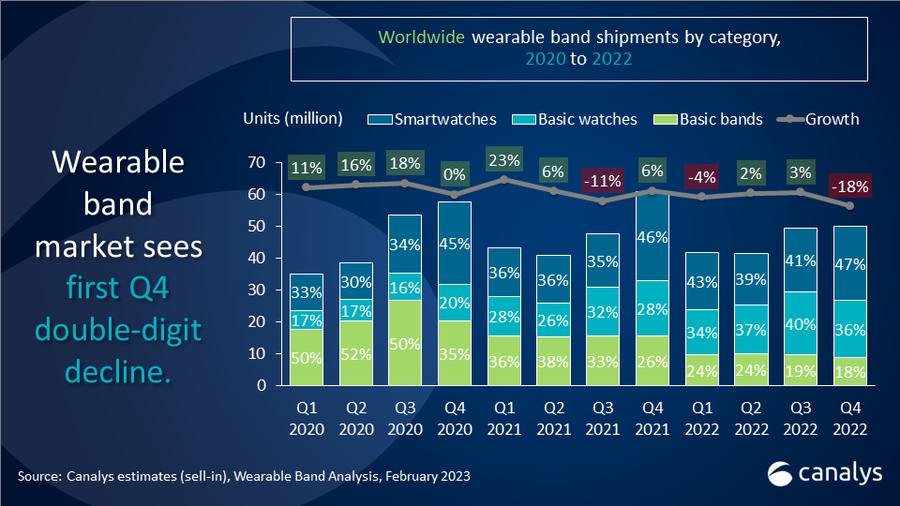

Global wearable band market falls 18% in 4Q22

Industry analyst company Canalys has released its latest estimates on the wearable band market, revealing a challenging Q4 2022 with an 18% shipment decline to reach 50 million units. This marks the first double-digit decline for the market in a typically seasonally strong Q4 quarter. The smartwatch category suffered a similar fate with a double-digit decline of 17%. Basic bands experienced their ninth consecutive decline with a 43% drop, while basic watches grew only 3%, with the growth engine India slowing significantly.

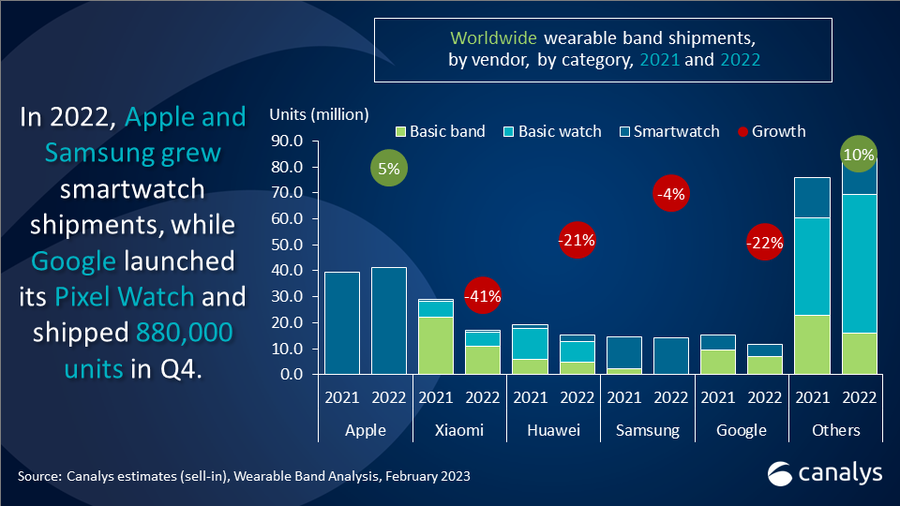

Vendors across the board felt the impact of the challenging macroeconomic environment in Q4. Apple, the leader of the smartwatch category and the overall wearable band market, declined 17% on top of a tough comparison to its stronger quarter in 2021 as it returned to its regular launch schedule. Despite falling 25% due to waning Fitbit shipments, Google rose to second place as it was able to soften its decline with 16% smartwatch growth with the release of its Pixel Watch. Xiaomi, Huawei and Samsung all experienced big declines. Samsung even fell to fifth place as its growth streak abruptly ended in Q4 with a 35% decline as the dividend from the WearOS migration dwindled, and it was further limited by the iterative update of the Galaxy Watch 5 series. Despite declines in quarterly smartwatch shipments, Apple, Samsung and Huawei maintained annual growth, contributing to the smartwatches’ mild growth in 2022.

|

Worldwide wearable band shipments and annual growth |

|||||

|

Vendor |

Q4 2022 |

Q4 2022 |

Q4 2021 |

Q4 2021 |

Annual |

|

Apple |

13.8 |

27.5% |

16.5 |

27.1% |

-17% |

|

|

4.0 |

8.0% |

5.3 |

8.7% |

-25% |

|

Xiaomi |

3.6 |

7.2% |

6.7 |

10.9% |

-46% |

|

Huawei |

3.2 |

6.4% |

5.5 |

9.1% |

-42% |

|

Samsung |

2.9 |

5.9% |

4.5 |

7.4% |

-35% |

|

Others |

22.5 |

44.9% |

22.5 |

36.8% |

+0% |

|

Total |

50.0 |

100.0% |

61.0 |

100.0% |

-18% |

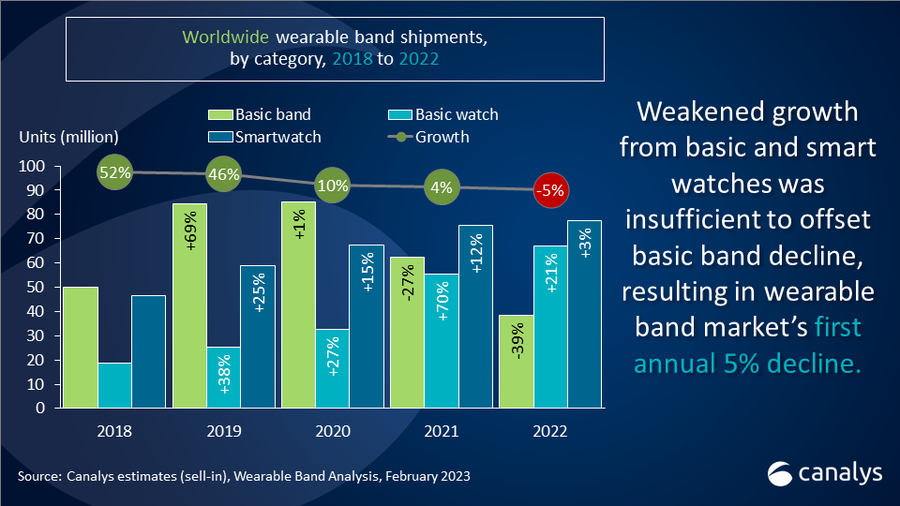

In 2022 overall, smartwatches grew 3%, basic watches rose 21%, and basic bands fell 39%, leading to the whole wearable band market declining by 5%.

“The wearable band market is expected to grow at a modest 2% in 2023,” said Canalys Analyst Cynthia Chen. “While we expect basic bands to continue declining, basic watches and smartwatches will grow, but growth will be capped below 10%. Vendors remain vigilant and will emphasize quality rather than quantity given some recovery in consumer spending.” Canalys expects smartwatches, with 8% growth, to fare better than basic watch’s 6% growth. Further development will center on smartwatch OS, with more chances of connectivity and tracking features supported by pragmatic use-cases to debut on smartwatches, backed by consumers’ rising interest in advanced watches.

|

Worldwide full-year 2022 wearable band shipments and annual growth |

|||||

|

Vendor |

2022 |

2022 |

2021 |

2021 |

Annual |

|

Apple |

41.4 |

22.6% |

39.4 |

20.4% |

+5% |

|

Xiaomi |

17.1 |

9.3% |

29.0 |

15.0% |

-41% |

|

Huawei |

15.2 |

8.3% |

19.2 |

9.9% |

-21% |

|

Samsung |

14.0 |

7.7% |

14.6 |

7.6% |

-4% |

|

|

11.8 |

6.4% |

15.1 |

7.8% |

-22% |

|

Others |

83.4 |

45.6% |

75.7 |

39.2% |

+10% |

|

Total |

182.8 |

100.0% |

193.0 |

100.0% |

-5% |

CT Bureau

You must be logged in to post a comment Login