Headlines of the Day

Global telecom gear MNCs urge govt to change norms, seek level field

Global telecom equipment vendors have urged the government to make sweeping changes to the method of calculating value addition norms, so that they are eligible for government contracts under the public procurement policy for the Preference to Make in India (PMI) scheme.

The scheme mandates preference for domestic products in public-funded projects. The letter, sent to the DoT a few days ago through the Cellular Operators Association of India (COAI) is critical for two reasons. Without a change in value addition norms, global vendors such as Nokia, Ericsson, and Samsung will not be able to participate in the upcoming RFP for 4G equipment to be bought by BSNL and MTNL.

In case of no change, telecom gear makers will be deterred from further investing in manufacturing and exports from the country, despite the government wanting them to invest more, especially by moving some of the manufacturing from China to India.

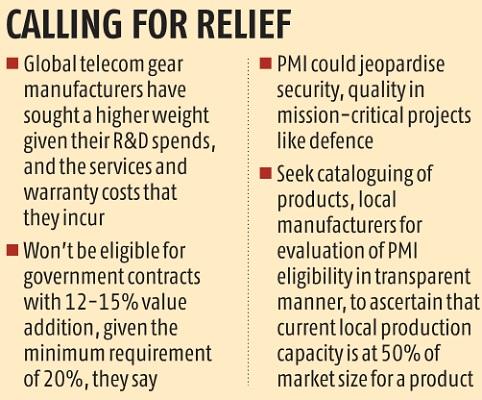

In the October 29 letter, the COAI asked for other factors to be included when value addition norms are calculated. For example, telecom gear makers could be given a higher weight for their large R&D investments, as well as for the costs they incur on maintaining and servicing warranties.

It asked for a scientific study on the Indian manufacturing poweress in telecom and networking to ensure a competitive market, where current local manufacturing capacity should be 50 per cent of the Indian market size of the product.

The COAI also demanded that firms be given credit under the public procurement policy (PPP) for the PMI scheme for components they source from India for their factories abroad. Further, manufacturing firms that adopt an export-led model should be considered to be ‘deemed domestic’ and given credits under the revised policy.

This was a reference to the Department for the Promotion of Industry and Internal Trade issuing revised guidelines for the PPP a few months ago. They stated that Class-I local supplier firms need to have local content of over 50 per cent. This virtually rules out foreign firms. To be eligible as a Class-II local supplier, the vendor needs local content of over 20 per cent, but less than 50 per cent.

Under these revised norms, where orders can be divided, if the lowest bidder (L1) is a Class-I local supplier, the entire order will go to the firm. However, in cases where the L1 bidder is not a Class-I supplier, only 50 per cent of the order will go to them. The rest will be offered to the lowest bidder among Class-I suppliers and such a firm will be asked to match the L1 price.

Where orders cannot be divided, the entire order will be given to a Class-I supplier if it is also the lowest bidder. The revised norms are yet to be ratified, and could be tweaked by the DoT if it decides to do so once its current discussions with stakeholders are over.

Most global gear makers do not have a value addition of more than 10-15 per cent, disqualifying them from participating in government orders. But a change in rules will help them at least become Class 2 suppliers. The COAI, by arguing for other criteria such as R&D investments to be included, wants to change the current value addition formula which is based on subtracting imported components from the selling price.

It points out in its letter that several local players import the bulk of their hardware yet still qualify under the PMI scheme on the strength of intellectual property registered in India. On the other hand, global companies that bring in billions of dollars as foreign exchange and employ many more local employees in high paying jobs, are unable to claim credit.

What’s more, the COAI argues, these OEMs partner with local companies for services which, again, are not included in the value addition calculation.

“If you keep the value addition norms as they are, there is no incentive for us to manufacture in India. After all, we are importing components like chips that go into making radios here because they are not available in India. This is not our fault but we seem to be facing the consequences by getting shut off from public contracts,” said a top executive of a telecom gear maker.

However, this executive and others agree that by adding other criteria such as R&D investments, costs of guarantees and services and credit for exports from India, global firms will raise their value addition to over 20 per cent.

The COAI also raised a red flag in its letter about the danger of ‘quality’ and ‘security’ possibly being compromised by the ‘forced implementation of the PMI scheme for products that have no India equivalents.

It says the scheme should not let government users compromise on security and quality in public procurement.

It argues that government users should not be discouraged from procuring high quality products from non-local suppliers. This, the COAI argues, is vital in areas such as remote governance, healthcare, banking, and defence. Business Standard News

You must be logged in to post a comment Login