Trends

Global smartphone market declined by 7% YoY in Q1 2022

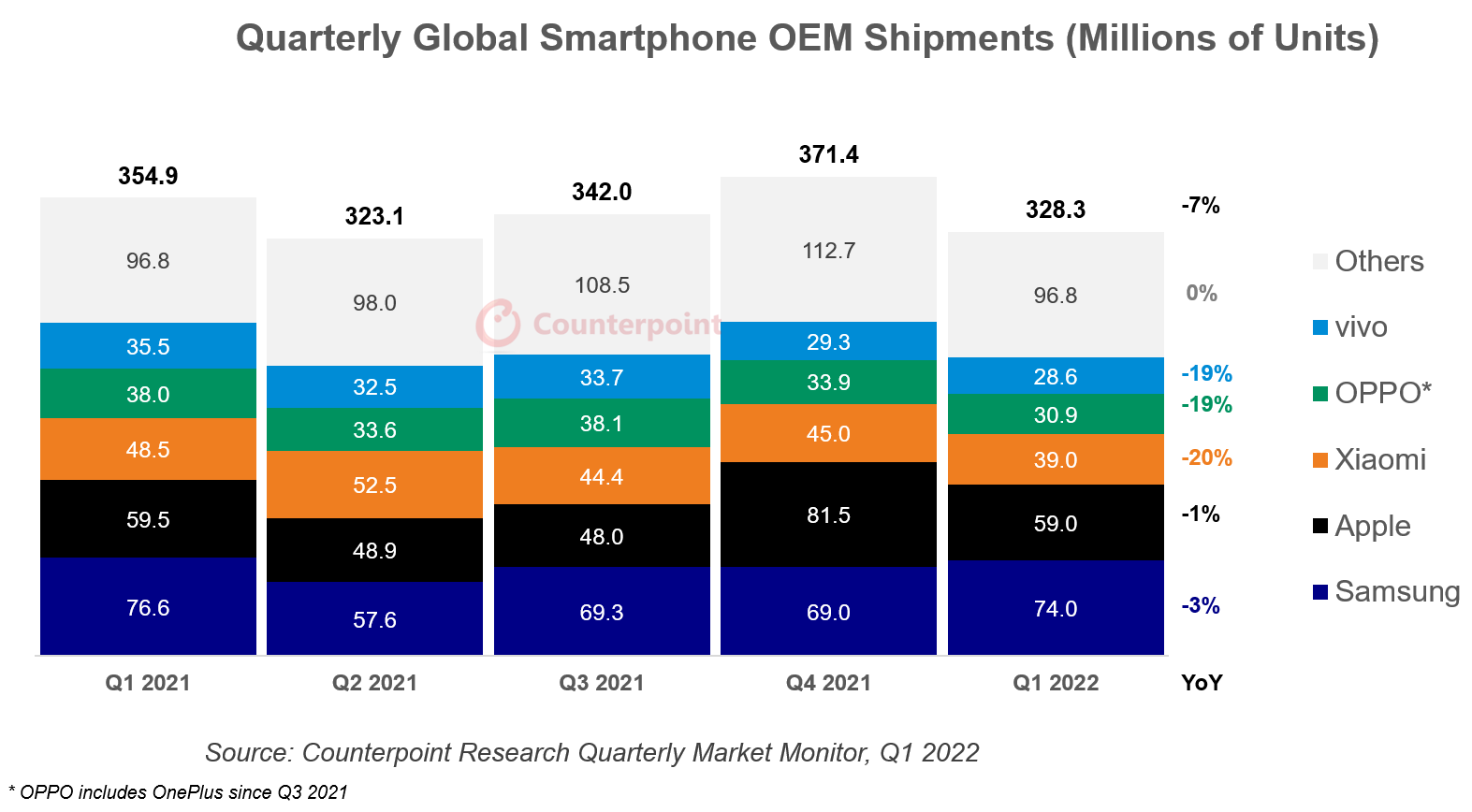

The global smartphone market declined by 7% YoY, shipping 328 million units in Q1 2022, according to the latest research from Counterpoint’s Market Monitor service. The decline was caused by ongoing component shortages, as well as COVID resurgence at the beginning of the quarter and the Russia-Ukraine war towards the end. The global smartphone market also, as expected, had a seasonal decline of 12% QoQ.

Commenting on the overall market dynamics, Senior Analyst Harmeet Singh Walia said, “the global smartphone market presented a mixed bag in the first quarter of 2022. Samsung seems to have overcome component shortages that affected its supply last year, as evidenced by higher-than-expected growth in its shipments despite a late flagship launch. Major Chinese OEMs such as Xiaomi, OPPO* and vivo, meanwhile, faced a greater component supply crunch, resulting in their shipments falling by 20%, 19% and 19% YoY respectively.”

- Samsung shipped 74 million units in Q1 2022, down just 3% YoY, and was one of only two top-five smartphone brands to come close to its pre-pandemic Q1 shipments. While its flagships were launched towards the end of February (a month later than last year) and at a price higher than the previous S21 series (despite lower BOM costs), customers responded well, driving a 7% QoQ shipment growth.

- Apple’s global smartphone shipments remained flat compared to Q1 2021 at 59 million units in Q1 2022. This was driven by strong demand for iPhone 13 series and the early launch of its first 5G-enabled SE Series which, even in a contracting market, helped push Apple’s market share to 18%, up from 17% in Q1 2021. Its quarterly shipment decline of 28% is primarily due to seasonality.

- Xiaomi’s global smartphone shipments declined by 20% YoY to 39 million units in Q1 2022, with its market share falling to 12% from 14% in the same quarter last year. This was caused by the relatively weak performance of the Redmi 9A and 10S smartphones, along with chip shortages that are hurting Xiaomi more severely than other vendors. Xiaomi was also unable to benefit from the Chinese New Year shopping festival, with its share of the world’s biggest smartphone market falling to under 15% (down from over 16% both in the last quarter and in the same quarter of last year).

- OPPO’s* shipments declined by 19% YoY and 9% QoQ to 31 million units in Q1 2022 due to supply-side constraints resulting from the ongoing component shortages. Being offline focused and with few new major recent launches, OPPO’s shipments were affected more acutely during the Omicron wave, especially in its key markets such as India. Consequently, its market share fell to 9% from 11% in Q1 2021.

- vivo also declined by 19% YoY and 3% QoQ with its market share falling to 9% in Q1 2022 down from 10% in the same quarter last year. vivo, like OPPO, has been facing component shortages more severely since the end of last year. There has also been greater competition in the mass market which is a key driver of vivo’s shipment volumes. Therefore, despite performing well in China where it replaced Apple as the top smartphone brand, it saw a decline in global shipments.

Research Director Jan Stryjak noted, “while component shortages are expected to ease soon, the Russia-Ukraine war poses a new challenge to the recovery of the global smartphone market. In Q1 2022, the war had little impact on global smartphone shipments. Although Samsung and Apple withdrew from the Russian market in early March, the consequences are, at the moment, relatively small on a global scale. The two vendors make up around half of Russian smartphone shipments, but their combined shipments in Russia account for less than 2% of total global smartphone shipments. However, the impact of the war may develop wider ramifications if it leads to a drop in availability of raw materials, a rise in prices, further inflationary pressure and/or other vendors withdrawing from Russia.”

Other key trends:

HONOR’s shipments grew by 148% YoY to 16 million units in Q1 2022 as it continued rebuilding supplier relationships post its separation from Huawei. It also saw a 7% QoQ shipment growth despite a seasonal contraction of the global smartphone market. Consequently, its market share rose to 5% this quarter, up from 4% in the last quarter and 2% in the same quarter last year. It also did well in its home country of China where it is among the fastest-growing smartphone brands.

realme shipped 14.5 million units in Q1 2022, up 13% YoY. This was driven by realme’s expansion in the overseas markets, especially in Europe where its shipments grew by 163% YoY. At the same time, its global shipments have declined by 30% QoQ after a record quarter while its European shipments have taken a smaller hit of 7% caused by the Russia-Ukraine war. In India, realme was the only brand among the top five players to experience YoY growth (40%) in Q1 2022. It captured the third spot during the quarter.

Transsion Group, which includes Tecno, Infinix and itel, continued its strong performance with a 23% annual growth. This was driven primarily by Infinix, which grew by 76% YoY and 4% QoQ with its shipments increasing in India, the rest of Asia Pacific and Middle East and Africa. Tecno’s shipments also grew by 28% YoY while itel fell by 3%.

CT Bureau

You must be logged in to post a comment Login