Trends

Global CIS market annual revenue falls for first time in a decade

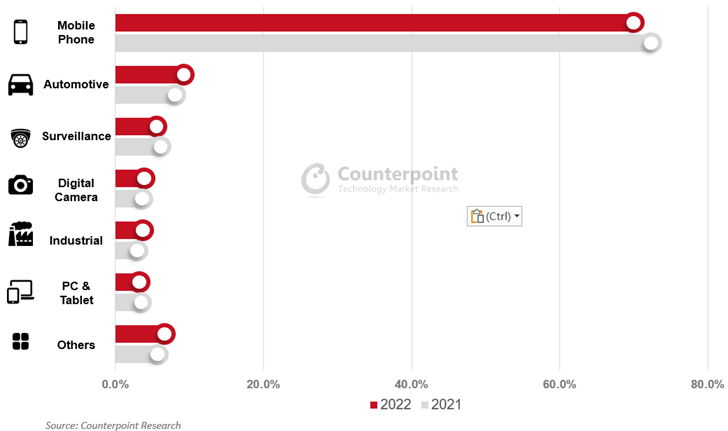

Last year proved to be tough for the global CMOS image sensor (CIS) market. Its revenue fell YoY for the first time in a decade to reach $19 billion, a decline of 7% YoY, according to Counterpoint Research’s data. Sluggish demand from the mobile phone, surveillance and PC and tablet segments led to this weaker-than-expected market performance.

Mobile phone segment

Amid unfavorable macroeconomic conditions, global mobile phone shipments fell 12% YoY in 2022. The average number of cameras per phone also fell to 3.5 with less adoption of depth and macro lenses. This dragged down the CIS market revenue from mobile phones to $13.2 billion, down 10% YoY. The segment’s market share also fell below 70%. It will continue to shrink in 2023 due to a lack of growth momentum and share gains of other segments such as automotive and industrial.

PC and tablet, surveillance segments

After a surge in 2020 and 2021 driven by online education and work from home during the COVID-19 pandemic, the PC and tablet market declined sharply in 2022 as the world gradually returned to normal and demand started to weaken in the post-COVID era. The surveillance market also grew in 2020 and 2021 thanks to rising demand from smart cities, intelligent transportation and contactless people temperature monitoring during the pandemic. But as the tide receded, the market began to shrink in 2022. Thus, CIS revenue for both segments fell YoY.

Despite all headwinds, the automotive, digital camera and industrial segments’ revenues still increased driven by strong demand.

Automotive segment

As the automotive industry moves toward advanced ADAS and autonomous driving, more cameras are needed for vehicles to capture adequate road information and improve safety and convenience. In 2022, the L2 and above penetration of passenger vehicles was 23%, which helped boost the image sensor shipments for vehicles. Thus, the automotive segment’s share rose to 9% in 2022 to take the second spot after mobile phones. As autonomous driving moves toward a higher level, the market is expected to see explosive growth in the next few years.

Digital camera segment

The share of digital cameras also grew YoY in 2022 as the increase in the average selling price (ASP) made up for lower shipments. The pent-up demand resulting from travel curbs and supply chain shortages in 2021 also contributed to this growth. With the demand gradually abating, we expect the market to stay relatively stable in 2023.

Industrial segment

Over recent years, CMOS sensors have become increasingly important in modern factories. They are widely used for manufacturing, logistics, quality inspections and other activities. Driven by strong demand for smart factory and industrial automation, industrial image sensors grew steadily in 2022.

Other segments

Other segments such as AR/VR and IoT also saw growth in 2022, but these markets are still quite small.

Market outlook

Looking into 2023, we expect the global CIS industry to slowly recover and see a low-single-digit YoY growth driven by strong demand from automotive and industrial markets and a modest recovery of the mobile phone market. But there are still uncertainties over geopolitical conflicts, global inflation and macroeconomic environment. Therefore, we will keep a close eye on the dynamics and constantly track the market.

CT Bureau

You must be logged in to post a comment Login