Trends

Global cellular IoT module shipments grew 35% YoY in Q1 2022

Global cellular IoT module shipments grew 35% YoY in Q1 2022, according to the latest research from Counterpoint’s Global Cellular IoT Module and Chipset Tracker by Application. India was the fastest growing market (59% YoY) followed by Middle East Africa, Japan, North America, China, Western Europe and Korea, all registering healthy double-digit growth. However, the largest IoT module market, China, saw demand dip by 11% QoQ due to the new wave of COVID-19 and resulting lockdowns.

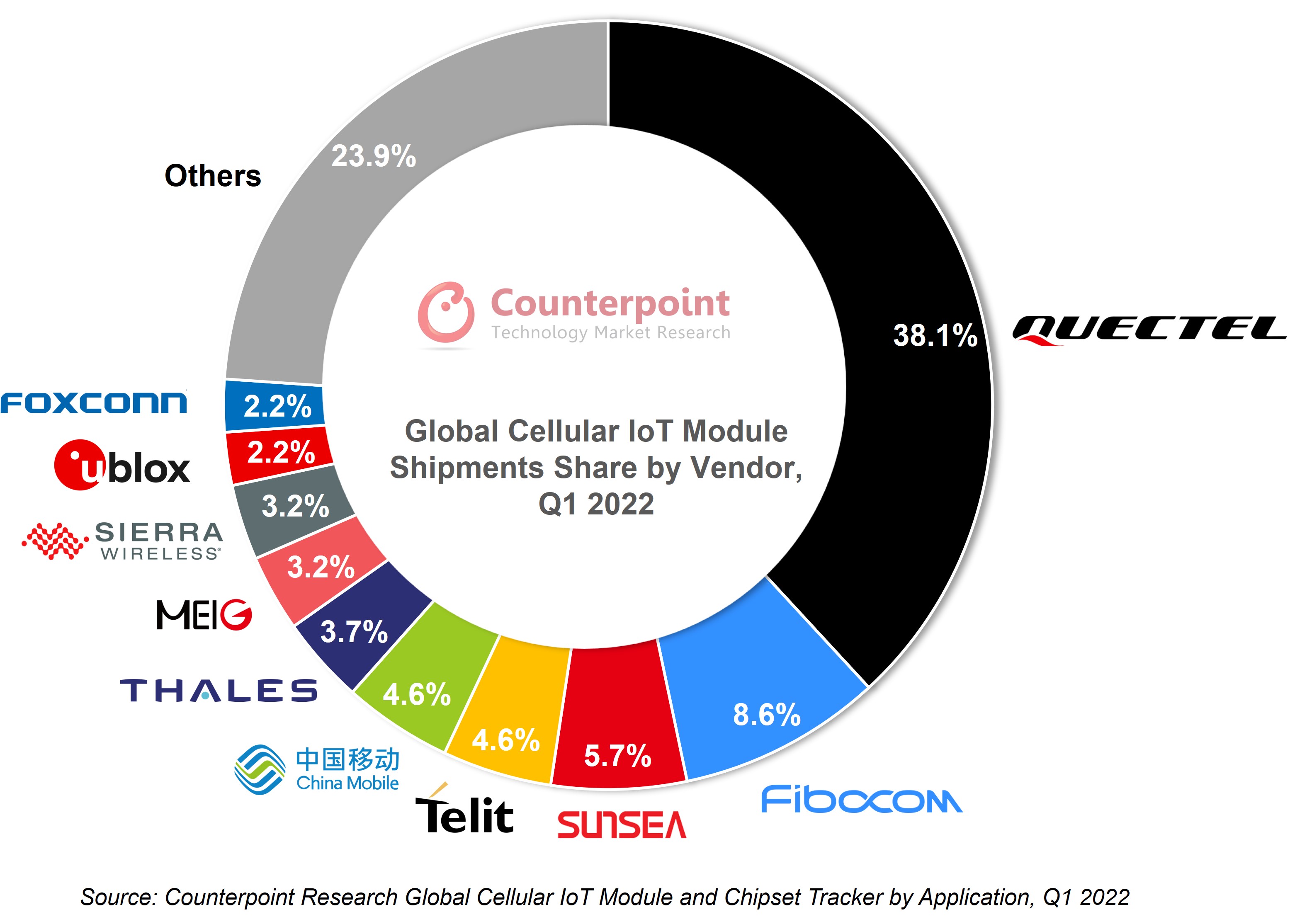

Commenting on the market dynamics, Senior Research Analyst Soumen Mandal said, “The cellular IoT module market remains competitive, but there is growing consolidation. For example, Quectel, Fibocom and Sunsea accounted for more than half of the global IoT cellular module shipment volumes for the first time ever. This highlights the growing influence, expertise, and scale of these Chinese vendors in the fast-growing global market.

Quectel’s cellular IoT module shipments grew 77% YoY in Q1 2022 to a healthy 38% of global volume. Quectel now ships more modules than the next ten vendors combined. Quectel continues to dominate geographically with leadership in seven out of ten key markets globally. Quectel commands a strong position in 4G and NB-IoT modules. Quectel is expanding its 5G portfolio and aims to gain scale as the technology ramps.

Fibocom’s shipments grew by 24% YoY benefitting from the surging demand for 4G Cat 1 bis modules, which is one of the fastest growing segments and led by Fibocom globally. 4G Cat 1 bis is becoming a key technology targeting the 2G and 3G IoT installed base and similar applications such as POS and telematics. Fibocom is also heavily focusing on 5G AIoT based smart modules to maintain a lead in high value applications.

Sunsea AIoT which includes the brands SIMcom and Longsung, has cemented its place in the top three brands. It focuses on 4G Cat-1 and NB-IoT modules. China continues to be the key market for Sunsea; it will need to diversify if it wants to scale and grow at the same pace as its peers.

Telit captured 4.6% share and is the only non-Chinese brand in the top five players. Demand for its modules remains healthy in North and Latin America. The module mix shifted slightly with increasing demand for legacy 2G and 3G modules offsetting some volume decline in 4G modules due to supply chain constraints. Telit leads the Latin America market and is among the top three vendors in North America.

China Mobile, Sierra Wireless and u-blox improved their market share in Q2. The world’s largest EMS, Foxconn, also entered our top ten module players list with growing demand in the CPE and connected PC segments. The relationship with top device makers, potential EV business growth and a focus on 5G technology, should help Foxconn to grow in this sector in the mid- to long-term.”

Commenting on cellular IoT technology evolution, Associate Director Ethan Qi, said, “There is a significant shift happening in the adoption and proliferation of different cellular IoT access technologies, from LPWA (NB-IoT, LTE-M) to 4G (Cat 1, Cat 1 bis) to 4G Cat 3+, 5G and upcoming 5G Redcap. This is driven not only by the wide range of different applications, but also regional and operator adoption dynamics. NB-IoT is considered a key and fast-growing technology for low power IoT applications and has been widely adopted in China and some other parts of the world. Whereas LTE-M is preferred in markets such as Japan, Australia, North America, and parts of Europe. However, we are also witnessing many regions and operators favouring 4G Cat 1 and Cat 1 bis for some mature and some new IoT applications. While most of these technologies are complimentary, operators still have to selectively invest in one over others, depending on the IoT verticals of most importance to them.

As we see 5G rolling out, many of the advanced IoT applications such as automotive, router CPEs, PCs will move to 5G from advanced 4G technologies. Furthermore, the advent of 5G Redcap will also supplant some legacy technologies such as 3G/4G in some IoT applications. So, the entire IoT ecosystem has a wide array of cellular access technology solutions to choose from depending on the applications, data requirements, cost constraints and operator dynamics in a particular market.

The technology mix also shapes the overall cellular IoT module Average Selling Price (ASP), which declined by 3% annually in Q2 due to an increasing mix of lower cost 4G Cat 1 and 4G Cat 1 bis modules. Furthermore, the 4G Cat 4+ modules are still facing supply chain constraints and the % share of 5G modules remains small contributing to the overall ASP decline. We believe the 4G module supply chain issues will moderate later this year, but the fallling ASP for 5G modules will provide an option for device OEMs to either select 4G or 5G modules moving forward.”

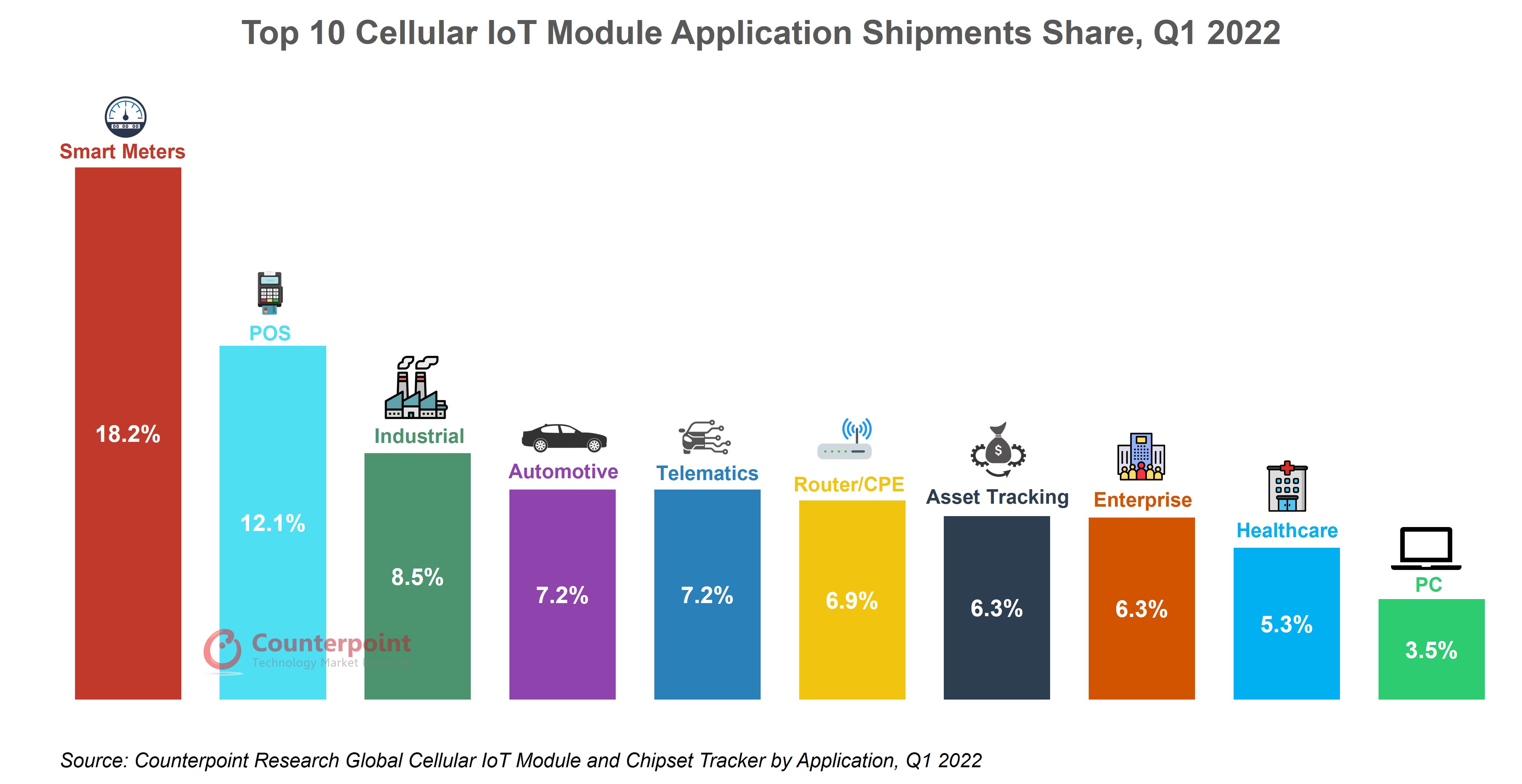

Commenting on which IoT applications are hottest, Research Vice President Neil Shah said, “Cellular IoT powers a diverse set of applications and the number of things that can be connected to the internet continues to rise.

Smart meters, POS and industrial were the top three applications in the global cellular IoT module market in Q1 2022. These segments are contributing to nearly 40% of total cellular IoT module shipments.

Smart meter projects have restarted in many markets post-COVID and the segment is seeing strong growth with shipments doubling compared to a year ago. Meanwhile, demand in the router/CPE segment is steadily growing as the supply constraints lessen and demand increases for FWA CPEs for the work-from-home segment, and 4G/5G upgrade projects increase for enterprise-grade routers across retail, factories, offices, etc.”

CT Bureau

You must be logged in to post a comment Login