Trends

Global cellular IoT module revenue grows 58% YoY in Q4 2021

Global cellular IoT module revenue grew 58% YoY in Q4 2021, according to the latest research from Counterpoint’s Global Cellular IoT Module and Chipset Tracker by Application. China, the leading region in the cellular IoT module market, accounted for more than 40% of the revenue. However, India was the fastest growing (154% YoY) cellular IoT module market. 5G was the fastest growing (324% YoY) technology followed by 4G Cat 1 (105% YoY). Router/CPE, PC and industrial were the top applications for 5G.

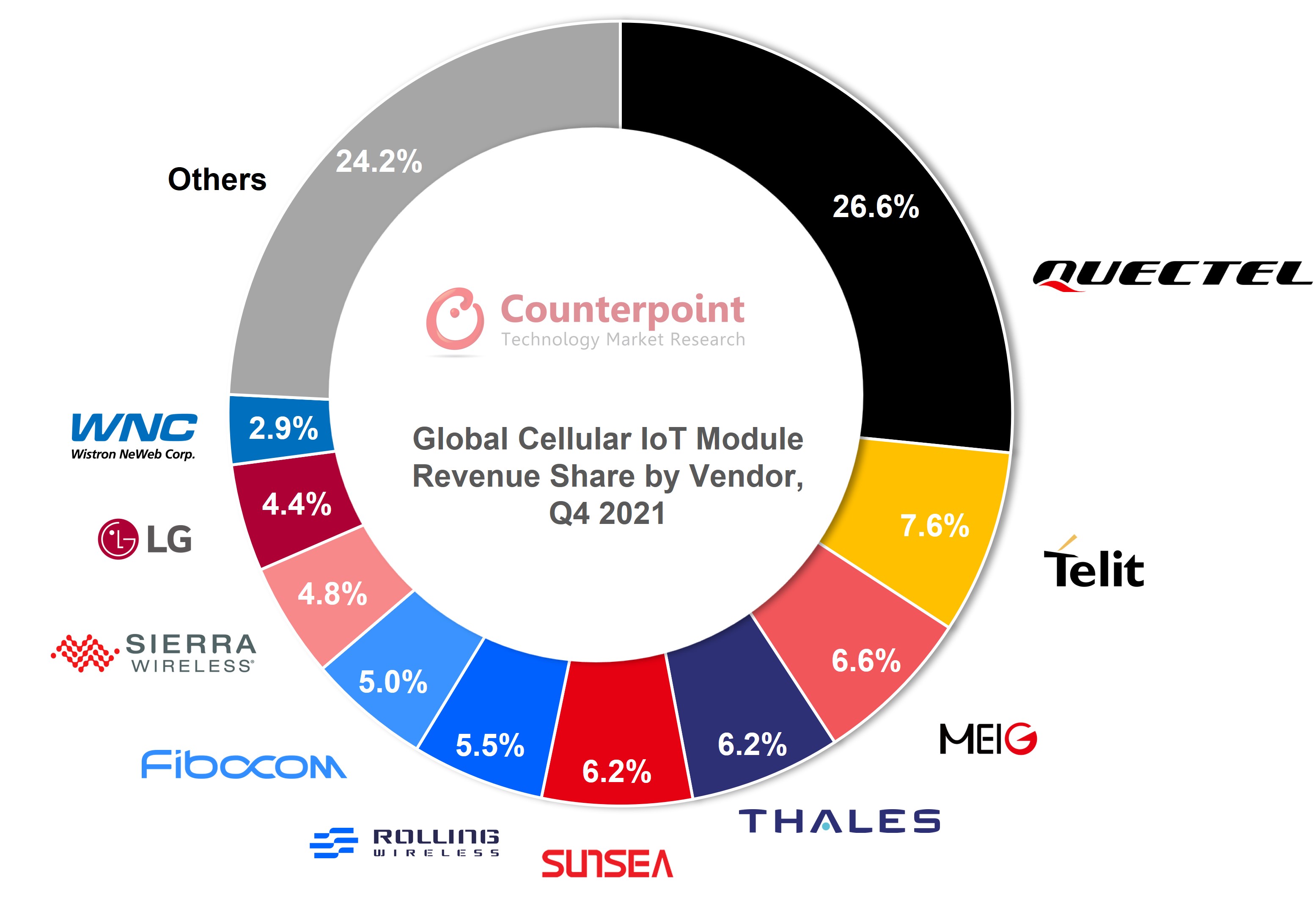

Commenting on the market dynamics, Senior Research Analyst Soumen Mandal said, “Quectel, Telit and MeiG held the top three positions in the global cellular IoT module market, accounting for 40% of the total revenue in Q4 2021. For 2021, global cellular IoT module shipments and revenue grew by 59% and 57% YoY respectively.”

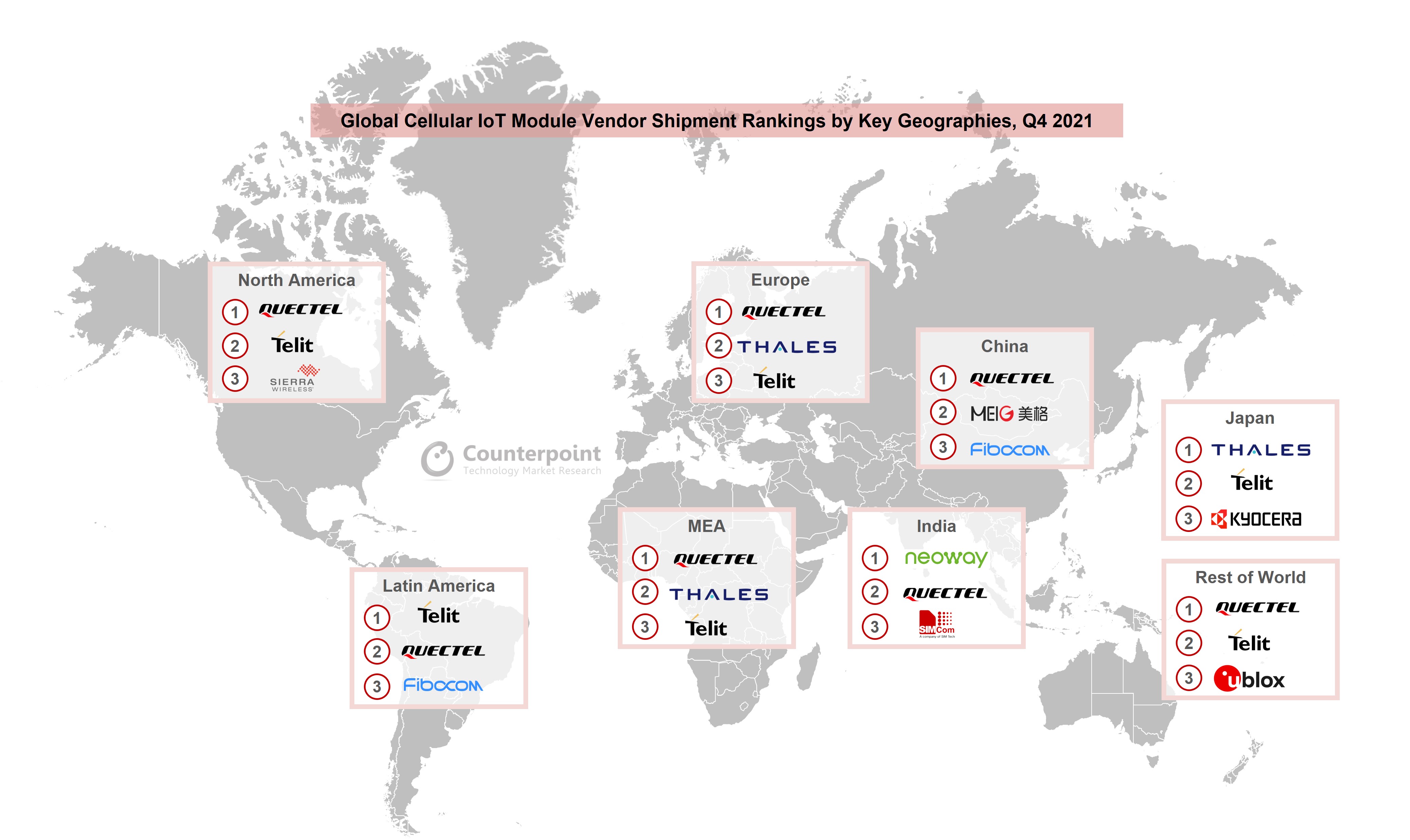

Quectel’s cellular IoT module revenue grew more than 100% YoY in Q4 2021. Strong partnerships, superior service and a wide range of product offerings are supporting its growth. Quectel launched a new ODM brand, Ikotek, targeting the US market. We expect it to help Quectel increase its footprint in North America and Latin America. Moreover, the products can be customized and designed according to the regulatory requirements of a project.

Telit made a strong comeback after a relatively weaker performance in recent history. Telit has been expanding its offerings, which is helping its revival. Telit NExT is providing flexible connectivity plans across 190 countries to take advantage of emerging business models and removing major bottlenecks for many IoT device vendors. In Q4 2021, Telit’s focus on Latin America to help customers migrate legacy 2G and 3G modules to 4G Cat 1 modules helped it become the leading module supplier in the region to complement its strong position in North America.

MeiG is another Chinese player which is making continuous progress and made it to the top three in cellular IoT modules, both in shipments and revenue. It is focusing more on AIoT and smart module-based higher-end applications such as router/CPE, intelligent cockpit, video recordings, industrial PDAs, drones and AR/VR. MeiG entered lower-end applications in 2021. This product mix of higher-end and lower-end modules helped MeiG increase revenue by more than 100% in Q4 2021.

Thales, Rolling Wireless, Sunsea, Fibocom and Sierra Wireless are other key players. Out of the top 10 players, Rolling Wireless and LG are focussing on the automotive segment only.

Thales is performing well in Europe, North America and Japan targeting smart meter, healthcare and industrial applications. Sunsea improved its performance in the global IoT module market, but it wasn’t enough to prevent its share from going down. The industry is growing at a faster rate compared to Sunsea’s growth. Fibocom is showing a stronger presence in 4G Cat 1 bis technology. However, Fibocom slipped out of the top five module vendors rankings due to weaker performance of NB-IoT modules.

Rolling Wireless’s and Sierra Wireless’s revenues increased 105% and 87% respectively. After spinning off from Sierra Wireless’s automotive division last year, Rolling Wireless quickly made it to the top 10 module vendors list. Rolling Wireless and Sierra Wireless have been successful in targeting specific applications, such as automotive and router/CPE respectively.

Automotive, router/CPE, industrial, PC and POS are the top five cellular IoT applications in terms of revenue. However, drones, PC and router/CPE are the top three fastest growing segments. Smart meters is another key segment but the lower ASPs of NB-IoT and 4G Cat 1 modules mean it is not among the top five IoT applications in terms of revenue.

Commenting on the regional performance of module vendors and pricing dynamics, Vice President Research Neil Shah said, “International players made a strong comeback in Q4 2021 after weaker performance in the previous quarter. Quectel, MeiG and Sunsea were the top three cellular IoT module players in China in terms of revenue. For the rest of the world, Quectel, Telit and Thales were the top three cellular IoT module players.”

Quectel is leading in most regions except Latin America, India and Japan. However, as these regions currently represent a small share of the global cellular IoT module market, it doesn’t have much impact overall. Japan’s preference for LTE-M works against Quectel.

In China, MeiG overtook Fibocom to become the second largest cellular IoT module vendor.

Neoway, another Chinese module vendor, maintained its leading position in the Indian market. Strong partnerships with smart meter manufacturers and telematics providers are helping Neoway to maintain its position.

The overall cellular IoT module ASP increased 7% sequentially due to supply chain constraints, especially in 4G modules. Chinese chipset players are trying to reduce the 5G module ASP for mass commercialization. However, 5G adoption hasn’t picked up as expected. We see 5G peaking in the global cellular IoT module market after 2025.

CT Bureau

You must be logged in to post a comment Login