5G Features

Global 5G market scenario

In many ways, we are nearing the end of 5G’s journey. And once Rel-17 is completed, work will begin on developing a whole new set of tools for the 5G arsenal, which will ultimately – but not just yet – pave the way to 6G.

The global telco CapEx growth is expected to moderate from 9 percent in 2021 to 3 percent in 2022 at USD 328 billion, before tapering off in 2023 and 2024. Estimated at USD 325 billion annualized global CapEx in 2021, the ratio of CapEx to revenues, or capital intensity, reached 17.2 percent in 2021, the highest level since 2015. The coupling between carrier investments and manufacturing infrastructure revenues is expected to prevail over the short-term CapEx.

The top fifty carriers in the world collectively generated combined annual revenue and investments of well over USD 1.4 trillion this past year, estimates Dell’Oro. These carriers account for roughly 80 percent of worldwide CapEx and revenue.

Excluding China/HK-based companies, which have not finished reporting yet, the top 10 biggest telco CapEx spenders in 2021 were AT&T, DT, Verizon, NTT, Comcast, Vodafone, Orange, Charter, America Movil, and Telefonica. The biggest CapEx gains in 2021 were seen at America Movil (+USD 2.54B versus 2020 total), Telecom Italia (+USD 2.49B), Verizon (+USD 2.09B), AT&T (+USD 1.93B), Deutsche Telekom (+USD 1.74B), BT (+USD 1.63B), and Rakuten (USD 1.47B).

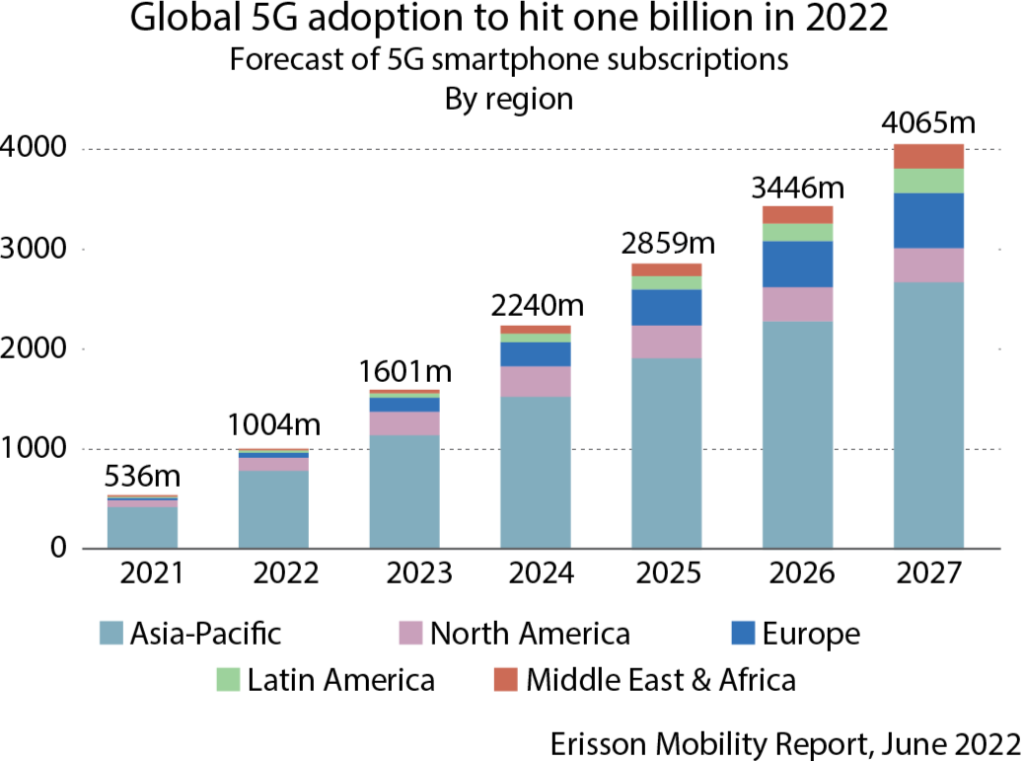

5G connections will surpass 1 billion in 2022 and 2 billion by 2025. By the end of 2025, 5G will account for over a fifth of total mobile connections according to the Mobile Economy Report 2022, GSMA. Ericsson agrees. About a quarter of the world’s population currently has access to 5G coverage. Some 70 million 5G subscriptions were added during the first quarter of 2022 alone to reach 620 million. By 2027, about three-quarters of the world’s population will be able to access 5G, that is 4.4 billion 5G subscribers, accounting for almost half of all mobile subscriptions by that point.

This unprecedented growth represents the fastest generational roll-out for the mobile industry, compared to 3G and 4G. By comparison, 18 months after its launch, 5G accounted for more than 5.5 percent of mobile connections – neither 3G nor 4G exceeded 2.2 percent penetration in the same period.

Today, there are nearly 200 live 5G networks in seventy countries. There are 493 operators in 150 countries that have been investing in 5G networks in the form of tests, pilots, license acquisitions, planned and actual deployments, as in June 2022. Of those, 214 operators in 85 countries have launched commercial 3GPP-compatible 5G services (mobile or fixed-wireless access), including 68 operators providing 5G fixed-wireless access (FWA) services. 108 operators are identified by Global Mobile Suppliers Association as investing in 5G standalone for public networks and 24 operators as having deployed or launched 5G standalone in public networks. All this supports consumer demand, propelled by an ever-growing portfolio of 5G-enabled smartphones across various price points.

North America is forecast to lead the world in 5G subscription penetration in the next five years with nine-of-every-ten subscriptions in the region expected to be 5G in 2027. The 2027 timeline in the latest Ericsson Mobility Report also includes projections that 5G will account for 82 percent of subscriptions in Western Europe; 80 percent in the Gulf Cooperation Council region; and 74 percent in North-East Asia.

In India, where 5G deployments are yet to begin, 5G is expected to account for nearly 40 percent of all subscriptions by 2027. In global terms, 5G is forecast to account for almost half of all subscriptions by 2027, topping 4.4 billion subscriptions.

Indeed, the 5G share of mobile data traffic is growing, but not as fast as FWA (3G/4G/5G). FWA is playing an important role in the delivery of broadband services. The number of FWA connections is forecast to exceed 100 million in 2022 and 110 million by 2027, with an estimated market size of USD 88.5 billion.

In the past year, 5G seems to have entered a new phase of development. The first steps, like achieving nationwide coverage and establishing a broad smartphone ecosystem, are done for a majority of the developed countries.

5G is now evolving. In this wave, there is a move from non-standalone (NSA) to standalone (SA), from an architecture linking an LTE core to new radios supporting 5G frequency bands to a cloud-native 5G core, and to more open architectures by disaggregating the radio access network (RAN). Also, in respect to the frequency usage, which is the additional spectrum, 5G is going to enhance.

Carriers that invest in and build standalone 5G networks will be the first to offer advanced connectivity and will find themselves well-positioned to form new partnerships with gaming-content providers, and dominate the 5G cloud-gaming sector accordingly. Because of this fact, a lot of telcos are partnering with gaming companies, a trend that is expected to continue.

With 5G largely here, the industry turns to questions of monetization. Unlike previous generations of cellular technology, which have been highly consumer-focused, 5G, with its promise of lower latency and higher throughput, is being used to address enterprise, Industry 4.0 and autonomous vehicle needs, opening up new monetization opportunities for communications service providers (CSPs), as long as they carefully pair technology investments to the desired business outcomes.

The three big US carriers – AT&T, Verizon, and T-Mobile US have spent more than USD 100 billion on 5G airwaves and network upgrades, but they have little to no revenue or major new businesses to show for it. Moreover, the arrival of 5G technology has gone largely unnoticed by consumers, and the future fortunes the industry is banking on are far from certain.

Lacking a compelling reason to persuade customers to upgrade, carriers have been offering USD-1000 5G phones for free to help jump-start the conversion process. Such promotions are needed because 5G is not even among the top four reasons people switch carriers. Those reasons typically include price or overall network reliability.

Early network capability initiatives are underway to support the increasing number of innovative consumer and enterprise use cases across the 5G era. These include the 5G utilization of multiple sub-3GHz spectrum bands, 5G mmWave, 5G Advanced, and private networks.

This was not the way 5G was envisioned or promoted. Carriers were rolling out 5G to deliver a wow experience that customers would willingly pay extra for. Instead, the technology has become a standard feature in an arena where mobile phone companies and cable operators are battling it out with similar packages. As that reality started to take hold, the carriers pointed to bigger, more immediate opportunities, such as selling 5G to large companies and governments.

It has become apparent that the most compelling use cases for 5G would revolve around businesses rather than consumers. To help make that happen, the major carriers have formed partnerships with the big cloud service providers, including Amazon’s AWS, Microsoft’s Azure, Google, and Meta Platforms that handle data storage, online ordering, and video streaming for big companies. Each cloud giant sees 5G as a valuable entry into new classes of services, such as secure private networks to replace Wi-Fi, factory automation, and edge computing, which brings network hardware closer to end users to increase speeds.

The wireless carriers are staking their futures on these workplace roles. But because no 5G hyper-connected, cloud-powered commercial ecosystem has been built before, tech giants and telecommunications companies are collaborating to tackle the challenge.

The carriers provide businesses with a roster of services including voice, data, network management, and security, and they will want to keep control of those relationships as services emerge in 5G. But as the cloud providers gain a bigger role in a business’s network infrastructure, running everything from robotics on the production floor to in-office wireless data systems, the carriers’ role may shift to more of a wholesale supplier of network capacity and mobile cellular service to the cloud companies.

5G-Advanced to be launched in 2025. Some 75 percent of 5G base stations will be upgraded to 5G-Advanced by 2030, five years after the estimated commercial launch, according to a report by global tech intelligence firm ABI Research.

5G-Advanced will bring new enhancements to mobile network capabilities and use case-based support to help mobile operators with 5G commercialization, long-term development of AI and ML, and network energy savings for a fully automated network.

As AI plays an expanding role in 5G, there will be better spectrum utilization and the minimization of battery life for 5G-enabled products, such as smartphones, small cells, and IoT devices in the future. While 5G viewed the entire network as one system, 6G will be a kind of system of systems, or network of networks, in which there are multiple networks and then, depending on QoS or the use cases, the most appropriate one can be selected. In many ways, 5G’s journey is coming to an end – rollouts are far along, and devices have hit the market. Rel-17 is expected to be completed soon, and once that happens, work will begin on developing a whole new set of tools for the 5G arsenal, which will ultimately – but not just yet – pave the way to 6G!

You must be logged in to post a comment Login