Industry

Enterprise networking market bounces back

The enterprise networking equipment has reported a recovery in all segments, reveals IDC data. Demand has not weakened, and vendors have at least two-quarters of backlogs to clear, with H2 expected to have significantly higher business compared to H1

The enterprise network is undergoing a transformation as companies rethink how they manage their networks and how far they should reach. As a result, businesses around the world are adopting a two-pronged approach to their enterprise network infrastructure investments – reinvesting in technologies that were delayed or postponed during the pandemic’s peak, and planning for a reimagined enterprise network that will support their business’s needs in the years ahead.

The enterprise networking market is expected to expand with ongoing developments in high-speed Ethernet switches and wireless LAN technology. The development of smaller, more effective chipsets and modules with expanded functionality depends on this technology. Rising high-speed Ethernet switch demand is anticipated to create new growth opportunities for market participants in the coming years. The demand for routers, switches, and wireless LAN networks has also increased due to government initiatives to accelerate digital transformation, which is anticipated to spur market growth in the future.

India’s networking market, which includes Ethernet switches, routers, and WLAN segments witnessed a 2.9 percent year-over-year (YoY) growth in terms of vendor revenues during 1H22. Vendors continue to battle chip shortages, which are extending the lead times. Though the delays are starting to get rationalized in the wireless segment, the shortages in the switching segment continue to worsen, specifically in the access and distribution layer. The prices of network equipment have significantly increased over the last few quarters owing to the high input costs driven by semiconductor demand, logistics, and fluctuating currency. Despite these challenges, the demand for networking equipment has not weakened and vendors have at least two quarters of backlogs to clear in the coming months. The second half of the year is expected to have significantly higher business compared to the first half.

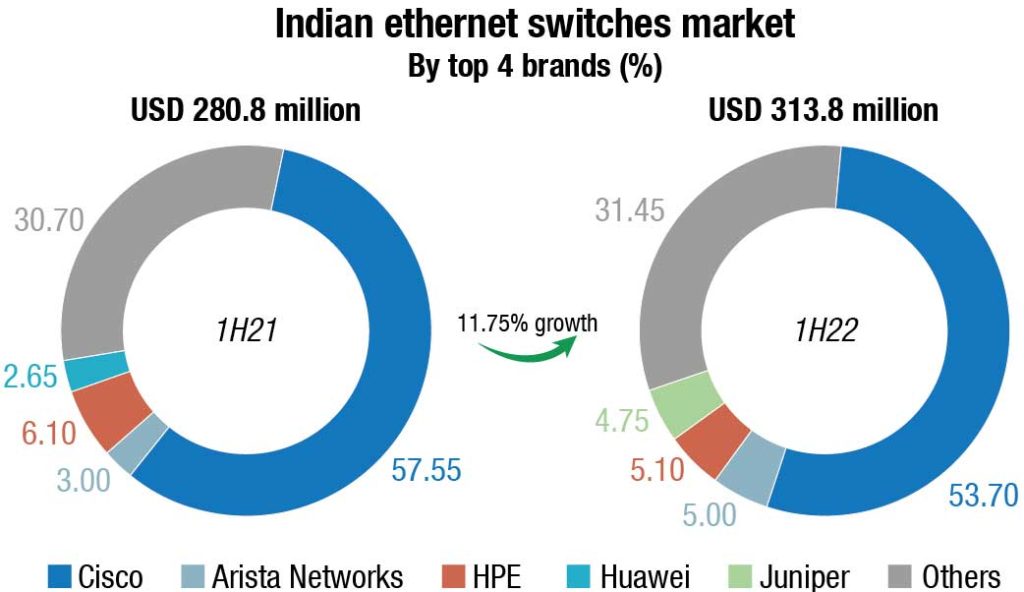

The 1H22 Ethernet switch market in India stood at USD 313.8 million, by vendor revenue, registering a strong YoY growth of 11.75 percent. DC switching segment contributed with a YoY growth of 19.8 percent. Non-DC on the other hand declined by 2.9 percent owing to the chip shortages that vendors are facing primarily in the low-end switching that includes PoE switches. The lead times of switches continue to suffer with vendors struggling to clear backlogs worth two–three quarters. Enterprises are willing to go beyond the top five vendors while procuring non-DC switches, considering the existing lead times. Strong growth came from multi-gig, 25G, and 100G speeds. 200G switches are also picking up traction in India. Key business verticals for switching during 1H22 include services, manufacturing, finance, and telecom.

Cisco continued to lead the Ethernet switch market with a 53.7-percent share during 1H22, followed by Hewlett Packard Enterprise (HPE) and Arista.

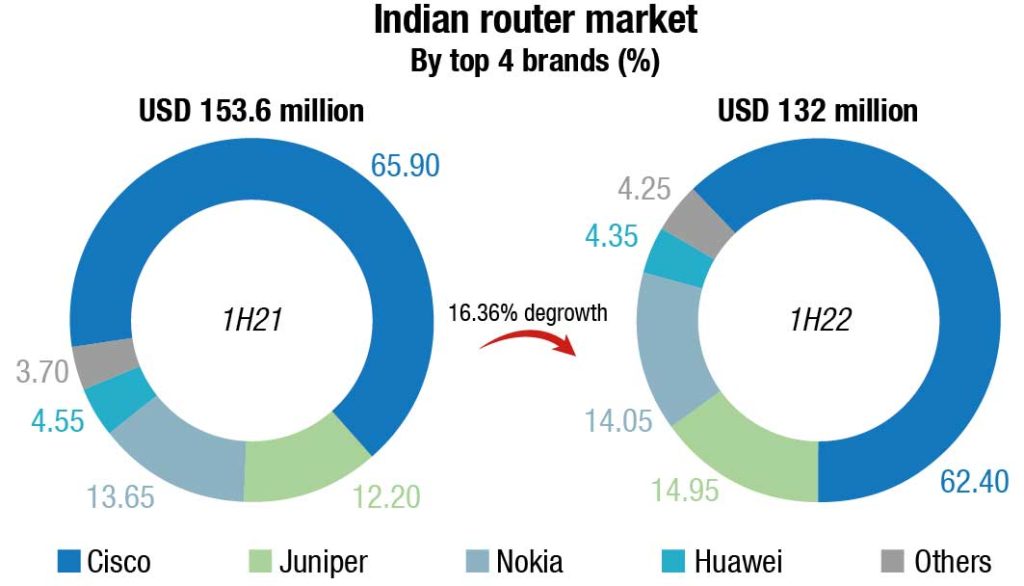

India’s router market declined 16.36 percent YoY by vendor revenues during 1H22. The Indian router market in 1H22 stood at USD 132 million as compared to USD 153.6 in 1H21. The decline can be mainly attributed to telecom service providers going slow on router investments. Service provider deployments declined by YoY 25 percent during 1H22. Service providers contributed 62.3 percent of router revenues and were majorly responsible for the category to decline. However, expect to witness telecommunications vendors incurring CapEx ahead of the 5G rollouts in India, which in turn would grow SP router deployments in India during the coming quarters. Enterprise router business grew by 16.3 percent YoY, with investments aimed at regular refreshes and SD-WAN deployments. Apart from telecommunications, the key verticals for routing include services, finance, and government.

Cisco leads the router market with a 62.4-percent market share in 1H22 followed by Nokia and Juniper.

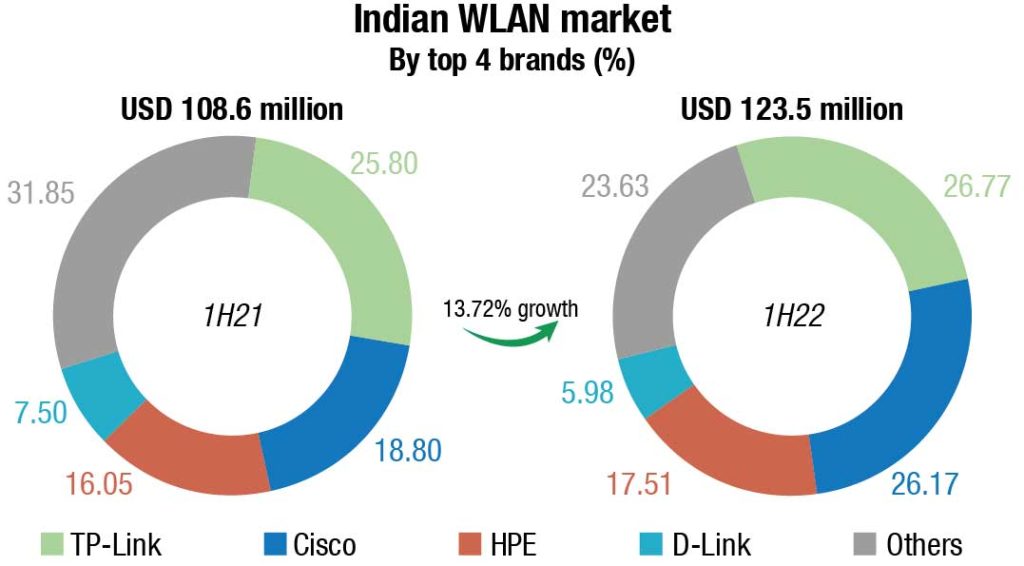

The Indian WLAN market had a strong YoY growth of 13.72 percent by vendor revenue during 1H22, majorly driven by the enterprise wireless segment. The market stood at USD 123.5 million (by vendor revenue).

The chip shortage situation is comparatively easing out in the WLAN segment compared to switching. Vendors are currently focused on clearing the backlogs as much as they could before CY 2022 to be able to efficiently cater to future demand. The trend of choosing vendors other than the top three to be able to get quicker shipments was evidently seen in the wireless segment as well. Services continued to be the top spending vertical. However, verticals such as education, retail, hospitality, etc., which were in a long slumber caused due to Covid, have started to gain significant traction. Wi-Fi 6 continued to dominate WLAN revenues with a 70-percent share by vendor revenues. Despite the growth of Wi-Fi 6, older generations of wireless i.e., AC Wave 2 continue to have market demand owing to the cost effectiveness, and to bridge the gap in the lack of Wi-Fi 6 access points in the market.

The consumer gateway router business grew by 5.7 percent YoY, by vendor revenue. Despite offices opening in the country, the trend of hybrid work is largely propelling the growth of consumer gateway routers. While AX is starting to gain adoption in the consumer segment, the market is still dominated by Wi-Fi AC, followed by N routers as ISPs continue to use these generations of routers for enabling home broadband connectivity.

With a market share of 26.77 percent, TP-Link was the market leader in the WLAN segment during 1H22. Within the enterprise-class WLAN segment, Cisco was the market leader with 26.17 percent market share followed by HPE with 17.51 percent.

The Ethernet switch, router, and WLAN market is expected to grow in single digits in terms of compound annual growth rate (CAGR) for 2021–2026. The increased adoption of emerging technologies, such as cloud, IoT, mobility, and the like, would drive incremental revenues. Large investments for 5G rollouts in the next couple of years are also expected.

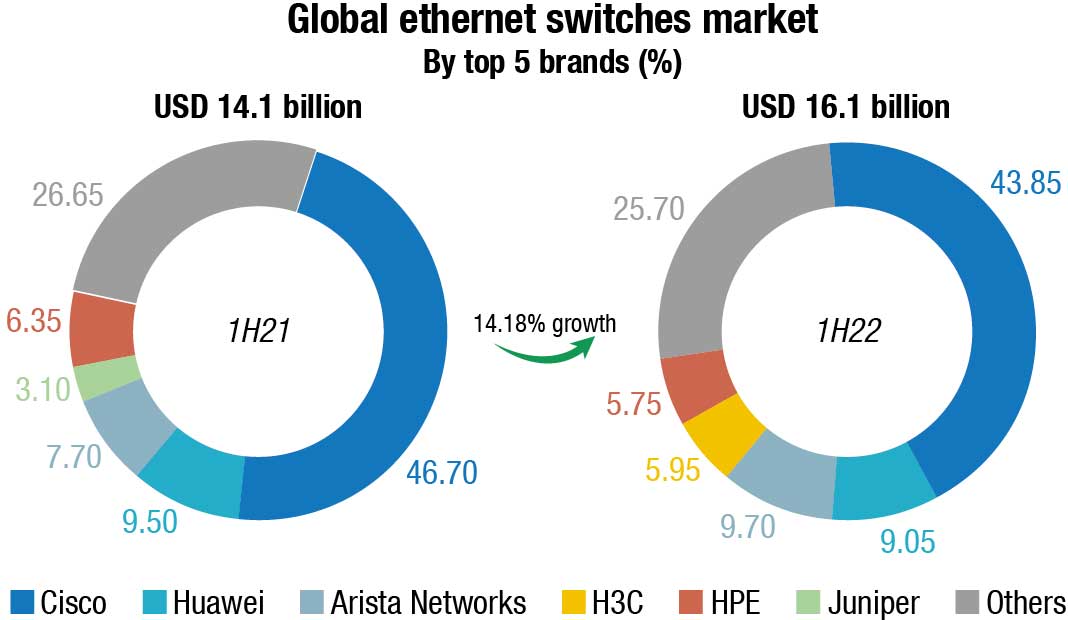

Global market

The Ethernet switch market’s annualized growth of 14.6 percent builds on momentum from the first quarter of 2022, when the market increased 12.7 percent YoY; for the first half of 2022, the market is up 14.18 percent compared to the first half of 2021. For the first half of 2022 (1H22) the Ethernet switch market is estimated at USD 16.1 billion. Revenues in the non-datacenter segment of the Ethernet switch market – which includes Ethernet switch deployments in the enterprise campus and branch – grew 5.8 percent YoY, while port shipments decreased 0.4 percent YoY. Revenues in the datacenter segment rose 26.9 percent YoY in 2Q22, while port shipments increased 11.7 percent.

The higher-speed segments of the Ethernet switch market continue to see significant growth, driven by hyperscalers and cloud providers. Market revenues for 200/400GbE switches grew 67.4 percent on a sequential basis from the first to the second quarters of 2022, with port shipments increasing 89.5 percent. 100GbE revenues increased 28.3 percent YoY in 2Q22, while port shipments rose 23.4 percent YoY; 100GbE switch sales account for 26.2 percent of the market’s total revenues. 25/50 GbE revenues increased 22.1 percent YoY in 2Q22 while port shipments rose 5.4 percent annually.

Lower-speed switches, which are a more mature part of the market, saw moderate growth. Revenues in the 1GbE segment of the market rose 2.6 percent YoY in 2Q22, with port shipments increasing 1.6 percent. 10GbE switches declined 1.3 percent in the quarter, while port shipments grew 2.1 percent YoY. 2.5/5GbE switch revenue – also known as multi-gigabit Ethernet switches – rose 41.2 percent on an annualized basis, with 6 percent sequential growth from 1Q22 to 2Q22, with port shipments increasing 58.7 percent annually, but rising 0.8 percent sequentially.

From a geographic perspective, the Ethernet switch market saw growth in most regions of the world. In the Asia-Pacific region, excluding Japan and China, the market grew 14 percent YoY, while in the People’s Republic of China, the market increased 9.3 percent and in Japan the market fell 6.4 percent. In the United States, the market rose 23.3 percent YoY, while Canada’s market increased 10.4 percent and the Latin America market was up 18.8 percent. In Western Europe the market rose 14.8 percent annually, while in the Middle East & Africa region the market grew 1.7 percent. In Central and Eastern Europe, the market declined 12.5 percent, with Russia’s market down 89.2 percent from a year earlier.

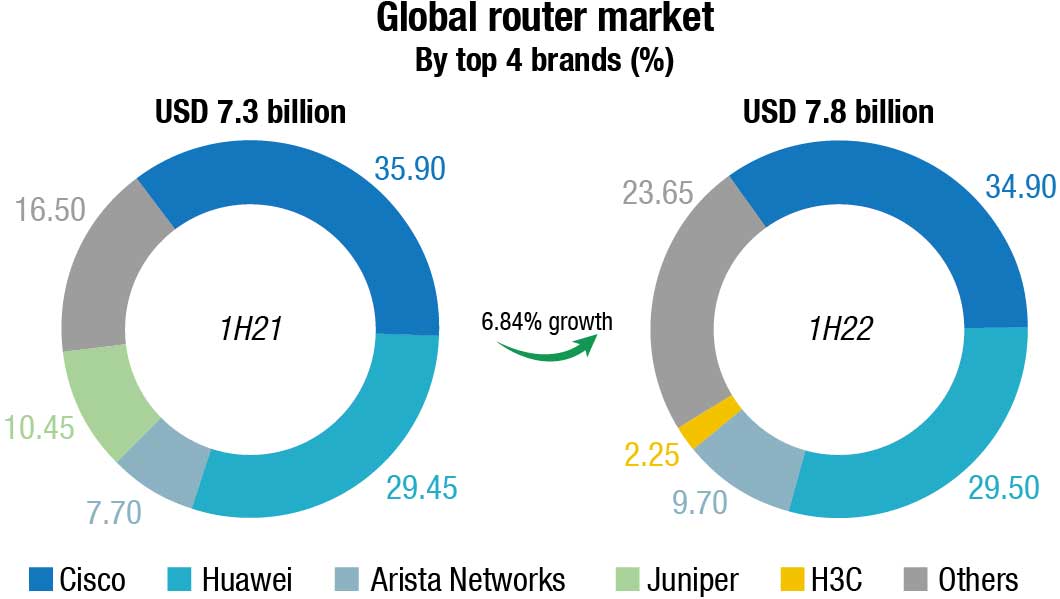

The total worldwide enterprise and service provider (SP) router market recorded USD 7.8 billion in revenue in 1H22, a 6.8 percent increase over 1H21. The service provider segment, which includes both communications SPs and cloud SPs, accounted for 73.8 percent of the total router market revenues, and this segment of the market increased 2.2 percent. Revenues in the enterprise segment account for the remaining share of the market and rose 20.2 percent from a year earlier.

From a regional perspective, the combined service provider and enterprise router market in 2Q22 rose 3.4 percent in the Asia-Pacific region, excluding Japan and China. Japan’s market declined 6.9 percent while the People’s Republic of China market was down 1.8 percent annually. Revenues in Western Europe increased 4.2 percent YoY, while the Central and Eastern Europe market declined 25.2 percent annually. The Middle East & Africa region increased 9.3 percent. In the US, the enterprise segment of the market increased 36.6 percent, while service provider revenues increased 16.8 percent, giving the combined markets a 21.3-percent increase on an annualized basis. The Latin America market grew 11.0 percent on an annualized basis and Canada’s market declined 1.1 percent.

Brad Casemore

Brad Casemore

Research Vice President, Cloud and Datacenter Networks, IDC

The Ethernet switch market maintained its strong growth in 1H22, driven by a variety of factors. In the datacenter, hyperscalers and other cloud service providers are adding switches to keep pace with robust demand from customers for popular applications and services. In the campus, growth is sustained by enterprises pursuing digital transformation and resiliency. What is impressive is that this growth is occurring in the face of headwinds occasioned by supply-chain disruptions, rising inflation, and the ongoing war in Ukraine. The resilience of the Ethernet switch market’s growth rates in recent quarters shows the importance of connectivity and digital infrastructure in today’s digital-first business world.

Cisco’s Ethernet switch revenues decreased 2.85 percent in 1H22, giving the company market share of 43.85 percent. Meanwhile, Cisco’s combined service provider and enterprise router revenue decreased 1 percent in the 1H22. Cisco’s combined SP and enterprise router market share stood at 34.90 percent in 1H22.

Huawei’s Ethernet switch revenue increased 9.1 percent in 1H22, giving the company market share of 9.5 percent. The company’s combined SP and enterprise router revenue increased 5.3 percent YoY, resulting in a market share of 29.5 percent.

Arista Networks saw Ethernet switch revenues increase 55.1 percent in 1H22, giving the company 7.7 percent market share in the quarter.

Sudharsan Raghunathan

Sudharsan Raghunathan

Associate Research Manager, Enterprise Networking, IDC India

With India looking to roll out 5G, the technology will play a pivotal role in the growth of the enterprise networking market. Though telecom vendors are expected to incur lesser CapEx on network equipment compared to the previous generations, IDC expects that the top two telcos will incur significant expenditure on network infrastructure, aimed at building edge data centers to deliver the 5G promise of faster speeds and lower latencies. As enterprises come out of the effects of Covid-19, the demand for network infrastructure across all verticals is looking stronger than ever with bookings piled up to serve 2–3 quarters from now. IDC expects the second half of 2022 to have a much stronger demand compared to the first, with demand coming from services, telecom, finance, and manufacturing.

H3C’s Ethernet switch revenue increased 4.8 percent in 2Q22, giving the company market share of 6.35 percent. In the combined service provider and enterprise routing market, H3C’s revenues rose 5.6 percent in the quarter, giving the company 2.25 percent market share for 1H22.

HPE’s Ethernet switch revenue declined 5.5 percent, resulting in market share of 6.35 percent in the 1H22.

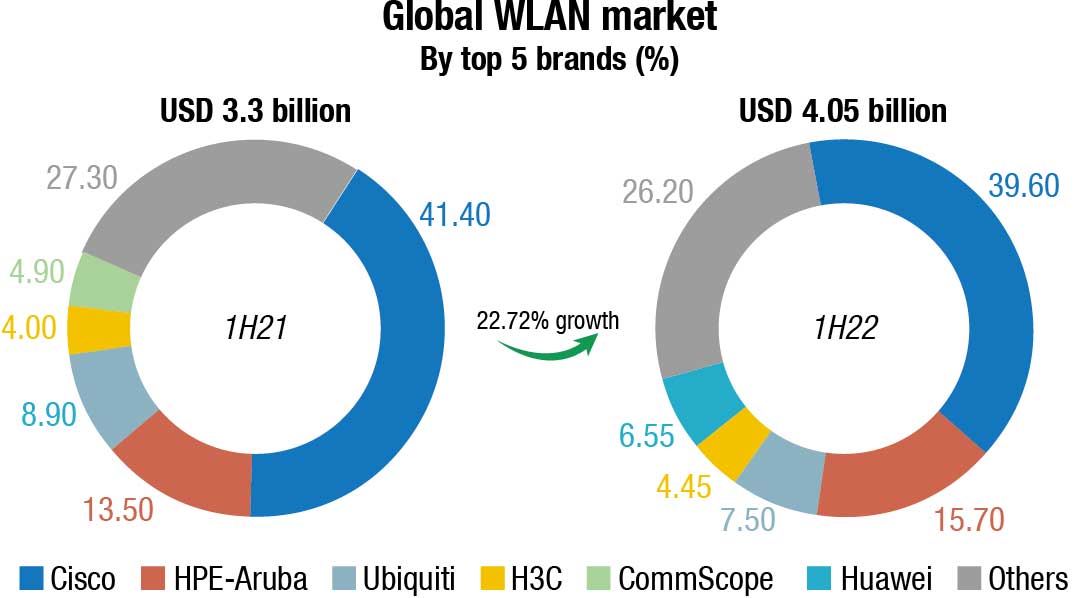

The enterprise segment of the worldwide wireless local area network (WLAN) market continued its strong growth in the first half of 2022 (1H22), increasing 22.72 percent over 1H21 to USD 4.05 billion. Growth in the enterprise WLAN market continues to be driven by the latest Wi-Fi standard, known as Wi-Fi 6 or 802.11ax. Wi-Fi 6 access points (AP) made up 76.5 percent of the revenues in the Dependent AP segment and accounted for 62.7 percent of unit shipments within the segment. Wi-Fi 5 products, also known as 802.11ac, made up the remaining balance of Dependent AP sales.

The consumer segment of the WLAN market declined 3.5 percent YoY in 2Q22, with the quarter’s unit shipments remaining relatively flat at 0.6 percent growth compared to the first quarter of 2022. Adoption of Wi-Fi 6 continues in the consumer segment of the WLAN market too. In 2Q22, Wi-Fi 6 made up 33.5 percent of the market’s revenues.

“The enterprise WLAN market continues to grow at a rapid clip, emphasizing the importance of wireless technology in the network and digital transformation goals of organizations across the globe,” said Brandon Butler, research manager, Enterprise Networks at IDC. “The enterprise WLAN market is not immune to challenges, however, with the supply chain disruptions and component shortages being notable examples. But strong demand for wireless refreshes to Wi-Fi 6 – and increasingly to Wi-Fi 6E – is buoying the market and leading to strong growth rates.”The enterprise WLAN market had mixed results across the globe. In the United States, the market increased 15.7 percent annually, while in Latin America the market grew 47.7 percent from a year earlier. In Canada, the market declined 1.6 percent. In Western Europe, the market increased 45.4 percent, but in Central and Eastern Europe, the market declined 20.6 percent. Within Central and Eastern Europe, Russia’s market declined 73.2 percent as the Russia-Ukraine war rages on. In the Middle East & Africa, the market rose 23.2 percent. In the Asia-Pacific region, excluding Japan and China, the market rose 26.5 percent, while in the People’s Republic of China the market increased 8.7 percent YoY. In Japan the market rose 6.2 percent.

Cisco’s enterprise WLAN revenues increased 19.3 percent YoY in 1H22, giving the company market share of 39.60 percent, compared to market share of 41.40 percent in the first half of the previous year (1H21).

HPE-Aruba revenues rose 48.6 percent YoY in 1H22, giving the company market share of 15.70 percent, up from 13.50 percent in 1H21.

Ubiquiti enterprise WLAN revenues increased 10.5 percent YoY in 1H22, giving the company 7.5 percent market share in the first half of 2022.

Huawei enterprise WLAN revenues rose 20 percent YoY in 1H22, giving the company 6.55 percent market share.

H3C revenues increased 16.4 percent YoY in 1H22, giving the company market share of 4.45 percent, up from 4 percent in 1H21.

Vendor revenue in the overall security appliance market grew 5.7 percent YoY in the second quarter of 2022 (2Q22), reaching over USD 4.9 billion, representing a USD 269-million increase compared to the same quarter in 2021. In the same period, security appliance shipments delivered 7.2 percent YoY growth to more than 1.3 million units.

The combined Unified Threat Management (UTM) and Firewall market saw YoY growth of 7.2 percent in 2Q22. All other security appliance markets – content management, intrusion detection and prevention (IDP), and virtual private network (VPN) – also saw positive YoY growth in the second quarter.

“The overall security appliances market experienced healthy growth in the second quarter of 2022, with the Middle East & Africa, the United States, and Asia-Pacific (excluding Japan and China) regions driving the market. Security subscription services attached to hardware platforms are playing a key role in the relevance of this platform within security hybrid strategies for securing ICT environments,” said Carlo Dávila, research manager, Enterprise Trackers, IDC.

Regional results show the Europe, Middle East & Africa (EMEA) region led the market with YoY growth of 10 percent in 2Q22, followed by the Americas with 9.4 percent growth where USA played a key role with its 9.5 percent growth.

The worldwide shipments of hardcopy peripherals declined 8.32 percent to 44.4 million units in the first half of 2022 (1H22). Persistent supply shortages continued to affect the HCP market and full inventories are not expected until 2023.

Notable highlights from the quarter include:

- Shipments for the remainder of 2022 are expected to be inconsistent across most segments, with significant amounts of new products being diverted to fulfill back orders and tenders rather than for new business.

- In terms of regional markets, Asia-Pacific (excluding Japan and China) (APeJC) and the People’s Republic of China (PRC) outperformed all other global regional markets, posting YoY unit gains of 7.4 percent and 1.0 percent respectively. The growth was mainly driven by economic recovery across all countries in APeJC compared to the same period last year. On top of that, supply and logistics issues also saw improvements over the past few quarters. Large-scale promotional activities on June 18 in PRC also played a role in boosting the sales of ink cartridge printers.

- Canon, the second ranked company, recorded 10.0 percent YoY growth worldwide with more than 4.4 million units shipped. Canon’s overall supply was better in 1H22 for 4-in-1 ink cartridge printers than for 3-in-1 ink tank printers. There were new commercial models introduced, and Canon was hoping for inkjet to make up for the gap left behind by the discontinuation of previous models.

During the early days of Covid-19, companies rushed to connect their workforces. This was phase one. They invested heavily in their existing infrastructure. Most enterprises, though, will not go back to working solely from the office anytime soon. In the backdrop of the world’s largest experiment in remote access and the decade’s most sophisticated security breach, enterprises will continue to increase bandwidth at key sites, and do whatever is necessary to get the company equipped to support widespread work-from-home efforts.

The worldwide IT and business services revenue is expected to grow by 5.6 percent in 2022. The improved market view reflects robust 2021 bookings and pipelines by several large services providers, an improved economic outlook (compared to the previous forecast cycle), and inflationary impact on the services market, offset slightly by the negative impact of the Ukraine-Russia conflict.

The market will continue to expand throughout the next few years at a rate of 4–5 percent, representing an overall increase of 40 to 80 basis points each year, pushing the market’s long-term growth rate to 4.6 percent, up slightly from the previous forecast of 4.3 percent.

The Americas services market is forecast to grow by 5.3 percent in 2022, up 150 basis points from the October 2021 forecast. This is attributed to a faster economic rebound and the impact of inflation. IDC believes that the trend will continue in the short term – 2022 and 2023 growth rates were adjusted up by 150 and 100 basis points, or around 4 percent YoY growth for the next five years.

Our mid- to long-term growth prospects for Canada and Latin America improved marginally. Both regions will continue to see recovery well into 2022 and 2023. Latin America’s near-term growth outlook is further lifted by the commodity price rally since March.

The outlook for the US market has also been adjusted up by 160 and 80 basis points for 2022 and 2023, respectively. The adjustments were made across all markets. The improved economic outlook and vendors’ strong bookings and pipelines in the world’s largest services market partially drove this upward change, while the rest can be attributed to our inflation-impact assumptions, especially in project-oriented markets. The long-term US growth prospect remains largely unchanged.

Xiao-Fei Zhang

Xiao-Fei Zhang

Program Director, Worldwide Services Tracker Program, IDC

In this forecast cycle, IDC services analysts have looked at short-term impacts, such as pent-up demand and the Ukraine-Russia conflict, as well as more structural ones, such as adoption of public cloud, the talent crunch, inflation, data security/residency/sovereignty, and more. Based on our analysis, we adjusted our outlook accordingly at the market level. However, at the individual vendor level, services providers will need to brace for more volatility. On the heels of a global pandemic, enterprise buyers face another black swan event in 2022, which will accelerate large global trends, such as remaking the global supply chain and value chain and exacerbating the talent crunch by changing demographics. We should expect more of the unexpected in the years to come.

Growth forecast for EMEA (Europe, Middle East, and Africa) was raised by more than 220 basis points.

While Europe is the most impacted region by the ongoing Ukraine-Russia conflict, the near-term outlook for Europe remains sanguine and unchanged. The Central & Eastern Europe (CEE) forecast has been reduced significantly due to the conflict in Ukraine. The CEE services market is expected to grow only by 5.5 percent and 7.3 percent in 2022 and 2023, respectively, down from our previous forecast of 9–10 percent growth. Russian and Ukraine markets will shrink significantly this year.

Western Europe’s near-term growth forecast has been adjusted up – the region is forecast to grow by more than 6 percent in 2022, up by 280 basis points. The improved outlook is largely due to the EU’s revised 2022 GDP outlook at the end of 2021 (prior to the Ukraine-Russian crisis). EU-funded investments are anticipated to drive services spending. Inflation also contributed to nominal growth, although to a smaller degree.

This was partially offset by the Ukraine-Russia conflict. Based on March assumptions about the crisis, which assumed a more neutral scenario (limited military escalation and disruption to the global supply chain), the crisis will dampen Western Europe’s mid-term market growth, but will be offset by other drivers. Of course, because the situation is ever evolving, its actual impact to the EU economy may be more severe than expected.

The Middle East & Africa’s (MEA) growth prospects for 2022 and 2023 have also been raised by 250 and 100 basis points, respectively. Due to a strong rebound from the pandemic and economic malaise, particularly in previously beleaguered markets, such as Turkey, as well as rapid IT infrastructure spending, including hyperscaler buildouts, MEA market looks more positive. The negative impact of the Ukraine-Russia crisis on the region will be only marginal.

Asia-Pacific’s growth outlook improved by 0.9 percentage points in 2022, largely due to PRC (China) and other developed Asian markets (i.e., Australia, Japan, Singapore, Korea, etc.). Japan’s growth rate was lifted by 0.2 to 0.6 percentage points per year for the next five years while Australia, New Zealand, Korea, and Singapore all saw adjustments of 100+ basis points in 2022 and 2023 growth rates.

The forecast for China’s market growth has been adjusted up to 6.4 percent and 8 percent for 2022 and 2023, respectively. While China’s GDP growth is expected to cool down, IDC believes that digital transformation remains central to the country’s long-term new infrastructure initiatives, which will further drive services spending in both the public sector and strategic industries, such as BFSI, manufacturing, and energy.

Within the IT and business services markets and across all regions, cloud-related services spending has been the main growth accelerator since 2020. It forecasts to continue to grow close to 20 percent YoY in 2022 and between 15 percent and 20 percent over the next three years.

More services providers can also be seen crossing over from IT and business services to operational technology (OT) services. Even after accounting for the supply-side disruption, caused by the Ukraine-Russia crisis, the product engineering and operational technology engineering services and operational technology services markets are forecast to grow twice as fast as IT and business markets.

Overall, while inflation may artificially increase market size in the short term, this is largely offset by demand instability and rising labor costs.

You must be logged in to post a comment Login