Industry

Embracing a greener future

As technology costs fall and environmental concerns grow, renewable-energy systems offer more and more opportunities for incumbents and new entrants alike.

For telecommunications network operators specifically, the issue of sustainability has become urgent. The unprecedented demand for digital communications during the pandemic has forced telco infrastructures to consume more energy than ever. Telecom operators account for 2 percent to 3 percent of total global energy demand, making them some of the most energy-intensive companies in their geographic markets.

With more than 90 percent of network cost spent on energy, consisting mostly of fuel and electricity, the demand for energy-saving measures from telecom operators is growing. This demand likely will continue or increase as companies not only rush to adopt remote work during the pandemic but make these tools a permanent part of the workplace. According to experts, there will be a need to increase network capacity through to 2030 by 1000-fold, while at the same time sustaining or reducing energy usage.

As data traffic grows, the amount of power it takes to run telecommunications networks – and the source of that power – is the environmental elephant in the room. Additionally, edge computing will drive the construction of a more distributed datacenter model, which again means more power and more infrastructure as edge servers run flat out to guarantee low latency and high reliability of services around the clock.

Datacenter energy consumption is expected to increase by 21 percent by 2025, with cloud data centers accounting for 60 percent of the energy consumption of data centers and edge data centers 12 percent. Moving forward, the cloud’s continued exponential growth is likely to translate directly into exponentially rising energy demand.

For many years, the ICT industry’s impact on the environment went relatively unnoticed. But its effect is consequential and gaining attention. The industry accounts for 3 to 4 percent of global CO2 emissions, about twice that of civil aviation. And with global data traffic expected to grow around 60 percent per year, the industry’s share will grow further unless investments in energy efficiency and renewable energy can offset the effect.

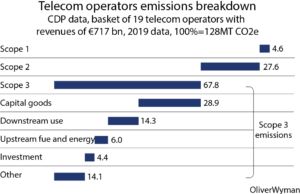

As a specific segment within the ICT industry, telco operators have a sizeable impact on both CO2 emissions and waste. To assess the CO2 impact, companies need to take into account all three scopes of emissions.

According to the GSMA’s Mobile Net Zero report, it is estimated that the mobile industry produces around 220 million tons of carbon dioxide equivalent (Mt CO2e) per year, representing roughly 0.4 percent of global carbon emissions. This represents part of the global information and communication technology (ICT) industry’s carbon emissions, which amounts to roughly 700 Mt CO2e per year or 1.4 percent of global carbon emissions.

Telcos generate few so-called Scope 1 emissions – those generated from directly burning fossil fuels. Scope-2 emissions result from purchasing energy and heat (so what is in Scope 2 for a telco is in Scope 1 for the energy supplier). Finally, Scope 3 emissions are caused by downstream and upstream activities, such as the energy consumption of suppliers. This is by far the biggest impact area, typically making up more than two-thirds of a telco’s total carbon emissions, and sometimes more than 90 percent. In the past few years, most telcos have begun to acknowledge that they should assume responsibility for their Scope-3 emissions, for example, by demanding transparency into their suppliers’ footprint, engaging with them to improve, and factoring this into the selection process.

In addition to lowering their own end-to-end emissions, telcos have a historic opportunity to help other industries become more energy efficient. Smart products and solutions from telcos – e.g., smart agriculture and smart logistics – are already available that can help other industries reduce their carbon emissions by an amount up to 10 times the telco industry’s own emissions.

GSMA has committed to science-based targets (SBTs), that the wireless operators shall lower emissions by a minimum of 45 percent through 2030. A shift to clean and low-carbon energy sources is projected to make up the majority of decreases over this timeframe, together with operators becoming more energy efficient. Usage of renewable energy, which may differ widely according to geographic location, remains an essential factor for an operator’s capacity to meet SBTs. Twenty-nine operator groups representing 30 percent of global mobile connections are already committed to SBTs. These targets for the industry include emissions’ reduction trajectories for mobile, fixed, and datacenter operators to meet the ambitious Paris Agreement goal of limiting global warming to 1.5°C, designed to substantially reduce the risks and effects of climate change. Networks and data centers account for the next biggest share of emissions in the telecom industry.

5G is expected to usher in aggressive growth in energy consumption over the remainder of this decade. This may partly be attributed to exponential growth in the number of connected devices. Last year, the overall energy footprint of the global mobile industry was about 19.8 million tons oil equivalent (or Mtoe). By 2030, it will hit 51.3 Mtoe, says a recent report released by ABI Research and sponsored by InterDigital.

5G will impact energy efficiency in many other ways:

- 5G is inherently more energy-consuming than 4G due to the stringent power requirements of Massive MIMO deployments; however, when estimating the energy required for a single Mbps of capacity, 5G is a much more efficient technology.By digitizing enterprise workflows and other parts of daily life, 5G enables more efficient operations that reduce energy consumption and carbon footprint. Current deployments of 5G have the potential to reduce global energy consumption by 290,000 Terawatts by 2030, and that number balloons to over 900,000 Terawatts of energy reduction under ubiquitous 5G coverage.

- Network operators are exploring next-gen solutions to aggressively combat 5G’s energy footprint. For example, operators have implemented sustainability or carbon-neutrality requirements for suppliers, considered new modes of self-energy generation like micro-grids and smart-metering, and explored the use of AI algorithms to predict and adjust energy consumption.

- By 2030, 5G adoption for key enterprise verticals can reduce global CO2 emissions by up to 37 Gigatons and, therefore, be an important building block for industry carbon neutrality by 2050. To drive this, the entire industry must embrace this consolidated ecosystem effort and encourage close collaboration with implementing enterprises to understand their pain points and key requirements.

The 5G NR radio access network (RAN) standard was intentionally designed to be more energy efficient per gigabyte when compared with 4G LTE. However, RAN densification means that many more antenna sites are needed and along with that power and new infrastructure. So, effectively 5G will increase energy usage.

With LTE and 5G upgrades in emerging and developing markets anticipated to more than triple electricity consumption, telecom operators are increasingly deploying distributed renewable energy-generation technologies and distributed energy-storage systems. Between 2021 and 2030, global telecom network providers are expected to install nearly 121.9 GW of cumulative new distributed renewable energy-generation technologies and distributed energy-storage systems capacity.

On the occasion of the United Nations’ COP26 climate change conference in Scotland, Nokia and GSMA Intelligence took the opportunity to investigate how telcos plan to tackle a variety of energy-efficiency issues.

GSMA Intelligence surveyed 103 telcos around the world and found that they overwhelmingly view rising energy demand and costs as critical issues to their operations and their customers.

According to the research, 83 percent of telcos surveyed see energy efficiency as a major network transformation driver that will grow in importance as 5G is operationalized by industry, while 67 percent expect their energy costs to rise over the next three years based on current trends.

And it seems that many believe the implementation of AI will be critical in the fight against climate change.

Along with the use of renewables, AI energy-management software is said to be central to many telco strategies to shrink their environmental footprint because it can be deployed quickly across an entire network with little to no human intervention.

According to Nokia, by using zero-touch automation, AI programs can improve energy savings by closely aligning equipment usage patterns with real-time network demands; and identifying performance anomalies in underperforming network equipment that saps energy resources and requires replacement.

Running systems that are not in constant use consumes significant amounts of energy. Typically, radio access network (RAN) accounts for about 60 percent of the power used at a mobile site. Data-traffic loads are intermittent, though, so that different parts of RAN can be put briefly into sleep mode, even during periods of peak traffic. A mobile operator in Australia found that simply turning off the power-amplifier symbol at a site could cut consumption by more than 7 percent, without any service degradation.

AI expands the potential for such energy-saving opportunities across the network. The ability to analyze vast amounts of data relating to traffic patterns, real-time demand, and network-resource availability allows for quick, automated decisions on the parts of the system that can be put into sleep mode or shut down. For example, this could involve shutting down frequency carriers or shutting down a site momentarily in areas where there is overlapping coverage. We estimate that such energy-conserving AI tools can deliver 5 to 7 percent savings for some operators, in addition to savings that accrue from stand-alone, site-level efficiency measures. And the potential will surely rise further. As open and cloud-native approaches to building RAN gain ground, additional AI solutions that not only save energy but also minimize related customer-experience issues, such as latency, are emerging. They can also be used on all networks, from 2G to 5G.

Similar energy-saving advances are occurring with AI on fixed networks. For example, AI can reduce the energy cost of central offices by between 3 and 5 percent by continuously calibrating the optimal settings of chillers, pumps, and fans to guard against waste.

The AI tools for managing energy efficiency in data centers (where the cloud RAN will be located) are considerably more mature. Google, for example, has reported 30 percent energy savings using AI at its data centers, illustrating just how high telecom operators could set their sights, observes a McKinsey paper.

|

Telcos’ energy costs continue to rise, but they have arange of new tools to cut consumption and alter supply Key energy-demend and cost-reduction opportunities, illustrative |

|||||||

| Layers |

Description |

Energy costs addressed % |

Potential cost improvement % |

Energy cost saving % | CapEx | Complexity | Achievable with a year |

| Smart sleep and shutdowns | Site level: power-amplifier symbol, adaptive power consuption, multiple-input and multiple-output muting | 20 | 10 | 2 | Low | Low | |

| Multisite level: carrier shutdown, cell shutdown, cross-base-station optimization, cross-radio (3G/4G) optimization | 40 | 15 | 8 | Low | Medium | ||

| Internet of Things–enabled energy optimization | Sensors to optimize colling | 25 | 15 | 4 | Low | Low | |

| ToU/Smart metering | 100 | 5 | 5 | Low | Low | ||

| Fuel monitoring | 5 | 15 | 1 | Low | Low | ||

| Structual and architectural transformation | 2G or legacy shutdowns | 3 | 100 | 3 | Medium | Medium | |

| Newer cooling systems, insulation, reflective paints |

15 | 200 | 3 | Medium | Medium | ||

| Stratagic and sustainable energy sourcing | Purchase or generate green energy | 100 | 30 | 30 | None | Medium | |

| Direct procurement/competitive sourcing | 100 | 5 | 6 | None |

Low |

||

IoT-based energy optimization. It is hard, if not impossible, to reduce energy consumption and costs if you cannot measure consumption accurately. That is the starting point of any concerted energy-efficiency program. But until recently, accurate measurement on an industrial scale has been difficult. Old equipment does not always measure consumption, and even if it does, recording it requires hundreds of employees to make and submit accurate readings. The IoT, by contrast, uses sensors to track consumption.

That advance opens up all sorts of new ways for operators to save energy. Sensors that read consumption – essentially, smart meters – give companies access to time-of-usage discounts in markets where they are offered. One Southeast Asian operator saved 5 percent on its energy costs because of a differential pricing offer from the utility provider.

And the IoT can counter the theft of fuel and grid power, which is a serious concern in some developing markets, where it can raise energy consumption and costs for some operators by 10 to 15 percent. By placing sensors at various points to gauge grid-power input, fuel levels, the number of hours the generation set has been running, battery voltages, and consumption by different types of equipment, and then analyzing the data, operators could uncover potentially costly anomalies. What is more, the IoT platform could provide real-time alerts when they occur.

Like AI, the IoT also makes it much easier to optimize consumption – with air conditioners, for example. Many operators have already moved heat-generating equipment outdoors to take advantage of natural convection cooling. Nevertheless, our analysis shows that, on average, about 20 percent of a telecom operator’s sites and other facilities still use air conditioning. On mobile sites where this is the set case, air conditioning accounts for 30 percent of energy consumption. Here, the installation of sensors would allow monitoring and remote adjustment of the site temperature. The sensors could even alert the operations center if a door was left ajar or the maintenance crew altered the setting, forcing the air conditioning to work unnecessarily hard. The overall result could be a 1 to 3 percent reduction in a site’s energy consumption.

Importantly, companies can retrofit the IoT for use by old equipment, even as OEMs are integrating it into newer equipment.

Where the opportunities lie

The biggest opportunities for energy-consumption and cost reductions lie in four areas. Some are more complex than others to capture, and some require more capital spending than others.

For global warming to be kept below irreversible levels beyond 1.5°C, net global emissions will have to come down by half by 2030, before reaching zero by 2050. Innovative approaches to manage supply and demand are needed to accelerate the transition from an energy system 84 percent dependent on fossil fuels, to one that runs on renewable power. Interconnectivity between all elements is vital to achieve a smart energy system (SES).

GSMA had conducted a study and recommended that the fundamental transformation required is to decarbonize as we digitize. And the most fundamental industry to decarbonize is the energy system. Until now, there has been a lot of focus on renewable technologies, such as solar, wind, tidal, and hydropower and less discussion on how they will work together. This is where smart energy systems come in. Connectivity has a key role to play and in particular mobile connectivity. To reap the most benefit from mobile connectivity, there needs to be greater evolution and cooperation between sectors, such as energy, mobile network operators and ICT companies, and energy regulators.

The mobile sector will be essential to providing the backbone infrastructure for this. Using wireless connectivity, a broad network of diverse devices can be aggregated that both produce and consume energy. Harnessing the power of AI-based cloud computing, platforms can be created that control and optimize the use and storage of renewable energy resources, and retire fossil-fuels from the existing energy mix.

GSMA maintains that the implementation of smart energy systems will prevent an overbuild of capacity worth 16,000 TWh of annual generation, which based on today’s electricity prices will save approximately USD 1.9 trillion per year. More importantly, compared to today’s energy mix, it will save emissions of 7.7 billion tons of CO2 making it responsible for over 23 percent of global decarbonization.

Leading telcos are doing well on sustainability at this moment, especially on their carbon footprint reduction; handset vendors less so, but telcos have to take some responsibility for the impact of smartphones too and work with handset vendors to reduce them. Telcos are clearly a key part of the ecosystem and have benefited greatly from the success of smartphones, which have driven connection growth and will likely do so again with the introduction of 5G models and applications.

Telecom operators can be leaders in sustainability practice, provided the right policy framework is put in place. Telecom operators are hungry for ways to become fully renewable in the energy they use and hungry to deliver climate action with measurable results. These companies can have great impact in transforming our energy system with the right green-energy products and the right policy framework.

As the pressure for environmental sustainability builds, telcos need to begin embedding sustainability issues into their everyday business decisions in a structured, comprehensive way. To this end, CEOs must own these initiatives, not only to reduce the company’s own carbon footprint, but to enable customers and other industries to better manage theirs as well. Far from being merely a cost topic, approaching sustainability from this perspective will open up enormous business opportunities.

India is key to this global climate agenda. According to IEA’s India Energy Outlook 2021, the country is projected to see the largest rise in energy demand of any country by 2040; its electricity demand is set to increase more rapidly than its overall energy demand, at around 4.7 percent each year.

The corporate uptake of renewables merits being subsumed under the umbrella of aligned public-private climate action. RE100 – the global corporate renewable energy initiative bringing together hundreds of large and ambitious businesses committed to 100-percent renewable electricity – is stepping up to this task. RE100 in India has brought together voices of 70+ businesses operating in the country on what it will take to build an enabling regulatory landscape, toward the shared objective of decarbonizing the power sector.

The RE100 proposal has been synthesized into a set of policy asks, which cut across a variety of renewable-sourcing options, including open access, rooftop solar, Indian RECs and green tariffs. As the government, regulators, and utilities are all coming together to pave the way for India’s energy transition, time is ripe for renewable buyers to be integrated into the country’s clean growth plans. And that is what RE100 is seeking to do with its proposition of a comprehensive framework of policy solutions, in particular, and as a channel for engaging the biggest demand-side cohort, in general.

India as a country has the largest production of energy from renewable sources. The total potential of solar itself in India is 748 GW. The renewable energy industry’s potential for growth is generating tremendous optimism, given the Government of India’s announcement of a target for installing 175 GW of renewable energy by 2022, out of which 100 GW would come from solar power, 60 GW from wind, and the remaining from hydro and biomass.

In last few years, Indian renewable-energy industry has progressed tremendously. In January 2021, a total of 1489 MW of solar and wind capacity was added, taking the cumulative RE capacity to 92.6 GW as on January 31, 2021. A lot of prominent projects have been commissioned that have maintained the growth momentum for the industry with a promise of further growth. Indian government has been instrumental in giving the much-needed aggressive push to the sector at all important levels.

India has an aggressive installation target of 280 GW of solar by 2030. Reaching the target requires adding nearly 24 GW of solar each year – a daunting prospect. India added 7.4 GW of solar capacity in 9M 2021, an increase of 335 percent compared to 1.73 GW in the same period in 2020, according to Mercom India Research’s recently released report Q3 2021 India Solar Market Update. India’s cumulative installations at the end of Q3 2021 stood at 46.6 GW.

Stakeholders believe that renewables in general and solar in particular will grow in 2022. Energy storage will come into its own. Round-the-clock and hybrid tenders will drive more deployment of grid-connected storage. Indian manufacturing across the solar value chain, wafers, cells, and modules will ramp up substantially.

India is running the world’s largest clean-energy program to achieve 175 GW of renewable capacity, to help reduce its carbon footprint by 33–35 percent from the 2005 levels, as part of global climate change transition commitments, adopted by 195 countries in Paris in 2015. India currently has an installed renewable-energy capacity of 89.63 GW, with 49.59 GW capacity under execution.

You must be logged in to post a comment Login