Industry

Digital Transformation Fuels Demand

Digital transformation, which is becoming mainstream amongst Indian businesses, will propel market gains over the next couple of years. Forrester pegs technology spending in India to climb 12 percent this year to hit USD 70 billion.

ICT infrastructure is the gateway to the digital transformation reshaping a nation’s industries, companies, and the way people live and work. It plays an increasingly critical role in driving sustainable growth and prosperity.

Today’s conventional wisdom on digital transformation is that broadband connectivity is no longer the ultimate goal. Broadband was the path to fast internet access and moving business into global e-trading. But it is now viewed as simply the first step to build ICT infrastructure, a platform to deploy the other four core technologies namely: cloud services, data centers, big data, and the Internet of Things (IoT).

Today’s conventional wisdom on digital transformation is that broadband connectivity is no longer the ultimate goal. Broadband was the path to fast internet access and moving business into global e-trading. But it is now viewed as simply the first step to build ICT infrastructure, a platform to deploy the other four core technologies namely: cloud services, data centers, big data, and the Internet of Things (IoT).

The Global Connectivity Index (GCI), an annual, comprehensive report that gauges nations’ status in ICT infrastructure investment, adoption, experience, and future potential as they work toward the digital economy, compiled by Huawei Technologies Co. Limited is an eye-opener for India. A nation that plays a key role in the global IT industry is emerging as one of the countries in the group of digital have-nots.

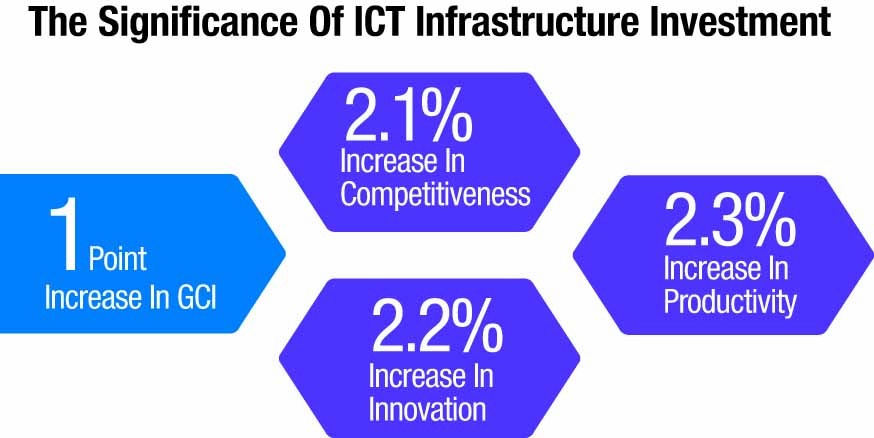

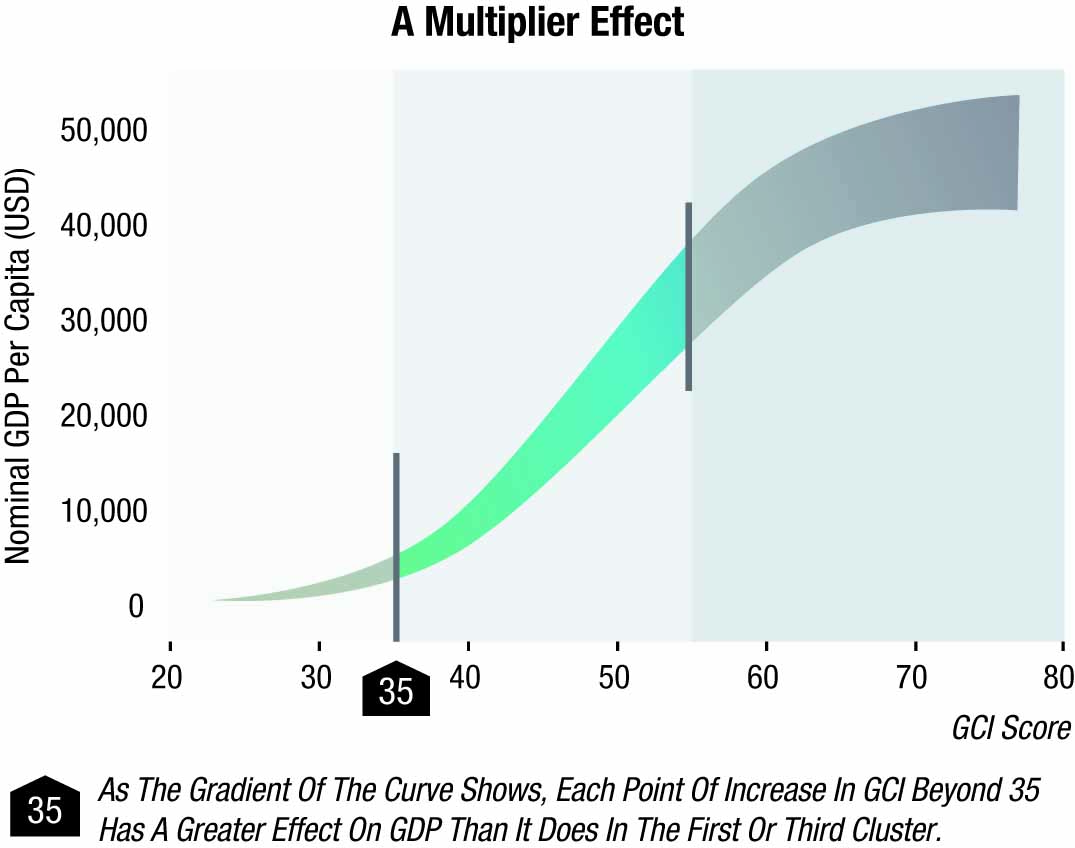

The GCI’s S-curve plots 50 nations’ progress in digital transformation, grouping them into three clusters based on their GCI scores: starters, adopters, and frontrunners. India qualifies as a starter ranked 43 (out of 50) with a score of 32. Benchmarking and tracking the progress of 50 nations in the digital economy, the index analyzes 40 indicators, and points to progress made by the interplay of investment, adoption, user experience, and future potential of ICT. As such, the movement of even a single GCI point is a significant reflection of a nation’s progress toward a digital economy.

Starters may be defined as nations with an average GDP per capita of USD 3000. These nations are in the early stage of ICT infrastructure build-out. Their focus is on increasing ICT supply to give more people access to the digital economy.

Starters may be defined as nations with an average GDP per capita of USD 3000. These nations are in the early stage of ICT infrastructure build-out. Their focus is on increasing ICT supply to give more people access to the digital economy.

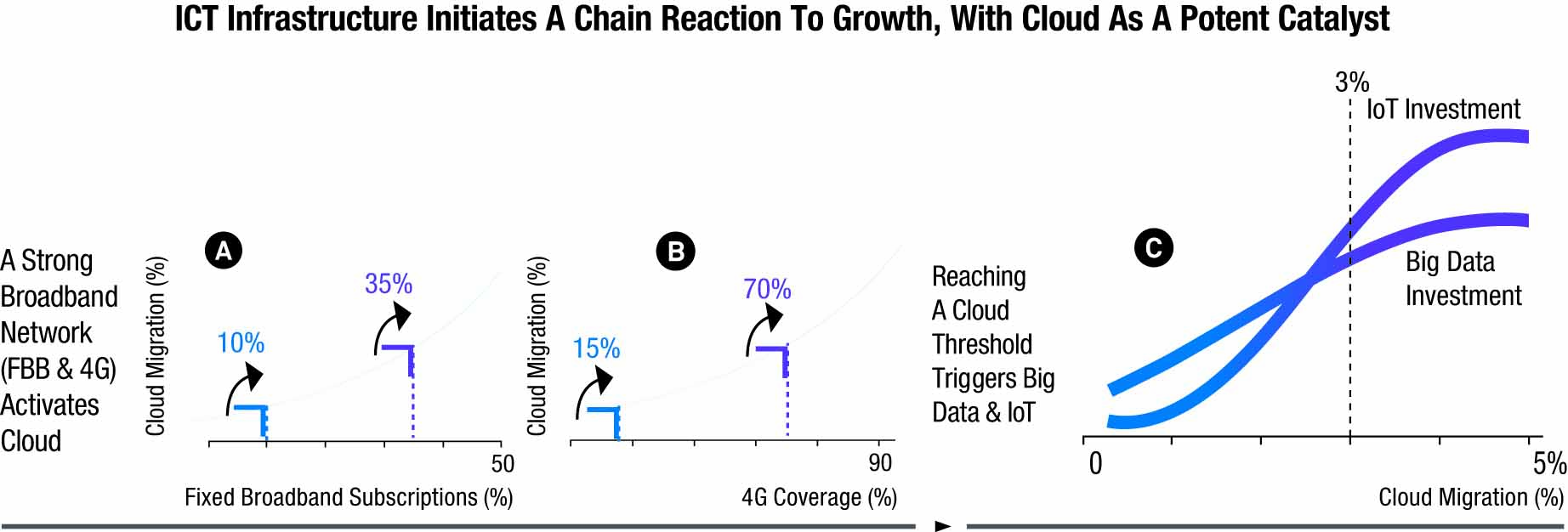

Through correlations of GCI data, the following thresholds are observed:

Fixed broadband subscriptions. As starters’ fixed broadband subscriptions reach 10 percent, they compete with adopters’ cloud capability.

4G coverage. As starters achieve 15 percent 4G coverage, they can compete with adopters’ cloud adoption rate.

Once deployed, cloud acts as a catalyst accelerating the time for a nation to tap the economic benefits of big data and IoT – ultimately leading to growth and prosperity. According to GCI data, when a nation reaches 3 percent of its total IT spending on cloud it begins to effectively use big data and IoT capabilities. This is a threshold that separates the frontrunners from the rest.

Once deployed, cloud acts as a catalyst accelerating the time for a nation to tap the economic benefits of big data and IoT – ultimately leading to growth and prosperity. According to GCI data, when a nation reaches 3 percent of its total IT spending on cloud it begins to effectively use big data and IoT capabilities. This is a threshold that separates the frontrunners from the rest.

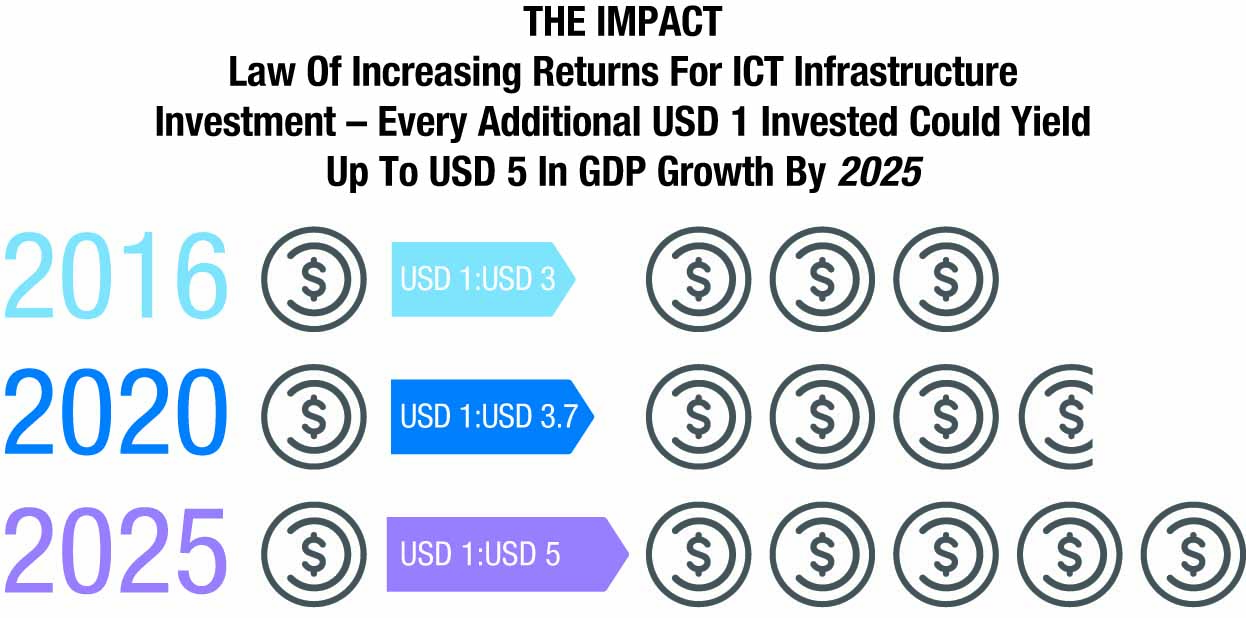

A nation that makes an additional 10 percent investment in ICT infrastructure, from 2016 to 2025, can benefit from a multiplier effect on that investment. Using this economic impact model, every additional USD 1 of ICT infrastructure investment could bring a return of USD 3 in GDP at present, USD 3.70 in 2020, and the potential return increased to USD 5 in 2025.

A silver lining for starters. The frontrunners’ accumulated advantage is based on a head start in investment capital and other resources that enabled them to deploy ICT infrastructure earlier. Yet starters at the low-end of the GCI S-curve should not be discouraged as GCI data confirms that when a nation’s GCI score breaks through 35 points they yield a higher GDP improvement proportionately as they boost ICT investment. The 35 mark is the tipping point when starters make the jump to the adopter cluster.

A silver lining for starters. The frontrunners’ accumulated advantage is based on a head start in investment capital and other resources that enabled them to deploy ICT infrastructure earlier. Yet starters at the low-end of the GCI S-curve should not be discouraged as GCI data confirms that when a nation’s GCI score breaks through 35 points they yield a higher GDP improvement proportionately as they boost ICT investment. The 35 mark is the tipping point when starters make the jump to the adopter cluster.

What sets ICT investment apart from other investments is that the development can be revolutionary rather than evolutionary. Simply put, nations do not necessarily need to modernize their mobile networks from 2G to 3G, then from 3G to 4G to achieve the speed and bandwidth of 4G networks. They can simply modernize their 2G networks by leapfrogging – investing in a 4G build-out. Starters that invest more aggressively in ICT fast track digital transformation and improve their chances to move up to the adopter cluster.

India is one of the nations the report has identified as investing in ICT infrastructure to accelerate digital transformation, and is leveraging the power of cloud to create new opportunities and growth potential for industries, companies, and people.

India is one of the nations the report has identified as investing in ICT infrastructure to accelerate digital transformation, and is leveraging the power of cloud to create new opportunities and growth potential for industries, companies, and people.

India: From ITO to KPO

In the GCI data, we see a strong correlation between cloud and indicators of a knowledge economy. This includes cloud investment and fixed broadband penetration’s impact on IT workers and higher skilled IT developers in adopter and starter clusters.

Touted as the global leader in IT outsourcing (ITO), India’s industrial transformation has been made possible in part by its increased international internet bandwidth. This has enabled the export services sector to upgrade and transform itself from labor intensive programming work and helpdesk support (ITO) to business process outsourcing (BPO) and knowledge process outsourcing (KPO).

Although ITO is considered of higher value than manufacturing, taking advantage of low labor cost is still the prevalent business model in India. However, as nations start to offer BPO, the requirements and remit will change significantly, as BPO requires a sound understanding of business operations for example, finance, procurement, and HR. As KPO involves the export of expertise, for instance engineering and R&D functions, it is generally considered to be of higher value than BPO and viewed by many to be the ultimate stage of outsourcing.

In short, while ITO relies on good quality broadband networks and data centers for data storage and communication, BPO and KPO require data processing and sophisticated computing capabilities, ever higher bandwidth, and greater storage. Cloud, supported by sufficient bandwidth, will thus become an important enabler for nations considering BPO and KPO services as they transform their industries in the digital economy. The figure illustrates India’s cloud investment, computer households’ penetration, and analytics data creation per capita growth rate over the past 3 years, compared to global average speed.

2017 was the best year for networking

Revenue from ethernet switches globally rose 8 percent in 2017, nearly reaching USD 25 billion for the year. The largest yearly growth in switch revenue in 7 years was attributed to increasing demand from both the data center and enterprise segments.

The ethernet switch market experienced two successive quarters of double-digit growth in the middle of the year, a rate that did not seem sustainable and was not. Fourth quarter revenue was up 2 percent sequentially, to USD 6.7 billion. Compared to the like quarter a year ago, revenue was up 7 percent.

“Growth in the Ethernet switch market is being fueled by data center upgrades and expansion, as well as growing demand for campus gear due to improving business confidence. If you look at the large data center operators, many are expanding their data center footprint in response to surging interest in cloud services. In addition, they need to upgrade their older facilities every 2–3 years,” said Matthias Machowinski, senior research director for enterprise networks and video at IHS Markit.

The transition to 25/100GE architectures in the data center is in full swing, driving strong gains in 25GE and 100GE, while in turn bringing down the 40GE segment, which had its first annual decline. Power over ethernet is also growing once again, a sign of strengthening campus switching demand.

The 25/100GE segment is actually the 25/50/100GE segment. IHS Markit characterized sales growth for the 100GE port as ferocious, increasing fourfold year over year (Y-o-Y) and reaching over 4 million ports in 2017. Some of that came at the expense of the market for 40GE ports, which experienced its first annual decline, falling off 9 percent.

On a regional basis, growth in the North American Ethernet switch market came back in 2017 (up 5 percent), as did EMEA to a lesser extent. Asia-Pacific (APAC) remains the top growth region, primarily due to China.

That has had some effect on which sales were going to. Cisco remains the market leader, but its revenue declined 2 percent Y-o-Y. Huawei solidified its position as the No. 2 supplier, with revenue growth of 24 percent. In third place was HPE (Aruba), which grew 13 percent. Huawei is growing despite being frozen out of North America.

IDC also noted the growth in 100 GbE as a driver for switch revenues in 2017. According to the research firm, 100 GbE at the end of 2017 accounted for 9.6 percent of total market revenue, up from 4.8 percent in the fourth quarter of 2016. Though there is movement toward 100 GbE, there is still lots of money being made in the 10 GbE and 1 GbE space as well. IDC reported that 10 GbE shipments grew by 37.2 percent in 4Q17. 1 GbE also grew port shipments though only by a more modest 5.4 percent Y-o-Y. In terms of revenue, 1 GbE accounted for 42.4 percent of the overall ethernet switch market’s revenue while 10 GbE represented 34.7 percent.

As the enterprise gears up to transition to higher-bandwidth networks, vendors are rolling out new products. Rather than opt for 40 Gbps and then make a more difficult transition to 100G, organizations are adopting 25G now and may simply quadruple those lanes when the time comes. 25G is replacing 10G on server and rack infrastructure to better support 100G and 400G in both the data center and wide area. For all these line rates, the interfaces are being implemented in merchant silicon, FPGAs, or ASICs, with some designs supporting PAM4 and/or coherent 16/64QAM using advanced DSP techniques. At the same time, the industry is moving toward optical solutions like silicon photonics, which is expected to accelerate as 100G, 400G, and even 800G networks emerge for short-haul and transport applications.

Organizations are focused on adding bandwidth, investigating ways to modernize their networks with software, and expanding their wireless networking capabilities. In fact, Morgan Stanley, which advises people on industry investments, says investors could see double-digit earnings growth from the hardware sector in 2018.

However, their overriding priority is network security. Companies are beginning to acknowledge that networking and security personnel work better as a team, just as development and operations personnel did in creating the DevOps movement. Also, increasingly, network security is being driven by machine learning and artificial intelligence, the two proving to be extremely dependable sentinels. This is a distinct shift from the current thinking of a security professional that if you have an updated database, secure firewall, patched open SSL, etc., you are secure. After all, a secure, reliable network is essential to digital business.

In the world of networking, including enterprise switching, routing, virtualization, SD-WAN, mobility, and collaboration, a lot of different developments are taking place.

IoT is moving from evaluation to full-scale deployment. The increase of IoT data will put even more demands on DNS infrastructure, but legacy DNS solutions based on BIND and derivatives will be unable to keep up with the real-time requirements of IoT applications, which will rely upon high-velocity real-time traffic management to enable edge computing strategies that slash latency. The solution to this distributed architecture model may be that enterprises move computing and data centers closer to the IoT devices at the edge. In turn, enterprises will increasingly rely on DNS technologies that include intelligent traffic management to direct workload across such highly distributed edge architectures.

An increase in network segmentation projects seems to be taking place in 2018. Networks are being split into isolated subnetworks. The advantage of this approach is that it can increase network performance and overall network security. Using network segmentation, critical data and infrastructure can be isolated in one network segment, while employees are isolated in another. What is more, employees and data can be microsegmented into even smaller groups. This may result in a growth in systems that use intelligent network inference, machine learning, and other automated analysis technology to identify zones of defense and ensure the intended network-wide behavior. This trend is gaining momentum as part of a broader movement toward intent-based networking (IBN).

More and more large enterprises are embracing the web-scale model for flexible, resilient, and on-demand infrastructure. Gartner predicts that by 2020, 40 percent of global enterprise CIOs will have initiated a corporate web-scale IT initiative. This will result in a change in the role the network plays for the business, as well as the day-to-day working lives of network engineers.

Digital transformation is increasingly being perceived as crucial to business success. IDC predicts that in 2018, spending on the software, hardware, and services that enable digital transformation will reach nearly USD 1.3 trillion an 16.8 percent jump compared to the USD 1.1 trillion spent in 2017.

Automation will move beyond vision and become fully operationalized. The very automation tools that have been serving the compute world for years are now being extended into the networking world. Engineers can now automate the complete operational life cycle of network devices from configuration and provisioning to policy-based change management.

In the most basic sense, automation is providing rapid provisioning; what used to take weeks and months now takes seconds and minutes. Automation now allows for more complex network implementations including reactive network changes, zero downtime upgrades, and automatic threat response.

This advanced level of automation in the network frees up network engineers’ time, allowing them to spend time on projects they find more interesting: projects that generate revenue versus just keeping the lights on.

And as more and more companies make the switch from proprietary hardware to open infrastructure they will use the savings to invest in employees who are change-makers, automation experts, and great problem solvers. The fundamental changes in networking technology will create equal – and positive – change for the professionals who build and run networks too.

What does the emergence of 5G networks mean for enterprises?

As with its predecessor 4G, 5G was developed in a direct response to the growing number of mobile devices seeking an internet connection; however, this time around we are no longer talking about connected phones or tablets. The rise of 5G coincides with the explosion of connected devices and systems associated with the IoT. In addition to more processing power, 5G promises speeds 10 times faster than those of 4G, meaning a sensor detecting a significant pressure change in an oil field can report back to the refinery instantly and eliminate the risk of costly downtime. Processing these high volumes of data, at a faster speed, will require new antennas, new devices, and new applications for wireless data. No matter what the setup looks like, the influx of additional data – which will need to be processed in real-time – will drive the need for edge computing.

Recognized by many as the next significant enterprise tech trend after cloud computing, edge computing refers to infrastructure that enables data processing as close to the source as possible. It allows for faster processing of data, reducing latency, and improving customer experiences. For some industries, the need for rapid processing extends beyond customer satisfaction. In the case of medical wearables, for instance, a lag in data processing could create a life or death emergency. This type of computing will require closer data centers as well. In fact, IDC predicts that internet providers will add micro-data centers into or nearby 5G towers as a means of creating this access.

It will require automation as a critical component of any network management strategy. Real-time monitoring of network and data centers will become imperative. The sheer number of computations and connections will demand automated traffic management that factors in conditions beyond geography, such as real-time data center performance and traffic volume/speed. These considerations will be key to optimizing application performance.

Another example of automation driven by 5G includes the growing use of IoT applications in industrial settings. The new bandwidth and speed benefits offered by 5G will enable smart factories to utilize robots and unmanned warehouse transportation to automate the critical, yet time-consuming aspects of their manufacturing process. Municipalities, too, will reap the benefits of connected devices more efficiently reporting road issues, traffic pattern snarls, and weather fluctuations.

In summary, 5G has wide-scale implications for enterprises from both the employee and customer standpoint. Businesses that have long operated on the global scale will experience a transformation in service delivery and customized user experience unbounded by location. The adoption of 5G and edge computing will drive new expectations for an always-on, high-performing network and services, which will lead many enterprises to embrace automation.

Which brings us to a final point: will there ever be a 6G? “Believe it or not, we doubt that such will be necessary,” opines Craig J. Mathias, a Principal with Farpoint Group. 5G itself will evolve over time, transparently incorporating leading-edge innovations like massive MIMO to continue to meet the ever-growing demand for wireless connectivity. So, for now, anyway, it is safe to conclude that all of us – vendors, carriers and operators, IT departments, and even end-users – are far enough up the wireless experience curve that the transition to 5G, despite the remarkable advance in overall capability, may very well be the smoothest cellular upgrade ever.

– CT Bureau

You must be logged in to post a comment Login