Trends

Counterpoint Macro Index caps off 2022 with another quarterly drop

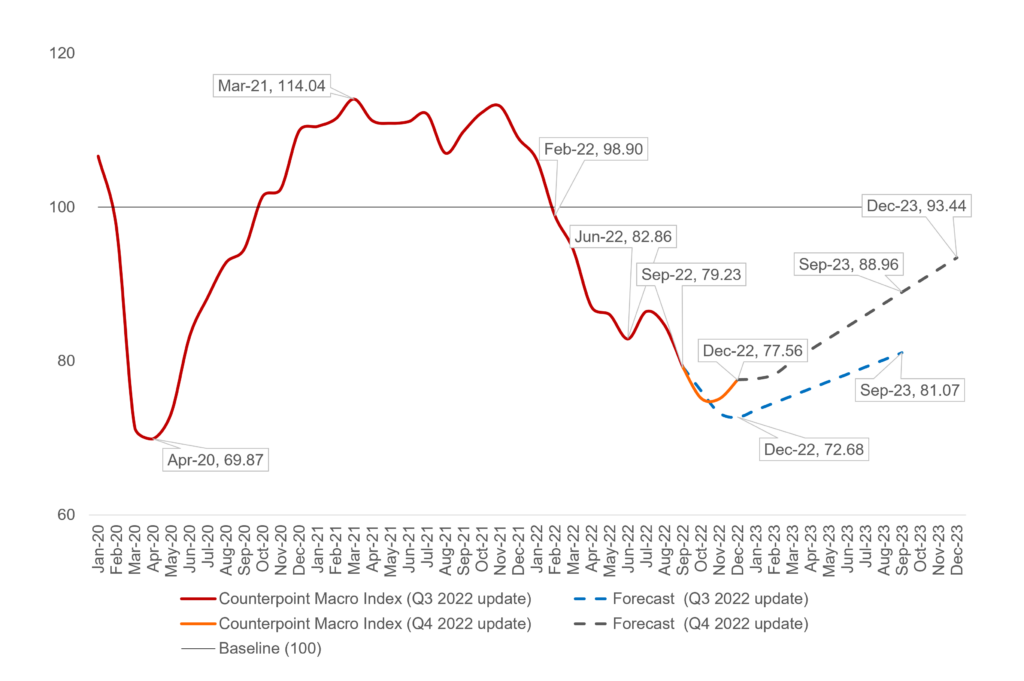

The Counterpoint Macro Index, which tracks the environment and sentiment for the global technology industry, closed at 77.56 in December 2022. This is a small drop of 1.67 points from September.

December’s reading was only the second month-on-month rise in the index during 2022, after dropping to a post-pandemic low of 75.08 in November.

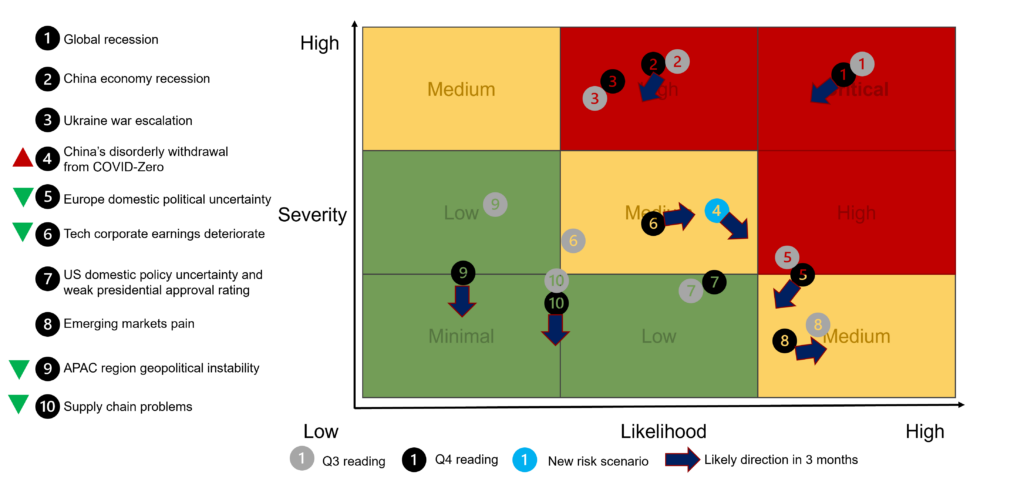

Unsurprisingly, the biggest headwinds for the index in Q4 were yet again the Ukraine war and inflation. Both issues weighed on the index throughout the year, as the war continues with no end in sight, while structural issues in the global economy, including rising interest rates, energy crisis and slumping consumer confidence, are unlikely to be resolved quickly.

The technology sector, which held up resiliently during the post-pandemic ‘boom’, was the latest domino chip to fall during the quarter. In Q4, we saw a slew of disappointing revenue forecasts (Samsung, Amazon, Alphabet, Meta, Tesla), capex cuts (TSMC, Intel, SK Hynix, Micron) and, more recently, layoff plans (Amazon, Meta, Microsoft, Salesforce). We see no let-up in the current earnings season. The supply chain sub-segment, in which Counterpoint covers a broad range of tech manufacturing metrics such as foundry capacity, pricing and inventory levels for key components and semiconductor equipment purchases, also deteriorated in the quarter. This is mainly due to the rapid turn in the semiconductor super-cycle where the demand-supply balance has tilted swiftly to a supply glut. Key chipset, memory and component manufacturers face rapidly retreating demand, inventory and pricing pressures, but at the same time cannot afford to cut spending and capacity for fear of another supply chain snarl-up.

On the other hand, a big rebound in politics and policy-related metrics was seen in Q4. Most prominently, the withdrawal of COVID-Zero restrictions by China, as well as the end of the crackdown on tech and real estate sectors in China helped end a precipitous slide in consumer and business sentiments in the country. Furthermore, a softening of China’s diplomatic tone may usher in a period of better relations with the developed world, and reduce the likelihood of military confrontation in the near future. The economic reopening and potential pent-up trade in China will be the biggest reason for optimism in 2023. In the US, anticipated political turmoil from contentious mid-term elections failed to materialize, as the Republicans underperformed while Democrats held onto the majority in the Senate. Support for Biden’s presidency also staged a small rebound after many months of consecutive declines as inflation peaked, with the Federal Reserve on the cusp of drawing back many months of rate hikes. Further afield, there were also important wins on the ESG front, as COP27 reached a historic agreement on providing financial assistance to developing countries for losses and damage caused by the climate crisis, while landmark policies were signed in the US and Europe to fund renewable energy and cut carbon emissions.

Risk-Impact Map, Q4 2022

We expect the same risks that cast a shadow over the global tech scene in 2022 to continue to exert a negative influence in 2023. However, looking toward 2023, we have revised our 12-month forecast significantly from 81.07 to 93.44 points (100 is the baseline). We believe the worst of the macro headwinds may have already passed, while an uplift can be expected from economic normalization in China and the end of the rate hike cycle in most of the developed world, which can both reduce the risk and impact of a recession. The war in Ukraine, however, will continue to be the biggest cause for caution in 2023 as there appears to be no end in sight, and there may be renewed troubles regarding food and energy supplies.

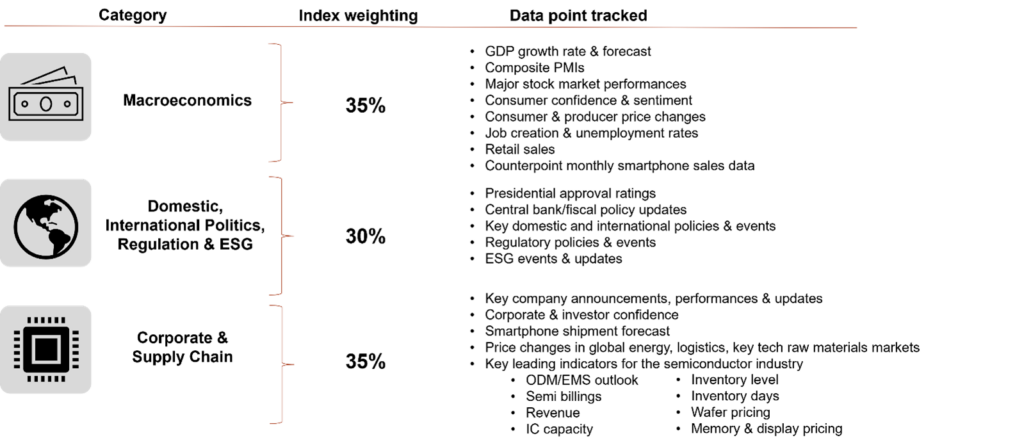

Counterpoint Research’s market-leading Macro Index is a monthly report that aims to capture the environment and sentiment for the global technology industry. We look at issues and measures in macroeconomics, domestic and international politics, supply chains, industry performance and outlook, and regulatory events and outlook. The index captures more than 130 data points every month. Below are some of the key data points that we track:

CT Bureau

You must be logged in to post a comment Login