Trends

Colombia smartphone shipments decline 3% YoY in 2022

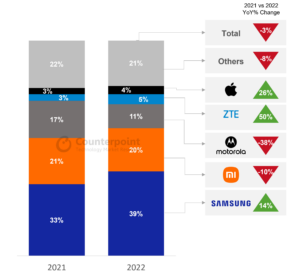

Colombia’s smartphone shipments fell 3% YoY in 2022, according to the latest research from Counterpoint’s Market Monitor service. OEMs recorded mixed numbers, ranging from rising stars like HONOR with a 200% YoY growth to incumbents like HMD with double-digit declines of more than 40%.

Principal Analyst Tina Lu said, “Like the rest of the region, Colombia is being affected by macroeconomic headwinds, just a bit more due to the risks connected with the new government. It has decreased the number of VAT-free days, which used to be the main events for driving sales. But still, the shipment decline was much less compared to LATAM’s 5.5% YoY fall. This is because Colombia’s market finished the year with a higher level of inventory.”

Research Analyst Andres Silva said, “Inventory was the biggest worry of OEMs in 2022. Samsung, Apple and ZTE grew in double digits in 2022, reflecting the importance of tried and tested channel management processes in the country. Also, brand equity plays a key role – with economic uncertainty, consumers tend to prefer known brands. Motorola and Xiaomi suffered specifically in the premium and flagship devices. Even local kings, or the ‘Others’ category, shipped 8% less YoY.”

Commenting on the overall market outlook, Silva said, “Going forward, the market might continue to decline as end users are showing more appetite for experiences. For example, concerts and outdoor activities increased 37% YoY in 2022, the second year of post-COVID reopening. The replacement cycle continues to lengthen while shipment units recover to pre-pandemic levels. Nevertheless, the market still has room to grow – sub-$200 5G devices can become popular if the 5G network rollout picks up.”

2022 full-year market summary

Despite the seasonality associated with Q4, which is usually the strongest quarter of the year due to Black Friday and the Christmas holiday season, Q4 2022 could not avoid the 2022 trend of a decrease in consumer demand.

Inflation eased and the peso’s position improved slightly towards the end of Q4, but still, they could not compensate for the purchasing power lost throughout the year.

Samsung grew 14% YoY, with its H2 2022 being better than H2 2021 (+27% YoY). Supply chain constraints were encountered by the OEM in 2021. Also, the Buds 2 bundle offer attracted upgraders and new customers throughout the year.

Motorola declined 38% YoY, with high inventory levels of the Edge 30 series in the operator channel and of the G60 and G60s series in the open channel.

Xiaomi dropped 10% YoY on premium device stocks at stores and the last legs of the Redmi Note 11 series, which slipped drastically in Q4 2022.

ZTE’s shipments increased 50% YoY benefiting from the demand in low-mid and low segments, which are exempt from VAT. Also, ZTE offered device insurance on purchases through the open channel.

Apple was up 26% YoY despite restrictions on its 5G devices following Ericsson’s case against the brand over 5G patent infringement. The iPhone 11, a 4G device, was the OEM’s top-selling model.

TECNO saw another year without a trace of presence in the operator channel. The double-digit YoY loss reflects its lack of exposure to most customers.

HONOR registered the biggest growth of the year at 200% YoY. A multi-channel and multi-device strategy paid off for the brand. The OEM is on track to build brand appeal among Colombians.

OPPO grew 11% YoY driven by in-store marketing activities like an extra warranty (one year more than competitors) on its devices.

vivo’s bet on the FIFA World Cup did not bring results as Colombians failed to find in retail the devices it was promoting.

The ‘Others’ category, mainly composed of local kings, saw an 8% YoY decline. This category’s performance is highly correlated to economic health.

CT Bureau

You must be logged in to post a comment Login