Trends

China’s premium smartphone sales increased by 33% in Q2

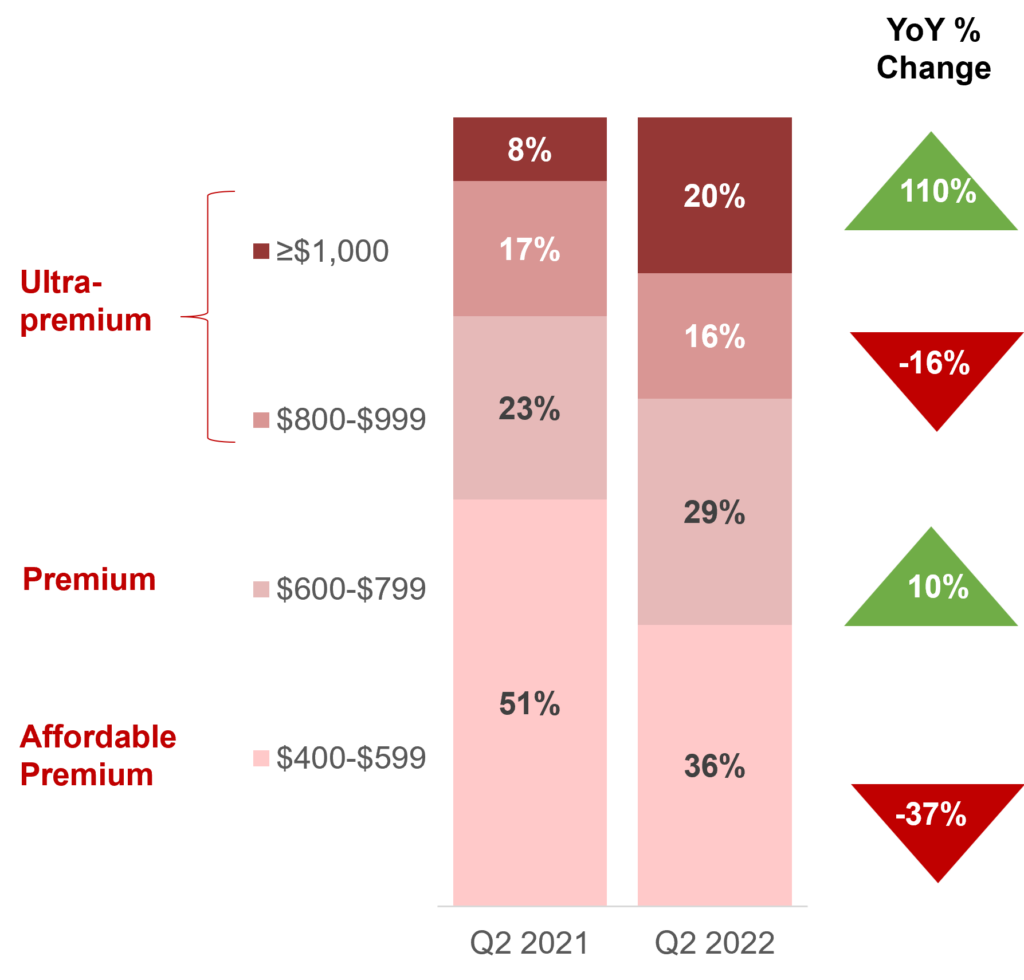

China’s premium smartphone market ($400 and above wholesale price) sales volume share edged upwards to 33% in Q2 2022 from 31% in Q2 2021, according to Counterpoint Research’s Market Pulse Service. Premium segments (which include affordable premium, premium and ultra-premium segments) declined by only 10% in terms of unit sales compared to the broader market which fell 14%. The $600-$799 (premium) and $1,000 and above (ultra-premium) segments recorded increases in Q2 2022.

Exhibit: China Premium Smartphone Market Share by Price Band and YoY Growth, Q2 2022

Commenting on the changes in the premium segment, Research Analyst Mengmeng Zhang said, “After back from COVID-19 in the second half of 2020, China’s smartphone sales reached a temporary peak in Q1 2021 before declining again and reaching the lowest point in a decade in Q2 2022. This trend prevented a big drop in premium segments in Q2 2022. Of course, lockdowns in key Chinese cities impacted the premium segment sales because customers for this segment are mostly based in these cities.”

Zhang added, “Apple did well in the $1,000 and above segment, recording 147% YoY increase, while Samsung also grew 133% YoY. Both these brands benefitted from Huawei’s decline and the shift in purchase trends towards premium phones in China. Driven by the vivo X80 series’ success, vivo grew 504% YoY in the premium segment. The vivo X series perfectly combines design and performance for this segment, helping vivo perform well in online channels.”

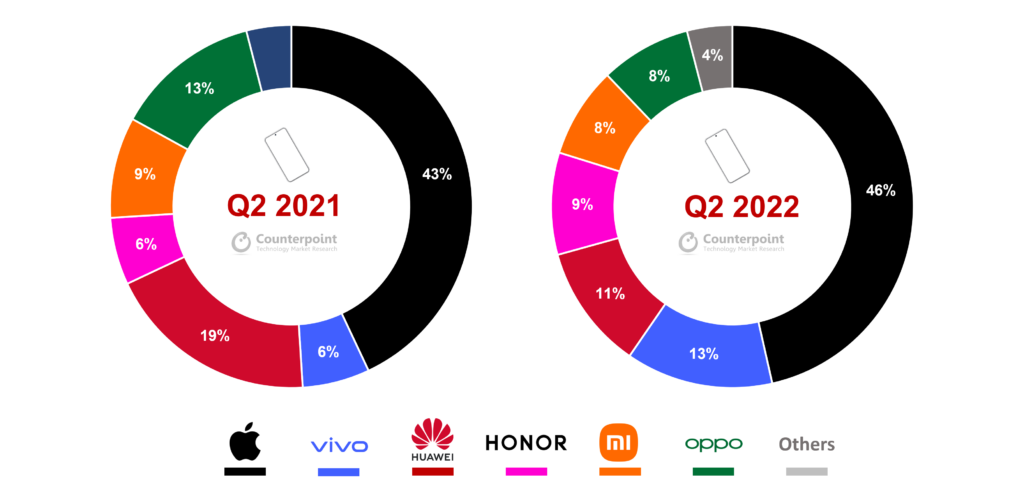

Exhibit: Top Smartphone OEMs’ Market Share for Premium Segment in China, Q2 2021 vs. Q2 2022

The top six OEMs took 95% of the premium segment in Q2 2022. vivo’s unit sales grew 91% YoY, displacing Huawei to take the second spot in China’s premium segment for the first time ever.

Commenting on vivo’s performance, Senior Analyst Ivan Lam said, “Apple and Huawei have been competing for the first and second spots for long. But now other major Chinese OEMs have started targeting the premium segment.

In Q2 2022, vivo faced strong competition from HONOR in the $400 and above segment, where HONOR grew unit sales and market share by 43% and 50% respectively. Both vendors managed to gain a significant share from Huawei and OPPO, which gave up a combined share of almost one-sixth of the market. Lam added, “OPPO was especially sensitive to lockdowns and its offline sales got severely impacted during the quarter.”

Commenting on the ongoing trends in the premium segment, Senior Analyst Varun Mishra said, “Leading Chinese OEMs have been actively focusing on the premium segment with concrete strategies, including bringing foldable flagship models customized for Chinese consumers and partnering with traditional camera giants such as Leica, Zeiss and Hasselblad. We expect the competition in this segment to intensify going forward. At the same time, Samsung is capturing a higher share in this segment due to its foldables line-up, which could result in a resurgence for the South Korean vendor.”

CT Bureau

You must be logged in to post a comment Login