5G

China iPhone sales and one more thing

This year, Apple launched its new generation iPhones (iPhone 12 lineup) late. Moreover, only the iPhone 12 and 12 Pro reached the market in October. The iPhone 12 mini and iPhone 12 Pro Max were still not being sold in October. At the same time, October 2020 numbers include iPhone SE sales, a model which did not exist in October 2019.

It’s against this backdrop that we’re going to estimate iPhone sales in China during October 2020. These sales come in the heels of Q4 FY2020 sales which were very weak (-40% in my own estimation), due to the late iPhone 12 launch.

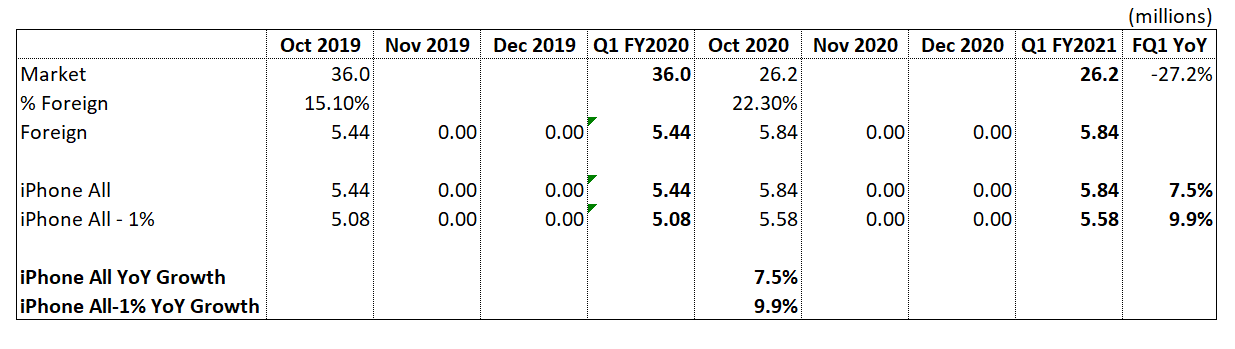

So, how did the iPhone do in China in October? Here’s my estimate (using a methodology I previously described):

Where it concerns the iPhone, some things are immediately obvious from these estimates:

- As expected, the iPhone range is back to growth. During October 2020, iPhone sales in China increased 7.5-10% year-on-year (in units). This is certainly explained by the late iPhone 12 launch, which thus concentrated more sales in October (versus fewer in September).

- The increase in iPhone sales doesn’t yet fully reflect the loss of sales in September. The drop in September sales amounted to nearly 4 million units, while the October pickup is a mere 0.4 million units. However, we should remember that the iPhone 11 range was on sale throughout entire October 2019, and the iPhone 12 was only released for ordering on October 16 and available in stores on October 23.

- Thus, for now, November should provide a better read on Chinese iPhone sales. However, due to a still-large order backlog as well as the iPhone 12 mini launch, November growth figures should be extremely high (40%+).

The Overall Smartphone Market

One thing which also surprises in this report is how negative the overall smartphone market continues to be in China. October saw a -27.2% year-on-year drop in smartphone sales, even with the iPhone growing.

Except for a coronavirus rebound back in April, smartphone sales in China have been consistently very negative throughout 2020. This has happened in spite of widespread 5G adoption, with 5G phones consistently representing nearly 2/3rds of all smartphones sold.

These negative sales have also happened in spite of the mid-market segment (smartphones costing $150-$250) now being populated by very capable models in all regards. Of course, above the mid-market segment, where phones are now typically 5G capable, prices rose a bit and that might have served as an obstacle to sales. Indeed, though probably temporarily, and due to 5G costs as well as cheaper Apple models (the iPhone SE, iPhone 12 mini), the iPhone has not been so price competitive (in the high-end segment) for a long time.

It however remains to be seen whether the iPhone will be able to retain growth beyond January or, at the latest, April 2021 (when it laps the iPhone SE launch).

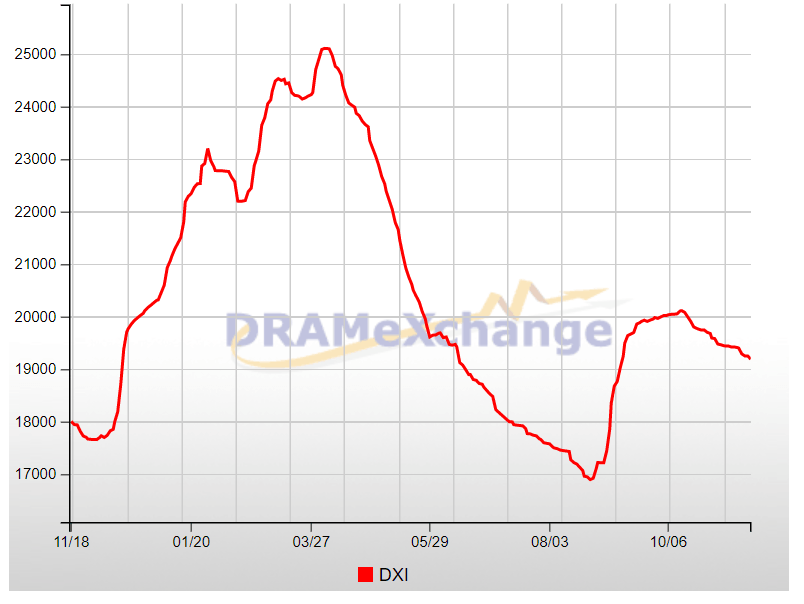

On another theme, these consistent drops in smartphone sales come across as a headwind for the semiconductor sector. And indeed, DRAM pricing hasn’t been doing well in general, after a large rally in early 2020:

Source: DXI Index, DRAMExchange.com

The Apple M1 Chip

I have been writing about the ARM inroads into the x86 market, and how ARM-based solutions will likely make the x86 architecture obsolete. Apple is presently the leading developer of ARM-based chip solutions. Its smartphone chips have long dominated the single-threaded performance benchmarks. Only recently did ARM start to mount a serious response (since the A76 core, and now with the X1 core).

Just a few days ago, Apple finally unveiled its first ARM-based MacBooks (and a Mac mini). They are all powered by the same 8-core (4 performance cores, 4 efficiency cores) M1 chip. As per Apple (and independent testing) these chips blow the x86 solutions out of the water. They do so on performance and efficiency as well. Indeed, the efficiency advantage is large enough that the MacBook Air even does without a fan altogether. A note here: one less fan means a better, more reliable machine that’s also cheaper to make.

Although this was expected, its materialization should be yet another warning for the x86 world. For Apple, initially, this step should allow it either to price its laptops more competitively, or to enjoy larger margins on its laptops. For now, Apple seems to have gone for margins as the starting prices for the new MacBooks are the same. However, we can argue that Apple’s entry-level laptops now perform in line with high-end x86 laptops, so the pricing is now very competitive, more competitive than before.

Moreover, the observations when it comes to the Apple M1 chip don’t end on the CPU side. The M1 GPU is equally impressive, and equivalent or better than something like a GeForce GTX 1050ti or Radeon RX 560. It’s by far the most potent integrated GPU on the market.

A final observation, the M1 is Apple’s entry-level chip, yet it elevates even entry-level MacBooks to high-end laptop performance levels – with much better efficiency and on a much better form factor.

We are still to see Apple’s higher-end chip/chips, for its Mac Pros. Moreover, since Apple now has such an obvious lead on chip performance and efficiency, it would almost be a pity if it didn’t also take the chance to enter the server market with its own chips as well. That would be a first. This is the most obvious “one more thing” we’ve seen in a while. Of note, the M1 performance stats are being achieved on the power budgets we would usually associate with a chip carrying a high number of cores, such as those found in servers.

Conclusion

The late October shipping of the iPhone 12 range in China has brought back iPhone sales to positive territory. However, we aren’t yet seeing the full effect of this launch along with the backlog from a late launch. Hence, it’s likely that the iPhone will post much, much higher growth in China in November when the new iPhones are on sale for a full month.

It’s arguable that the late iPhone 12 launch is distorting all these numbers, so we should only have a clearer picture on how the iPhone is performing in China by January 2021 or April 2021 (to lap the iPhone SE effect). Still, between here and January/April 2021, any iPhone growth numbers from China should look good or exceedingly good.

As for Apple’s ARM-based laptops, they are an unabashed positive which will likely enable Apple to take more market share from Windows laptops. The Apple MacBooks will be faster than anything at similar prices, will have higher margins than anything at similar prices, and will also be better in terms of reliability due to the lack of a cooling fan (MacBook Air).

Still, Apple lives more by what happens to the iPhone than anything else. So, the iPhone should remain the center of attention.

I would however leave a potential surprise (one more thing) here: It would be logical for Apple to enter the server chip market. The server chip market has the type of margins Apple covets. Apple has the performance and efficiency advantage to do it, so it’s just a matter of it choosing to do so (or not).

Idea Generator is my subscription service. It’s based on a unique philosophy (predicting the predictable) and seeks opportunities wherever they might be found, by taking into account both valuation (deeply undervalued situations) and a favorable thesis.

Idea Generator has beaten the S&P 500 by around 15% since inception (in May 2015). There is a no-risk, free, 14-day trial available for those wanting to check out the service. Seeking Alpha

You must be logged in to post a comment Login