5G

Changing Tides-A Telecom Services Special

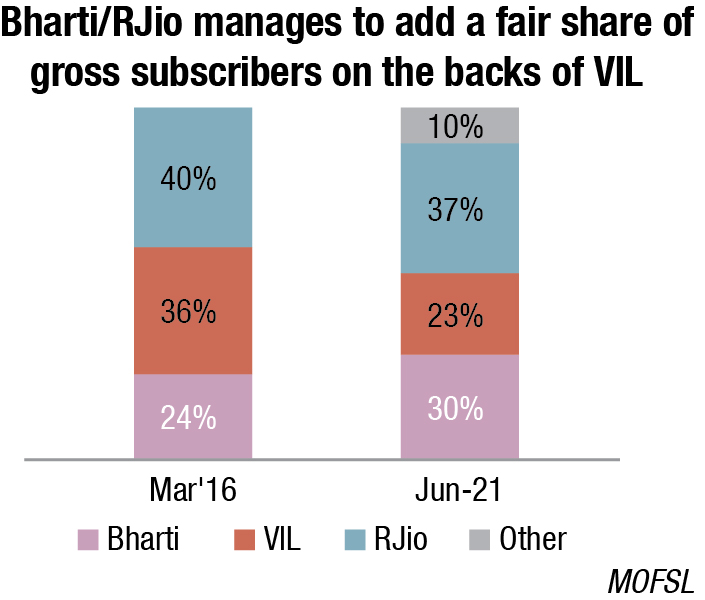

Five years ago, when Reliance Jio launched its 4G services, offering free voice calls bundled with OTT platforms and high speed data at 95 percent lower tariffs than competitors, perhaps even Ambani had no idea of the scale of the disruption that would be unleashed by his policy. Reliance Jio kicked off a new phase in the telecom industry; from being primarily voice centric, it adopted broadband on a colossal scale, catapulting India into the number-one slot on mobile broadband usage. Service providers either had to exit the segment or were forced to match the tariffs. From 10 operators in 2016, India now has only four players. This changed the entire landscape for the Indian consumer and the businesses.

The country was connected like never before. Affordability of services had always been a dominating factor for telecommunication adoption in India. Indian telecom pricing became among the lowest globally and the data usage the highest. India also became one of the largest markets for smartphones. Not only is the five hours daily time spent on a smartphone the highest average globally, the government’s manufacturing program and the differential duties also helped in encouraging manufacturing in India.

Ashwini Vaishnaw

Ashwini Vaishnaw

Telecom and IT Minister

Government of India

“The government is fully committed to reforms and ensuring healthy competition in the sector. We are an open-minded government. We want to reform this sector and provide level-playing-field to everybody. We want healthy competition in this sector. So please (addressing the industry) come up with recommendations, which will help us formulate policy in that direction.”

K. Rajaraman

K. Rajaraman

Secretary-Telecom

Department of Telecommunications

“The demand for satellite-based and terrestrial telecom services has put unprecedented demands on radio spectrum, in particular the C-band and the Ka-band frequencies are needed for both space-based as well as terrestrial telecommunication services.

Since spectrum is a finite resource, its value can be augmented through sharing and with coexistence by different services. Thus, it is necessary to ensure efficient use of spectrum, including revisiting the uses in the existing frequency bands as well as in the new frequency bands. We are engaged in this exercise in consultation with TRAI.

The recommendations from TRAI on the licensing framework for satellite space connectivity for low bit-rate applications are currently under consideration by the DoT. We hope to take a decision very soon. This is likely to open up a large potential for IoT and machine-to-machine-based applications.”

PD Vaghela

PD Vaghela

Chairman

Telecom Regulatory Authority of India

“There is an urgent need for policies that attract investments, allow use of space technology for the common man, and ensure flexibility and ease of doing business.

TRAI is in the process of releasing a consultation paper for licensing framework for satellite earth station gateways, an area that requires complete transformation to facilitate establishment of earth stations by any satellite operator. Further, TRAI is working on bringing out a consultation paper for developing a comprehensive single-window online portal, having interdepartmental linkages for transfer of application and information for parallel processing.”

Shifting gears, the move also spurred the growth of online startup companies. From 10 unicorns, the number grew six-fold to over 51, predicted to touch the 100 number-mark within two years. Two success stories come to mind, Zomato and Byju. The OTT space saw major success too, with the likes of Netflix, Amazon Prime, and Disney Hotstar together reporting 60 million consumers in 2020, as compared with a mere 1.3 million in the year that Jio launched. The total viewers also doubled to over 300 million.

Now, since July 2020, when Bharti won the bid for OneWeb, satellite communication is being seen as an affordable connectivity option. New companies including Starlink, Project Juniper, Telesat-Nelco, and more are stepping into India with satellite broadband services. Industry players have also shown interest in investing in various satcom segments. Bharti Global-backed OneWeb in the meantime has cornered an LoI for GMPCS that will let it offer satellite services to the end-consumer, while its existing NLD license lets it provide backhaul services to other telecom providers. OneWeb has launched more than half of its LEO satellite fleet that will deliver high-speed, low-latency global connectivity, bringing total in-orbit constellation to 358 satellites. The company is building gateways on the ground that will act as data exchanges between satellites and the internet.

Satcom will completely change the dynamics of the Indian broadband market, just like the advent of the mobile transformed the telecommunications market over 20 years ago. India, with its digital ambitions and the goal of broadband for all desperately needs satellite communications to deliver broadband to both the unserved and underserved by internet connectivity.

No doubt, concerns over the unavailability of the premium 5G spectrum bands for satellite companies, licensing framework, and regulatory approval processes will need to be ironed

out.

The powers-that-be agree. “Given our relatively low fixed-lines, fiber penetration, and spectrum availability limitations, it is clearly not practical to rely solely on terrestrial wireless technology for universal broadband access. Satcom can be an affordable option, provided there is a regulatory environment in place,” said Amitabh Kant, CEO, NITI Aayog, at a virtual event for the launch of the new space association the Indian Space Association (ISpA). The minister is also in agreement. “We are an open-minded government. We want to reform this sector and provide level-playing-field to everybody. We want that there should be healthy competition in this sector. So please come up with recommendations, which will help us formulate policy in that direction,” responded Ashwini Vaishnaw, Minister for Communications and IT.

All of this movement on the satellite front has left Jio, for once, an awkward spectator. Jio has since its inception been moving the forces of the country to exit from the 2G space, with its brutally competitive pricing and nearly fully-fiberized network rule over 4G services, and with its own 5G technology playing a dominant role in 5G services. Satellite broadband, however, could upend those plans. Crucially, the Digital Communications Commission has cleared a provision of using satellite connectivity in telecom networks through VSAT, and the international grouping that approves telecom specifications, 3GPP, has integrated satellite with mobile telephony. Its upcoming release allows satellite as a medium to run 5G.

Jio has received another setback on the JioPhone Next front. The telco, in partnership with Google, was to launch the JioPhone Next – a 4G smartphone that is easy on the wallet, whilst capable of handling the full suite of offerings from both Google and Jio. By bundling data plans with JioPhone Next, and drawing on its huge on-ground sales team, the plan was to attract VIL and Airtel’s considerable 2G user base (2G subscribers contribute 30 percent of the telcos’ overall revenue) to Jio’s 4G network. With the semiconductor shortage and technical hitches as issues with the placement and positioning of Jio apps on the device, and challenges with creating Indian language interfaces the launch plan has been delayed.

However, going by past experience, this could just be a bit of a breather for Airtel and Vodafone Idea, for Jio cannot lie low for too long.

The government has not disappointed. Over the last one-and-a half years, COVID-19 pandemic amply demonstrated that the telecommunication sector is the connectivity backbone, the lifeline of the economy. With businesses shifting to work from home, education moving online, and OTT platforms becoming the go-to source for entertainment, the role of telecom operators has never been more relevant than it is today.

Sunil Bharti Mittal

Sunil Bharti Mittal

Chairman

Bharti Group

“Telecom reforms have paved the way for all players to come together and work as a team to unleash India’s telecom dream. Time has come for three plus one operators to close ranks and work as a team for building telecommunications rather than being fierce competitors. We will compete, but just like in other industries like steel, build the ecosystem together.

Synergy between the three telcos will bring better technology to the Indian consumer. In 25 years, the tariffs have been close to each other and the market highly competitive. If one telco dropped prices, there was no choice but to be close to it. The market share in the industry has been reasonably set now. So we have to, for our sake, be sensible (on increasing tariffs). I will play my part, but if others don’t and press on for more market share, we will also fight back. But then how long will the business be unsustainable.

No, I am not at all disappointed (that the telecom relief package did not reduce levies on the telecom sector like the licence fee or the GST rate). I am sure these would be dealt with in the second reforms package. The telecom minister said, that this is just the beginning and more would come. My guess is that the telecom ministry did what all was in its domain and now the finance ministry needs to take over.”

Mukesh D. Ambani

Mukesh D. Ambani

Chairman and Managing Director

Reliance Industries Limited

“Jio has created a complete 5G solution from scratch, that will enable us to launch a world-class 5G service in India, using 100 percent home grown technologies and solutions.

Jio has truly democratized digital connectivity in India, by offering the highest quality, most affordable 4G broadband services in the world. Google and Jio teams have jointly developed a truly breakthrough smartphone that we are calling JioPhone Next. This is testimony to a global technology company and a national technology champion working jointly to make a break-through product.”

Evolution of telecommunication capabilities has fueled digitized transformation of industries, particularly gaming, banking, healthcare, education, e-commerce, entertainment, manufacturing, fintech, real estate, and automobile. These sectors have restructured their business models and developed digitized revenue portfolios.

The success of government’s programs as BharatNet, Ayushman Bharat Digital Mission (ADBM), Aadhar Enabled Payment System (AePS), Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA), MyGov platform, and other similar initiatives linked with Digital India are directly dependent on a resilient and secure telecommunication system.

The government has been prudent to announce critical structural and procedural reforms that will eventually pull the cash-strapped, debt-laden sector out of its misery. The relief package includes:

- Four-year moratorium on regulatory dues (AGR and spectrum) with NPV neutral for government;

- Option to pay interest in equity, and government may also convert deferred dues in equity at the end of four years, for which guidelines to come;

- Prospectively, non-telecom revenue excluded from AGR;

- Future spectrum dues will not require bank guarantees for immediate installment;

- Spectrum tenure in future auction increased to 30 years (from present 20 years);

- Operators will be allowed to surrender spectrum after 10 years of acquisition through auction;

- 100 percent FDI allowed through automated route; and

- Spectrum auction calendar to be fixed.

Private-partnership (PPP) models are being encouraged to connect gram panchayats with internet across India. The government is also promoting local manufacturing of network equipment by providing incentives to manufacturers.

In addition to the structural reforms, DoT also laid down some procedural measures as part of the relief package to ensure ease of doing business and seamless

approvals.

A single-window clearance for the standing advisory committee on radio frequency allocation (SACFA) and other bodies will ease right-of-way requirements. Replacing paper customer acquisition form (CAE) with digital storage of CAP and provision of self-KYC and no requirement for fresh KYC for prepaid to postpaid migration and vice versa will also make processes more efficient and less time-consuming. The reduction of e-KYC authentication charges to ₹1 from the current ₹41 is also a big relief as this will reduce the subscriber acquisition charges of telcos significantly.

One of the key procedural measures is putting forward an annual spectrum auction calendar. As per the new measures, the spectrum auction will take place in the fourth quarter of every financial year.

These measures make it possible for Bharti Airtel to avail the moratorium of dues offered and redirect the cash flow to aggressively build networks and invest back into the network for 5G. The cash flow should amount to ₹35,000–40,000 crore with which a lot of public market debt can be reduced. “We will be able to invest the savings in cash flow into the industry and invest in technology. I can assure you the savings on the cash flow will not go into the dividend,” Sunil Mittal, chairman, Bharti group assured at one of the press meets. Regarding the clause that operators have the option to pay the deferred NPV amount in equity, he said that on this option the matter would be referred to the board. He had added, “We need to see whether this is an upfront equity conversion after four years or whether we will be able to do it every year. In the case of Airtel, the total amount of interest is ₹7500–10,000 crore.”

Change in outstanding and EMI dues (₹ bn) |

||

| Pre-moratorium | Post-moratorium | |

| Bharti Airtel | ||

| Amount outstanding | 747 | 926 |

| EMI | 110 | 182 |

| VIL | ||

| Amount outstanding | 1,007 | 1,518 |

| EMI | 157 | 306 |

| MOFSL | ||

For Reliance Jio, the removal of SUC for spectrum acquired in future auctions would improve the profitability for its telecom operations, while the extension of moratorium on payments for past spectrum purchases will improve its cash-flow generation and strengthen liquidity. Increased remote working and shift to online transactions would drive data consumption higher and also raise earnings and cash flow for the segment. “That said, we expect RIL’s earnings from its digital services segment to grow over the next 12-18 months on the back of a further ramp up of its home and enterprise broadband services,” said Moody’s Investors Service.

It would not be inaccurate to say that the government had no option but to bite the bullet. It faced the risk of letting the telecom market devolve into a duopoly – dominated by Reliance Jio and Airtel.

Vodafone-Idea’s fragility is an open secret. The telco is losing subscribers. They are not making enough money. They are under huge debt. And they have huge payment obligations due soon, they are in line to pay ₹16,000 crore in March 2022 alone.

VIL 1QFY22 annualized cash EBITDA stands at ₹55 billion, and non-government interest payments likely at ₹26 billion (including interest on non-funded facilities). VIL may have to do CapEx of ₹80 billion, which is not sufficient as it lags peers in 4G, and needs to upgrade fiber to strengthen backhaul. This leaves VIL with deficit of ₹51 billion, which requires 25-percent ARPU increase. It may require tariff hike of 30 –35 percent.

The government has provided the option to convert interest on deferred payment into equity, which works to ₹94 billion; and at the end of four years, the government also has the option to convert the deferred instalment into equity, which works to ₹1008 billion for VIL. Total equity conversion will be ₹1102 billion in the next four years on market cap of ₹260 billion. The equity conversion will ensure at the end of four years, VIL will not have elevated debt liability; but, the massive dilution, if happens, will significantly dilute the existing shareholders’ stake, and government may end-up becoming the largest shareholder of the telco, thus, increasing going-concern visibility for VIL.

Ravinder Takkar

Ravinder Takkar

MD & CEO

Vodafone Idea Limited

“The recent telecom reforms unveiled by the government have addressed all investor concerns. The enthusiasm and interest to invest in the sector has increased with the government’s package. To what extent the co-promoters of VIL will participate and in what ways is something which only they can answer, but they have been very supportive all along. They have invested ₹1.90 lakh crore in the last 10 years.

During the challenging times (of the pandemic), VIL continued to serve its customers and community at large by providing seamless connectivity as well as maintaining superior quality of services. VIL GIGAnet’s superior network experience on both data and voice, is testified through top rankings in independent external reports. We continue to focus on executing our strategy to keep our customers ahead, and our cost optimization plan remains on track to deliver the targeted savings. We are in active discussion with potential investors for fund raising, to achieve our strategic intent.”

PK Purwar

PK Purwar

CMD

Bharat Sanchar Nigam Limited

“BSNL is operationally-stable now, and can launch 4G services within six months, it’s looking to place an initial 4G equipment order of 50,000 sites following the successful outcome of the proof-of-concept (PoC). In the immediate term, Tejas Networks has assured 4G gear supplies. BSNL’s debt is well below Airtel and VIL’s, but the only immediate challenge is monthly interest outgo on debt that ranges between ₹200 crore and as much ₹1,000 crore. We had cleared bulk of our MNC-related vendor dues and reduced it to ₹1,000 crore from ₹3,000 crore not too long ago.”

It has other liabilities to service, such as ₹60 billion NCD payment from December 2021; VIL needs to renew bank guarantees worth ₹120 billion in the next 12 months. It needs to get funding both in debt and equity for accelerating CapEx investment and meeting other liabilities, and without tariff hike, securing funding will be difficult.

While the relief provided by the government will address their issue with cash flows, the issues with P&L and balance sheet remain. Significant capital infusion is required because their capital deployment in the network has been quite patchy as compared to what Bharti and Jio have invested in the last few years. Incrementally, of course, as we move toward 5G, Vodafone-Idea may completely fall short on that technology evolution as well.

There is no relief on the P&L front because of these announcements. The license fee and the spectrum-usage charge stand around 11 –12 percent across all operators. That is something which could have been reduced. The government has done away with SUC or auctions in future but for the bulk of the revenues, which could be generated on the base spectrum that they have acquired over the last several years, the SUC charges and the license fees are something these companies will have to continue to pay at the same rate.

Also, while the relief will provide short-term liquidity, the debt liability will increase by way of interest. The interest on the pending dues will be charged at State Bank of India’s MCLR+2 percent (earlier it was MCLR+4 percent). Though the interest rate has been reduced by two percentage points, the future repayments will rise steeply because of the interest accumulation and shorter repayment period (total repayment period stays the same).

As per the current spectrum-pricing methodology, pricing of future spectrum auctions is linked to the final bid price of the previous auction, thereby skewing the spectrum-pricing for future auctions.

The telcos will need to leverage this four-year period to their benefit and put their house in order, including their financials. This may mean pushing the government hugely on fee reduction, deferment of USO levies and reduction in taxes; and no more molly coddling the customer. On pricing, it has been done in December 2019 earlier. a unanimous move (which at the moment seems highly unlikely, Jio with its target of 500 million subscribers by 2023 and Airtel’s focus being on high ARPU subscribers) from all the players will be needed. A unilateral tariff hike will backfire and impact each telco differently.

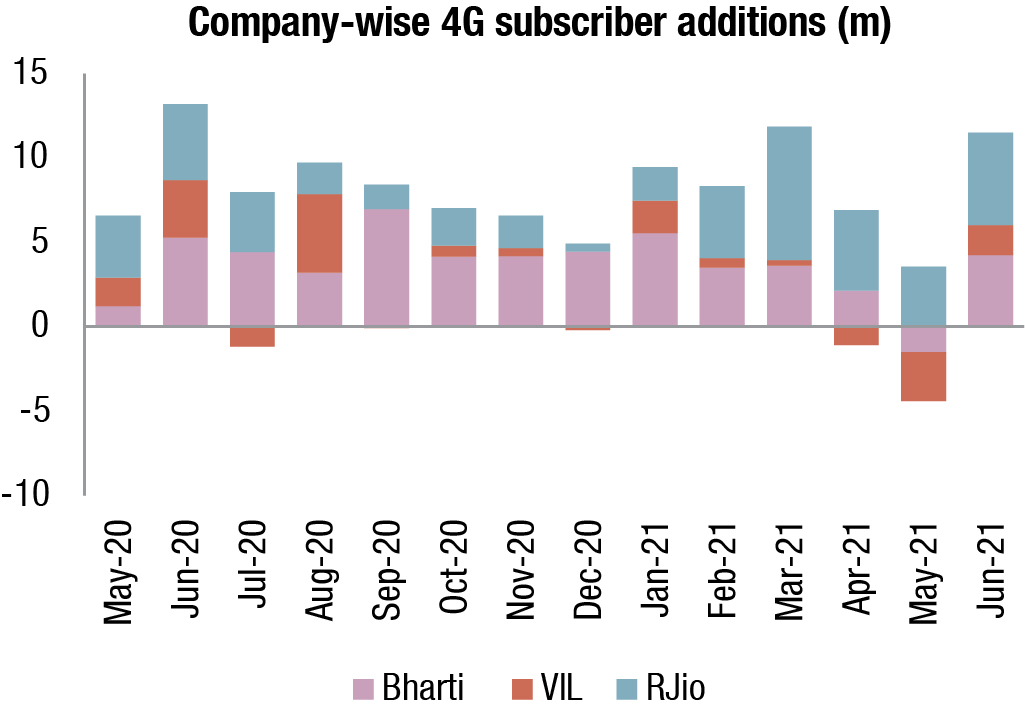

The second quarter of the fiscal 2021-22 is likely to be a healthy quarter for the telcos, and overall growth will likely see a pickup. Jio’s performance will likely be driven by subscriber additions, and Bharti and Vodafone-Idea will benefit from tariff hikes taken in July and some recovery post-severe wave of COVID-19.

IIFL Securities expects Bharti to marginally outperform Jio on sequential India mobile revenue growth; five percent and four percent quarter-on-quarter EBITDA growth for Jio and Bharti consolidated and anticipate that Vi could see flat EBITDA; and with the relief package reducing the urgency around tariff hikes, we now build in significant price increases only in 2H2022 versus early 2022 previously.

Jefferies expects Reliance Jio to post a 4.7-percent revenue growth, quarter-on-quarter (QoQ), ARPUs to rise by 1 percent QoQ to ₹140. Bharti Airtel’s India mobile revenues are expected to grow by an estimated seven percent QoQ in 2QFY22, led by seven percent growth in ARPU to ₹157 on the back of tariff hikes in the prepaid voice and corporate postpaid segments that were effective from August. Its Africa revenues are seen up 3 percent sequentially in dollar terms. The key focus areas for Bharti’s results will be ARPUs, the timing of further tariff hikes, and CapEx outlay.

Subscriber and ARPU trends for Bharti and Jio are likely to be opposing, with Bharti seeing a sharp ARPU increase with subscriber declines and Jio witnessing strong subscriber additions with steady ARPUs, and margins are likely to remain steady.

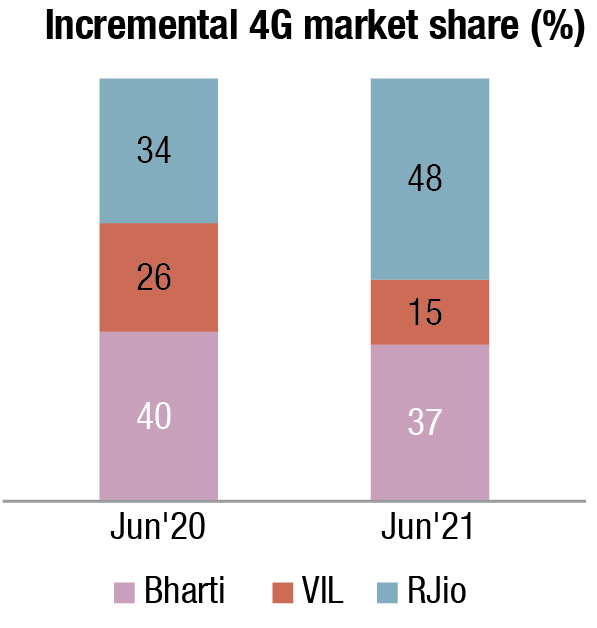

“While the Government’s recent moves improve the chances of Vodafone-Idea’s survival, it is unlikely to arrest the market share shift from Vodafone-Idea toward Bharti Airtel and Reliance Jio,” said Jefferies’ note. This, along with Bharti’s hikes in July should keep revenue growth strong over the near to medium term.

Credit Suisse, in its earnings preview note, said that 2QFY22 is expected to mark higher subscriber churn and 4.5–6 percent sequential ARPU growth for Airtel and VIL.

For Airtel, we expect revenue market share gains to continue, with India mobile revenue growth of 4.2 percent QoQ, on the back of 4.5 percent QoQ ARPU growth offset by 0.6 percent QoQ decline in subscriber base,’’ it said.

It expects Vodafone-Idea Ltd. to report a second consecutive quarter of 10 million-plus subscriber loss on higher churn and SIM consolidation. ‘‘Thus, despite a 6-percent QoQ ARPU growth, we estimate revenue growth to be muted at 1.6 percent QoQ (−13.8 percent YoY),’’ Credit Suisse note said. In the case of Vodafone-Idea, the key aspects to watch out for will be quantum and visibility of fundraising and the company’s strategy to ringfence lower ARPU subscribers from affordable smartphone launch by Jio and cashback by Airtel.

The telcos generally declare their respective 2QFY22 results end-October.

For the next two years, the battlefield will be 5G. Airtel and Jio are readying for the launch. It promises to kick off yet another disruption of the digital economy with the entry of automation, the spread of IoT, and low-latency services ranging from remote surgery to autonomous cars.

Gopal Vittal

Gopal Vittal

CEO

Bharti Airtel

“The balance sheet (of Bharti Airtel)continues to remain strong with healthy cash flows and a net debt to EBITDA of just about three. A position that is comfortable. The business has been generating strong cash flows for many quarters now. This has been a result of revenue growth, strong operating leverage, and effective deployment of capital.

In every one of our businesses, we are at a lifetime high in terms of revenue market share, the most critical barometer of our competitiveness. Our momentum going into Quarter-II (FY2022) has been strong. Our strategy and choices are dictated by our view of the India market opportunity. These are cohesive and simple. Even more importantly, we’re building an Airtel of the future and are well positioned as we go forward.”

Lt. General SP Kochhar

Lt. General SP Kochhar

Director General

Cellular Operators Association of India

“We welcome the spectrum reforms notified by the government including removal of financial bank guarantee requirements and scrapping of SUC for future auctions. They will reduce the financial burden on TSPs (telecom service providers) and will go a long way in enhancing the ease of doing business in the telecom sector.”

5G has already launched in many developed markets, including to a large extent in countries like South Korea. In India, the auctioning of radio spectrum has been postponed more than once. Reasons range from the spread of the coronavirus to high base prices, which telecom operators objected to. The financial situation of leading operators, especially Vodafone-Idea, has also been a concern.

On May 4, 2021, DoT authorized carriers to carry out trials of 5G technology in the country. The applications from Bharti Airtel, Reliance Jio Infocomm, Vodafone-Idea, and MTNL to carry out these 5G trials in partnerships with vendors including Ericsson, Nokia, Samsung, and C-DoT were approved.

DoT awarded experimental spectrum in the mid-band (3.2 GHz to 3.67 GHz), millimeter-wave band (24.25 GHz to 28.5 GHz) and in the 700 MHz band for these 5G trials. Mobile operators could also use their existing spectrum in the 800 MHz, 900 MHz, 1800 MHz, and 2500 MHz bands.

The 5G trials expected to last for a six-month period, included a time period of two months for procurement and setting up of the equipment. The permission letters specified that each carrier will have to conduct trials in rural and semi-urban settings in addition to urban settings so that the benefit of 5G technology proliferates across the country and is not confined only to urban areas. During the trials, application of 5G in Indian settings will get tested. This includes tele-medicine, tele-education, drone-based agriculture monitoring, etc. Telecom operators will be able to test various 5G devices on their network.

Also in June, Bharti Airtel kicked off a 5G trial, using 3.5 GHz spectrum in the city of Gurugram, delivering peak throughput of more than 1 Gbps. The telco and Tata Group had announced a strategic partnership to implement a 5G network in India. Under the agreement, Airtel will pilot Tata Group’s O-RAN-based radio and NSA/SA core beginning in January 2022 as part of a larger push to utilize solutions and products that are made in India.

Randeep Singh Sekhon, Airtel CTO says, “Having demonstrated India’s first 5G network and also the first 5G cloud gaming experience, Airtel is proud to have also conducted the nation’s first 5G trial in a rural geography. 5G will be a transformational technology when it comes to delivering broadband coverage to the last mile through use-cases like FWA, and contribute to a more inclusive digital economy. Airtel will continue to be at the forefront of 5G technology and bring more India-relevant use-cases through partnerships, such as the one with Ericsson.”

In June 2021, Reliance Jio started standalone 5G trials in Mumbai, using mid-band and mmWave spectrum. In the trials, the operator used locally-developed equipment. The telco had applied to carry out 5G radio and core network tests in New Delhi, Hyderabad, and Gujarat, using equipment from Samsung, Ericsson, and Nokia.

Reliance Jio has reportedly undertaken a trial of its immersive high-definition virtual reality (VR) meeting, using its indigenously developed 5G NR radio and 5G core network (5GCN). Both the enhanced mobile broadband (eMBB) and 5G’s low-latency capabilities were leveraged during the trial.

“By using Jio’s indigenous 5G NR radio and 5GCN, we have trialed an immersive high-definition VR experience. This trial leveraged both eMBB and low-latency capabilities of 5G to deliver the end-user experience. It is truly exciting to experience the possibilities that come to life using 5G and the potential transformation that is possible!” said Aayush Bhatnagar, Senior Vice President at Jio Platforms.

Jio in its trial demonstrated HD multi-party VR video calling with participants physically wearing the VR headsets, while others joined from the cloud also demonstrated collaborative screen sharing and presentations across VR participants, and also whiteboarding/sketching, using VR control and live sharing.

Bharti – FY23E SoTP-based valuation |

||||||

| EBITDA (₹ bn) |

Ownership | Proportionate EBITDA (INR b) |

EV/EBITDA | Fair value (₹ bn) |

Value/ share |

|

| India standalone business (excluding towers) | 447 | 100% | 447 | 12 | 5,414 | 992 |

| Tower business (15% discount to its fair value) | 41.7% | 234 | 43 | |||

| Africa business | 185 | 55.2% | 102 | 5 | 553 | 101 |

| Less: Net debt | 1618 | 297 | ||||

| Total value | 4582 | 840 | ||||

| Shares outstanding (b) | 5.5 | |||||

| CMP | 728 | |||||

| Upside (%) | 15 | |||||

RJio – Valuation based on FY23E EV/EBITDA |

|

| Particulars | (₹ bn) |

| EBITDA | 460 |

| EV/EBITDA (x) | 20 |

| EV | 9,192 |

| Debt | 850 |

| Equity value | 8,342 |

| Value per share | 1,316 |

| Stake | 66.48% |

| RIL stake in RJio | 875 |

Interest cost on availing moratorium for Bharti (₹ bn) |

|||||

| FY23 | FY24E | FY25E | FY26E | Total | |

| Spectrum | |||||

| Outstanding dues | 638.3 | 638.3 | |||

| Interest (MCLR + 2%) | 57.4 | 62.6 | 68.2 | 74.4 | 262.7 |

| Total outstanding | 695.7 | 758.3 | 826.6 | 901.0 | 901.0 |

| AGR | |||||

| Annual payment | 273.5 | 273.5 | |||

| Interest (MCLR + 2%) | 24.6 | 26.8 | 2.4 | 0.2 | 54.1 |

| Total outstanding | 298.1 | 26.8 | 2.4 | 0.2 | 327.6 |

| MOFSL | |||||

Jio has achieved end-to-end network slicing on its indigenous 5G standalone core. Jio has developed its homegrown 5G stack, including core and radio products, hence it becomes extremely important for the company to aggressively test these equipment and technology before the commercial deployment after the spectrum auction.

Meanwhile, Vodafone-Idea has joined hands with Ericsson and Nokia to conduct trials in Pune and Gandhinagar. The telco has made progress in deploying several 5G-ready technologies, such as massive mimo, dynamic spectrum refarming, cloudification of core, etc. VIL has also achieved peak speed in excess of 3.7 Gbps on the mmWave spectrum band in Pune city. The telecom operator also recorded peak download speeds of up to 1.5 Gbps in the 3.5GHz band 5G trial network, in Gandhinagar and Pune city. The telco is deploying 5G-ready equipment for both radio and core.

Jagbir Singh, CTO at Vodafone-Idea, said, “We are pleased with the speed and latency results in the initial stages of the 5G trials on the government-allocated 5G spectrum bands. Having established a robust 4G network pan-India, delivering fastest 4G speeds, and a 5G-ready network, we are now testing the next-generation 5G technology to be able to bring a truly digital experience for enterprises and consumers in India, in the future.”

VIL has also joined hands with Larsen and Toubro (L&T) for a pilot project to test 5G-based smart-city solutions. The companies will collaborate to test and validate 5G use-cases built on Internet of Things (IoT), Video AI (Artificial Intelligence) technologies leveraging L&T’s smart city platform – fusion, addressing the challenges of urbanisation, safety and security, and offering smart solutions to the citizens. Vodafone-Idea’s Chief Enterprise Business Officer, Abhijit Kishore, said, “Telecom solutions are the backbone of building smart and sustainable cities. The advent of 5G technology opens whole new opportunities to address challenges of urban growth and provide end-to-end solutions to support sustainable creation of smart cities, in the future.”

Telcos are fully poised to launch 5G services in India, within two quarters once the spectrum is auctioned by the government. “A quarter or two quarters from the auction, we would start seeing 5G networks going live in India, and in one year’s time, we should see large portions of India, especially where demand is high, being covered,” said Randeep Sekhon, CTO, Bharti Airtel.

Umang Das

Umang Das

Chairman

Confederation of Indian Industry

“The telecom sector is at of the cusp of transformation. The government and the private sector are coming together to weave an unpreceded wave of digitization that will drive Industry 4.0, and significantly improve the day-to-day lives of a billion Indians.”

Peeyush Vaish

Peeyush Vaish

Partner and Telecom Sector Leader

Deloitte India

“The rollout of high-speed broadband through 5G and satellite broadband will see the convergence of the telecom ecosystem, and significantly affect the lives of a billion Indians. It will pave the way for bridging the urban-rural divide across sectors.”

The timeline of the spectrum auction is not firm yet, though Ashwini Vaishnaw, Minister for Communications, had recently announced that it would most probably be held in February 2022. However, the authorities may miss this timeline to conduct a public sale of 4G and 5G airwaves unless the telecom regulator sends in its pricing suggestions by November.

The DoT has sought recommendations on pricing, quantity to be auctioned, and other factors from the TRAI for a gamut of airwave bands, together with key ones like 700 MHz, 3.3–3.6 GHz and the coveted millimeter waves. It has additionally sought recent base costs for 4G airwave bands, reminiscent of 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, and 2300 MHz, which will also be used for 5G sooner or later. Typically, the TRAI recommendation document takes four-five months.

The present base value for a unit of 5G spectrum within the 3.3–3.6 GHz band is ₹492 crore. The telcos have additionally sought a lower reserve price for the 700-MHz band, as telcos gave the band a miss for the second successive sale.

With the recent telecom relief measures announced, the revenue earned from the auction assumes great significance. The authorities garnered ₹77,814 crore within the final spectrum public sale in March 2021 and ₹65,789 crore in the October 2016 auction.

RJio is looking forward to making its homegrown 5G technology a success, and taking it to foreign shores; Bharti Airtel is on the way to deliver connectivity not just in the underserved and unserved areas in India, but across the United Kingdom, Canada, Alaska, Northern Europe, Greenland, and the Arctic Region; Vodafone Idea has got a bit of a breather and is putting its house in order, whereas BSNL is hell-bent on making it a sustainable business. Challenges abound, but there is an excitement in the air. Finally, the telecom business is at an exciting juncture, to be nurtured, and the available technologies put to use.

The DoT recently notified that for future spectrum auctions, the need for submission of financial bank guarantee (FBG) to securitize annual spectrum instalment has been done away with, and spelt out other modalities around new spectrum allocation. The telecom department has also addressed the eligibility conditions for participation in the auction, so that participants have sufficient financial capacity. The government has also issued fresh guidelines for sharing of access spectrum by access service providers.

Lt Gen Dr SP Kochhar, Director-General, COAI, thanked the government. “We appreciate the steps taken by the government with regard to the future spectrum assignments to the TSPs. Measures, such as removal of FBG and performance bank guarantee requirements, increasing the validity of future access spectrum assignment to 30 years, defining schedule for future spectrum auctions, providing option for surrendering spectrum after 10 years, and removal of additional SUC of 0.5 percent in case of spectrum sharing are very welcome steps, which will reduce the financial burden on TSPs, and will go a long way in enhancing the ease of doing business in the telecom sector,” he said.

6G explained. With every generation of communications technology, the focus of the network changes. The 2G and 3G eras centered on human-to-human communication through voice and text. 4G heralded a fundamental shift to the massive consumption of data, while the 5G era has turned its focus on connecting the Internet of Things (IoT) and industrial automation systems.

In the 6G era, the digital, physical, and human world will seamlessly fuse to trigger extrasensory experiences. Intelligent knowledge systems will be combined with robust computation capabilities to make humans endlessly more efficient, and redefine how we live, work, and take care of the planet. Even though there is still a lot of innovation in 5G with the 5G-Advanced release of new standards, Nokia Bell Labs has already begun the research work on 6G to make it commercially available by 2030.

The 6G network. 6G will call for a change in the way communication networks are designed. Multiple key requirements must be reconciled – serve the massively growing traffic and the exploding numbers of devices and markets, while also accomplishing the highest possible standards regarding performance, energy efficiency, and strong security, enabling sustainable growth in a trustworthy way.

Stepping up to 6G. The rollout of 5G and subsequently 5G-Advanced could not have come at a better time when global resources are stretched thin. Communications technology is going to play a critical role in boosting productivity and help pursue comprehensive green policies. 6G will further build on the successes of 5G by bolstering human well-being and unveiling new possibilities that we cannot yet define or imagine.

According to Nokia Bell Labs, there are six technology areas that will characterize 6G.

VIL cashflow situation(₹ million) |

||

| Q1FY22 | Annualised | |

| Subs (mn) | 255 | 255 |

| ARPU (₹) | 104 | 104 |

| Mobile revenue | 81,619 | 3,26,477 |

| Others | 9,904 | 39,615 |

| Total revenue | 91,523 | 3,66,092 |

| Expenses | 77,746 | 3,10,984 |

| Cash EBITDA | 13,777 | 55,108 |

| EBITDA (%) | 15.1 | 15.1 |

| Non-govt borrowings | – | 2,35,000 |

| COD (%) | – | 10.0 |

| Interest payment | – | 23,500 |

| Non funded debt | – | 1,30,000 |

| COD (%) | – | 2.0 |

| Interest payment | – | 2,600 |

| Cash after interest cost | – | 29,008 |

| CapEx | – | 80,000 |

| CapEx intensity (%) | – | 21.9 |

| Cash after CapEx | – | (50,992) |

| AGR dues | – | 6,46,176 |

| EMI (at 9.5% COD) | – | 96,299 |

| Spectrum dues | – | 10,34,903 |

| EMI | – | 1,55,688 |

| Regulatory payment | – | 2,51,987 |

VIL’s total equity issuance |

||||||

| (₹ mn) | FY22E | FY23E | FY24E | FY25E | FY26E | Summation of 4 years |

| AGR EMI | 96,299 | 96,299 | 96,299 | 96,299 | – | 3,85,197 |

| MCLR + 2% (=9%) | 8,667 | 8,667 | 8,667 | 8,667 | – | – |

| Spectrum EMI | 77,844 | 1,55,688 | 1,55,688 | 1,55,688 | 77,844 | 6,22,750 |

| COD (9.5%) | 7,395 | 14,790 | 14,790 | 14,790 | 7,395 | – |

| Interest on deferment |

16,062 | 23,457 | 23,457 | 23,457 | 7,395 | 93,829 |

| 77,844 | ||||||

| Total equity issuance |

11,01,776 | |||||

| I-Sec Research | ||||||

Artificial intelligence and machine learning. AI/ML techniques, especially deep learning, have rapidly advanced over the last decade, and deep learning has already been deployed across several domains involving image classification and computer vision, ranging from social networks to security. 5G will unleash the true potential of these technologies, and with the approaches in 5G-Advanced, AI/ML will be introduced to many parts of the network at many layers and in many functions – from the optimization of beam-forming in the radio layer to scheduling at the cell site with self-optimizing networks, all using AI/ML to achieve better performance at lower complexity. AI/ML will go from an enhancement to a foundation by taking a clean-slate approach, where we do away with the complexity, and let AI/ML figure out how to best communicate between two endpoints.

Spectrum bands. Spectrum is a crucial element in providing radio connectivity. Every new mobile generation requires some new pioneer spectrum that helps fully exploit the benefits of a new technology. Refarming of the existing mobile communication spectrum from the legacy technology to the new generation will also become essential. The new pioneer spectrum blocks for 6G are expected to be at mid-bands 7–20 GHz for urban outdoor cells, enabling higher capacity through extreme MIMO, low bands 460–694 MHz for extreme coverage and sub-THz for peak data rates exceeding 100 Gbps.

While 5G-Advanced will expand 5G beyond just data communication, and substantially improve positioning accuracy to centimeter-level, especially for indoors and underground facilities, where satellite signals are unavailable, 6G will take localization to the next level by taking advantage of wide spectrum and new spectral ranges all the way up to terahertz.

“The sliding voice tariffs, growing data tariffs, increasing data usage per subscriber, and increasing data subscribers in the overall subscriber base over the last one year indicate that the average revenue per user of the industry could grow even without tariffs hikes.” India Ratings and Research (Ind-Ra)

The government announced a relief package for the Telecom sector, providing: a) a near term liquidity solution, particularly helpful to VIL, and b) addressed multiple long term issues of the sector. These measures show a strong intent of the government to address the near term liquidity of VIL. But a tariff hike is a must and VIL investment the business is a key monitorable. Bharti and RJio should reap gains from VIL’s situation and the government’s cleanup of a few legacy issues.

Valuation and view. Over the last 10 years, RoCE for the telecom industry has been in the low single- digits. We see a strong opportunity for both tariff and market share gains for Bharti and RJio. We do not see any significant risk of higher CapEx intensity over the next 2- 3 years as 5G is still some time away and 4G investments are peaking. A steady increase in earnings and peaking CapEx should drive steady FCF yield. Incremental EBITDA could drive RoCE and FCF for Bharti and RJio.” MOFSL

A network that can sense. The most notable aspect of 6G would be its ability to sense the environment, people, and objects. The network becomes a source of situational information, gathering signals that are bouncing off objects and determining type and shape, relative location, velocity, and perhaps even material properties. Such a mode of sensing can help create a mirror or digital twin of the physical world in combination with other sensing modalities, thereby extending our senses to every point the network touches. Combining this information with AI/ML will provide new insights from the physical world, making the network more cognitive.

Extreme connectivity. The ultra-reliable low-latency communication (URLLC) service that began with 5G will be refined and improved in 6G to cater to extreme connectivity requirements, including sub-millisecond latency. Network reliability could be amplified through simultaneous transmission, multiple wireless hops, device-to-device connections, and AI/ML. Enhanced mobile broadband, combined with lower latency and enhanced reliability, will improve the experience of real-time video communications, holographic experiences, or even digital twin models updated in real-time through the deployment of video sensors.

In the 6G era, we can expect use-cases with networks that have specific requirements in sub-networks, creating networks of networks with networks as an endpoint. Machine area networks, such as a car area network or a body area network can have hundreds of sensors over an area of less than 100 meters. These sensors will need to communicate within 100 microseconds with extreme high reliability for the operation of that machine system. Making networks within cars or on robots truly wireless will open a new era for the designers of those devices as they would no longer need to install lengthy and bulky cable systems.

New network architectures. 5G is the first system designed to operate in the enterprise/industrial environment, replacing wired connectivity. As the demand and strain on the network rises, industries will require even more advanced architectures that can support increased flexibility and specialization.

5G is introducing services-based architecture in the core and cloud native deployments that will be extended to parts of the RAN, and the network will be deployed in heterogeneous cloud environments, involving a mix of private, public, and hybrid clouds. In addition, as the core becomes more distributed and the higher layers of the RAN become more centralized, there will be opportunities to reduce cost by converging functions. New network and service-orchestration solutions exploiting the advances in AI/ML will result in an unprecedented level of network automation that will reduce operating costs.

Security and trust. Networks of all types are increasingly becoming targets of cyber-attacks. The dynamic nature of the threats makes it imperative to deploy sturdy security mechanisms. 6G networks will be designed to protect against threats like jamming. Privacy issues will need to be considered when new mixed-reality worlds, combining digital representations of real and virtual objects, are created.

Moving toward Industry 5.0. In recent decades, a range of technological improvements has fueled the rise of smart factories. Connectivity, however, has remained a major issue. 5G jumpstarted the fourth industrial revolution with a host of modern technologies. The march toward Industry 5.0 will receive further momentum with the widespread adoption of 6G.

Moratorium to provide

|

||

| VIL’s ARPU hike requirement (INR b) |

Without moratorium |

With moratorium |

| CapEx | 40 | 40 |

| Cash Interest | 25 | 25 |

| Bank debt repayment | 49 | 49 |

| Deferred spectrum liability | 157 | – |

| AGR payment/year (20 years) | 66 | – |

| Total EBITDA requirement | 338 | 114 |

| EBITDA (pre Ind AS 116) | 105 | 105 |

| Incremental EBITDA required | 233 | 9 |

| Incremental revenue required | 358 | 14 |

| ARPU (INR) | 125 | 125 |

| Subscribers (m) | 258 | 258 |

| ARPU hike required (INR) | 115 | 5 |

| New ARPU (INR) | 240 | 129 |

| Increase in ARPU required (%) | 93% | 4% |

Net debt position for VIL(₹ bn) |

||

| Net debt classification | AGR | 1QFY22 |

| Spectrum debt | 963 | 1,060 |

| Market debt | 231 | 234 |

| Total debt | 1,194 | 1,294 |

| Cash and equivalents | 4 | 9 |

| Net debt excluding AGR | 1,190 | 1,285 |

| AGR dues | 610 | 622 |

| Net debt including AGR | 1,800 | 1,907 |

Interest cost on availing moratorium for VIL(₹ bn) |

|||||

| FY22 | FY23E | FY24E | FY25E | Total | |

| Spectrum | |||||

| Outstanding dues | 1,050.0 | 1,050.0 | |||

| Interest (MCLR + 2%) | 94.5 | 103.0 | 112.3 | 122.4 | 432.2 |

| Total outstanding | 1,144.5 | 1,247.5 | 1,359.8 | 1,482.2 | 1,482.2 |

| AGR | |||||

| Annual payment | 504.0 | 504.0 | |||

| Interest (MCLR + 2%) | 45.4 | 49.4 | 4.4 | 0.4 | 99.7 |

| Total outstanding | 549.4 | 49.4 | 4.4 | 0.4 | 603.65 |

| MOFSL | |||||

Communication and control co-design will enable lower cost and higher data rate and increase the number of use-cases. 6G network as a sensor will enable joint communication, sensing, and localization that will address the needs of industries with a single system, thereby reducing cost.

New zero-energy or battery-less devices could be enabled in 6G using backscatter communications that will allow a massive scaling of data gathering for analytics and closed-loop control. There will be extensive use of mobile robot swarms and drones in various verticals, such as hospitality, hospitals, warehouses, and package delivery.

Looking beyond 5G future technology trends toward 6G The ITU-APT Foundation of India and 5G India Forum have taken a lead in India. The Foundation has come forth and offered to work with DoT in various spectrum-related studies and 5G and 6G technology developments. At a recent conference, AK Tiwari, Member Technology, Digital Communications Commission, DoT, called upon the telecom industry to work with DoT in setting up the necessary infrastructure and organization for spectrum studies toward 5G and 6G technology implementation in the country.

A review

The Indian telecommunication industry’s ecosystem has transformed over the last few years. It has come a long way from the traditional landlines to future-ready 5G. From phone applications to home automation to cashless commerce, digital disruption is the new normal for consumers. Affordability of services has always been a dominating factor for telecommunication adoption in India. Today, such services are within the economic reach of customers.

Comparative analysis of telecom players (1QFY22 numbers) |

||||

| Unit of measurement | Bharti | VIL | RJio | |

| Financial matrix | ||||

| Revenue | ₹ m | 2,68,536 | 91,523 | 1,79,940 |

| Revenue growth (QoQ) | % | 4.3 | (4.7) | 3.7 |

| Network cost | ₹ m | 57,973 | 24,927 | 59,730 |

| Network cost (as a percentage of revenue) | % | 21.6 | 27.2 | 33.2 |

| Network cost (QoQ) | % | (2.0) | 16.7 | 3.8 |

| EBITDA | ₹ m | 1,29,803 | 37,077 | 86,170 |

| EBITDA margin | % | 48.3 | 40.5 | 47.9 |

| EBITDA growth (QoQ) | % | 5.3 | (15.9) | 3.9 |

| Finance cost | ₹ m | 39,773 | 51,949 | 8,210 |

| PAT | ₹ m | 9,414 | (73,191) | 35,010 |

| PAT margin | % | 3.5 | (80.0) | 19.5 |

| PAT growth (QoQ) | % | (37.7) | 4.2 | 4.2 |

Operating matrix |

||||

| ARPU | ₹ | 146 | 104 | 138 |

| ARPU growth (QoQ) | % | 0.7 | (2.8) | 0.1 |

| Subscriber base | m | 321 | 255 | 441 |

| Net additions | m | – | (12) | 14 |

| Churn | % | 2.8 | 3.5 | 1.0 |

| Total data volume | m MB | 1,07,71,051 | 54,97,000 | 2,03,00,000 |

| Total voice traffic | m minutes | 10,02,263 | 5,03,057 | 10,60,000 |

| Wireless broadband subscribers | m | 194 | 121 | 437 |

| Wireless broadband subscriber additions | m | 5 | (2) | 14 |

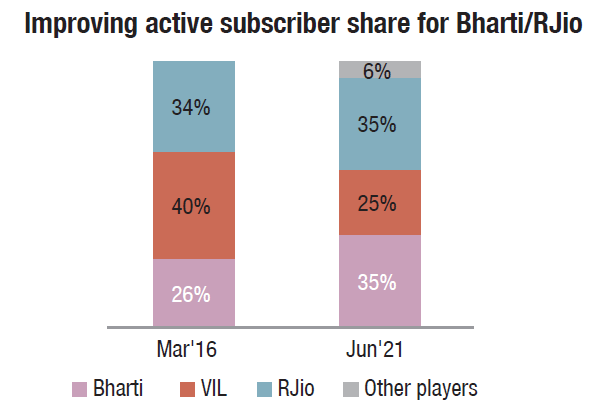

| Active subscriber market share | % | 34.9 | 24.5 | 34.6 |

| 4G subscribers | m | 184 | 113 | 441 |

| Total cell sites | no. | 2,19,310 | 6,27,788 | – |

| Cell site additions (QoQ) | no. | 2,409 | (5,346) | – |

In response to the need that emanated from the COVID-19 pandemic, the industry has undergone a tremendous metamorphosis to the high demand for data across sectors and fields. The telecommunication sector has become the connectivity backbone for industries, such as gaming, banking, healthcare, education, e-commerce, entertainment, manufacturing, fintech, real estate, and automobile. New untapped customer segments and markets have unlocked for operators to create customized solutions and promote internet adoption through collaborations with government and other solution providers.

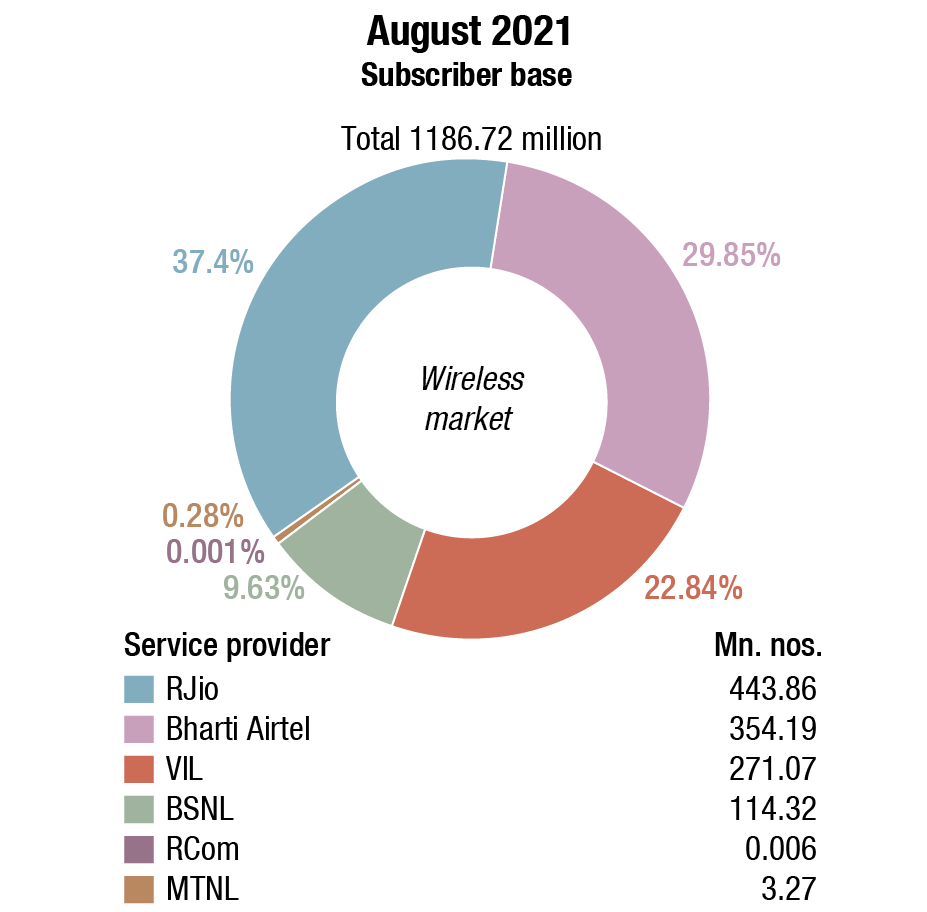

India’s total telecom customer base stood at 1.21 billion, end-August 2021. The industry, having witnessed consolidation into three large private players, saw accelerated absorption of multiple-SIM users, leading, in turn, to a slowdown in growth of the customer base.

At the end of August 2021, Reliance Jio had the largest number of wireless subscribers at 443.86 million, followed by Bharti Airtel (including Tata Teleservices) at 354.19 million users. Vodafone Idea had a 271.07 million wireless subscriber base. State-run BSNL ended August 2021 with 114.32 million users. The balance share was contributed by MTNL, Reliance Communications, and Quadrant.

At the wireline front total at 22.86 million, BSNL led the pack at 7.9 million subscriptions. Bharti Airtel had 5.17 million subscribers, Reliance Jio 4.41 million, and Vodafone Idea 0.56 million.

End-August 2021, urban telephone subscription contributed 671.31 million and the rural subscription 538.28 million. The overall tele-density is 88.45 percent, with urban at 141.52 percent and rural at 60.27 percent. The share of urban and rural subscribers in total number of telephone subscribers was 55.50 percent and 44.50 percent respectively.

Among the metros, Delhi has the highest density at 278.27 percent. Among the service areas excluding metros, Himachal Pradesh has the highest tele-density (149.35 percent), followed by Kerala (131.4 percent), Punjab (126.61 percent), Tamil Nadu (109.07 percent), Maharashtra (108.23 percent), Karnataka (104.8 percent), Gujarat (99.62 percent), Andhra Pradesh (98.54 percent), Haryana (96.37 percent), and Jammu & Kashmir (88.54 percent). On the other hand, service areas, such as Bihar (53.81 percent), Uttar Pradesh (69.11 percent), Madhya Pradesh (69.85 percent), and Assam (72.18 percent), have comparatively low tele-density.

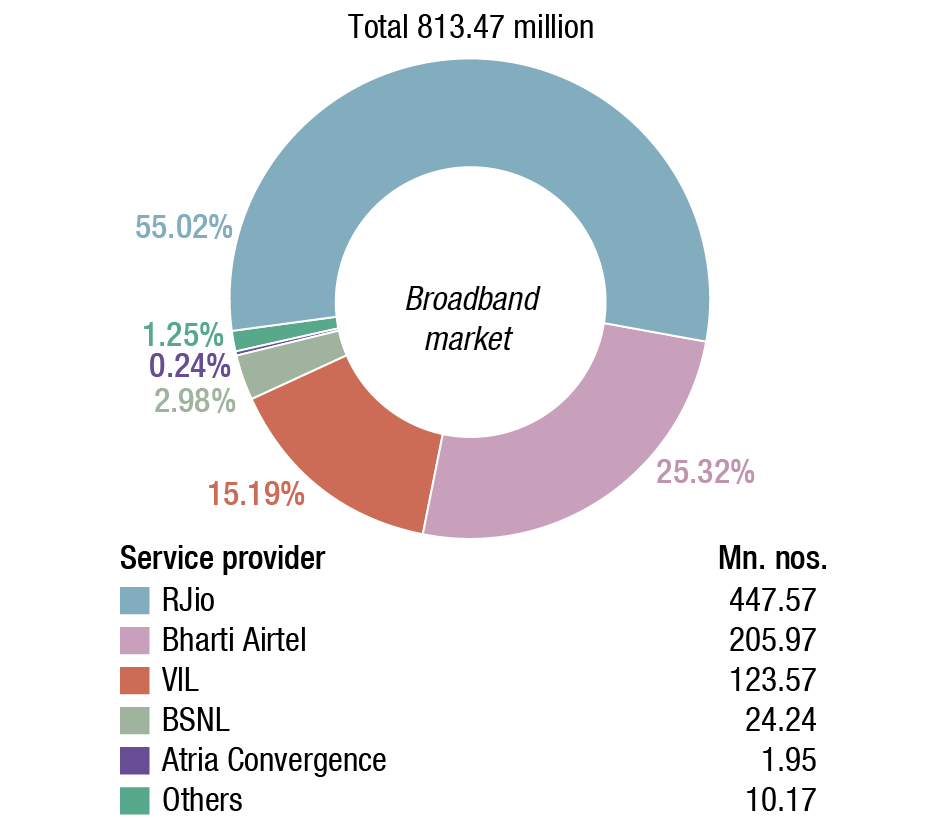

The continued accessibility to mobile services and low-priced tariffs has spurred the growth and deployment of wireless broadband internet. Mobile broadband is the primary medium to access internet in India as the lack of adequate wired-internet infrastructure restricted its growth only to major cities. As the operators continue to expand their 4G coverage and capacity, India witnessed an impressive growth in wireless broadband subscriber (>512 kbps), up from 258 million in March 2017 to 755 million in March 2021, an addition of 497 million subscribers in five years. In August 2021, the corresponding figure is 813.47 million. In March 2021, the wireless broadband subscribers base of 755 million in India was almost 33 times compared to 23 million wired-broadband subscribers.

During the last five years, while the wireless broadband subscribers have grown exponentially, the fixed-line broadband subscribers have grown slowly from 16.5 million to 24.05 million only. Except a small spurt seen last year, which could be due to the pandemic, fixed-line broadband subscribers have largely remained constant during the three years preceding the last year, i.e., 2020. While it is economical to use fixed-line broadband to access data-heavy applications, when it comes to cost per GB of data consumption the reason for such a poor penetration of fixed-line broadband in India may be either due to supply-side constraints (non-availability of service) or demand side constraints (like affordability or perceived benefits issues). Fiber penetration is even lower with most fixed broadband running on legacy copper-based infrastructure.

In 2020-21, the telecom industry continued to grapple with hyper-competition as all the operators, to defend their subscriber base, continued to discount unlimited voice plans with bundled data. The significant ARPU erosion, despite the multi-fold growth in volume of voice and data usage over the last several years, has led to persistent financial stress for the operators. The increasing penetration of unlimited bundled plans has also necessitated continuing CapEx and spectrum investments to expand 4G coverage and capacity. The unanimous pre-paid tariff hike in December 2019 across all price points did not result in ARPU recovery, and the industry continues to provide unsustainably low tariffs. India continues to have the lowest tariffs globally, while the proliferation of unlimited data bundles has led to India having one of the highest data usage (per subscriber) in the world.

Sunil Bharti Mittal, Chairman, Bharti Enterprises, has on many occasions stated that the ARPU of the industry must retune to ₹200 levels by the end of this financial year and ₹300 in the near future, up from the measly ₹146 a month currently. In a system where at least 35 percent of a telco’s revenue goes toward a combination of levies, the need for a higher ARPU to make the telecom business sustainable cannot be disputed. With 5G on the way, the telcos will have to invest more in both the infrastructure at the ground level as well as the spectrum, which will not be cheap.

And for Vodafone Idea to survive, hike in tariffs is imperative.

However, RJio seems to be in no mood for price hikes and instead is adamant on acquiring more customers as it unveiled new offers for its popular prepaid recharge options. Jio is now offering 20 percent cashback on popular pre-paid recharge options, which means Jio’s plans are now almost 30 percent cheaper than the rivals.

Following the acquisition of the right to use spectrum in all 22 circles across India in the March 2021 auction, Reliance Jio has completely de-risked its spectrum portfolio. Subsequently, Jio has also signed a definitive agreement with Bharti Airtel Limited, for trading of right-to-use spectrum in the 800 MHz band in Andhra Pradesh, Delhi, and Mumbai circles. Post the spectrum auction and the trading agreement with Bharti Airtel Limited, Jio has expanded its spectrum footprint by 56 percent to 1732 MHz. It now has adequate sub-GHz spectrum with 2X10 MHz contiguous spectrum in 18 out of the 22 circles. It also has at least 2X10 MHz in 1800 MHz band and 40 MHz in 2300 MHz band in each of the 22 circles.

In the auction for sale of spectrum in different bands that concluded on March 2, 2021, Airtel acquired 355.45 MHz spectrum across sub-GHz, mid-band, and 2300 MHz bands for a total consideration of ₹187,034 million for a period of 20 years. With this, Airtel has secured pan-India footprint of sub-GHz spectrum.

VIL is adequately covered on the spectrum front too. The telco’s spectrum holding, post-March 2021 auction stands at 1768.60 MHz.

IUC regime for domestic voice call ends. Following the industry’s transition from interconnect usage charges (IUC) to bill and keep (BAK) regime on January 1, 2021, telcos made off-net domestic voice-calls free as soon as IUC charges were abolished. On-net domestic voice calls have always been free on the Jio network. The transition to BAK regime is expected to hasten the adoption of more efficient technologies like VoLTE, which have a negligible cost for carrying and servicing essential voice services.

By 2026, as per Ericsson Mobility Report 2021 released in June 2021, 4G subscriptions are forecast to rise from 680 million in 2020 to 830 million in 2026, increasing at a CAGR of 3 percent in the India region. 4G remained the dominant technology in 2020, accounting for 61 percent of mobile subscriptions. The technology will continue to be dominant, representing 66 percent of mobile subscriptions in 2026, with 3G being phased out by that time. 5G will represent around 26 percent of mobile subscriptions in India at the end of 2026, estimated at about 330 million subscriptions.

The number of smartphone subscriptions was 810 million in 2020 and is expected to grow at a CAGR of 7 percent, reaching over 1.2 billion by 2026. Smartphone subscriptions accounted for 72 percent of total mobile subscriptions in 2020, and are projected to constitute over 98 percent in 2026, driven by rapid smartphone adoption in the country.

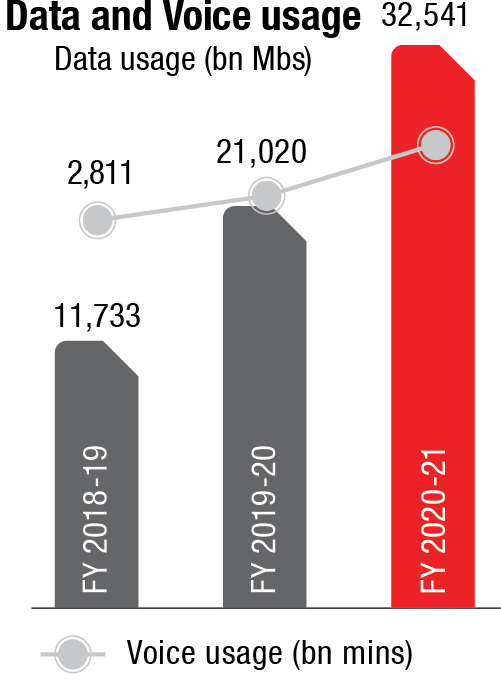

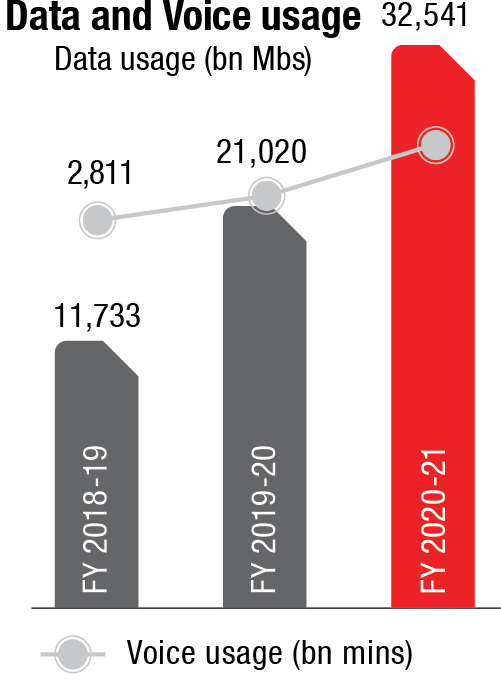

The huge smartphone subscriptions in COVID-19 have accelerated India’s digital transformation as more and more consumers rely on digital services – be it digital payments, remote health consultations, online retail, or video conferencing – to fulfil their business or personal needs. Accordingly, the average monthly mobile data usage per smartphone continues to show robust growth, boosted by people increasing their smartphone usage while staying at home. The reliance of people on their mobile networks to stay connected as well as work from home has contributed to the average traffic per smartphone user increasing from 13 GB per month in 2019 to 14.6 GB per month in 2020. The average traffic per smartphone in the India region stands second-highest globally, and is projected to grow to around 40 GB per month in 2026. Competitive pricing by service providers for subscription packages, affordable smartphones, and increased time spent online, all contribute to monthly usage growth in the region. Total mobile data traffic in India has grown from 6.9 EB per month to 9.5 EB per month in 2020, and is projected to increase by more than four times to reach 41 EB per month in 2026. This is driven by two factors – high growth in the number of smartphone users, including growth in rural areas, and an increase in average usage per smartphone.

The telecommunication services industry is gearing up to shift its focus from coverage and voice to applications that will be the nucleus for achieving infrastructure transformation across the length and breadth of this vast country.

Reliance Jio Infocomm Limited (RJIL)

1QFY22. Jio Platforms Limited’s revenue for the quarter was ₹18,952 crore, an underlying growth of ~19 percent YoY, EBITDA up 21.3 percent YoY to ₹8892 crore, with 46.9 percent EBITDA margin. ARPU was stable at ₹138.4; total customer base was 440.6 million as of June 2021; net addition 14.3 million in 1QFY22, total data traffic 20.3 billion GB during the quarter, with 38.5 percent growth and 26 percent YoY increase in per capita consumption to 15.6 GB per month. The overall data traffic on Jio’s network crossed 20 exabytes for the quarter.

RJIL, along with Google, has developed smartphone JioPhone Next. Google Cloud and RJIL are embarking on a comprehensive, long-term strategic relationship with a goal of powering 5G in enterprise and consumer segments nationwide. Jio and Microsoft have operationalized an initial 10 MW capacity of Jio-Azure cloud data centers across Jamnagar and Nagpur. Onboarding of pilot customers across SMEs and start-ups is underway, with further enhancement in capacity to be done in subsequent quarters. Jio Platforms Ltd. Has also collaborated with NXP Semiconductors NV to implement a 5G NR O-RAN small-cell solution that incorporates NXP’s Layerscape family of multicore processors.

Bharti Airtel Limited

1QFY22. Bharti Airtel’s consolidated revenues for the quarter grew by 4.3 percent sequentially to hit ₹26,854 crore. Consolidated EBITDA was at ₹13,189 crore;

EBITDA margins improved from 48.9 percent to 49.1 percent on a sequential basis. 4G customers were at 184.4 million, mobile ARPU at ₹146, monthly mobile data consumption per customer at 18.5 GB, highest-ever customer additions of 285,000 in the homes business and digital TV business added 282,000 customers.

The telco has three parts to its overall portfolio – India Mobile, Enterprises and Homes in India, and Africa. Sequentially of the ₹1106 crore of growth that Airtel showed at a consolidated level, India Mobile accounted for 20 percent of this growth. The rest of the growth, which is a balance 80 percent, came from other businesses as well as geographies outside of India.

There are three parts to Airtel’s investment in CapEx now. One is radios. The incremental radio investment is coming down now, with the exception of this big chunk of sub-gigahertz radios that were bought. Because a large part of the radio is only capacity radios, the 900-MHz band and 1800-MHz band are all across the country. The 2100 MHz band is in about 60 percent of the country, and the 2300 MHz is in 80 percent of the country. The incremental radios that are needed for covering additional sites or additional towers are marginal at best. And, therefore, the only source of radio investment is more capacity solutions, where there is very high consumption in the form of new sites. But with the spectrum purchases that have been more-or-less offset, moving forward, the radio investments will now come down.

The core investments, a modest part of the overall CapEx portfolio is a direct function of how the capacity grows.

And the last part is on transport and backhaul. This is where a substantial amount of investment has been made over the last few years. In the best telcos in the Western countries, as data grows, almost 40 percent of the CapEx is on transmission and fiber. Airtel too, over the last few years, has made a significant augmentation of transmission and fiber CapEx.

All in all, it is a balanced CapEx outlet. And, that is how it is expected to remain for the year.

Vodafone Idea Limited

1QFY22. Vodafone Idea’s consolidated revenues for the quarter were ₹9150 crore, EBITDA for the quarter was ₹3730 crore with EBITDA margins at 40.5 percent versus 45.9 percent in 4QFY21. The total gross debt (excluding lease liabilities and including interest accrued but not due) as of June 30, 2021, stands at ₹191,590 crore, comprising of deferred spectrum payment obligations of ₹106,010 crore and AGR liability of ₹62,180 crore that are due to the government and debt from banks and financial institutions of ₹23,400 crore. Cash and cash equivalents were ₹920 crore and net debt stood at ₹190,670 crore, VIL has debt obligations of more than ₹7,000 crore maturing in 3Q-4QFY22.

The subscriber base however declined by 12.3 million as the second wave of COVID disrupted economic activity, with lockdowns or restricted store timings impacting the gross additions during the quarter. The subscriber base stands at 255.4 million in 1QFY22 versus 267.8 million in 4QFY21. However, the 4G subscriber base remained resilient at 112.9 million versus 113.9 million in 4QFY21. Subscriber churn was 3.5 percent in 11FY22 versus 3.0 percent in 4QFY21. ARPU declined to ₹104 versus ₹107 in 4QFY21. The data volumes witnessed strong growth of 13.2 percent QoQ, driven by higher data demand during the lockdown. Data usage per broadband subscriber surged to 14.6 GB per month versus 12.8 GB per month in 4QFY21.

Cost optimization underway with target to achieve ₹4000 crore annualized OpEx savings by December 2021, have already achieved ~70 percent of the targeted annualized savings on a run-rate basis by the end of 1QFY22.

VIL continues to invest in 4G to increase coverage and capacity. During the quarter AMJ 2021, the telco added ~6400 4G FDD sites primarily through refarming of 2G/3G spectrum. The overall broadband site count stood at 447,114, lower compared to 452,650 in 4QFY21 as 3G sites were actively shut down. Till June 2021, the telco had deployed nearly 63,000 TDD sites in addition to the deployment of ~13,800 Massive MIMO sites and ~12,800 small cells. The telco’s 4G network covers over 1 billion Indians as of June 30, 2021.

The telco is expected to receive a financial infusion of ₹20,000 crore by end October–early November. Approximately ₹7,000–8,000 crore is expected to be invested through Vodafone Group Plc and Aditya Birla Group, and the remainder through returned bank guarantees. The telco is in advanced talks to promote a minority stake to global private equity investors together with Apollo Global Management and Carlyle to raise as much as ₹7500 crore by December, after which there could be a follow-on public offer (FPO) to raise another USD 1 billion around June 2022.

Bharat Sanchar Nigam Limited

Bharat Sanchar Nigam Limited (BSNL) is looking to upgrade about 50,000 sites to 4G across the nation. This will be Phase-I of the state-run telco’s 4G project. The remaining 40,000 sites will be covered under Phase-II. The telco is going ahead with the homegrown technology/equipment and has also tested it live in Chandigarh recently. It is waiting for the vendors to complete the proof-of-concept (PoC) challenge. Once that is done, BSNL could roll out live 4G networks within six months or by the next financial year.

PK Purwar, CMD, BSNL, said that the state-run telco had become an operationally sustainable organization. BSNL now has a market share of 10.25 percent, and its sole focus is 4G now.

At the same time, BSNL’s broadband business is growing at a rapid pace. The state-run telecom operator has been adding about 1 lakh new FTTH customers every month, which is a solid growth rate. Further, last year, BSNL had turned into an EBITDA-positive company.

After receiving a bailout package of nearly ₹70,000 crore in October 2019, BSNL has again sought ₹37,105 crore from the government either as a grant or as equity. The telco will be requiring capital expenditure, for the deployment of India 4G core, associated transmission network expansion, and fiberization of ₹17,500 crore – ₹5000 crore in current fiscal, ₹7500 crore in FY22-23 and ₹5000 crore in FY23-24. Further, it needs ₹19,605 crore during this period for servicing its debt obligations.

Revenues have stabilized and there has been a reduction of nearly ₹2500 crore in administrative and operating expenses in the last two years. The successful implementation of voluntary retirement scheme (VRS) has resulted in saving of ₹7000 crore in employee costs and reduction in manpower by 78,500.

The government also provided ₹23,814 crore toward administrative allocation of 4G spectrum to these firms. Unlike the private telecom operators, BSNL does not pay auction-determined price for 4G spectrum.

The government also provided a sovereign guarantee to BSNL and MTNL to raise up to ₹15,000 crore through long-term bonds. This was to be used for restructuring their existing debt and also partly meet their CapEx, OpEx, and other requirements.

BSNL and MTNL are also planning to monetize their assets worth ₹38,000 crore over a period of four years.

Financial Review: FY2020-21

Bharti Airtel Limited – Customer obsessed and innovation driven. Even during the stringent lockdown and later during the unlock phases, the telco ensured that it kept its customers and millions of people, homes, and businesses connected. Network investments and broadband installation machinery were accelerated to cater to the increased pandemic-led surge in data demand. Similarly, the company progressed in achieving a 5G-ready network and successfully tested, demonstrated, and orchestrated a live 5G service over a commercial network in Hyderabad city.

Building on key underlying strengths of data, distribution, payments, and network, during the year, the telco launched multiple digital services. Digital flywheel comprising digital services is enabling the company to be more efficient, create new revenue streams, and build a powerful ecosystem of strong partners. The announcement of the new corporate structure has been another key step toward sharpening focus on digital opportunity and value creation.

Key highlights

Recasting of consolidated financial statement on account of demerger of Bharti Infratel Limited. The Indus merger, which combined Bharti Infratel with Indus Towers, was completed effective November 19, 2020. Following the Indus merger, the 53.5 percent shareholding in Bharti Infratel was reduced to 36.7 percent in the merged Indus Towers entity. On December 2, 2020 and December 28, 2020, the company acquired an additional stake of 4.93 percent and 0.06 percent, respectively, in the merged Indus Towers entity, increasing its equity stake from 36.7 percent to 41.73 percent, and hence Airtel no longer holds a controlling stake. Accordingly, all the financial and non-financial numbers for the past periods for India, India SA, and Consolidated operations have been recast to exclude the impact of Bharti Infratel Ltd.

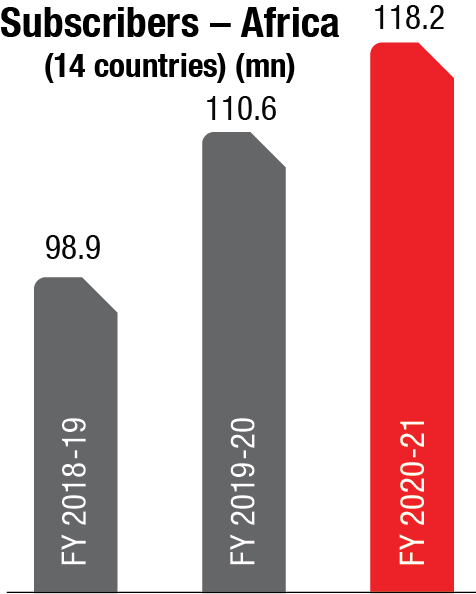

Highest consolidated revenue. The company witnessed the highest-ever consolidated revenues of ₹1,006,158 million (recasted revenue ₹969,992 million) for the year ended March 31, 2021, as compared to ₹846,765 million (recasted revenue ₹798,999 million) in the previous year, an increase of 18.8 percent (an increase of 21.4 percent on a recasted basis). Full year revenues of India and South Asia stood at ₹726,980 million as compared to ₹614,973 million in the previous year, an increase of 18.2 percent (up 21.8 percent on a recasted basis). Revenues across the 14 countries of Africa, in constant currency terms, grew by 19.4 percent. Increase in revenue is majorly led by customer addition on the back of strong demand for connectivity and solutions.

The capital expenditure for the financial year ending March 31, 2021, was ₹241,685 million.

Consolidated net debt, excluding lease obligations, stood at ₹1,155,124 million as on March 31, 2021, compared to ₹914,181 million as on March 31, 2020. Consolidated net debt including the impact of leases stood at ₹1,485,076 million as on March 31, 2021. The net debt-EBITDA ratio (USD terms LTM), including the impact of leases as on March 31, 2021, was at 3.26× as compared to 3.35× as on March 31, 2020. The net debt-equity ratio was at 2.52× as on March 31, 2021, as compared to 1.61× as on March 31, 2020.

Business overview

Mobile services. Airtel fortified its strong spectrum portfolio with the acquisition of 355.45 MHz spectrum across sub-GHz, mid-band, and 2300 MHz bands for a total consideration of ₹187,034 million in the latest spectrum auctions.

The company continued to re-farm its 3G spectrum for 4G and modernize it for increasing 4G coverage and capacities. As of March 31, 2021, the company had 321.4 million customers in India. The company had 188.6 million data customers at the end of March 31, 2021, of which 179.3 million were mobile 4G customers. The increased penetration through bundles with high inbuilt data has also led to the total MBs on the network growing by 54.8 percent to 32,541 billion MBs.

The company continues to expand its reach within the digital space. Wynk Music remains one of the top three music streaming services in India – it crossed 72.5 million monthly active users (MAU). Airtel Xstream crossed 37.5 million MAU.

During the year, revenues increased by 20.9 percent to ₹555,677 million as compared to ₹459,663 million in the previous year. On a recast basis, revenues increased by 26.1 percent to ₹519,510 million as compared to ₹411,898 million in the previous year. The segment witnessed an increase in the EBITDA margin to 43.7 percent during the year, compared to 36.9 percent in the last year. The EBIT margin for the year increased to 5.9 percent, compared to (negative) 6.9 percent in the previous year.

The company had 216,901 network towers, compared to 194,409 network towers in the last year. Mobile broadband (MBB) base stations numbered 606,783 at the end of the year, compared to 503,883 at the end of last year.

Strategic alliances and partnerships. Airtel continues to forge business partnerships with an aim to provide a seamless customer experience with a greater value proposition to end-users.

Airtel and Qualcomm announced their partnership for 5G in India; Airtel’s network vendors and device partners will utilize the Qualcomm® 5G RAN platforms to roll out virtualized and Open RAN-based 5G networks; with VOOT to bring more premium digital content onto its Airtel Xstream platform; with the Government of Tamil Nadu to bring quality online learning classes to students in the state through Airtel’s digital platforms; a strategic partnership with Nokia’s CloudBand-based software products; an agreement to deploy Altiostar’s open virtual radio access network (vRAN) solution. And selected Ceragon’s (Ceragon Networks Ltd.) products and services for additional 4G network expansions to address the growing demand for broadband.

Consolidated figures |

|||||

| Particulars | FY 2020-21 | FY 2019-20 | YoY % Change |

||

| ₹ in Mn | USD Mn* | ₹ in Mn | USD Mn* | in ₹ terms | |

| Gross revenue | 1,006,158 | 13,538 | 846,765 | 11,972 | 19% |

| EBITDA before exceptional items | 461,387 | 6,208 | 347,696 | 4,916 | 33% |

| Interest, depreciation & others before exceptional items | 438,799 | 5,904 | 392,514 | 5,550 | 12% |

| Profit before exceptional items & tax | 22,586 | 304 | (44,819) | (634) | 150% |

| Profit before tax | (42,063) | (566) | (445,711) | (6,302) | 91% |

| Tax expense | 89,325 | 1,202 | (125,124) | (1,769) | 171% |

| Profit for the year | (150,835) | (2,029) | (321,832) | (4,550) | 53% |

| EPS (in ₹/USD)* | (27.65) | (0.37) | (63.41) | (0.90) | 56% |

| *1 USD = ₹74.32 exchange rate for financial year ended March 31, 2021 (1 USD = ₹70.73 for financial year ended March 31, 2020) | |||||

Key ratios |

||||

| Key ratios | Units | FY 2020-21 | FY 2019-20 | YoY |

| CapEx productivity | % | 47.25 | 43.77 | 3 p.p. |

| Opex productivity | % | 33.64 | 36.48 | (3 p.p.) |

| Interest coverage ratio | Times | 3.62 | 3.16 | 15% |

| Net debt to shareholders’ equity | Times | 2.52 | 1.61 | 56% |

| EBITDA margin | % | 45.86 | 41.06 | 5 p.p. |

| Net profit margin | % | (15.0) | (38.0) | 23 p.p. |

| Return on shareholders’ equity | % | (22.17) | (35.47) | 13 p.p. |

Mobile Services (India) |

|||

| ₹ mn | FY 2020-21 | FY 2019-20 | YoY Growth % |

| Revenues | 555,676 | 459,663 | 21 |

| EBITDA | 286,502 | 206,319 | 39% |

| Homes services | |||

| Particulars | FY 2020-21 ₹ Mn | FY 2019-20 | YoY Growth % |

| Gross revenues | 23,342 | 22,451 | 4 |

| EBIT | 5,203 | 5,129 | 1 |

| Digital TV services | |||

| Particulars | FY 2020-21 ₹ Mn | FY 2019-20 ₹ Mn | YoY Growth % |

| Gross revenues | 30,562 | 29,238 | 5 |

| EBIT | 11,011 | 11,330 | (3) |

Mergers, acquisitions, and disinvestments. Airtel concluded a host of M&A transactions as a part of its growth and diversification strategy, and to harness economies of scale resulting from consolidations. Bharti Airtel acquired a strategic stake in EdTech startup Lattu Media Pvt. Ltd. (Lattu Kids), AI-focused startup – Voicezen, and cloud technology startup, Waybeo as part of the Airtel Startup Accelerator Program. And via its wholly-owned subsidiary, Nettle Infrastructure Investments Limited, Airtel acquired 100-percent stake in OneWeb India Communications Private Limited (OneWeb).