CT Stories

Capitalizing on the growth of data

The data center ecosystem will continue to thrive over the next decade

Across the world, businesses are generating more data than ever. Much of 2022’s outlook for the data center sector was concerned with balancing the growth in digitization with more sustainable practices.

Covid-19 had a tremendous impact on global supply chains across many sectors. However, once the pandemic receded, businesses everywhere were lulled into something of a false sense of security, believing they had been through the worst.

None expected a second body blow, a geopolitical crisis, even more disruptive to some supply chains – particularly the semiconductors and base metals vital to data center construction – than Covid. As a high-growth market, the data center industry is highly sensitive to supply chain disruption, especially at a time when it is looking to scale up.

A data center is home to a wealth of different technologies – from HVAC systems to mechanical and structural engineering, IT, and compute. The challenge is trying to accelerate such highly complex, interdependent types of environments to maintain the current trends for digitization. The modulization of data centers is one way of making the design and construction of a data center less complex while ensuring faster time-to-market.

Until now, London, Dublin, Frankfurt, Amsterdam, and Paris have been the traditional international data center clusters, either because companies are headquartered in these cities, or because they are natural economic clusters with a wealth of telecom connectivity and ideal client profiles. It is becoming more favorable to build data centers in the secondary cities of the main economic nations and in the capitals of smaller economic nations. But this expansion is not without its challenges, albeit many jurisdictions are welcoming data center operators with open arms, with some even offering incentives and subsidies to entice them.

Not so long ago, the main features sought in a data center would likely have included high-tech reliability and resilience, low running costs, and everything in between. Sustainable design and operational practices were more of a nice-to-have, embraced by progressive data center operators to reduce operational costs.

But more recently, all that has changed. While the major energy supply challenges that 2022 brought could not have been foreseen, sustainable data center operations and low-power usage effectiveness (PUE) have become crucial operational competencies over the past five to eight years.

Moreover, sustainable data centers are essential in winding back the environmental impact of data gravity, the rapidly increasing dynamic created by the widespread centralization of data. Also, it has become clear that companies need to understand the future of legislation to avoid big faults in data center design.

Without a clear sustainability plan, the costs of managing so much data will spiral out of control. This will become a liability for companies struggling to manage the cost and carbon footprint of their growing data operations.

The EU’s progress in promoting sustainable operations and business practices is a beacon for North American and Asia-Pacific companies that want to – or need to – manage data in the region.

The EU also offers important guidance for companies aiming to strengthen their role within the circular economy. This has become increasingly important for supporting sustainability objectives as data center operators look more closely than ever at their strategies for purchasing, maintaining, reusing, and upgrading core equipment.

European countries are world leaders in developing green energy sources, with 54 percent of power in Sweden coming from renewable sources and Denmark being the world leader in solar and wind power adoption The Green Future Index 2022 ranks 16 European nations among the world’s 20 greenest countries.

Stricter data privacy regulations and rising demand are drawing data center operators to set up facilities onshore, particularly in emerging markets within Southeast Asia and North Asia, and is expected to accelerate in the next two to three years. Concerns over privacy have sparked a wave of new legislation to govern sensitive data, essentially requiring companies to have data centers locally to serve the market in which they operate. But legislation is far from the only push factor. The trend of content localization is also energizing the data center and digital infrastructure industry.

Skilled labor in the digital infrastructure industry, however, remains scarce even in the established markets though there are encouraging signs. Despite these challenges, on top of the macroeconomic headwinds amid the pandemic, the pace of investors entering the data center space has really accelerated globally within the past two years and looks set to continue growing.

Access to more sophisticated capital and debt solutions has unlocked growth in the sector. While more capital will increase the size and scale of projects as new investors come in, challenges exist for those looking to source land as construction costs rise.

Investors are opting to convert old office buildings or empty warehouses into data centers as a quicker, more cost-efficient alternative to new builds. Besides the shorter timeline, another push factor for investors to pursue conversion is the potential savings, with costs going to building modifications rather than building a facility from ground up. The savings generated can be used to offset the surge in raw material costs – exacerbated by supply chain disruptions – which has led to overpriced installations in data center projects. This makes conversions, which require less materials than new builds, an attractive lower-cost alternative that limits exposure to these material inflation challenges. Such conversions may not necessarily be suited for hyperscale developments, which are driving the market, but enterprise or retail colocation operators could stand to benefit from projects coming on stream.

For a long while, private equity investors have invested in both digital infrastructure and industrial real estate. Now, logistics-focused real estate firms are beginning to eye up the data center industry as an opportunity for growth. An increasingly wider range of investors coming into the sector can be landlords or investors in data center enterprises and the operational business. Despite an e-commerce-driven boom in logistics, these firms are playing both sides and looking to tap into the burgeoning data center sector at the same time in an effort to grow further, even if both sectors might have competing demands for the same sites.

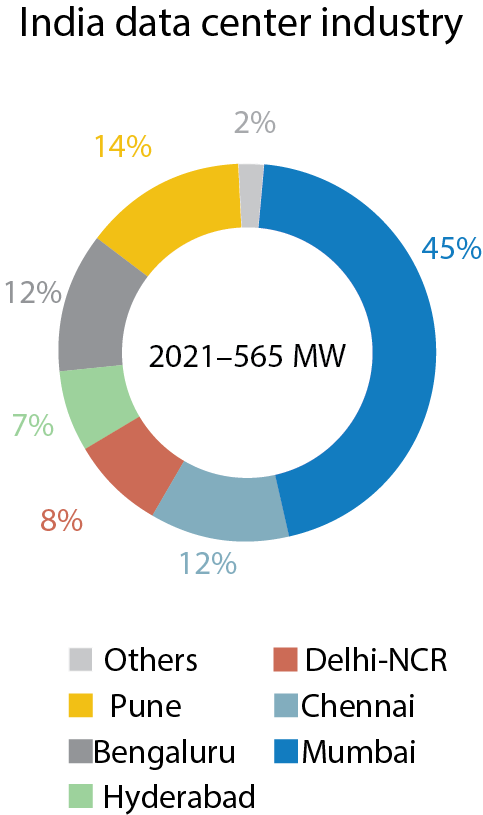

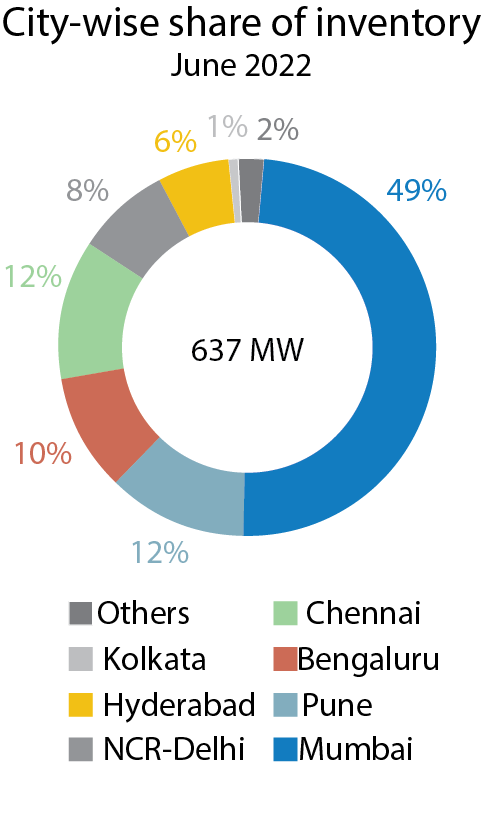

While every market in the data center industry is different, there is one thing they all have in common – they are growing, and extensively. India is no exception.

Data centers in India have emerged as one of the most attractive growth opportunities for global investors and leading developers. Investments are flowing in, with multiple new markets created simultaneously, along with the rapid development of campus sizes.

What Covid has done to Indian enterprises, in general, is they are having difficulty in accessing their on-premise data centers. Therefore, the number of enterprises having digitization initiatives has spiked a lot. What happened, as a result, is many enterprises in India migrated their infrastructure to the cloud, or they simply opted for managed hosting services in third-party data centers across India.

This pre- and post-pandemic experience has not been limited to the Indian market. The pandemic has created a fundamental shift across the data center industry, affecting the supply chain, workforce, demand, scale, and more.

In 2021, the data center market in India, as estimated by Arizton Advisory & Intelligence, was valued at USD 4.35 billion and is predicted to reach USD 10.09 billion by 2027 – a significant growth; the question lies in what this growth will look like, and how companies can best use this information to leverage their choices.

One of the key things driving growth lies in government measures aimed at driving digital infrastructure growth, including the Digital India initiative; classification of data centers as infrastructure assets, and proposing new data localization laws, all of which will drive the data center industry in the country – both cloud and colocation There could be a concern surrounding a battle between cloud and colocation, and which will win out. But the reality is that cloud and colocation can work together; the real threat is companies building on-premise data centers.

The future of the Indian data center market looks bright, if not entirely figured out as yet. A lot will depend on persuading companies to use cloud and colocation instead of building their own data centers, while in a market that offers a lot of incentive to do just that.

Announcements galore! Sify Technologies has announced an investment plan of ₹2692 crore in new data centers in Noida, India. This is in line with the company’s roadmap to build 200 MW of data centers in India over the next four years.

Web Werks, alongside partner Iron Mountain Data Centers, is investing ₹197 crore in a new hyperscale data center in Noida. The company will be setting up a new data center with a gross power capacity of 20 MVA.

Microsoft has acquired 22 acres in Mekaguda for around ₹40 crore, 41 acres in Shadnagar for ₹164 crore, and 52 acres in Chandenvelly for ₹72 crore.

Equinix has acquired a 5.5-acre parcel of land in the State Industries Promotion Corporation of Tamil Nadu Ltd. (SIPCOT) IT Park for USD 9 million. The company has also announced plans for its third facility in Mumbai; it plans to invest more than USD 86 million developing the facility, which will sit on a four-acre plot. Equinix had entered the India market in 2021 when it acquired the Indian operations of GPX Global Systems, picking up two data centers in Mumbai for USD 161 million.

Yotta Infrastructure is planning a new data center in Mumbai, India. The Hiranandani Group company has been granted permission by the state urban development department for the conversion of 7.7 hectares (approximately 19 acres) in the Powai area of Maharashtra from a special development zone to an industrial zone that would allow a data center to be built.

VueNow is proposing to build dozens of Edge data centers entailing investment worth ₹820 crore across the state of Bihar. It includes a 100-rack, 1.2MW facility in Patna as the master hub. Four other facilities are proposed in Dharbhanga, Bhagalpur, Purnea, and Buxar in the first phase totaling 2.4 MW. A total of 40 Edge facilities could be developed. Phase-II plan includes two hub locations and 10 Edge data centers, and a further 24 facilities in the third phase.

CtrlS has also broken ground on a new data center in Guwahati, Assam. The new facility will be spread over three acres and will have an initial capacity of around 1000 racks; it will be expanded to house more than 2000 racks over the next 12–18 months. The company aims to expand its footprint to six million square feet in the next 24 months with new facilities in Hyderabad – where it recently broke ground on a new facility – as well as Chennai and Mumbai, and hopes to expand internationally. CtrlS also aims to establish 500 Edge data centers in Tier-II and Tier-III cities across the country in phases.

NTT has launched a new data center in Navi Mumbai, and plans an 8-acre facility in Mahape, Mumbai. The Mahape campus is planned with the capacity for up to four data centers, reaching up to 150 MW. Phase one aims to develop 90 MW across two buildings. The company plans an availability triangle in the Mumbai region with hyperscale campuses in Chandivali, Mahape, and Airoli.

RailTel is setting up a data center worth USD 15 million for Madhya Pradesh government for the expansion of the state data center (SDC) and the creation of a disaster recovery (DR) center.

CapitaLand, Singapore, is planning to develop data centers in at least five markets across India. The company is looking to set up data centers in Mumbai, Hyderabad, Chennai, Bengaluru, and Noida. The campus in Airoli, Navi Mumbai, will comprise two buildings; the first building is scheduled to be ready by Q2 2024. The 6.6-acre greenfield site will be developed in phases up to 575,000 sq. ft. and 90 MW when fully built up. The company has also previously signed a Memorandum of Understanding with the Tamil Nadu government to build data centers in and around Chennai. CapitaLand is investing ₹1200 crore in a facility in the Ambattur area, west of Chennai.

On the global front, economic forces have disrupted data center construction. On December 21, 2022, Google announced that it had indefinitely postponed construction of a USD-600 million data center facility in Beck, Minnesotta. And the next week Meta stopped data center expansion in Denmark, and declared a moratorium on future builds.

Although these moves could be signs of a trend developing, these are restricted to Google and Meta and could just be a postponement, a wait-and-see approach as the data centers are not required right now, due to lower demand for the services. By contrast, data centers are in high demand for AWS and Azure. They are oversubscribed and plan to build data centers to fulfil commitments. There is no slowdown in building here.

In 2023, as the world continues to grapple with the industry’s rising energy and water consumption against the backdrop of ongoing climate change, data centers will experience increased regulation and third-party oversight. Mounting pressures to meet consumer demand for energy and water are forcing governments at all levels to take a harder look at data centers and their outsized consumption of those resources. Data centers are estimated to be responsible for up to 3 percent of global electricity consumption today and projected to touch 4 percent by 2030. The average hyperscale facility consumes 20–50 MW annually – theoretically enough electricity to power up to 37,000 homes.

According to a recent Omdia survey, 99 percent of enterprise data center operators say prefabricated, modular data center designs will be a part of their future data center strategy. That is more than a trend; it is the new normal. We can anticipate a continuing shift in the same direction among hyperscalers as they seek the speed and efficiencies standardization delivers.

Other trends expected to gain acceptance are a preferred alternative to diesel generator, possibly hydrogen fuel cells, higher-density racks, and creating thermal profiles that require liquid cooling. Data security will take center stage in 2023. The rollout of 5G network in India is expected to boost the data center market further.

The data center ecosystem is poised continue to thrive over the next decade and demand will continue to rise.

You must be logged in to post a comment Login