Industry

Building blocks of digital revolution in India

India is firmly on the digital transformation journey with 1.16 billion mobile connections, 800 million internet users with average data consumption of 14.73 gigabyte (GB) data per month as of October 2021. Digital infrastructure has become imperative at work, play and learn due to the uncertainty created by the pandemic. Data Centres (DC) are the pillars of this digital growth and have witnessed exponential growth in the last few years.

The convergence of data protection, industry-friendly regulations, government digital initiatives and investments are going to give a structural push to the DC industry. This coupled with the rollout of 5G, ever-rising digital usage, cloud consumption and real time applications triggering edge DC’s would usher high growth over the next few years. India due to its natural resources, strategic location, competitive cost advantage, skilled resources and large user market is ideally suited to be the global data centre hub.

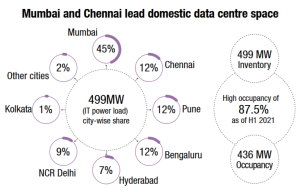

India colocation data centre industry is poised for strong growth. Indian DC industry which stood at 499 MW as of H1 2021 is expected to record another strong year of demand growth with commensurate supply. Cloud, DC and telecom players are adopting various strategies to capture a pie of India’s digital growth. DC operators acquired land parcels at key DC hubs to provide scalable and seamless options for cloud players leading to an appreciation of land prices at preferred DC hubs. Cloud players with self-build plans are in the process of acquiring land parcels at new locations in line with their growth strategies. Several state governments announced policies to provide various incentives for establishing data centres. ‘Infrastructure status’ to the DC industry during the recent Union Budget will make it more cost-competitive with access to long term funds and lower rates.

Coastal cities like Mumbai and Chennai are leading the race, due to inherent advantage of dense wet cable ecosystem offering best global latencies. Mumbai has been the front runner due to its central location on Indian geography with availability of reliable power, cable landing stations, BFSI hub and absence of natural hazards. Chennai is a growing alternate and second best option, with global BFSI presence and strong manufacturing base coupled with lower set-up cost. Strategic location, with lower global latency specially to APAC countries has been a shot in the arm to bring Chennai under limelight. NCR-Delhi has witnessed growth in recent years due to regulatory incentives and the potential for large demand from government organisations setting public community cloud. Pune has also shaped up as a redundancy option for Mumbai due to its proximity and better risk profile being landlocked. On the other hand, Bengaluru has a higher proportion of on-premises data centres operated by global in-house centres of Global players and IT/ITeS players. Kolkata, located in the densely populated eastern region of India is expected to have a new cable landing station in the next few years and will emerge as an important location. The existing and potential drivers of data consumption indicate that the upside to data consumption is going to be exponential. The sector is witnessing action from policymakers, investors, operators, regulators, enterprises and cloud players. At the same time, the industry is adopting sustainability measures to reduce its carbon footprint. Indian data centre industry capacity is expected to double from 499 MW IT load to 1008 MW IT load by 2023.

Strategic location in APAC markets with best latencies. Chennai is integral part of global submarine cable infrastructure serving the giant digital wave.Proximity to APAC data exchange hubs Singapore, HK, Malaysia with some natural advantage of large pool of secure land to be developed as state of the art DC facilities. Global enterprise planning to setup an alternative APAC network nodes or DR for their critical Infra sites are making a beeline for city of Chennai. It also acts as network exchange hub for southern part of India for major India telcos and well connected with other key business hubs of India. The city is already an export hub for the automobiles industry and has various supporting factors to make it a global data hub. The natural limitation and focus on sustainability has led – Singapore and Hong Kong drop in preferential metric for APAC. Chennai is emerging as an superior and fast moving alternative data centres exchange hub in APAC.

Ease of availability of skilled IT & Non IT resources makes Chennai a favourable spot for both DC colocation companies setting up large hyperscaler parks. But, with IT skills lot of global & domestic enterprises prefer to setup their DC/DR and Hyperscalers to setup core and edge providing superior thrust. Chennai offers very competitive cost structure for the DC construction, with ample amount of suitable land pool sets it apart from other APAC cities and domestically as well. Overall the entire value chain ecosystem is thriving the growth of data centres in this coastal city.

Chennai enjoys the advantage of direct access to APAC regions due to cable landings and can provide excellent intra-land connectivity to other landlocked cities at low latency. Chennai has the highest internet speed compared to other cities. The high speed enables growth in digital transactions as well as other data-driven services.

Power guzzlers data centres consume lot of power. Tamil Nadu as a state has a diversified electricity generation portfolio with an installed capacity of 31,894 MW which includes 50 percent of renewable energy. The state has installed solar power capacity of 3,974MW, while installed wind power capacity is 8,507MW and rest from other renewable sources. The ease and options of green energy this state throws also makes it the most sought after location by global cloud and data centre players who are running a race to meet their sustainability goal.

Supportive state policy. The Tamil Nadu state has recently formulated the Data Centre Policy which provides various fiscal and non fiscal incentives for DC players. The policy provides 50-100 percent exemption from stamp duty and eligibility for 100 percent subsidy of electricity tax on power purchased from the state utility. Besides these, preferential public procurements, open access to draw power, uninterrupted redundant power & water supply connections with specific building code for data centres will be in the offerings. To improve the profile on easy of doing business single window clearance system are established with exemption from inspection under wage act. Chennai is expected to reap benefit from the policy incentives and lead to higher growth with more announcement.

Mumbai and Chennai dominate the cable landings in India. Indian international connectivity at 9.8 tbsp is comparatively lower than China and other developed countries. India colocation data centres are currently connected through 20 cable landings with the global network. Mumbai accounts for the highest cable landings as the early telecommunication network was established in the city and presence of banking and financial services. Chennai due to its strategic location advantage in APAC & domestic geography, presence of IT/ITeS industries and dense interconnection capabilities will lead to the growth of new wet cable thus spurting DC growth.

Digital transformation in India is expected a create an economic value of USD 1 trillion by 2025. Data centres along with robust telecom Infrastructure will be the key levers driving this wave, superior thrust by Government of India and pandemic has added large momentum to this growth. All existing & new age sectors like Fintech, OTT, CDN, online education, video collaboration, intuitive maps, autonomous car and online gaming and digital netizen service have changed the way we consume service leading to humongous growth of data and real time computing. Indian DC industry will act as the important cog in the wheel in this whole transformational and digital story of India providing jobs, community development, cyclic economy and bringing global technologies to India. Mumbai and Chennai are expected to be the largest beneficiary of this growth. While Mumbai has the lead, Chennai is due to reap, owing to its strategic location in the APAC, cable landing ecosystem for interconnect, competitive costs and, highly skilled resources to be another feature in the success story of Digital India.

A JLL-Nxtra report

You must be logged in to post a comment Login