Headlines of the Day

Brickwork downgrades Voda Idea’s debentures to ‘B’ over fundraising delay

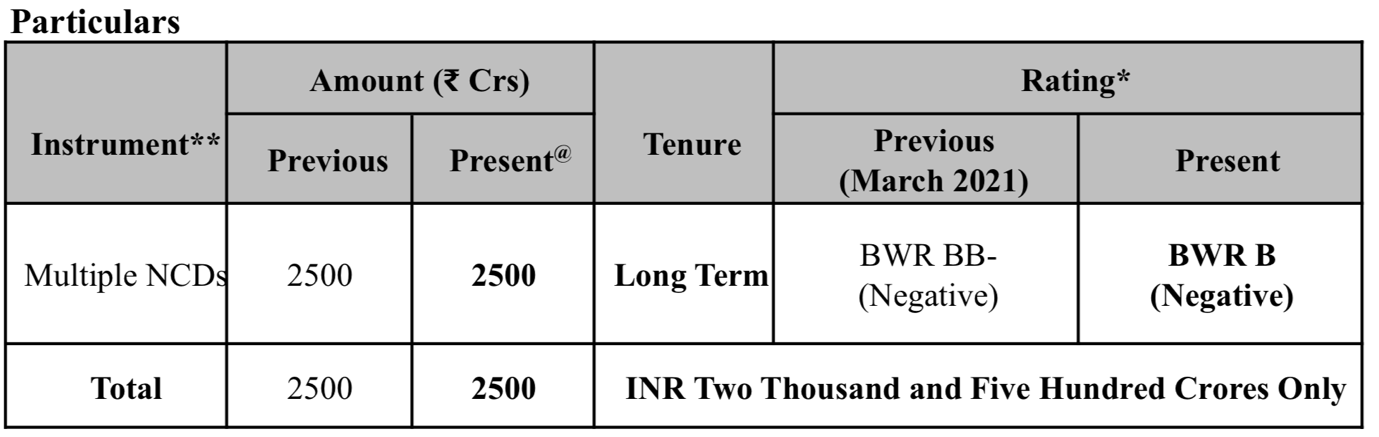

Brickwork Ratings (BWR) has revised the rating for the NCD Issue of Vodafone Idea Ltd on account of a continuous delay in the fund raising exercise impacting the company’s liquidity position and considerable deterioration in the performance of the company in Q1 FY22.

The modification plea filed by the company with the Supreme Court (SC) to allow corrections for computational errors has been rejected by the SC providing no relief to the company.

While VIL has filed a review petition in this regard, the outcome is uncertain. VIL has substantial amounts of debt maturing in FY22 (including the NCDs rated by BWR) and raising adequate funds in a timely manner is imperative for timely servicing this debt.

Additionally, the company’s spectrum payments and first tranche of AGR liabilities will also become due in the coming few months, making the availability of necessary funds all the more critical.

The downgrade reflects a substantial decline in the company’s subscriber base (VIL lost 12.40 million subscribers during Q1 FY22) and ARPU (further reduced to Rs. 104 in Q1 FY22 from Rs. 107 in Q4 FY21). The 4G subscriber base of the company, which was increasing QoQ till Q4 FY21, has also witnessed a decline in Q1 FY22 indicating the increased amount of stress on the company.

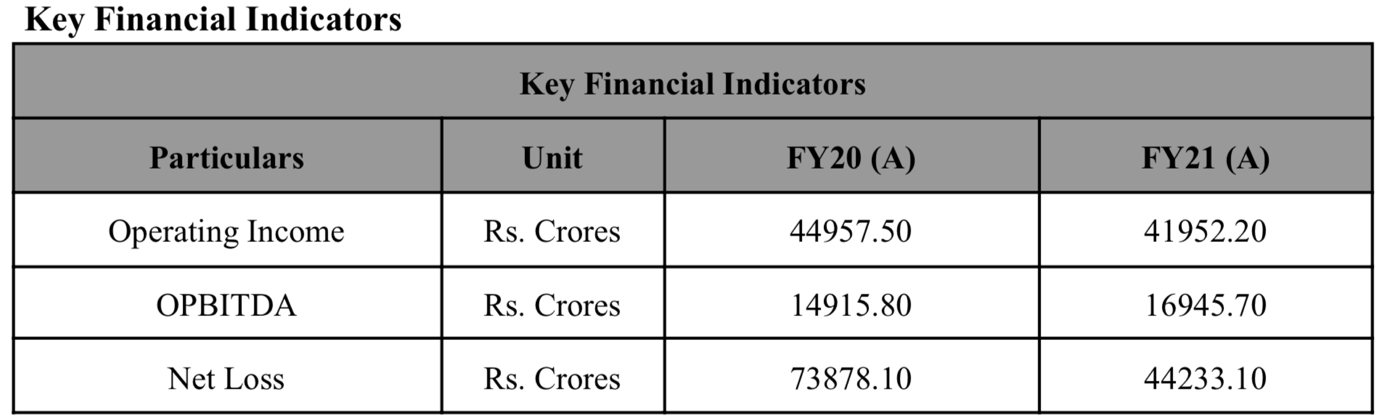

While the EBITDA has shown improvement over the past few quarters on account of realisation of synergy benefits and cost cutting measures adopted by the company, it continues to remain lesser than the financial costs.

VIL has also been urging the Government for setting up of floor tariffs for the sector to improve its viability but no concrete development has taken place in this regard.

The company has been vocal about the need for a tariff hike but has not been able to take any major action in this regard due to the high competitive intensity in the sector. VIL has increased the prices for some of the plans, however, a meaningful impact will only come once the prices are increased across all plans and categories.

VIL, along with other telcos, has been engaging with the Government of India (GoI) for a long time for a relief package to improve the viability of the sector however, no official confirmation/announcement has been made by the government in this regard till now.

VIL has also informed that it is in active discussions with few investors and is hopeful of completing the fund raising exercise before major payments become due. BWR will continue to monitor the developments in this regard as well as the company’s performance on an ongoing basis and will take appropriate rating actions as and when warranted.

-Key rating drivers-

Credit Risks-:

Delay in Fund Raising: VIL had got an approval from its board of directors to raise funds amounting to Rs. 25000 Crs in Sep 2020. The company has been trying to raise these funds for almost a year however, it has not been able to finalise the same. The company’s capex spends have also come down during this period due to its weak liquidity position. VIL has repayments amounting to Rs. 6757 Crs due between Dec 2021 and March 2022. In addition, the first installment of the AGR dues is to be paid by 31 March 2022. With a substantial amount of liabilities being due in the next few months, raising of fresh funds is extremely critical for the company as its operational cash flows are expected to be insufficient to meet these obligations.

Deterioration in the Overall Financial Risk Profile: The company continues to report net losses and reported a loss of Rs. 7319.10 Crs in Q1 FY22. On account of the continued net losses, the networth of the company has been wiped out and turned negative. Debt (including spectrum payments) continues to remain high and current financial flexibility continues to remain strained. The EBITDA, although has shown improvement in the last few quarters, continues to remain lower than the company’s financial cost. The company’s ARPU has come down significantly in the last two quarters from the levels of Rs. 120 in Q2 FY21 and Q3 FY21 to Rs. 107 in Q4 FY21 and Rs. 104 in Q1 FY22. The ARPU has been impacted on account of the discontinuation of IUC from Jan 2021 onwards and the second wave of covid-19 in the country. The fall in the ARPU has also affected the company’s revenue and profitability at the EBITDA level.

Declining Subscriber Base: While customer churn had come down in the last few quarters, it has again increased to 3.5% in Q1 FY22. VIL lost 12.40 million subscribers during Q1 FY22 bringing down the total subscriber base to 255.40 million as on 30 June 2021 from 267.80 million as on 31 March 2021. The company has lost more than 160 million subscribers since the merger and the same has negated whatever benefits the company was expecting to achieve.

Absence of Adequate Support from the Promoters: Both the promoters group i.e. Vodafone Group and Aditya Birla Group have refused to infuse any additional money into the company, as per the announcements made by them in various public forums. The company will receive only the proceeds amounting to Rs. 8400 Crs from Vodafone Group Plc with respect to the AGR dues under the contingent liabilities mechanism as per the implementation agreement. The company has already received partial payment (Rs. 2000 Crs) in this regard in FY21 from Vodafone Group Plc and the rest will come as per the agreed timelines. Beyond the said amount, no additional funding support is expected to be available to the company from the promoters at this point of time.

Credit Strengths-:

Pan-India Operations: VIL has a presence across 22 circles of the country with a subscriber base of 255.40 million through its unified brand ‘Vi’. VIL has a total of 1768.40 MHz of spectrum across different frequency bands out of which 1738.40 MHz spectrum is liberalised and can be used towards deployment of any technology (2G, 3G, 4G or 5G). Further, 1340.40 MHz of spectrum license acquired through auction between 2014 to 2021 has validity until 2034 to 2041. This large spectrum portfolio across 22 circles will allow the company to create enormous broadband capacity.

-Analytical approach and applicable rating criteria-

To arrive at the rating, BWR has considered the consolidated financials of the company owing to equity holding, commonality of management and various business synergies. List of the companies whose financials have been consolidated is given in the annexures.

For more details, please refer to the applicable criteria at the end.

-Rating sensitivities-

Positive: The rating can be improved if the company is able to complete the fund raising activities by Oct 2021 and GoI comes up with relief measures for the sector (such as setting-up of floor tariffs etc.) leading to improved viability and profitability of the company.

Negative: Delay in fund raising beyond Oct 2021 and/or delay in servicing any of the company’s outstanding liabilities will lead to a negative revision in the rating.

-Liquidity position: Stretched-

VIL has debt obligations of more than Rs. 7000 Crs maturing in Q3-Q4 FY22. Additionally, the company’s first tranche of AGR payments will become due in March 2022 and the spectrum payments will also recommence from April 2022.

The company’s cash generation from operations is not sufficient to meet these obligations. VIL’s networth has already turned negative and therefore, the successful fundraising is all the more crucial for the company to improve its liquidity position and ensure timely servicing of its obligations.

-Company Profile-

Vodafone Idea Ltd (VIL) is the combined entity post the merger of Idea Cellular Ltd and Vodafone India Ltd. The merger of both the entities was approved by NCLT on Aug 30, 2018 and is effective from Aug 31, 2018.

VIL is one of the leading mobile service providers in India and operates in all 22 circles in the country. The company is promoted by Vodafone Plc (44.39% stake) and Aditya Birla Group (27.66% stake). VIL reported an overall subscriber base of 267.80 million as on March 31, 2021 with broadband subscribers being 123.60 million.

Note: All financials are adjusted as per BWR standards.

Non-cooperation with previous rating agency if any: NA

CT Bureau

You must be logged in to post a comment Login