Headlines of the Day

Bharti shows superior execution, market share win, ICICI Securities

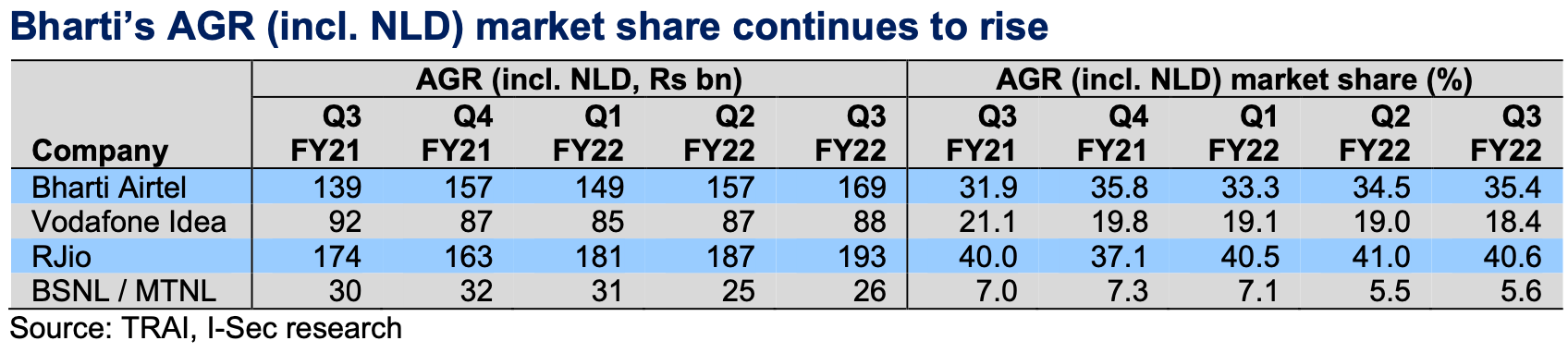

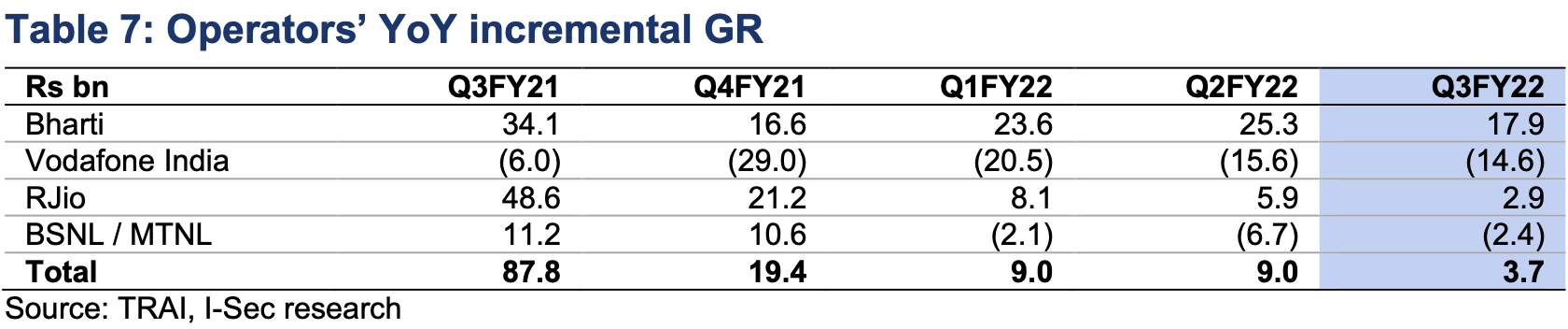

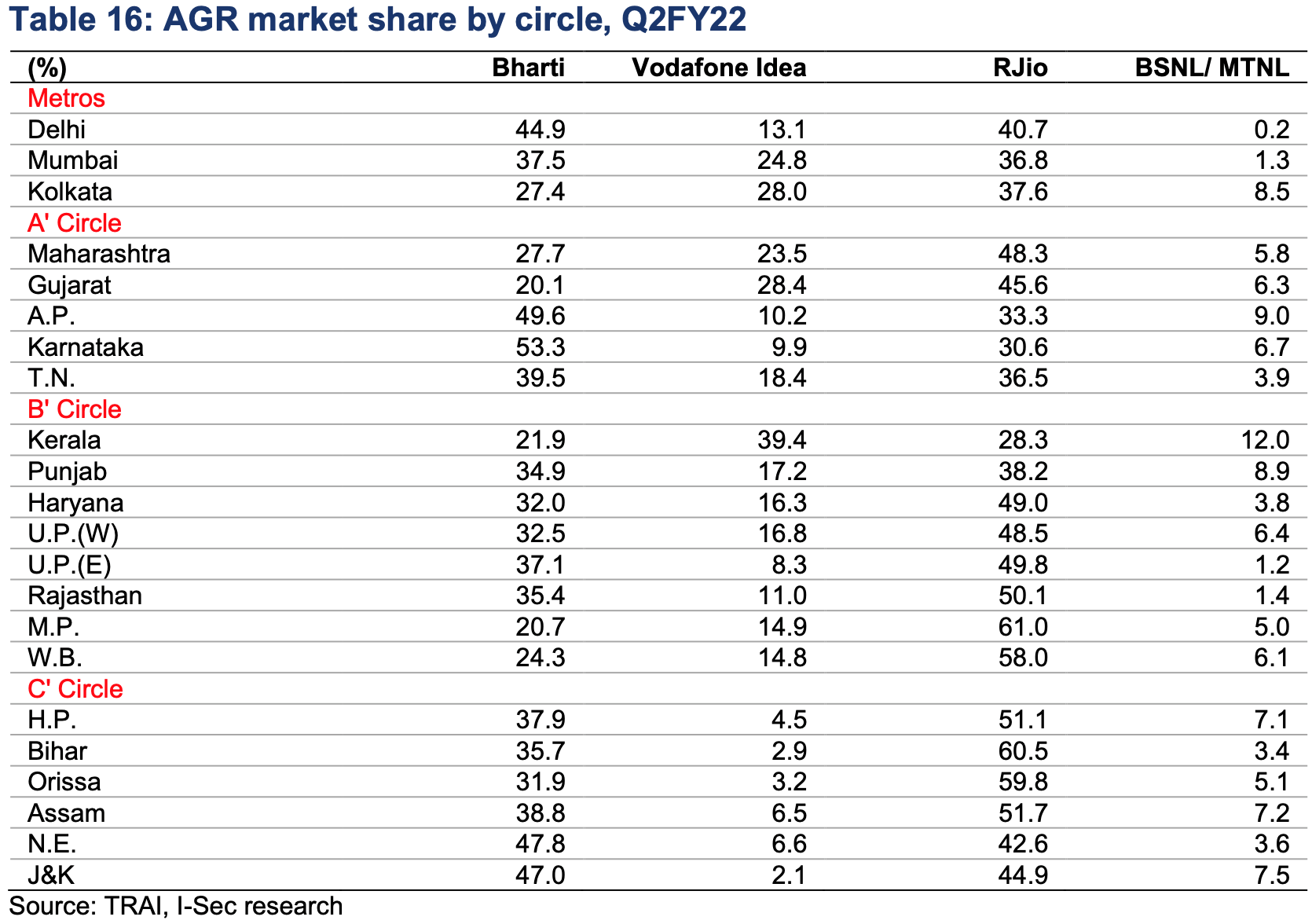

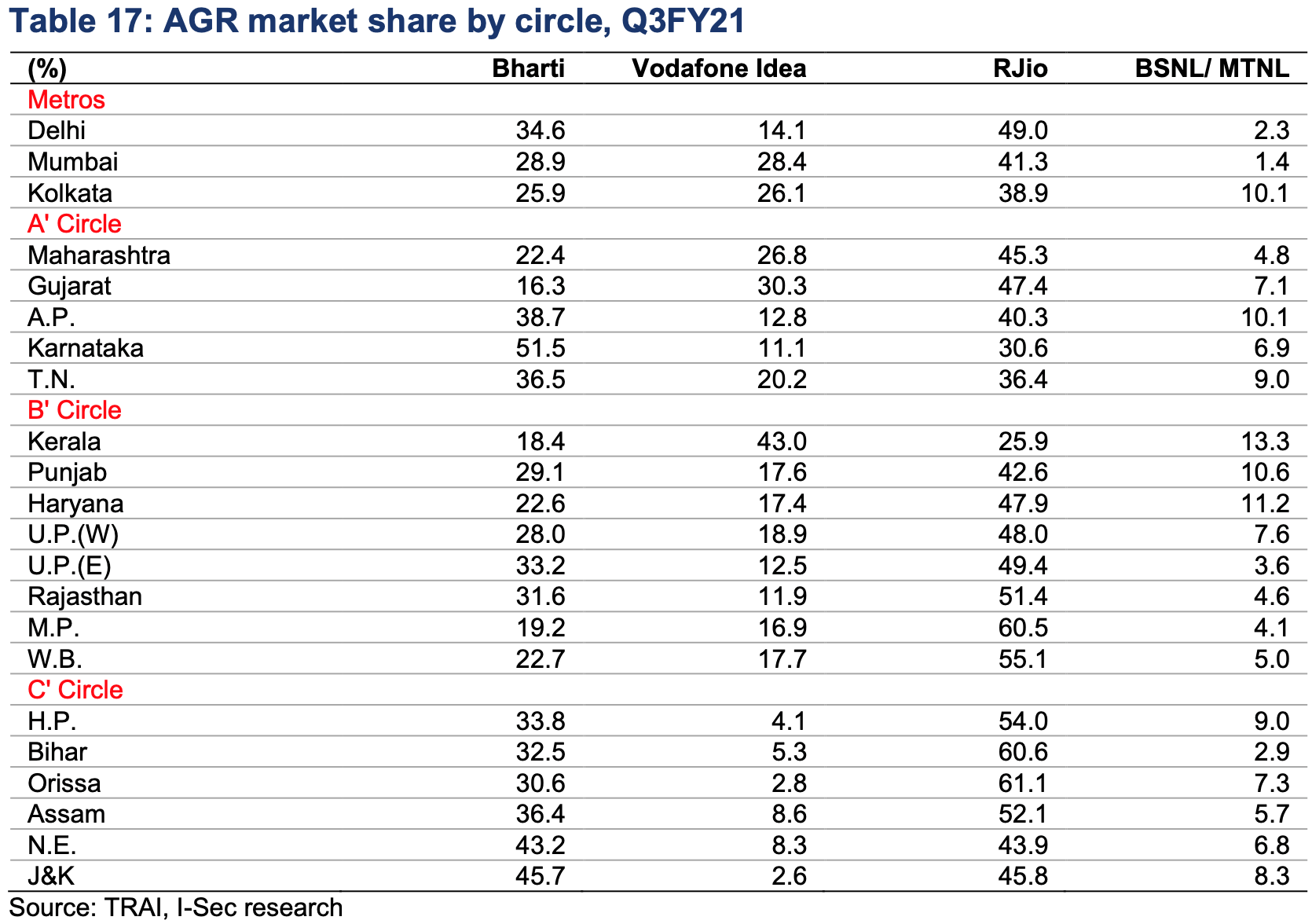

Industry AGR (incl. NLD) grew 9.4% YoY / 4.4% QoQ to Rs476bn on partial benefit of tariff hike. Bharti Airtel has gained AGR (incl. NLD) market share of 90bps QoQ (350bps YoY) which shows its execution remains strong, and has been winning market share. Bharti also had broad-based performance with only four circle growing slower than respective circle’s industry growth. VIL AGR (incl NLD) market share slippage continues with dip of 60bps to 18.4%, but its performance in key 16 circles has seen some improvement. RJio’s AGR (incl NLD) market share has dipped 40bps QoQ to 40.6%, but historically we have seen delayed impact of tariff hike for RJio on larger long validity customers. Key to watch out is market share performance in next two quarters as operators see full benefit of tariff hike.

- Industry AGR (incl. NLD) rose 9.4% YoY / 4.4% QoQ to Rs476bn. BSNL revenue rose 5.8% QoQ despite non-disclosure by MTNL. Top-3 operators’ AGR (incl. NLD) rose 11.1% YoY / 4.3% QoQ benefiting from tariff hikes. The benefit of premiumisation has been limited and SIM consolidation should have off-set some growth. We expect growth to accelerate in next two quarters with full benefit of tariff hike. Industry gross revenue has grown slower at 0.7% YoY (4% QoQ) to Rs529bn on nil IUC revenue.

- Bharti’s AGR (incl. NLD) up 21.5% YoY / 7.2% QoQ to Rs169bn. We have adjusted for non-core revenue in Q1FY22 and Q2FY22 (refer note in Table 1). Bharti’s AGR (incl. NLD) market share rose to 35.4%, up 90bps QoQ / 350bps YoY. Its incremental market share in the past one year has been Rs29.8bn vs Rs19.4bn for RJio, partly due to low base for Bharti. Nonetheless, Bharti has been steadily gaining market share which shows its incremental AGR has been higher than existing share. In circle-wise analysis, sharp QoQ decline in Mumbai, Delhi and AP AGR is from high base which had benefit of spectrum sales. Bharti had slower than underlying circle growth in only four circles of Gujarat, Haryana, UP(w) and Bihar. Thus, Bharti’s performance was broad based in Q3FY22.

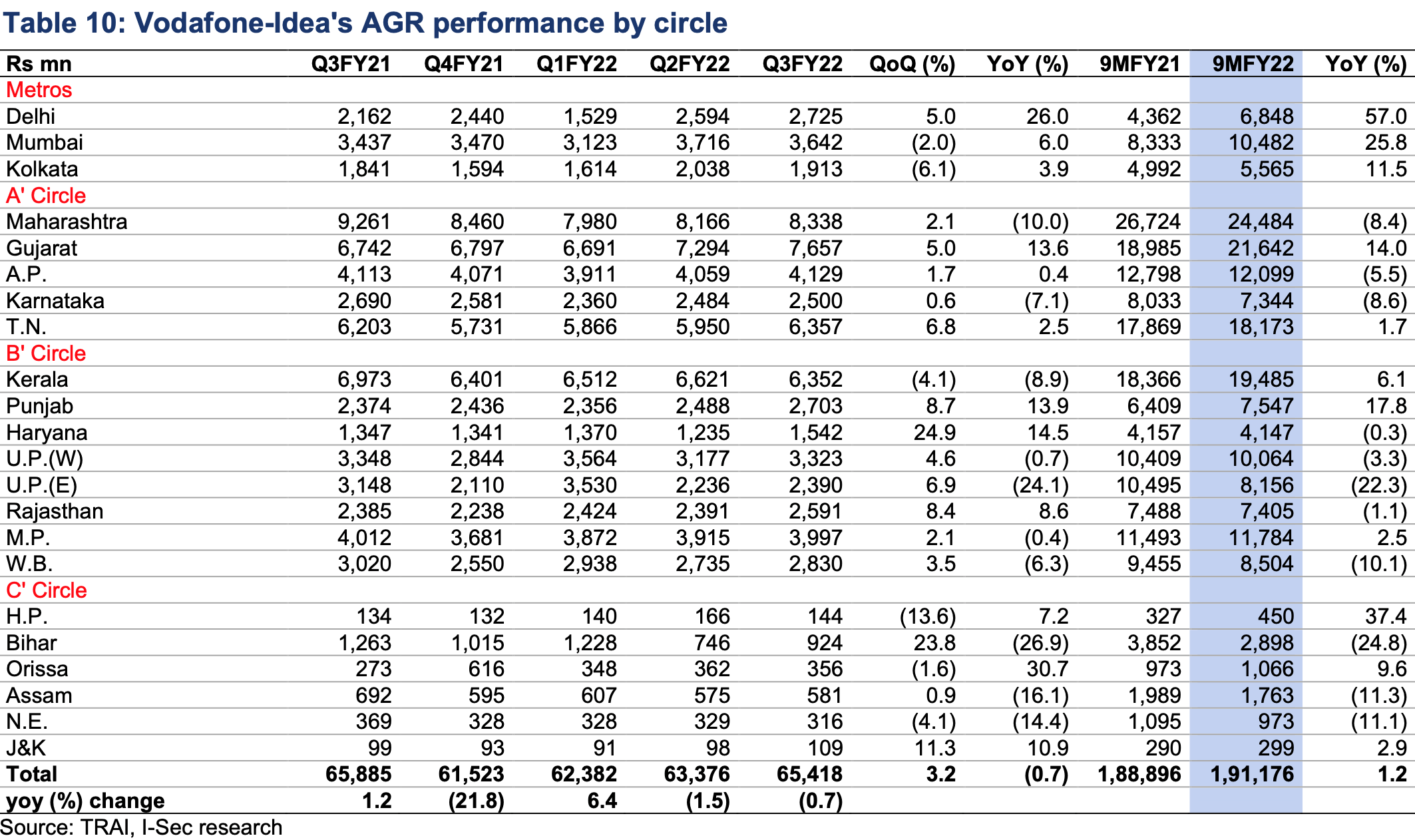

- VIL’s AGR (incl. NLD) market share dipped to 18.4% (down 60bps QoQ). VIL’s AGR (incl. NLD) dipped 4.8% YoY but rose 1% QoQ to Rs88bn. Among its focus 16 circles (excluding C’ circle), VIL has managed to show QoQ growth in 13 circles, and we believe it partly benefited from lower 2G to 4G transition as the transition has led to slippage of subs in the past.

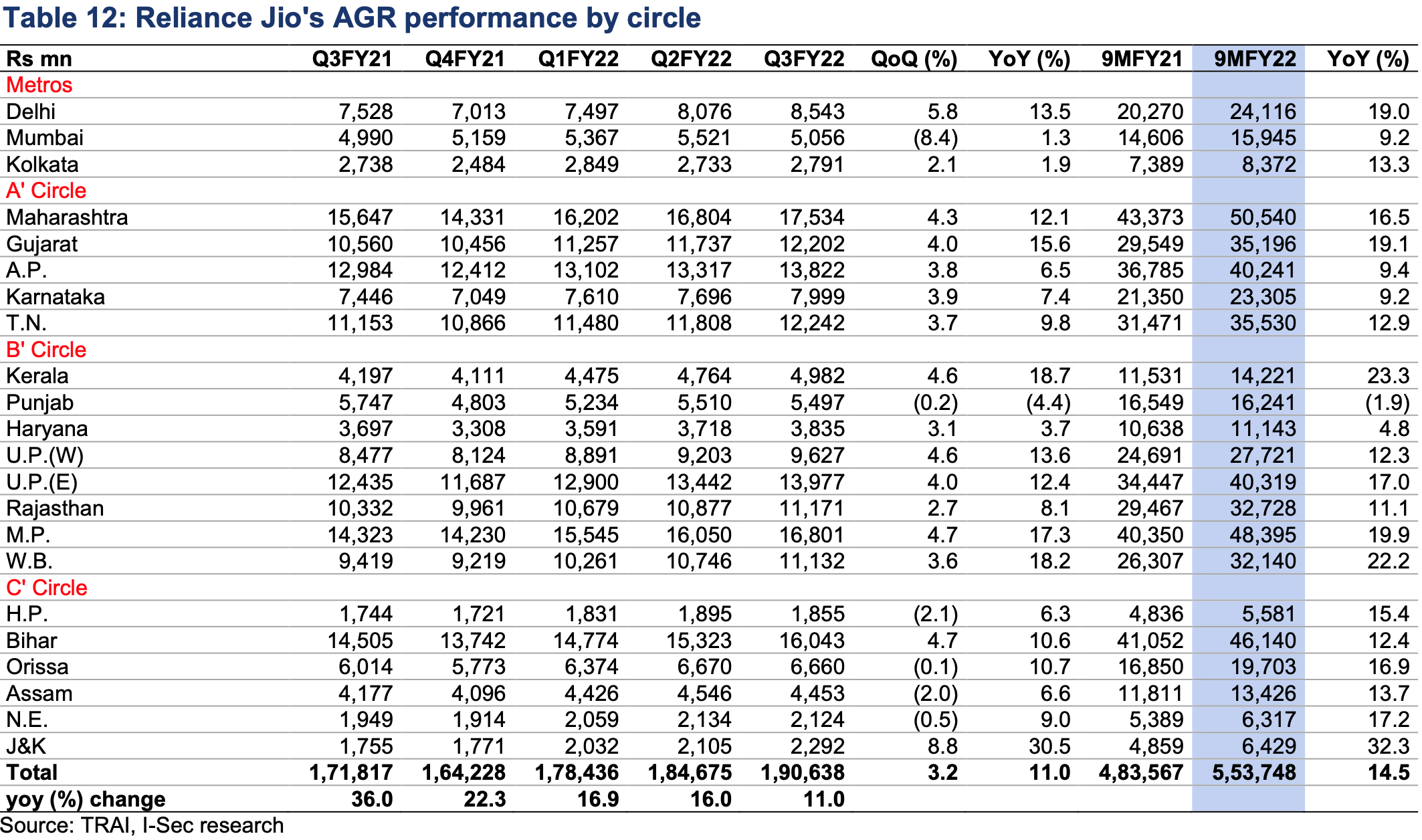

- RJio’s AGR (incl. NLD) rose 11.1% YoY / 3.4% QoQ to Rs193bn. RJio’s AGR (incl. NLD) market share was 40.6%, down 40bps QoQ but up 65bps YoY. RJio growth has been lower in metros at 0.4% QoQ, while A / B / C’ circles AGR rose 4% / 3.6% / 2.3%. Even in previous tariff hike we have seen benefit for RJio coming with a lag probably due to higher portion of long validity customers, and slightly late effective tariff hike implementation. Further, RJio has heavily pushed 365days plan ahead to new tariff which was limited in Q3FY22. Thus, we should see accelerated growth in Q4FY22 itself. RJio has grown slower than underlying circle growth in 14 circles. Looking forward to next quarter when full benefit of tariff hike sinks in.

CT Bureau

You must be logged in to post a comment Login