Headlines of the Day

Bharti Airtel’s tariff hike paves way for industry-wide ARPU recovery

India Ratings and Research (Ind-Ra) opines the hike in prepaid tariff rates announced by Bharti Airtel Limited (BAL: debt rated at ‘IND A1+’) today, will lead to improvement in EBITDA and average revenue per user (ARPU) for BAL. The tariff hike has also provided for industry-wide growth in the ARPU. The move will support improvement in the return on capital employed and reduction in operating expenses for the telecom companies (telcos).

Tariff Hike by BAL – a Move Towards Increase in ARPU and EBITDA: The agency believes a 20%-25% tariff hike by BAL in its prepaid tariff plans, effective 26 November 2021, is likely to meaningfully improve BAL’s ARPU and EBITDA, owing to the fixed-cost nature of the telecom business wherein about 70% growth in revenue is expected to directly flow into the EBITDA due to the tariff hike. Furthermore, the tariff hike announced by BAL today, is one of the sharpest and most broad-based (spanning across various tariff plans) witnessed in the recent past and is applicable to prepaid customers, who comprise about 95% of BAL’s total subscriber base. However, Ind-Ra will monitor the subscriber churn, especially in voice-only customer base, as historically such price hikes have led to sim-consolidation leading to a decline in the overall subscriber base.

BAL Paves Way for Industry-wide ARPU Growth: BAL, which was already reporting higher ARPU of INR153/month/subscriber in September 2021 than Reliance Jio Infocomm Limited’s (RJio: ‘IND AAA’/Stable) (INR144) and Vodafone Idea Limited (VIL; INR109), is the first telco to initiate direct tariff hikes since the last tariff hikes in December 2019. BAL’s revised tariff plans are at 20%-45% premium from the similar prepaid plans of RJio from 0%-20% premium earlier and about 20% premium from similar plans of VIL versus almost similar tariffs earlier. Ind-Ra, therefore, believes that this move by BAL has set the stage for industry-wide growth in ARPU, which would further reduce industry competitiveness and aid return on capital employed for telecos.

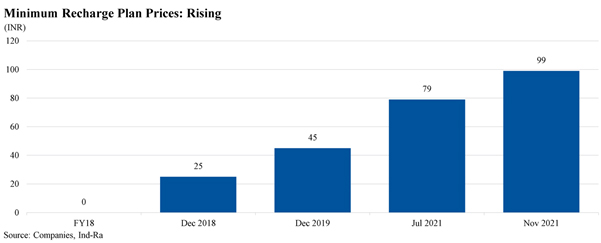

Improving Industry Dynamics: The most notable tariff hike is hike in tariff of voice-only plan to INR99 for 28 days from INR79 (about 25% hike) in line with the historical pricing actions (July 2021: INR79, December 2019: INR45, December 2018: INR25). Ind-Ra believes with the increasing proportion of data subscribers as a proportion of total subscriber base (August 2021: 66.5%, March 2021: 64%, March 2020: 57.7%), this move is also possibly aiming to shift non-data customers to data customers, which can lead to higher ARPU for the industry. Furthermore, lower proportion of voice-only customers can help telcos in re-farming some of the 2G/3G spectrum to 4G data usage, which can reduce operating expenses as well as reduce the requirement of further spectrum.

| Figure 1 Comparison of One of the Tariff Plans of Telcos |

||||

| BAL (new plans) | RJio | VIL | ||

| Cost | INR | 719 | 555 | 599 |

| Validity | days | 84 | 84 | 84 |

| Voice | mins | Unlimited calling | ||

| SMS | 100 SMS/day | 100 SMS/day | 100 SMS/day | |

| Data | GB/day | 1.5 | 1.5 | 1.5 |

| BAL’s premium | % | – | 30 | 20 |

| Source: Companies, Ind-Ra | ||||

Figure 2

CT Bureau

You must be logged in to post a comment Login