Headlines of the Day

Bharti Airtel: Stepping up on growth pedals! ICICI Securities

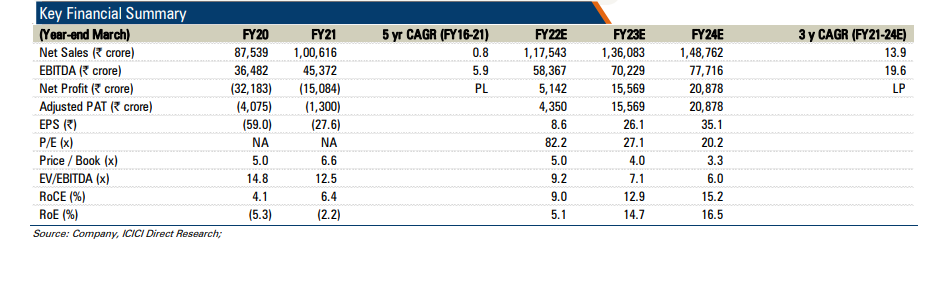

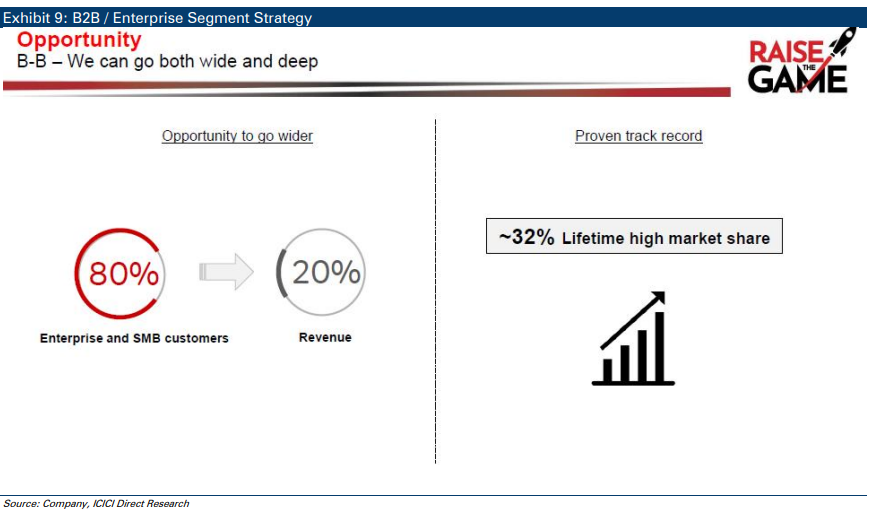

Bharti Airtel (Airtel) is India’s second largest telecom operator with a revenue market share of ~37%. The company has ~32.3 crore wireless customers in India and ~12.6 crore subscribers across operations in 14 African countries. It enjoys industry leading ARPU in the wireless business.

The management reiterated the call for higher ARPU, another tariff hike by CY22 end and a couple more in the next few years (albeit inflationary trend, competitive stance and affordability a lower end could be a key deterrent in the near term, in our view). It outlined that US$3,3 (| 250) ARPU could propel RoCEs to 20% vs. 6% in FY21 at US$2.2 ARPU. It indicated that all heavy lifting in terms of capex is done. It also termed itself 5G ready with trails done, successful testing of use cases, 5G core & infra ready with only implication being on higher radio capex in near term, albeit with no major change in capex in three-year period from current levels.

Identified broadband to be area of focus with home pass expansion from 16 million to 40 million by 2025 through own and LCO model of expansion.

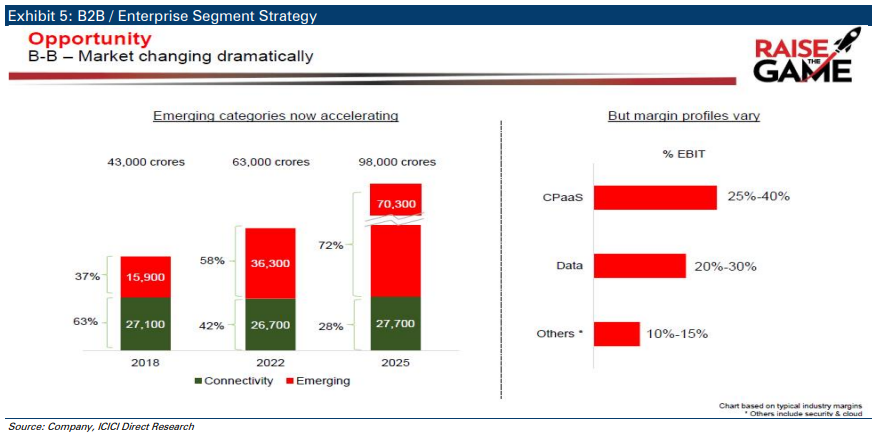

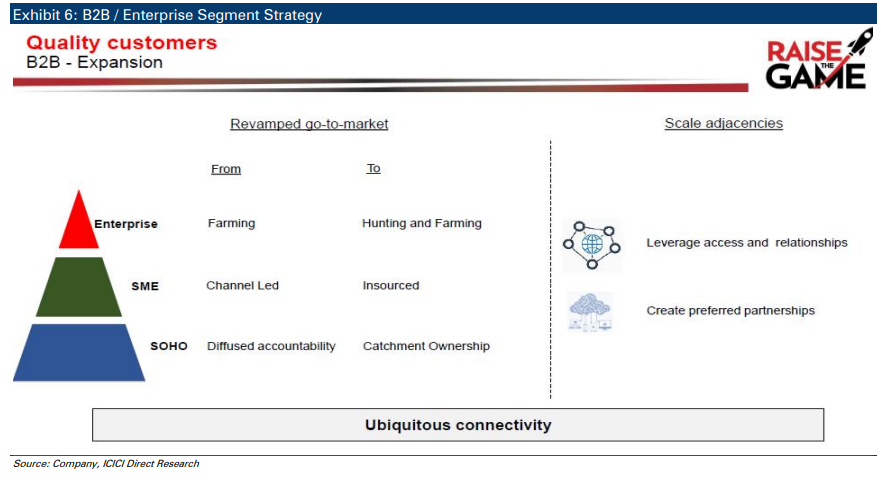

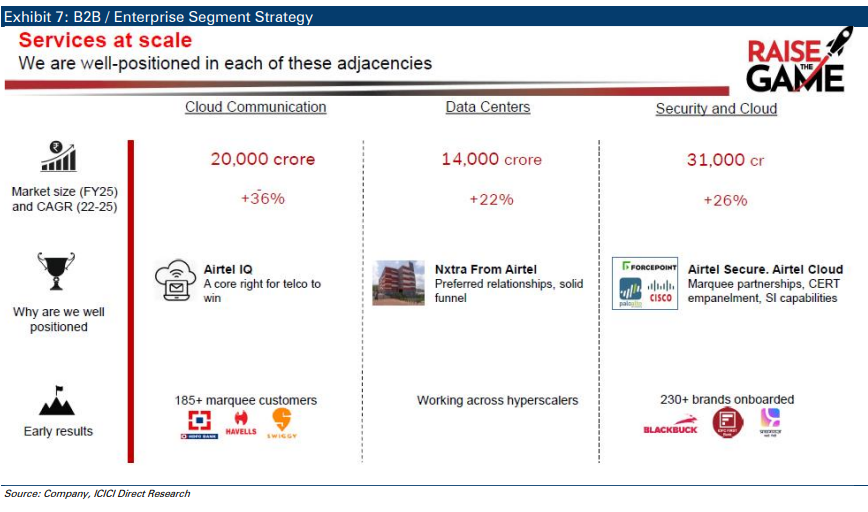

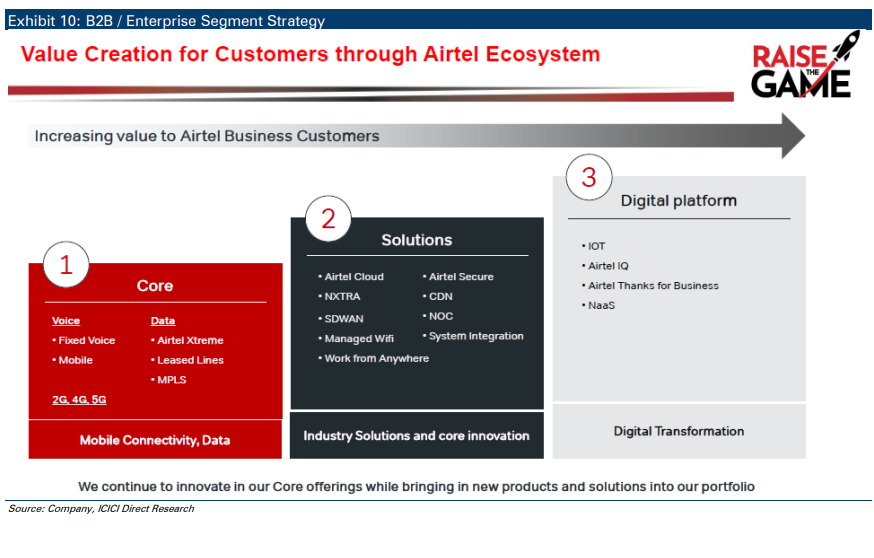

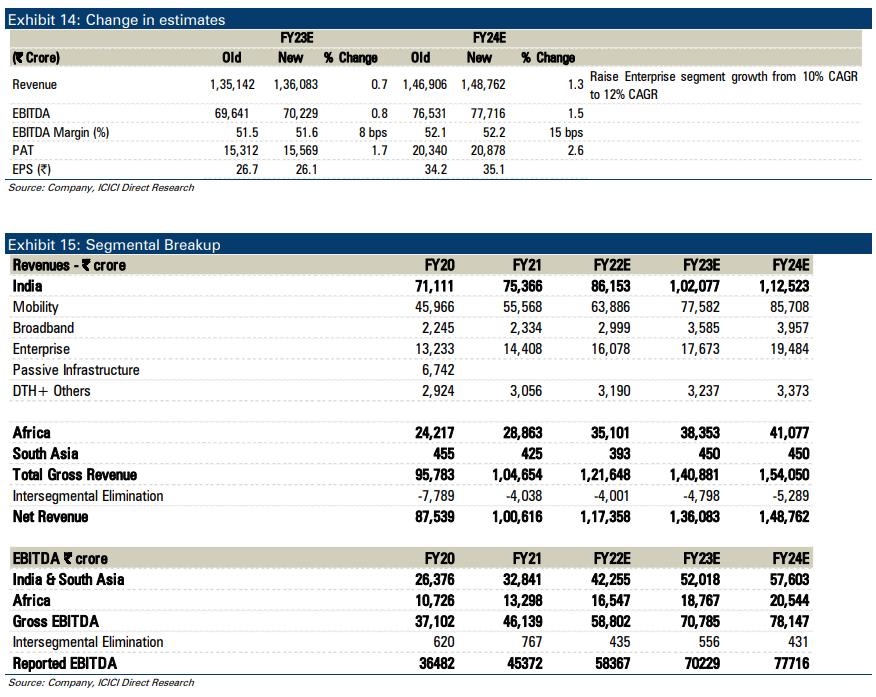

It outlined emerging products under Enterprise such as Data Centre, IoT, Security, Cloud, Communication Platform as Service (CPaaS) and Network as a Service (NaaS) as another key area of growth (current cumulative market size of | 36000 crore and ~25%+ CAGR ahead)

Key triggers for future price performance:

- Tariff hike flow through to boost Airtel’s India ARPU, India EBITDA by 20%, 30%, respectively, from pre-hike levels.

- Relative market share gain from VIL, given its stressed balance sheet and long term potential driven by growth opportunity from 5G & Enterprise.

Key highlights and meet takeaways

- ARPU: The company highlighted that it saw massive gain of ~40% in the last two years in terms of ARPU driven by tariff hike benefits, premiumisation (upgrades, etc) and focus on quality customers. It indicated that it is the market leader for 4G net adds in last one year, with its share at 48% in FY2021. The management reiterated the call for higher ARPU and another tariff hike by CY22 end and couple more in next few years (albeit inflationary trend, competitive stance and affordability a lower end could be a key deterrent in the near term, in our view). It highlighted ARPUs are lower vis-a-vis global countries as well as lower proportion of postpaid, which could catch up, going ahead. It added that it would not shy away from making the first move as it can pull back quickly if competition does not follow

- It outlined that US$3,3 (| 250) ARPU could propel RoCEs to 20% vs. 6% in FY21 at US$2.2 ARPU

- Broadband: Broadband is one segment wherein it has lagged its key peer. It has identified broadband to be an area of focus with home pass expansion from 16 million to 40 million by 2025 through own and LCO model of expansion. Currently, it is present in 850 cities through own (top 100 cities) and LCO partnership model. It expects 15% annualised growth in the segment ahead.

- Enterprise: The company outlined emerging products under Enterprise such as Data Centre (market size – | 14000 crore by 2025), IoT, Security (| 20000 crore market by 2025) Cloud (| 31000 crore market by 2025), Communication Platform as Service (CPaaS) and Network as a Service (NaaS) as the another key area of growth (cumulative market size of | 36000 crore and ~25%+ CAGR ahead)

- Adtech (market size of | 31000 crore by 2025), payments and digital marketplace were the other B2B segment identified as the major areas of growth focus.

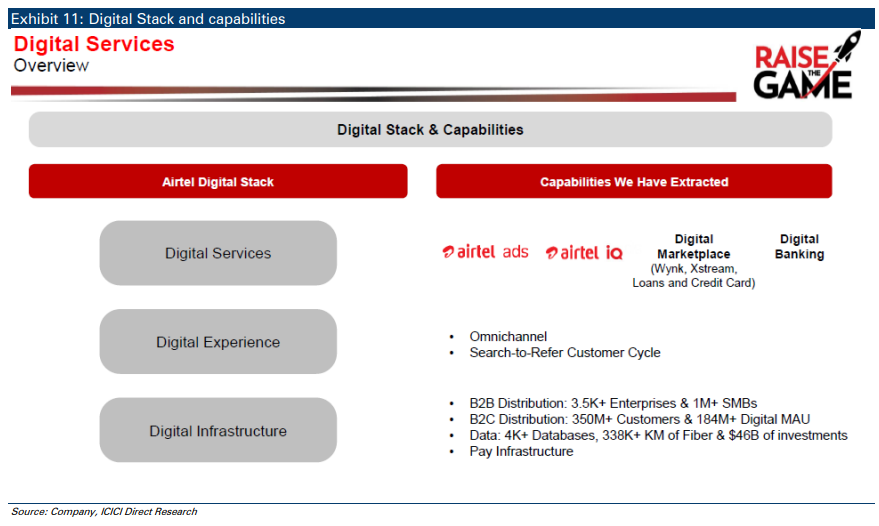

- It highlighted that Digital segment, Airtel IQ (Cloud communication) and Payment Bank have annualised turnover of | 1000 crore and are profitable segments.

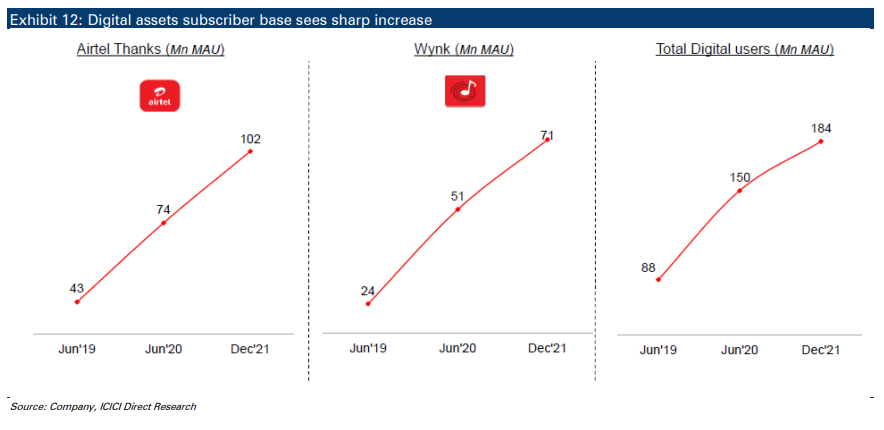

- Digital: The company highlighted that digital revenues are at an annual run rate of | 1000+ crore and it is driven by strong monthly active users of 184 mn across Airtel Thanks, Wynk, Xtreme etc. Overall digital services include Digital marketplace (apps and loans & credit cards), digital banking, ad tech and Airtel IQ (CPaaS). It highlighted that there is massive opportunity in Digital services monetisation ahead.

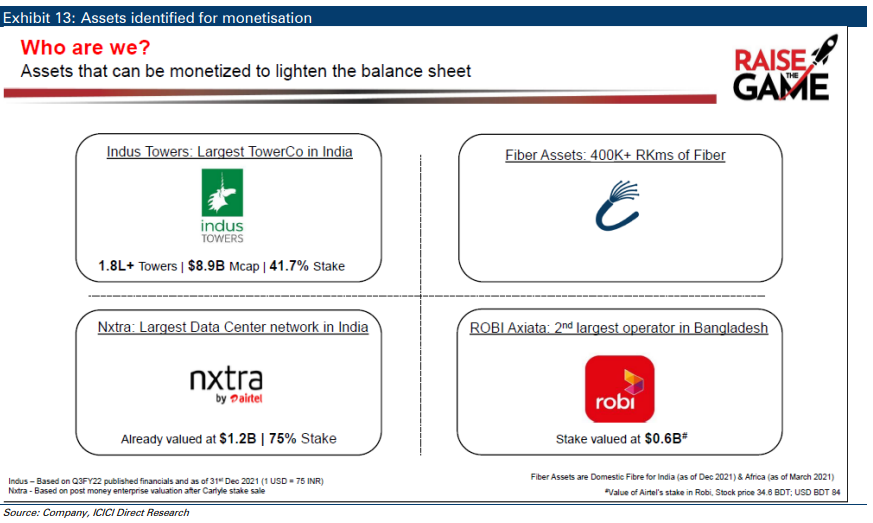

Asset Monetisation: The company said that four assets have been identified for monetisation over the medium to long term, which could deleverage the balance sheet.

- Indus Tower: It reiterated that over the medium to long term it intends to monetise the tower assets. The company also stressed that current incremental stake buy was intended to provide stability in shareholding given its criticality for Airtel. We note that Airtel has announced 4.7% stake buy in Indus Towers at | 187.88 per share on the basis of the agreed price formula in the agreement, aggregating to | 2388. 1 crore from Vodafone PLC. It is on the condition that the proceeds will be used for investment in Vodafone Idea and clearing its dues towards Indus Towers.

- Fibre Assets of ~400k RKM across India and Africa.

- Nxtra – Currently valued at US$1.2 billion and Airtel has 75% stake. The data centre has a network of 10 large and 120 edge data centres located strategically across India and manages critical submarine landing stations. It aims to triple the capacity from 130 MW to 400 MW by 2025 with | 5000 crore capex lined up.

- ROBI Axiata – (JV in Bangladesh valued at US$0.6 billion)

Other Highlights

5G: It indicated that all heavy lifting in terms of capex is done. It also termed itself 5G ready with trails done, successful testing of use cases, 5G core & infra ready. It is working on use cases such as drone based smart inventory, connected ambulances, surveillance, port solutions etc. The company has carried out 5G trials with recorded peak downlink speeds of 3.8 Gbps using a 5G Mifi device in the 26GHz band. However, it reiterated that pricing need to come down for spectrum for economic viability. It also added that with only implication on early 5G launch will be on higher radio capex in near term, albeit with no major change in capex in three-year period from current levels.

Payment Bank: The payment bank has achieved a sharp jump in revenues over the past three years and annualised revenues is over | 1000 crore currently. The revenue mix for the payments bank is 43%/33%/33% from banking clients/digital transaction/B2B segments. It indicated that focus is on optimising operating costs and reducing cost per transaction. It is also the only profitable payment bank. It remains upbeat on Payment Banks growth given the scalability and potential from its own 184 mn digital users for transactional conversion.

CT Bureau

You must be logged in to post a comment Login