Headlines of the Day

Bharti Airtel: Optimistic on profitable growth across segments, ICICI Securities

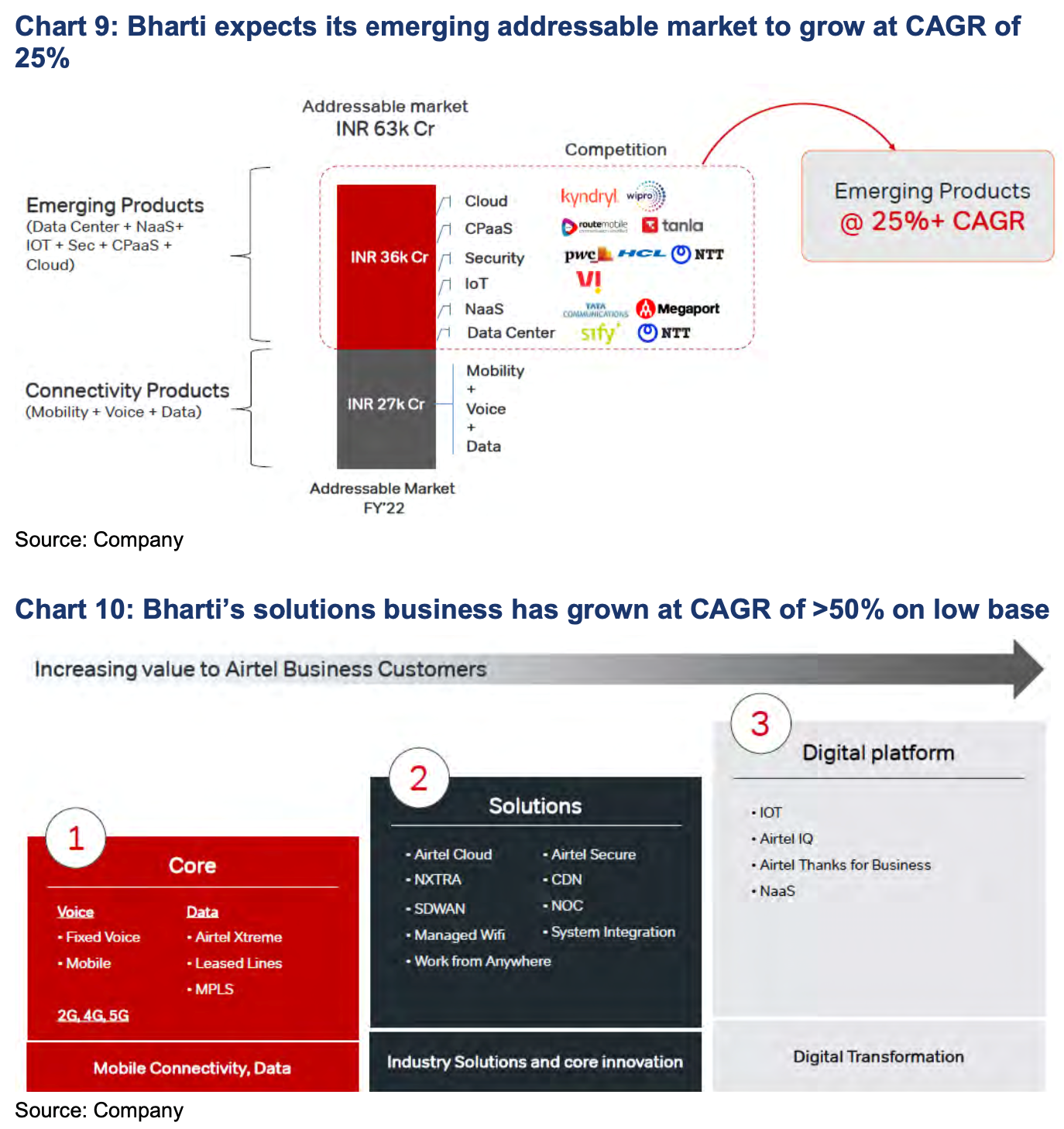

Bharti Airtel (Bharti) organised an analyst day on 25th Mar’22 to outline its growth plans and opportunities. It remains confident of sustaining strong revenue growth in mobile business and anticipates acceleration in non-mobile revenue growth in coming years. Digital business remains core for growth across both consumer and enterprise segments. Consumer business will benefit from rising adoption of digital properties by mobile users, which Bharti can monetise through ads and cross-selling. Also, enterprise segment looks more solid with CPaaS, data centre, IoT, and security & cloud. Bharti plans to achieve stronger growth in the payment bank business. We come convinced that 5G capex will have limited upside risk. Company plans monetisation of its payment bank and data centre businesses in the future, while digital and other businesses may remain under the Bharti Airtel umbrella.

Big picture. Bharti sees revenue growth to be driven by mobile / non-mobile businesses where it expects growth to accelerate / remain steady. Growth in mobile revenue is well captured in consensus: the big takeaway is company is aiming for another 2-3 tariff hikes apart from premiumisation. Non-mobile business is under-appreciated by consensus despite company belief that fixed broadband customer-base will expand significantly over the next three years, emerging categories in enterprise growing faster and digital & payment bank have just arrived. Bharti is staring at large FCF generation and reduction in 5G capex upside risk. To summarise, the company expects revenue growth momentum to continue in mobile, and accelerate in enterprise and digital (including payment bank), while capex to remain stable. Further, it plans to monetise data centre and payment bank businesses in the future, which should help unlock some value.

Strategy – quality and experience. Bharti’s strategy is built on two pillars: quality of customers, and brilliant experience. Company has changed its customer segmentation. Customers were earlier segregated separately for each business. But, now all customers are pooled across consumer businesses and one customer lifecycle management is applicable and omni channel experience on distribution. Bharti has significantly increased its investment in building infrastructure and enhancing digital analytical tools. Customer complaints have declined by 40% in absolute terms despite rise in sub base.

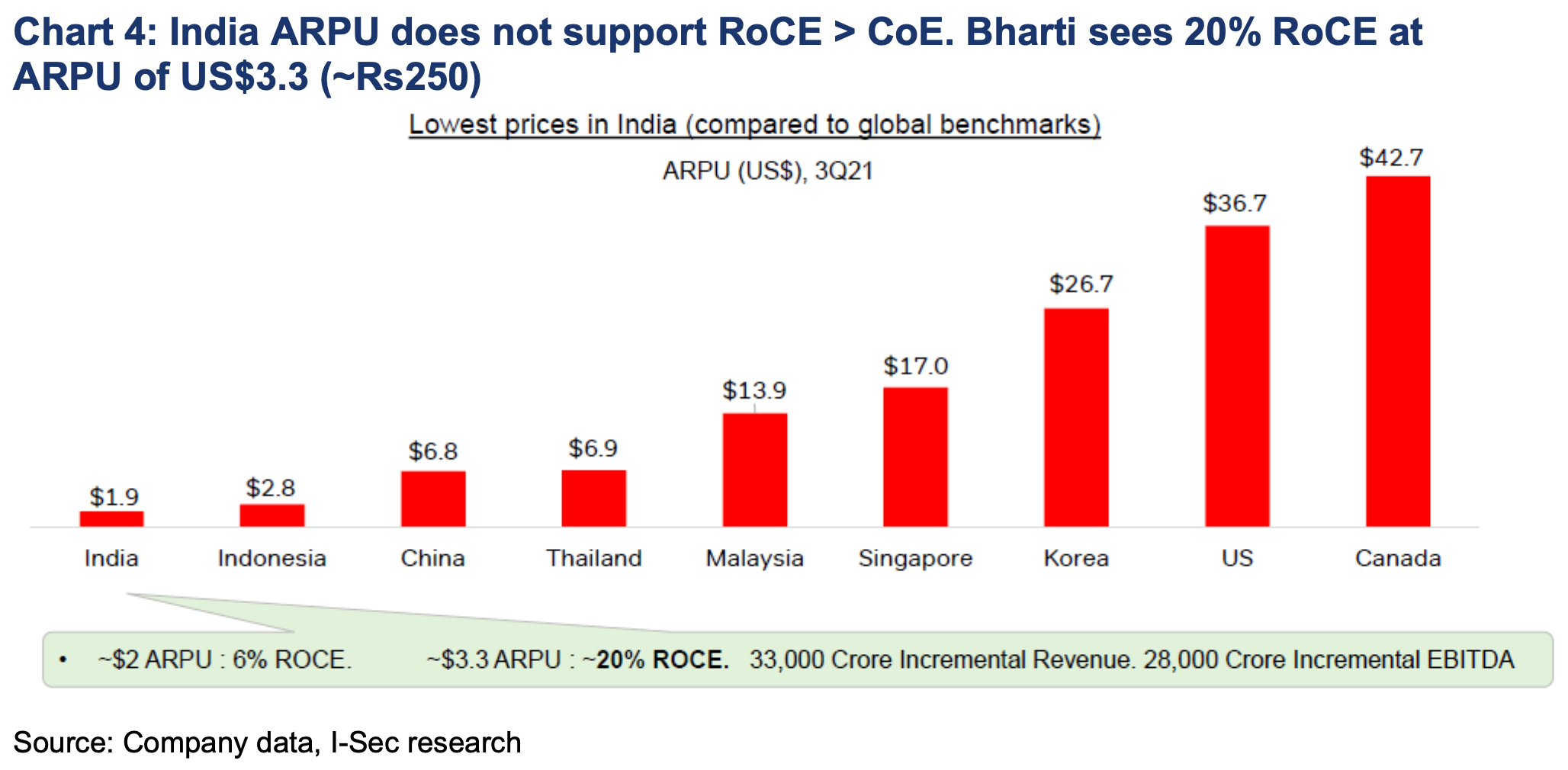

Mobile business – tariff hike + premiumisation. Bharti expects mobile revenue growth to continue on the back of more tariff hikes and four layers for premiumsation. It is looking at 2-3 more tariff hikes in the next 2-3 years as existing tariffs deliver RoCE < CoE. Four layers of premiumisation are: 1) subs upgrading to smartphone, and signing up data services on 4G; 2) adding ARPU from digital engagements such as payment bank, wynk music, xstream, Airtel Thanks and others; 3) upgrades to postpaid and use of converged services such as fibre and entertainment; and 4) Airtel Black. Bharti estimates to generate 20% RoCE at ARPU of US$3.3 (Rs250).

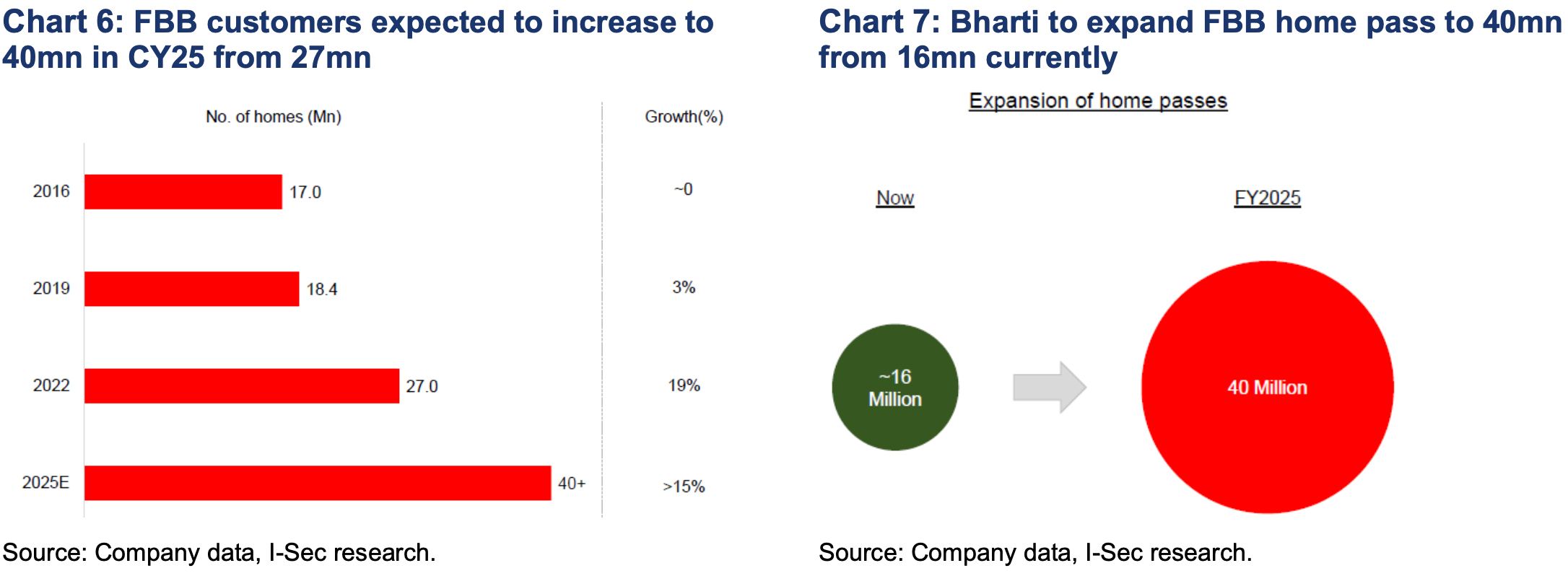

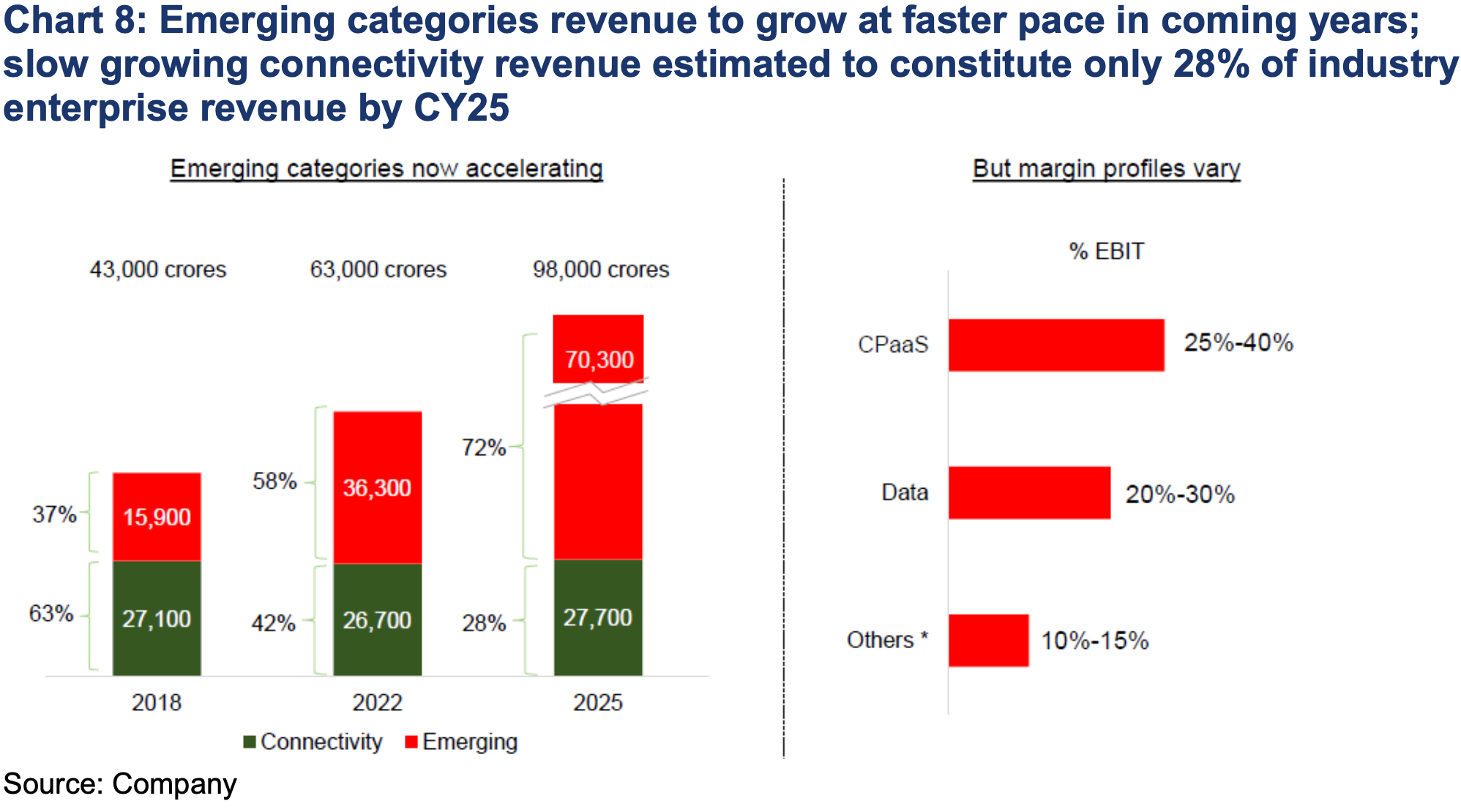

Non-mobile business is under-appreciated by consensus. 1) Bharti expects its fixed broadband subs to grow to 40mn in CY25 from 27mn in CY22 (14% CAGR). Each sub will come with ARPU of Rs650 in a market where Bharti’s subs market share is improving. Bharti is planning to expand its home pass from 16mn currently to 40mn in next three years; 2) within enterprise, emerging categories account for Rs363bn in revenue, and are anticipated to grow at a CAGR of 25% to Rs703bn over FY22E-FY25E. Bharti expects to grab good revenue market share in emerging categories. It has strong propositions for CPaaS, ad-tech, cloud and security, and digital marketplace. It is expanding its data centre footprint 2.5x with investment of Rs50bn; and 3) the payment bank business has profitably scaled up with focus on three segments, viz. digital, unbanked rural, and institutions.

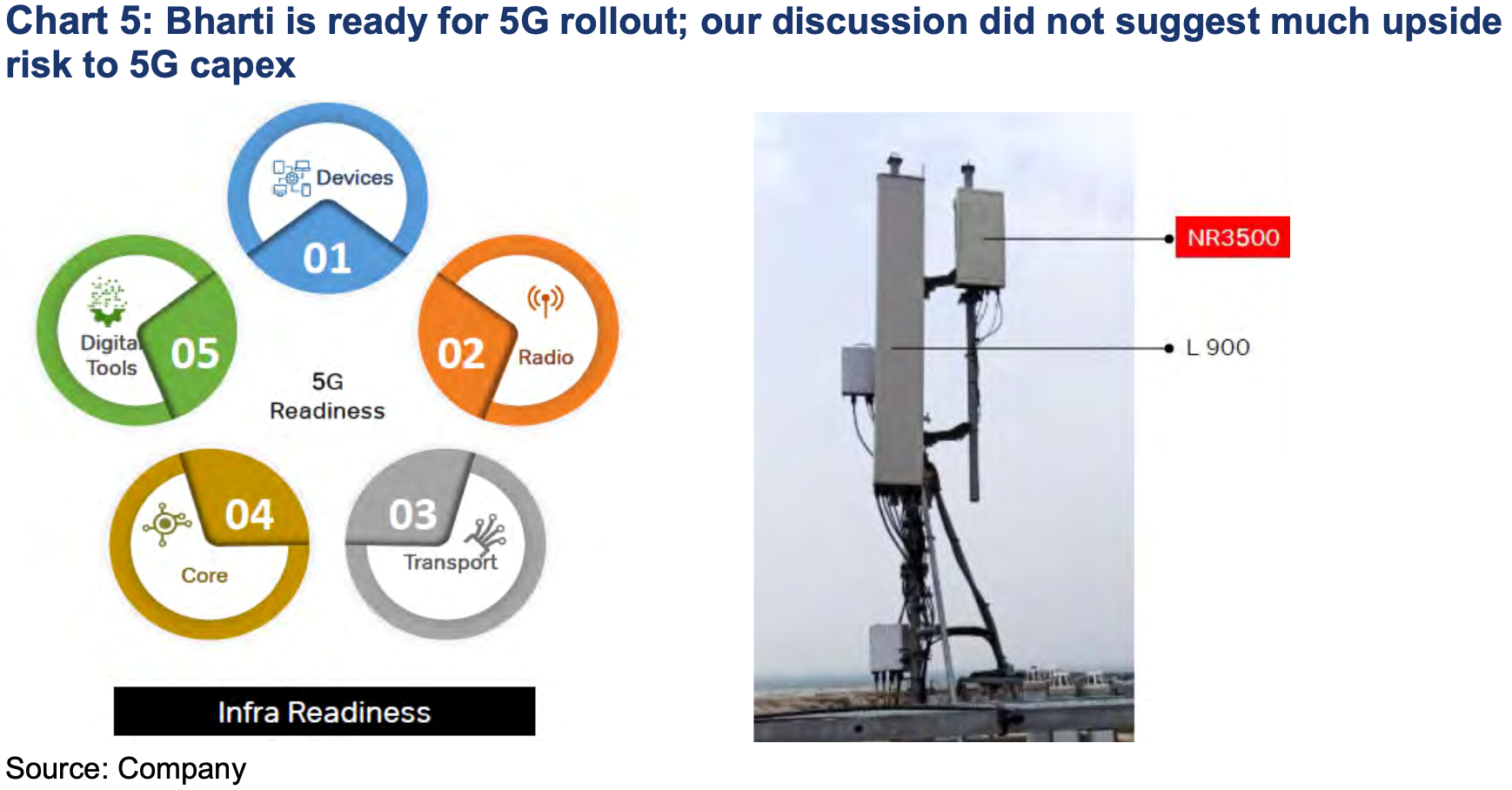

5G capex upside risk reducing. Our interaction with Bharti CTO suggests that there is not much upside risk from 5G capex. Company plans NSA 5G with likely 1800MHz (uplink) and 3500MHz (downlink) as base bands. The coverage on this configuration should help achieve existing L1800 (4G) coverage. Thus, we don’t see requirement of more tower rollouts; NSA 5G network rollout will largely be loading on existing towers. In 4G, the company had spectrum in four bands and three sectors implying 12 radios on each tower. In 5G, it would be single band and three sectors; thus there would be only three 5G additional radios per tower.

India mobile business – Enough levers for ARPU growth through more tariff hikes and premiumisation

- Bharti has four layers of premiumisation: 1) subs upgrading to smartphone, and signing up data services on 4G; 2) adding ARPU from digital engagements such as payment bank, wynk music, xstream, Airtel Thanks and others; 3) upgrades to postpaid, and use of converged services such as fibre and entertainment; and 4) Airtel Black.

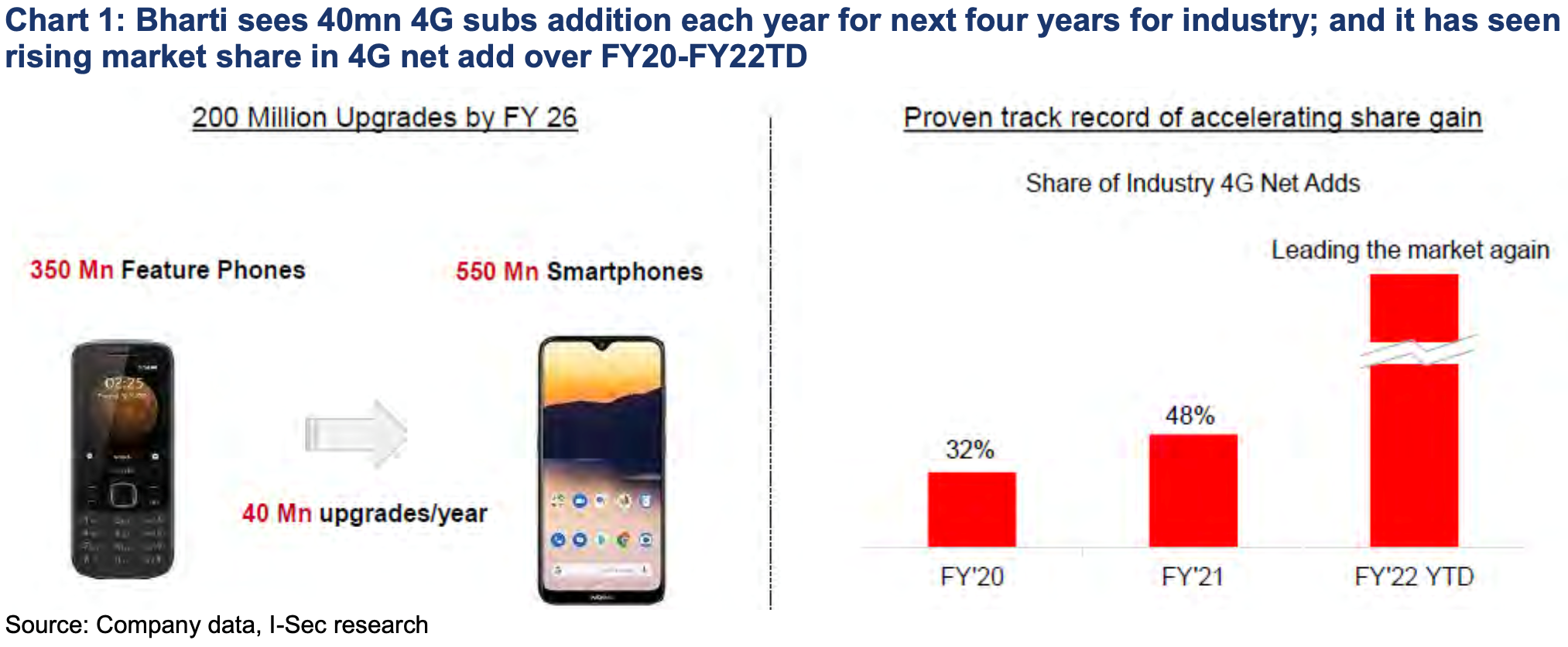

- India has 550mn smartphone (unique) subscribers and 350mn featurephones. Bharti estimates 200mn featurephone subs upgrading to smartphone over next four years (40mn upgrades/year). These subs would sign for 4G services, which should drive ARPU growth.

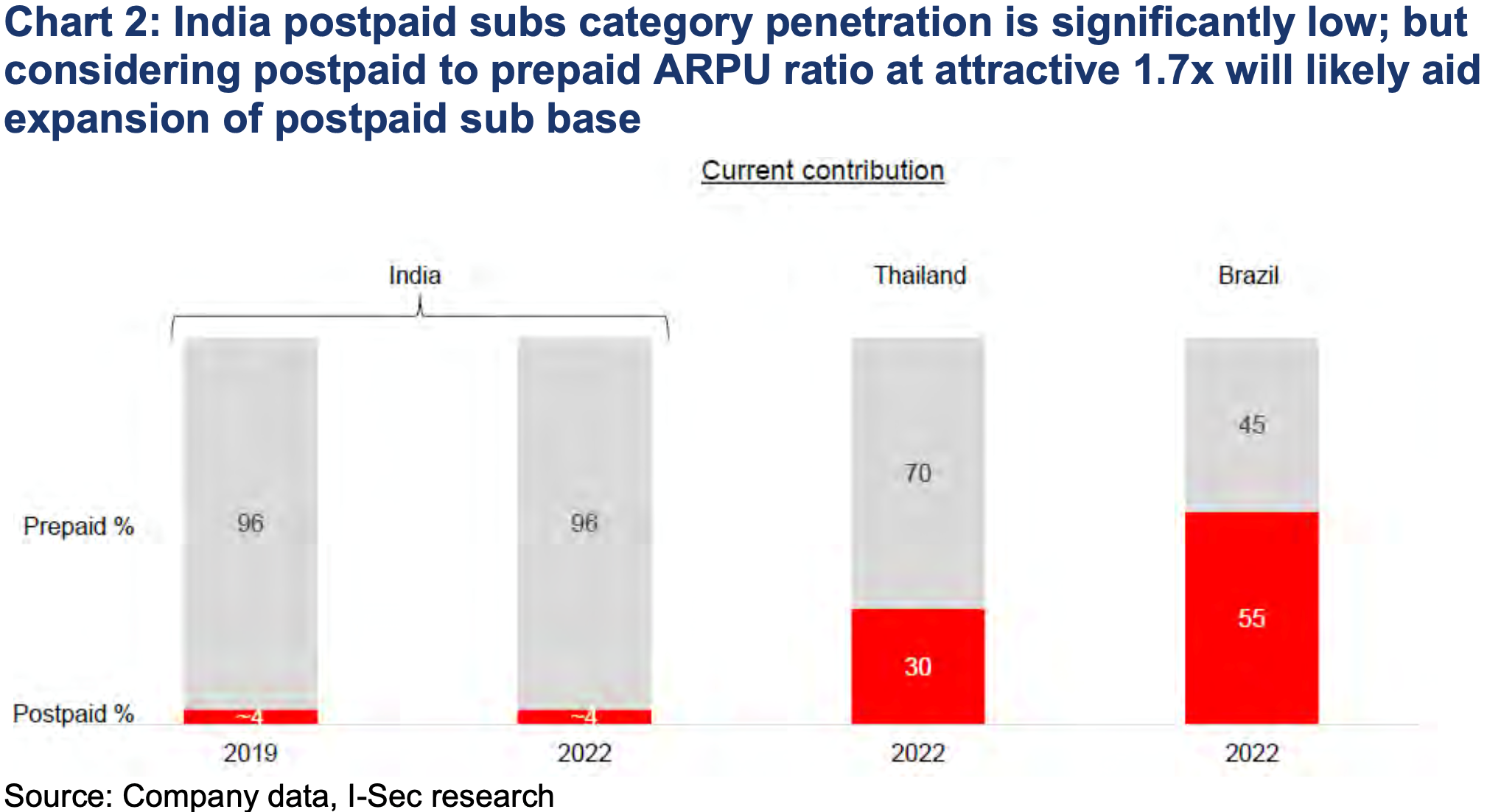

- India postpaid subscriber contribution has remained at 4% since FY19. However, Bharti has reported strong net adds in past few quarters. It sees postpaid subs addition to grow well henceforth; pre-RJio launch, postpaid sub-base was growing at 8% p.a.

- The ARPU in postpaid has traditionally been at 2x prepaid, which increased to 3x at peak of competitive intensity post RJio launch. It is now at 1.7x, which Bharti believes should aid subs growth. In past three years, Bharti has not significantly increased postpaid tariffs while prepaid tariffs have gone up sharply. However, going forward, Bharti expects to keep its ARPU ratio at 1.7x. This implies postpaid tariff may see similar price increase as prepaid in future.

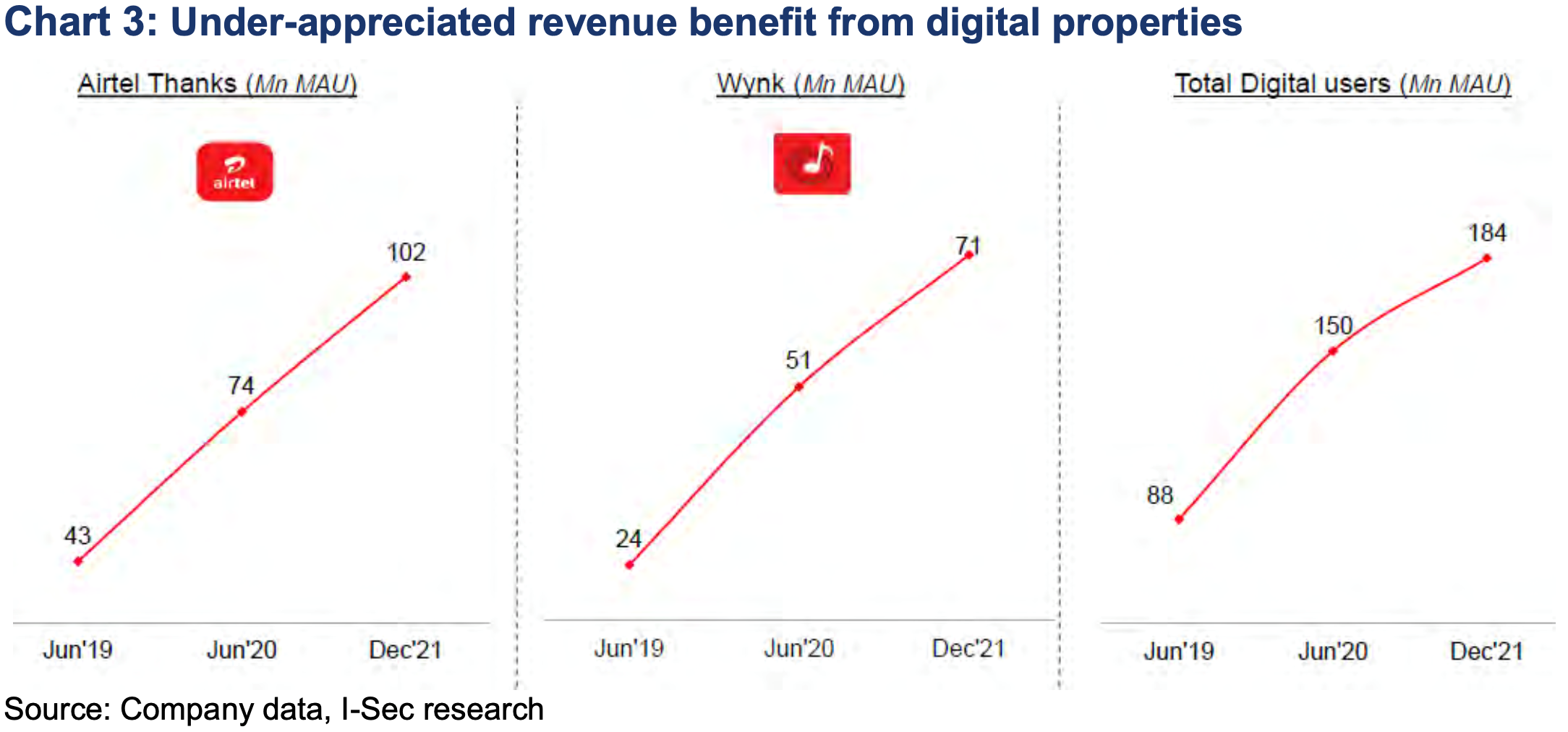

- Bharti’s digital services has seen significant penetration among its 4G sub-base. It has a total of 184mn digital users (MAU) (vs 4G subs at >190mn). Thus it has been able to see at least one digital property being used by each of its 4G subs on MAU basis. This is a commendable achievement. Increase in digital sub base would help Bharti to more effectively monetise these subs through Airtel Ads and cross-selling other entertainment products.

- Bharti anticipates another 2-3 tariff hikes in mobile services over next 2-3 years. It sees India ARPUs presently not supportive of respectable RoCE. It has reiterated reaching its ARPU target of Rs200 soon, and in the longer run sees an ARPU of Rs300.

5G readiness – company remain confident on 5G rollout

- Bharti is ready with each of the three infrastructures required for 5G rollout: front haul, back haul, and core. It expects NSA (non-standalone) 5G network rollout adopted, which will utilise 4G infrastructure for uplink and core.

- Company anticipate NSA 5G helping achieve 5G coverage with limited investments. Further, 5G will require fewer equipment on towers (vs 4G), which should help lower overall network capex.

- Example of coverage: A combination of 4G, say on 1800MHz (uplink) and 3500MHz (downlink), should give 5G experience with similar coverage as 4G on 1800MHz. It does not require any additional tower rollout.

- Example of capex: 4G was rolled out on multiple spectrum bands 900, 1800, 2100 and 2300MHz spectrum which required independent equipment for each spectrum band. Thus total equipment mounted on towers was 4 spectrum bands multiplied by 3 sectors equalling 12 radios. These equipment radiate 50-75MHz of spectrum. In 5G, a single band of 60-100MHz will used, thus total equipment per tower is 1 band multiplied by 3 sectors equalling 3 radios.

- In future, Bharti can use its existing 4G radio to refarm spectrum to 5G with minimal capex.

- Bharti said, on like to like basis, speeds on 5G are 15% higher than 4G; however, higher spectrum quantity makes 5G generate large data throughput.

- 5G equipment weight has significantly reduced to 15kg from earlier 27kg. This is important for tower reinforcement capex (which may increase only modestly now) for tower companies. The loading pricing (charged by tower company) may not now see significant rise.

- Bharti will also deploy lean towers to fill coverage blind areas.

- For back haul, the company doesn’t see any bottleneck to launch 5G. It has sharply increased its tower with fibre back haul; traditional microwave has also seen good technological advancement.

- Bharti’s core is already 5G-ready.

Home services – Industry fixed broadband customer base at 40mn by CY25E

- Fixed broadband sub base was at 18mn for many years, but has started growing since FY21 and reached 27mn by end-CY22. Bharti anticipates this sub base to grow to 40mn by CY25.

- Bharti opined that fixed broadband market would comprise two large players. These services would come with incremental revenue of Rs650 per sub per month.

- Bharti plans to expand its LCO partnership model aggressively to improve GTM. Its digital onboarding of LCOs take less than 10 minutes with real-time tracking of inventory and zero error payout for partners.

- Bharti plans to expand its FTTH home pass to 40mn in next three years from 16mn currently.

- Enterprise segment remains very exciting with rising opportunity, which would help drive faster revenue growth in non-mobile revenue for Bharti.

- Bharti expects connectivity business to grow marginally from Rs267bn in CY22 to Rs277bn in CY25 and emerging categories to grow to Rs703bn in CY25 from Rs363bn in CY22. The contribution of emerging categories will rise to 72% (vs 58% in CY22) of India industry enterprise revenue.

- EBIT margin for many products are anticipated to be lower than data business, but we believe RoCE would be higher due to lower capex requirement.

- Bharti’s addressable market was Rs630bn with emerging markets at Rs360bn. The key products in emerging categories are CPaaS, data centre, security, cloud, IoT and NaaS.

- Bharti remains confident of grabbing respectable market share in emerging categories as well.

- Company’s enterprise revenue has grown 11% YoY in 9MFY22 – while excluding voice it has grown at 18%. Its solutions business is growing at >50% CAGR in past few years on low base.

Digital services – Bharti is gung-go on digital opportunity

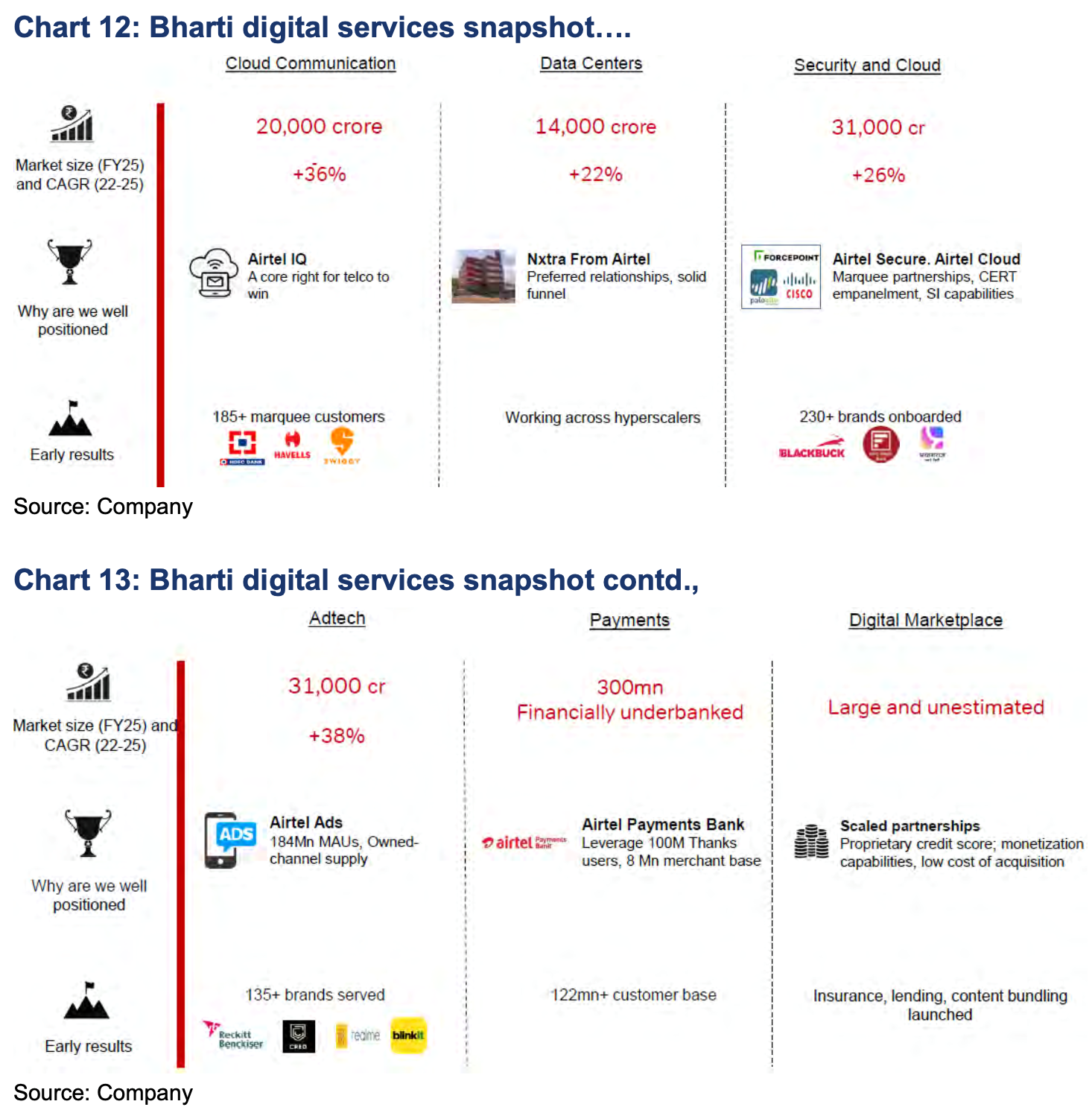

- Bharti has six key digital products and services: 1) CPaaS under brand Airtel iQ; 2) data centre housed in subsidiary nxtra; 3) security & cloud, which are offered in collaboration with global partners; 4) ad tech for digital marketing within Airtel digital properties; 5) payment bank; and 6) digital marketplace.

- CPaaS: Bharti remains excited about the opportunity in CPaaS, and believes telcos have good right to win in the segment. It has already onboarded >185 enterprises including Swiggy and HDFC Bank. CPaaS is expected to grow at a CAGR 36% to Rs200bn over FY22E-FY25E.

- Security and Cloud: This is a partnership-based service where Bharti has marquee partnership with Cisco, Polo Alto, etc. It has onboarded >230 enterprises. The market is expected to grow at a CAGR of 26% over FY22E-FY25E and likely have an addressable market of Rs310bn by FY25E.

- Data centre: Bharti has data centre capacity of 130MW and is in the process of expanding to 400MW with investment of Rs50bn. It would plan to build seven large data centres in various metros / capitals in India. Bharti works with hyper scaler for data centres. India data centre revenue is estimated to grow at a CAGR of 22% to Rs140bn over FY22E-FY25E.

- Ad tech: Bharti has active sub base of 184mn MAU on its digital properties, and has built ad tech to supply its own inventory. It has >135 brands already advertising.

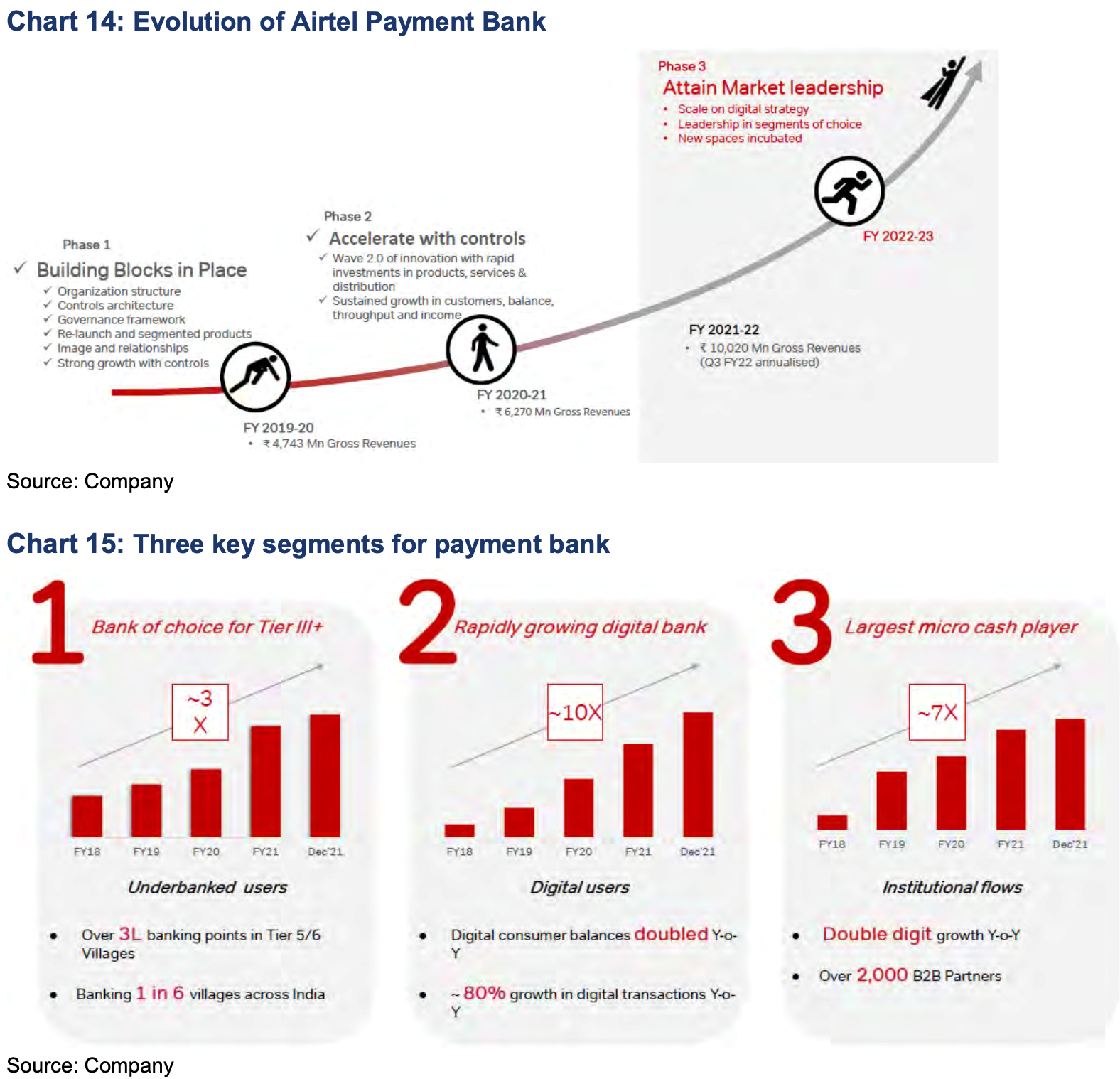

Payment bank – High possibility of listing

- Bharti is very optimistic on the payment bank opportunity. It is the only payment bank that has profitably scaled up, and is now ready to expand aggressively.

- It serves three broad customer groups: 1) unbanked rural people in tier-3 and smaller towns and villages; 2) digital users – growing digital transactions; and 3) micro cash players where it helps business partners digitise small-ticket cash transactions.

- Airtel Payment Bank revenue is split in the ratio of 40%, 30% and 30% for institutional space, unbanked banking and digital banking. It has seen the share of transaction-based revenue dropping with interest income (Rs10bn deposit) and fee-based revenue growing faster.

- Airtel Payment Bank is uniquely positioned as the only profitable multi-segment fintech company that has built a scalable business model.

Bharti believes its payment bank is among the businesses it would look to monetise / list separately in future.

CT Bureau

You must be logged in to post a comment Login