Headlines of the Day

Bharti Airtel Enterprise business – Under-appreciated, ICICI Securities

In continuation to our deep diving into enterprise business (link), we are evaluating Bharti Airtel’s (Bharti) enterprise business housed under Airtel Business.

Airtel Business is under-appreciated considering it is the most profitable business for Bharti with ROIC of 35-40% in the past three years and EBITDA CAGR of 13% over FY17-21, which underpins our optimism for the business. Airtel Business will benefit from the shift to new sales model for tapping SME opportunity which is adopting digital solutions like never before. Considering SME buy-bundled services unlike customised solutions by large enterprises, Airtel benefits from existing relationships and launch of new digital platforms. Nxtra (data centre and cloud offerings) has grown >3x over FY18-20, and is likely to grow over >3x in next 3-4 years. Digital platforms like Airtel IQ, Airtel Secure and Airtel IoT open doors in new-age digital solutions which are growing fast >30-50%. We see a significant upside risk to our growth estimate of 6.5% CAGR for enterprise revenue (FY21-23E). Reiterate BUY on Bharti.

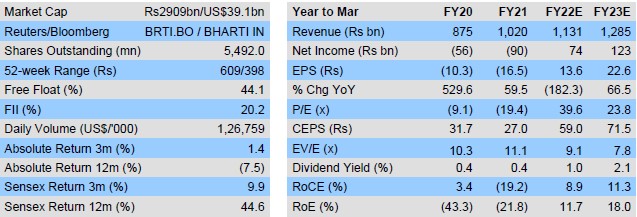

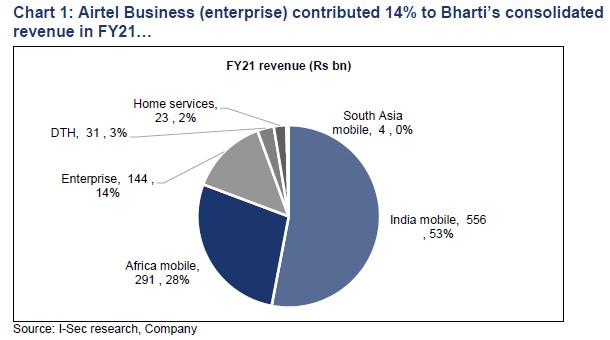

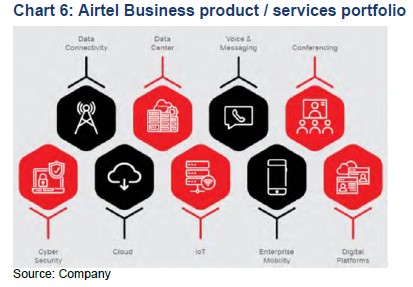

- Airtel Business is the most profitable business for Bharti. Airtel Business contributed 14% to consolidated revenue and 12% to EBITDA in FY21. Airtel Business revenue has grown at CAGR of 7.1% over FY17-21 to Rs144bn and EBITDA has grown at 12.9% CAGR to Rs55bn. It has generated FCF (EBITDA minus capex) of Rs132bn in past five years; in past three years ROIC has been 35-40%. Airtel Business offers products and services including voice, data, collaboration, cloud, data centre, security, IoT, network integration, managed services, and digital services. Airtel Business has sub-sea cable network of 365k-Rkms, covering 50 countries. In the past two years, Airtel Business’ market share has grown by 800bps to 31%, which establishes its prowess.

- Company changing business model to capture huge SME opportunity. Airtel Business gets 80% revenue from 20% customers and it sees huge opportunities in farming and hunting. It has made changes in business model – 1) in-source SME sales force (earlier outsourced) which should improve SME sales channel; 2) building omni-channel digital capabilities for customer acquisition and servicing; 3) entered new areas including data centres, Airtel Secure, Airtel IQ, Airtel Cloud and Airtel IoT; and 4) revamped teams’ incentive structure with targets for hunting and farming.

- Strong presence in fast growing India market. Airtel Business’ revenue grew at CAGR of 6.5% compared to 0.6% CAGR revenue growth for TCom. Airtel Business India non-voice enterprise revenue can continue to grow faster on higher contribution from new segments of security, cloud and cloud communications. It is also a beneficiary of IoT adoption and rollout of private network by industries for automation. We see Airtel’s India non-voice enterprise revenue growing in mid-teens at least over the next few years.

- Cloud – betting big on data centres. Nxtra Data offers 1,98,000 sqft of data centre space in 10 data centres. Nxtra Data revenue has grown by 3.2x over FY18-20 to Rs11bn; EBITDA has grown by 3x to Rs2.8bn. India data centre market is expected to grow 3x in next four years to 1,100-1,200MW. We expect Nxtra revenue to grow faster with the launch of more data centres and strong relationship with hyperscalers who are looking to expand presence in India. Further, Nxtra also offers public cloud, private cloud and hybrid cloud services and helps enterprises migrate to cloud architecture.

- Digital services – rising up in value chain which is likely to boost TAM. Airtel Business has also developed multiple platforms and services, which are adjacent to connectivity solutions and help the company grab a higher share of ICT spending by enterprises. The services launched by Airtel Business include:

- Airtel IQ – a cloud communication platform for customer engagement through customers’ preferred channels – calls or SMS and mobile or web app using APIs and software tools. It is designed for easy adoption (plug and play) into any application using easy API. Airtel Business has gained good traction for the product with on-boarding of 50 customers including Swiggy, HDFC Bank etc. The opportunity for Airtel IQ is quite high with underlying market opportunity in India at US$1.6bn and growing fast. Airtel IQ total addressable market will increase once it is launched in other geographies;

- Airtel Secure is multi-layered, full service cybersecurity offerings designed to safeguard enterprises against threats. It has partnerships with ~8 cybersecurity product companies which enables it to offer the entire suit of security services. India security market is estimated at US$700mn. Airtel Business has ~100 customers on Airtel Secure and the list is growing fast; and

- Airtel IoT is an integrated platform offering end-to-end solutions powered by a variety of connectivity technologies. Airtel IoT has >7,000 active customers with >6mn IoT device deployments already. It is adding, on an average, >12k IoT devices per day, which is a testimony for demand for IoT services. India IoT market stands at US$1bn and is growing fast.

- Rising contribution from new-age solutions likely to drive higher valuations for enterprise business. We remain excited on enterprise business within telecom due to 1) rising investment by enterprises into new-age solutions driving higher total addressable market; 2) telcos have done reasonable investments in digital solutions for enterprise business (unlike B2C, which are captured largely by startups or technology companies); and 3) 5G may drive higher growth for connected devices which should augur well for telcos. Further, we like Bharti’s strategy to enter new services such as cloud communications, security and cloud which should help the company grow faster in next decade. We see these services commanding sales multiple compared to 11x EBITDA multiple assigned by us. The company also plans to house digital business in parent in new proposed structure which should help drive higher value. Data centre business in Bharti is under-appreciated, which has been growing fast and may continue to do so for the next few years. Carlyle has valued the business at US$1.2bn; we see value for this business growing fast as we see revenue from the segment rise by 3x in next few years.

How important are enterprise services for Bharti Airtel

Bharti brands enterprise business as Airtel Business; it contributed 14% to consolidated revenue in FY21 and 12% to consolidated EBITDA. Airtel Business revenue has grown at a CAGR of 7.1% over FY17-21 to Rs144bn; EBITDA has grown at 12.9% CAGR to Rs55bn.

Airtel Business has been relatively more resilient with consistent growth; it was not impacted as severely as mobile services from rise in competitive intensity. Customer stickiness, particularly for large corporates, has been much higher and low churn which has helped the segment grow.

Airtel Business has generated FCF (defined as EBITDA minus capex) of Rs132bn in the past five years. It has remained stable despite rise in capex intensity in the past three years to average 17% from less than 10% in earlier two years. The company has been investing in building sub-sea fibre capacity and data centres. It has also added many new business segments along with traditional connectivity business.

Further, Airtel Business’ ROIC has been strong at 35-40% in the past three years, which is amongst the best for Bharti Airtel. Our ROIC working is based on 1) segmental EBIT for Airtel Business and 2) invested capital is derived from cumulative investment minus depreciation wherein consolidated depreciation is distributed proportionate to cumulative investment.

We estimate revenue CAGR of just 6.5% for Airtel Business over FY21-23E and see an upside risk.

Airtel Business sub-sea cable network is spread across 365k-Rkms, covering 50 countries and 5 continents, 33 international cables and 65 global PoPs (point of presence). Further, it is interconnected with its domestic network in India and direct terrestrial cables in SAARC countries, Myanmar and China. It also leverages presence of mobile services in 16 countries across Asia and Africa.

It has ownership in i2i submarine cable system which connects Chennai to Singapore; and consortium ownership in South East Asia – Middle East – Western Europe – 4 (SWM4), Asia America Gateway (AAG), India – Middle East -Western Europe (IMEWE), Unity, Europe India Gateway (EIG) and East Africa Submarine System (EASSY). Along with these seven owned subsea cables, Airtel Business has capacity on 27 other cables.

Airtel Business offers products and services including voice, data, collaboration, work-from-home solutions, cloud, data centre, security, IoT, network integration, managed services, enterprise mobility and digital media. Airtel Business revenue comprises 1) enterprise & corporate fixed line, data and voice, and 2) global business, which includes wholesale voice and data.

Global business offers an integrated suite of global and local connectivity solutions, spanning voice and data to the carriers, telcos, OTTs, large multinationals and content owners globally. It also offers mobile solutions (ITFS, signalling hubs and messaging), along with managed services and SatCom solutions. Global business also provides advanced consumer solutions like IoT.

Mr Gopal Vittal, CEO, Bharti Airtel has mentioned Airtel Business market share (India enterprise market) has improved to 31% in Dec’20 from 23% in Dec’18, up 800bps in past two years (per Frost and Sullivan report), which is impressive.

Bharti adopting new sales engine for growth

Airtel Business serves over 1,200 global customers (a significant number of them are carriers, OTTs and media companies); 2,000 large corporates such as BFSI, IT/ITES, manufacturing companies and others and 500,000 medium/small businesses across India. This is unlike Tata Communications, which only focuses on large corporates – ~1,000 globally. TCom is now planning to increase its efforts to expand its reach to 5,000 mid-market enterprises in India.

Bharti stated in earnings call that it gets 80% of revenue from 20% of enterprise customers, and it sees huge opportunity to grow revenue through farming (mining existing customers) and hunting (adding more customers). It has made four key changes in business model to adopt farming and hunting model: 1) in-sourcing entire SME sales force (from earlier outsourced model or partner acquisition model) which will significantly improve SME channel capabilities; 2) building omni-channel digital capabilities to on-broad customers and customer servicing; 3) entering adjacent and new areas including data centres, Airtel Secure, Airtel IQ, Airtel Cloud and Airtel IoT; and 4) revamping teams’ incentive structure, which are now given separate targets for both hunting and farming.

We understand the requirements for SMEs are different from larger corporates who look for customised architecture and network designs which meet their requirements and policies. SMEs are looking for basic services (a significant component of it would be connectivity) and more standard solutions. Airtel Business has configured many standard solutions, which meet the requirements of these SMEs; and omni-channel allows customers to on-board via digital platform. Bharti said more than 95% of new orders for enterprise product and services are coming through digital channels, which enables the company to expand its reach and gain share in the SME segment.

Bharti also services SOHO (small office home office) and micro businesses through its mobile and home services. The demand for these customers are limited to postpaid mobile connections, landline and fixed broadband and few value-added services. They are better served through mobile and home services segment. Recently, Reliance Jio (RJIO) launched bundled services targeting SOHO and SME segment which included services such as high speed data connectivity, IP centrex, and others. The starting price for services is as low as Rs901/month to Rs10,001/month which meets the requirement of MSME customers depending upon their size.

Strong presence in fast growing India market

‘Strategy&’, part of PWC network, estimates India enterprise connectivity market in 2019 at US$2.3bn across layer 2 and layer 3 solutions. It estimates the market size to grow to US$2.6bn in 2020 with layer 2 reaching US$1bn while layer 3 market is seen at US$1.6bn.

Layer 2 (OSI model) consists of ethernet, domestic leased circuit (DLC), international private leased circuit (PLC), etc. Layer 3 comprises MPLS, SD-WAN, and alternatives such as internet leased line.

The top two segments for connectivity business in India are BFSI and cloud/OTT, while BFSI relies on layer 3 connectivity such as MPLS; cloud services providers use more dedicated services on layer 2 for carrying huge data across their data centres (regions and availability zones). Unlike global connectivity market, which is expected to remain flattish, India is seeing strong high single digit to early teens revenue growth. This is on back of strong growth from digital transformation adopted by organisations and rising demand for fresh connectivity from MSME segment, which is gradually shifting to digital platform. RJio estimates India has 50mn MSME customers; we believe only a fraction of them are on enterprise-grade connectivity today which provides huge opportunity particularly for Bharti and RJio who enjoy deeper connectivity reach in India.

Faster growth in SME segment probably has been one of the key reasons why Bharti has grown faster than TCom in Indian market over FY18-20. Airtel Business revenue grew at CAGR of 6.5% compared to 0.6% CAGR revenue growth for TCom. Notably, TCom revenue was negatively impacted by deconsolidation of data centre business in which it sold 74% stake to ST Telemedia.

We see Airtel Business India non-voice enterprise revenue can continue to grow faster as it is now participating in new segments of security, cloud and cloud communications. It is also amongst the largest beneficiaries of IoT adoption and rollout of private network by industries for automation. We see Bharti India non-voice enterprise revenue growing in mid-teens at least over the next few years.

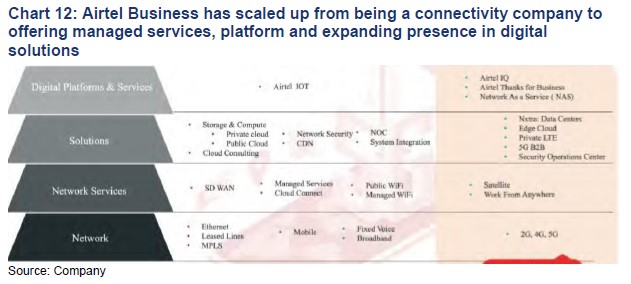

Airtel Business is designed to provide services demanded in India and customised for India to meet demand of various customer categories. The company has also evolved with rise in demand for new services including managed services, platforms and digital (cloud based) solutions. It is also investing in next-gen connectivity solutions such as SD WAN and NaaS (network-as-a-service).

Connectivity – adding next-gen solutions

Airtel Business thrives on strong terrestrial fibre in India, which is supported by sub-sea cable connecting 50 countries. It also enjoys strong connectivity with major cloud service providers. Connectivity remains the core of enterprise offering for telecom service providers; it also allows to monetise fibre assets across businesses.

You must be logged in to post a comment Login