International Circuit

AT&T’s recent dividend highlights its strength but options offers more potential

AT&T is a company we’ve consistently discussed, especially its record-breaking spectrum auction recently. Followers might wonder why we continue to discuss the company, despite its stagnant price movement. However, our answer is simple:

The market can remain irrational longer than you can remain solvent.

As we’ll see throughout this article, AT&T’s continued business execution, such as its recent dividend declaration, will enable the company to continue driving long-term shareholder returns.

AT&T Growing Industry

AT&T operates in growing industries, where it can gain more customers, despite the prevailing views of the company.

AT&T has a variety of customers across its business spectrum. This includes numerous large enterprise/public sector companies, ~128 million households that watch TV, numerous young adult/students, travel, and gamers. AT&T faces strong potential competition for these customers, however, it has the ability to dramatically increase its business size and capture these businesses.

It’s also worth noting that these businesses/customers are growing rapidly.

AT&T HBO Max

One of AT&T’s most impressive growth regions is its HBO Max business which has already surpassed all expectations.

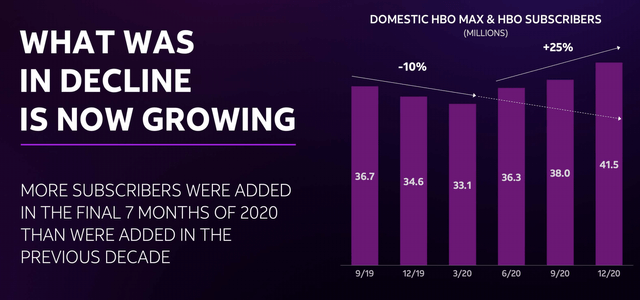

AT&T saw more customers added in the final 7 months of 2020 than the previous decade, showing the strength of HBO Max. The company grew from a pre-launch bottom of just over 33 million subscribers, by 25%, to almost 42 million subscribers by year-end 2020. That massive growth represents a new trend for the company.

The company originally forecasted 75-90 million subscribers by 2025. Since then, that forecast has changed to 120 million subscribers + 30 million (potential) from alternative markets. That’s a near doubling of the company’s forecast. Additionally, ARPU is expected to be growing steadily, meaning, by 2025, when breakeven is reached, this could be >$20 billion annual revenue.

AT&T 2021 Guidance

Putting this together, AT&T’s 2021 guidance highlights the company’s strength.

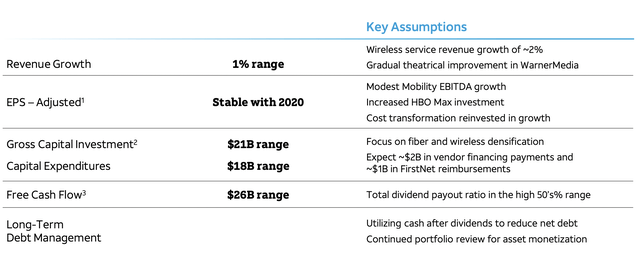

AT&T has ~$215 billion in market capitalization and finished 2020 with ~$150 billion in debt, for a total enterprise value of ~$365 billion. The company, in 2021, expects ~1% revenue growth and stable EPS, impacted by increased HBO Max investment. The company’s capital expenditures are expected to be $18 billion with $21 billion in gross capital.

However, it’s worth noting the company’s higher capital spending will partially come with First Net reimbursements. Past this massive spending, the company expects to have $26 billion in FCF, enabling it to continue a near 7% dividend, while reducing debt. That FCF is a ~12% yield on market cap and more than 7% on EV showing the company’s strength.

AT&T Financial Plan

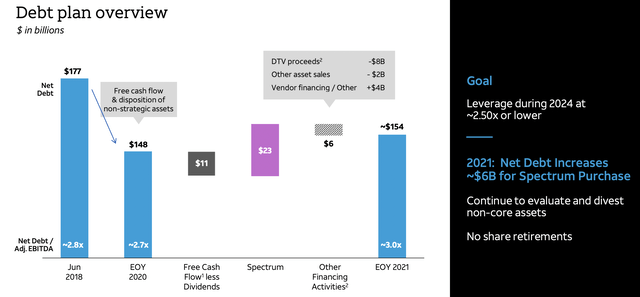

The company’s core financial plan, past this near 7% of dividend, is debt pay-down. Impacting this is the company’s massive, but necessary, $27 billion in spectrum spending.

AT&T, post its TimeWarner acquisition had $177 billion in net debt. By end of year 2020 that was expected to be ~$148 billion. Going into 2021 the company’s post dividend FCF ($11 billion) along with other financing activities (~$6 billion) and $23 billion in spectrum due will make net debt ~$154 billion. The company would have ~$4 billion in spectrum for future spending.

However, the takeaway here is that the company, after massive and necessary spending will end 2021 with ~$154 billion in net debt. It’ll have the financial ability to pay down ~$11 billion annually and each year it does so it’ll decrease its interest expenditures by ~$500 million permanently. That doesn’t count the overall growth in the company’s value.

AT&T Shareholder Return Potential

AT&T’s shareholder return potential here is significant. The company can, for example, pay its debt down to $20 billion in a decade. That’ll permanently increase its FCF by ~$5 billion as a result of its lower interest expenditures, not counting the overall market recovery in FCF.

That paints a picture of a company, in 2031, if the company continues focusing on share repurchases, of a cash flow giant. The company can continue to pay 7% in annualized dividend for the entire time. Then, in 2031, it’ll be positioned with $20 billion of net debt and annual FCF (assuming no further COVID-19 recovery) of $31 billion. That points to a market cap well above $215 billion.

The company needs minimal share appreciation to generate double digit rewards post a 7% dividend. More so, it’s worth noting that $31 billion assumes no further growth, despite the company’s expectation of much faster growth from HBO Max as it reaches profitability from heavy investment in 2025. The company’s other businesses will also keep growing.

Based on the company’s pre-COVID forecast of 2023-2025 FCF ~$31-32 billion, the company’s 2031, post debt pay-down FCF, could be $35-40 billion. That could help the company, with its lower debt, drive much stronger long-term shareholder returns.

Options Trading

For those interested in investing in AT&T we recommend using an options-based investment strategy for immediate yield.

A January 2022 $30 cash secured PUT is currently trading at ~$2.9/share. That means you can earn a 10% yield by investing for ~9 months (~13% annualized). If prices go up, you keep that 13% yield, if they go down you get a chance to invest at a breakeven of ~$27/share, a much better deal than the $30.5 current price.

AT&T Risk

AT&T’s risk is that it operates in a competitive environment. The company is seeing a growing competitor with T-Mobile and could see competition from numerous other major players. Some larger companies are getting into streaming or potentially the cellular business. Well capitalized competitors is a risk AT&T will continuously face.

Conclusion

AT&T has an impressive portfolio of assets and despite the massive overhang of COVID-19 through 2020, has continued to execute well in its core businesses. The company has massively expanded its HBO Max forecasts, and has numerous other growth opportunities, such as its fiber line home internet businesses.

The company operates in a competitive industry. Despite this, the company is in an incredibly strong financial position with significant FCF. The company is currently focused on paying down debt and will be able to continue paying its dividend while focusing on driving significant long-term shareholder returns. Seeking Alpha

You must be logged in to post a comment Login