Daily News

As Penalties Loom, How True Is Telecom’s Financial Distress Narrative?

The narrative of financial stress has once again started circulating in India’s telecom sector, in the run-up to key decisions being taken on penalties and the 5G spectrum auction.

For instance, on Wednesday, the Digital Communication Commission (DCC), formerly known as the telecom commission, will meet to consider reducing proposed penalties on incumbent telecom operators for violation of interconnection related licence conditions as the industry is in poor financial health.

According to sources, the DCC asked the Telecom Regulatory Authority of India (Trai) to consider reducing recommended penalties on the violators of licence conditions “in view of the health of the sector”.

In its response, The Wire has learnt, the telecom regulator pointed out that according to the TRAI Act, it should have recommended the cancellation of licences of the three errant operators. However, it imposed a lesser penalty of Rs 50 crore per circle in view of public interest.

The cumulative penalty on the three operators for not providing points of interconnecting to Reliance Jio is Rs 3,050 crore.

“As per the principle of natural justice, the law should be same for all. It shouldn’t matter whether one is rich or poor. Similarly, penalties should be as per the rule book. It should not vary depending on the financial health of companies or the sector,” a former Trai member told The Wire.

The pricing of the 5G spectrum auction, expected later this year, has also revolved around this narrative. In fact, some commentators have even proposed that the spectrum be given away for free in the beginning.

Analysis of financial stress

Since 1994, when the industry was privatised, telecom operators have been in a state of perpetual financial stress, a situation that has always prompted demands for concessions from the government.

Interestingly, all of India’s telecom promoters are among the richest in the country and have managed to create wealth from the industry. According to Forbes, the personal net-worth of Sunil Mittal is $7.2 billion and K M Birla is worth $12.5 billion. New entrant Mukesh Ambani is worth $47.3 billion.

The Ruia brothers made $5 billion when they sold their shares to Vodafone in 2011, while Chinese business tycoon and Hutchison promoter Li Ka-Shing sold his equity to Vodafone for $11 billion in 2007.

If losses are a barometer of the health of a company, then Netflix, Uber and Spotify, which are all valued in lakhs of crores (Netflix valuation of $100 billion+, Uber at $50 billion+) should have been sick. The basic point behind their valuation is that they are all taking a call on longer-term value creation and not immediate monetisation of their business.

Similarly, at a market cap of Rs 1,75,000 crore, Airtel is among the 15 most valued companies in India. In India, consumption of data has increased 1,28,000 percent in the last five years and it will create a lot of value for telcos when it is monetised later. The operators have taken a business call to keep tariffs low. Hence, they cannot seek compensation from the government.

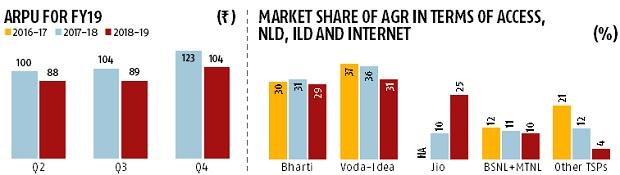

This strategy of telecom operators has started paying results and average revenue per user (ARPU) have risen by up to 20% in the last three quarters. The graph below shows the rise in just FY 2018-19.

In March 2019, at the conclusion of its rights issue, Airtel issued a statement saying that its rights issue had been oversubscribed and showed trust of shareholders in the company. It would further strengthen the company’s balance sheet with desired financial flexibility so as to meet future opportunities, particularly in the rapidly transforming Indian mobile market.

As a result, Airtel’s market cap has increased by 20per cent in the last six months.

Similarly, Vodafone-Idea completed a successful rights issue of Rs 25,000 crore in April 2019, which as per the company was oversubscribed. While Vodafone-Idea posted a consolidated loss of Rs 4,881.9 crore in the Jan-March 2019 quarter on revenue of Rs 11,775 crore, why would investors invest in a financially distressed company?

The answer is that the basic issue is not of financial distress, but only of right capital structure as has been shown by markets time after time. A combination of bad luck and poor government decisions means that promoters more often than not try to save pennies and not invest at the right time.

Reasons for high debt

Presently, there are only three private players in the market – Airtel, Vodafone-Idea and Reliance Jio. Airtel has a debt of about Rs 78,000 crore. Vodafone has a debt of Rs 1,18,000 crore. New entrant Reliance Jio has a debt of about Rs 70,000 crore and is a profitable company within a couple of years of launching services.

When talking about financial stress, it is important to understand the reasons behind these astronomical debt figures.

A closer examination shows that Airtel’s debt is mainly due to its expansion in Africa. It bought Kuwait-headquartered Zain in Africa in 2010, in a highly leveraged deal of $10.7 billion. It was only in FY16-17 that Airtel reported a profit before tax of Rs 39.6 crore for the first time as against the loss of Rs 3,700 crore it had faced a year ago in Africa.

An analysis of Airtel’s balance sheets shows that its net debt increased from Rs 2,547 crore to Rs 59,951 crore (almost 2000per cent) between FY 2010 and FY 2011, the same year it bought Zain, and since then it has been consistently increasing.

This was a big financial setback for Airtel. Instead of upgrading technology in India, Airtel invested in Zain Africa. Cash flows from Indian businesses were being used to fund investment in Africa.

Vodafone Idea

Similarly, Vodafone’s debt has been partly due to the acquisition of Indian assets and partly due to the high price paid to circumvent India’s foreign direct investment dispensation.

Vodafone or Idea did not invest any equity in their respective businesses in the last ten years (till this year’s rights issue). Vodafone may claim that it has invested 18 billion in India, but $11 billion of that was paid to the Hong Kong-based Hutch and $5 billion to Ruia brothers of Essar Group. None of it was invested to create infrastructure. If similar amounts had been invested in the company, it would have been in a different position of strength today.

Vodafone also paid a ‘surrogacy cost’ of Rs 1,241 crore to Analjit Singh and Rs 8,900 crore to Piramal Enterprises for holding Vodafone assets until 100per cent FDI was allowed in telecom. Basically, a significant part of the money spent by Vodafone went to the pockets of Chinese and Indian promoters and middlemen.

RCom and Tata

Both Tata Teleservices and Rcom made wrong business decisions by getting into CDMA technology in 2003, building debt of Rs 30,000 crore and 46,000 crore respectively. Both are out of business now.

For a long time, the revenue model of India’s telecom operators was based on charging for voice calls from subscribers, while 4G was a luxury service that only the rich could afford. However, from FY17 onwards, this model had to change as 4G had become a necessity for India’s billion users.

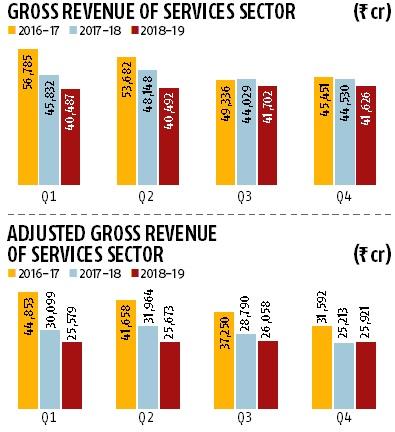

As a result, they were forced to invest in technology and upgrade their network to 4G. There was a dip in the revenues of incumbent operators in FY 2016-17. For Vodafone Idea Ltd, an increase in losses after the merger is mainly due to multi-fold increase in network and IT outsourcing costs, finance, depreciation and amortisation expenses, which is a commercial decision that was part of the merger of two large entities. The following graphs show that gross revenue (GR) and adjusted gross revenue (AGR) of the sector has now not only practically stabilised but has started showing a rising trend with respect to Q1 of 2018-19.

From the above, it is clear that the pervasive narrative of financial stress is more nuanced than portrayed by a few large companies. If some players take well-informed commercial decisions and it backfires, we need to ask whether taxpayers should then be forced to compensate them for their bad decisions.

It is clear that there are issues when companies miss the trend of new technology and do not invest in time. However, now that the other operators are also investing, the industry is heading back to normalcy, with increasing ARPUs and reducing losses.

When it comes to penalties or auctions — or taking a call on bailing out the sector through financial incentives — there is not a very strong case for the government to help out.―Business Standard

You must be logged in to post a comment Login