International Circuit

Apple: Big Surprise For iPhone 11 As New Details Are Revealed

While Apple (AAPL) prepares for the 2019 iteration of iPhone, all eyes are on the 2020 5G iPhone cycle. Apple analyst Ming-Chi Kuo has estimated that all three iPhone models of 2020 will be 5G compatible. He also mentioned that the next year model will have a completely new form factor. Availability of 5G in the successor of lower-priced iPhone XR should help in lifting the overall upgrades. It also will reduce the need for massive discounts or exchange offers by Apple which will help in improving the margins. The interest for next year’s model is much higher than the 2019 iPhone. Piper Jaffray’s report mentions “limited excitement” for 2019 iPhone which will limit customer upgrades.

However, it also should be noted that the probability of a recession or a slowdown has increased significantly as the trade war intensifies. If an economic slowdown happens in late 2020 or 2021, it will end up hurting the bullish case for Apple due to the 5G upgrade cycle. There are few applications out there which will benefit from an upgrade to 5G speeds from the current 4G networks. Wall Street will continue to focus on the 2020 iPhone cycle even if the iPhone sales of 2019 cycle are modest. But there are several challenges for the 2020 cycle which can lead to lower than expected sales.

Betting on 5G

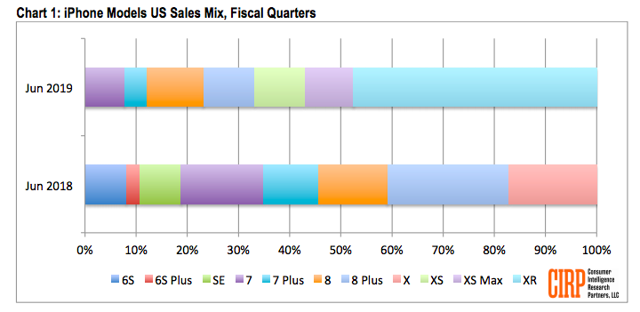

The recent report by Ming-Chi Kuo mentioned that even the cheapest iPhone model in 2020 will have 5G compatibility. According to CIRP, iPhone XR has cornered close to 50% of total sales in the 2018 cycle. Hence, by launching 5G on the cheaper iPhone model, Apple’s management is hoping for significant increase in upgrades.

Source: CIRP

It also should allow the company to phase out the older models which will help in increasing the average selling price. In the current iPhone cycle, there are four older models which have grabbed more than 30% of total sales. These models help in increasing the unit sales but lead to massive decrease in margins.

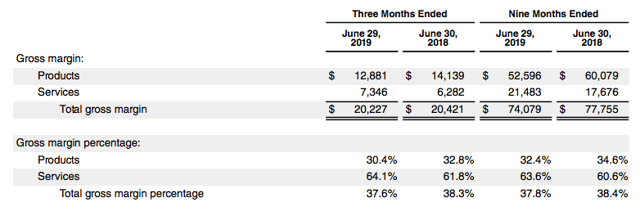

Apple already is suffering from a rapid decrease in Product margins. In the latest quarter, Apple reported a 2.4 percentage point decline in gross margin of Products compared to the year-ago quarter. A big chunk of this decline should be due to the iPhone business in which Apple has been offering huge discounts and exchange offers.

Source: Apple Filings

Reasons for being wary

There’s a big opportunity for Apple to lift its iPhone sales and margins by marketing the cutting-edge features of 5G technology. But there are several reasons why investors need to be circumspect about the next iPhone cycle. Recently, we saw a massive shock in the market when there was an inversion of the yield curve. Data for the past few decades shows that a recession usually follows a yield inversion within six to 18 months. The possibility of a recession or slowdown in 2020 is very real, which will negatively impact iPhone sales.

The trade war tariffs and rhetoric have been amplified in the last few days on both US and Chinese sides. The possibility of an amicable solution has decreased significantly. It’s difficult to see how a solution can be found as the next presidential election cycle starts in US. Hence, any major changes on tariff or a trade deal can be postponed to 2021, after the next White House administration assumes control. This will end up hurting Apple’s sales in China in this holiday season as well as 2020. Greater China contributed close to 20% of the total revenue base of Apple in the last fiscal year. A massive fall in the sales in this region will limit any major bullish momentum for Apple stock.

Besides these external factors, Apple’s 5G launch will need to face the fact that there are few applications which need the 5G capability. We can argue that with the increase in 5G acceptance, new apps and services will be designed specifically for a 5G environment. However, at least in the initial stage, the attraction of 5G might not be enough to force customers to upgrade from their 4G iPhones.

Where to bet?

Apple has moved to a three-year cycle in its iPhone segment. The iPhone 6 model of 2014 was followed by similar iterations in the next two cycles. The launch of iPhone X in 2017 was followed by XS and a similar form factor model in the 2019 cycle. In anticipation of a major change of 2014 and 2017, Apple stock has seen a bullish run 10-12 months before those periods.

In the bullish run from July 2013 to February 2015, the stock price more than doubled from $60 to $130. The 2014 iPhone cycle played a major role in this trend. From July 2016 to November 2017, Apple stock increased from $100 to $170. In this phase also the anticipation of a big change in 2017 cycle helped in increasing future earnings estimates and pushed the stock higher. Hence, we need to ask if a similar trend will be seen in the next 12 months where analysts are increasing the future estimates of iPhone sales and margins for 2020 iPhone cycle which will improve the bullish sentiment of the stock.

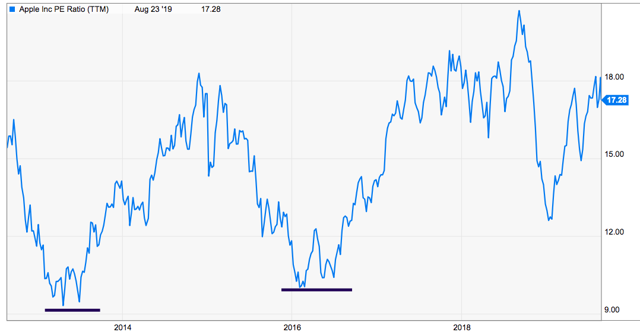

One of the reasons why we might not see a similar stock price increase in the 2020 cycle is because of current valuation.

Apple’s valuation in terms of P/E ratio in the last two bullish runs was close to 10. Hence the combination of bullish future estimates and low valuation pushed the stock higher in the 2013-14 cycle and 2016-17 cycle. But the current P/E ratio of Apple is already over 17. This leaves little room for a big bullish rally even if the future estimates of a 5G iPhone cycle are very good.

Another reason for subdued stock performance before a 5G iPhone launch is that the overall revenue share of iPhone has been falling in the last few years as management focuses more on the Services and Wearables segment.

The smartphone industry is saturated and is declining in important regions. This should limit the massive increase in unit sales we saw in the previous two upgrades of 2014 and 2017. In addition to these, there are macroeconomic challenges from a trade war and economic slowdown.

Hence, I don’t think that we will see another bullish rally in Apple stock prior to the launch of 5G phones in 2020. At the same time, investors can find a good entry point in the stock if there’s a substantial correction in the next few months due to trade tensions or lower upgrades in the 2019 cycle.

Investor Takeaway

Apple faces a number of challenges as it prepares to launch a major iPhone upgrade in 2020. This 5G upgrade will probably be against a backdrop of economic slowdown and trade tensions. In the last two major iPhone upgrades, Apple stock has shown a massive bullish rally.

But it’s likely that we will not see a similar trend in this upgrade because of the high current valuation of Apple stock, falling revenue share of iPhone and saturation in the smartphone industry. However, if there’s a massive correction in Apple stock, there can be a good entry point for investors betting on the 5G cycle.―Seeking Alpha

You must be logged in to post a comment Login