International Circuit

Apple: A Lost Year For iPhone

Apple’s (AAPL) fiscal 2019 Q3 earnings report slightly beat expectations for flatyear-over-year growth as revenue grew by 1%. The report likely sets the pattern for the next year, as a decline in iPhone sales is offset, at least partially, by growth in other categories such as wearables and services. It’s clear that iPhone growth is in hiatus as consumers await the arrival of 5G, even as rivals such as Samsung begin to ship their first 5G phones.

Fiscal Q3 sets the pace for the next year

I think it’s important not to obsess too much about the iPhone sales decline. Apple has experienced such reversals in the past. Apple offers a wide variety of other products and services, and they’re all doing very well.

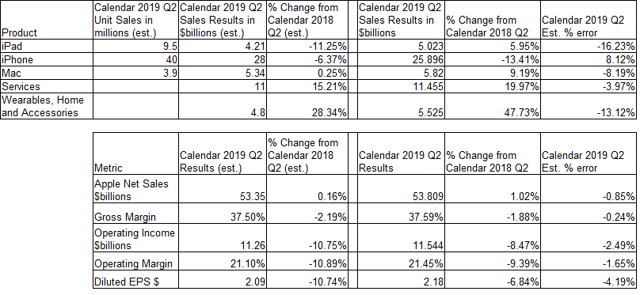

Excluding iPhone, Apple’s other product categories all outperformed my expectations, especially, iPad, which continues to grow year-over-year in revenue. Shown below is a summary of fiscal Q3 results along with comparisons with my predictions I shared with RT subscribers.

Of course, Services and Wearables were the stars in terms of y/y revenue growth. I estimate, very roughly, that Apple sold 9 million Watches in the quarter. It’s getting to the point where Wearables are close to being able to take up the slack of declining iPhone sales.

Much of the conference call was devoted to highlighting Services and Wearables growth. Apple had double-digit Services revenue growth in all of its geographic segments. Apple Pay now processes nearly a billion transactions a month, more than double the year ago volume. Apple Pay launched in 17 countries in the June quarter.

Cook on the Wearables segment:

As I mentioned at the outset, it was another sensational quarter for Wearables, with growth accelerating to well over 50%. We had great results for Apple Watch, which set a new June quarter revenue record and is reaching millions of new users. Over 75% of customers buying Apple Watch in the June quarter were buying their first Apple Watch. We continue to see phenomenal demand for AirPods. And when you tally up the last four quarters, our wearables business is now bigger than 60% of the companies in the Fortune 500.

I’m gratified by the growth in iPad, considering that Intel wrote off the tablet market when it gave up on its fruitless attempt to muscle into the market with subsidized Atom processors in 2016. The growth of iPad is one of the most important examples of the impact of Apple’s ARM processor prowess.

Whereas processor performance seems to make little difference to smartphone consumers, it definitely is making a difference to tablet consumers. iPad’s combination of computational performance, battery life, and light weight is in a class by itself, and the market is responding accordingly. The performance of iPad suggests very strongly what Apple could achieve with MacBooks powered by its A series systems on chip (SOCs).

There always will be questions about how much iPhone unit sales have declined. IDC claims that Apple suffered an 18% unit sales decline, but I think that unit sales probably declined proportionally to revenue, which is to say about 13.4% y/y to about 35.8 million. IDC’s unit sales estimate of 33.8 million puts the ASP at $766, which is historically too high for Apple’s Q3. For the estimated 35.8 million unit sales, ASP is $723, which seems more reasonable to me.

And there will certainly be a debate about the reasons for the iPhone sales decline. For the first two fiscal quarters, I believe that the trade dispute with China was the most important factor. However, Cook claimed that iPhone had improved in China during fiscal Q3:

I’d like to provide some color on our performance in Greater China, where we saw significant improvement compared to the first half of fiscal 2019 and return to growth in constant currency. We experienced noticeably better year-over-year comparisons for our iPhone business there than we saw in the last two quarters and we had sequential improvement in the performance of every category. The combined effects of government stimulus, consumer response to trade-in programs, financing offers, and other sales initiatives and growing engagement with the broader Apple ecosystem had a positive effect. We were especially pleased with a double-digit increase in services driven by strong growth from the App Store in China.

Revenue in Greater China did seem to recover somewhat, with only a 4% year-over-year decline compared to last quarter’s 21% year-over-year decline. However, I expect Apple’s performance in China to continue to be impacted by the trade dispute, especially if it appears that no resolution is in sight.

Going forward, I expect iPhone sales to be mostly hurt by the simple fact that iPhone isn’t 5G ready. 5G has been well publicized, and consumers are aware that it’s going to start being rolled out in 2020. No one expects the new iPhones that will be revealed this September to feature 5G, whereas it’s widely expected that the iPhones released in September 2020 will have 5G. If I were looking to purchase or upgrade my iPhone this year, I would certainly opt to wait a year.

The lack of 5G means that this is going to be kind of a lost year for iPhone. Apple apologists may argue that there’s no point in Apple selling a 5G phone when virtually no one would be able to use it in 5G mode. But there is a point, and the point is that Apple’s competitors are already selling 5G phones.

Samsung seizes the smartphone initiative

Every year in August, Samsung (OTC:SSNLF) attempts to upstage Apple’s iPhone launch with the launch of its massive Galaxy Note phablets. Occasionally, these have gone horribly wrong, as in the Note 7 battery fires and recall.

But this year’s Aug. 7 Galaxy Note 10 unveiling may finally have succeeded in eclipsing the iPhone launch. For all its overly scripted staginess, Samsung managed to unveil considerable innovation.

It started a few hours before the Note 10 event, when Samsung announced its Exynos 9825 processor, its first to be fabricated on its 7 nm extreme ultra violet (EUV)-enabled process. This may make the Note 10 the first smartphone to use an EUV-enabled process.

Although the processor will see first use in the Galaxy Note 10 smartphones, it won’t be used for the most important markets of the U.S. and China. For these markets, Samsung will use the Qualcomm (QCOM) Snapdragon 855, according to GSM Arena. The 855 is produced by TSMC (TSM) on its 7 nm (non-EUV) process.

The Note 10 features a massive Samsung OLED screen in 6.3” diagonal and 6.8” diagonal for the Note 10+. The screens are truly edge-to-edge, with a small circular cut-out for the front facing camera. Samsung continues to eschew facial recognition and instead has an ultrasonic fingerprint sensor embedded in the screen.

Ron Amadeo of Ars Technica was not particularly impressed by the Note 10s, but the Notes have a number of features that stand in contrast to iPhone. Stylus support has been a long standing feature of the Note series, and it’s something that is only being rumored for the upcoming iPhones. Now that Apple has overcome its Jobsian aversion to stylus-based computing (in iPad), it really needs to provide stylus support in at least one iPhone model.

Both Note10 models come equipped with three cameras, thus giving Apple one better, until the next iPhones are launched. The Note 10+ adds a world-facing 3D sensor based on time of flight measurements, albeit at low VGA resolution. This is a first for Samsung, and likely will set a trend that other smartphone makers, including Apple, will follow.

Finally, the most important feature of the Note 10s not present, or likely to be present in the coming year, on iPhone, is 5G support. Here, we see another likely rationale for using Qualcomm’s chips. The Note 10+ even supports millimeter wave 5G, which isn’t even supposed to be available in wireless networks for another couple of years.

According to Mark Gurman of Bloomberg, the next iPhones will catch up to the Note in a number of features, including number of rear facing cameras. Gurman expects an improved FaceID system that will work over a larger angle, improved water resistance, and a faster A13 SOC. Since TSMC has stated that it is already in production on its own EUV enhanced 7 nm process, I think it’s likely that the A13 will use it.

The improvements are all welcome, but I don’t think they’ll be deciding factors for most consumers. In contrast, the September 2020 iPhones seem much more compelling. In addition to 5G they are rumored to feature a “world facing” 3D sensor to support augmented reality and other uses. The SOC in the phone is expected to be produced on TSMC’s 5 nm process, which should provide a major boost in performance and capability, especially in areas such as artificial intelligence.

Apple pays the price for its war with Qualcomm

The situation with iPhone could have been very different if Apple had not launched its abortive war against Qualcomm, as well as teamed up with the wrong player, Intel (INTC), in 5G. I always felt this was somewhat ill conceived for a number of reasons.

From the outset, it was apparent that Apple didn’t understand the nature of the patent license agreements that Qualcomm had with Apple’s contract manufacturers. These agreements covered a broad portfolio of standards essential patents (SEPs) and non-standards essential patents.

Apple’s complaint that it was paying a huge “tax” on each iPhone for a few SEPs was thus fundamentally flawed. Apple’s argument that Qualcomm abused its monopoly position in wireless modems did carry some weight, however, which the decision of Judge Koh in the FTC case served to confirm.

But it was the failure of Intel to come through with a 5G modem that ultimately undid Apple’s war. Without a viable alternative to Qualcomm, Apple was forced to settle. Unfortunately, the settlement in April came too late for this year’s iPhone. Samsung, on the other hand, showed more foresight, settling its dispute with Qualcomm back in January, thus paving the way for its 5G phones.

Even though things didn’t go entirely Apple’s way, I won’t say that Apple made a mistake in launching its crusade. The deeper reason for it that Apple never talked about was the pressing need to incorporate wireless modems directly into its SOCs. This is something that both Huawei and Samsung already do, and it was becoming a competitive necessity to match this capability.

In order to begin building its own modems, Apple needed a direct patent license from Qualcomm, which it had been unable to get prior to the settlement. With the Qualcomm settlement, Apple now has that license, presumably on much better terms than the contract manufacturers’ licenses.

If there was any doubt about Apple’s intentions to build its own modems, these were erased by Apple’s decision to buy the smartphone modem business from Intel. The purchase really highlights the power of the “paradigm shift” pioneered by Apple. Apple may not have achieved everything it wanted in its war with Qualcomm, but it completely out-maneuvered Intel.

Investor takeaways

In the long run, the lost year will probably prove to have been worth it. Apple achieved crucial strategic objectives in its patent license with Qualcomm and the acquisition of (OTCQB:MOST) of Intel’s cellular modem business. During the conference call, Cook acknowledged the importance of the acquisition:

Turning to the future. Last week we announced an agreement with Intel to acquire the majority of its smartphone modem business. This is our second-largest acquisition by dollars and our largest ever in terms of staff. We’re looking forward to welcoming all of them to Apple. We see this as a great opportunity to work with some of the leading talents in this field, to grow our portfolio of wireless technology patents to over 17,000, to expedite our development of our future products and to further our long-term strategy of owning and controlling the primary technologies behind the products that we make.

Investors should keep these accomplishments in mind as we suffer through the lost year. It will be a year to test our confidence and resolve, and it may see significant declines in share price as iPhone sales suffer further declines. I expect fiscal 2021 to be much different, however, as the new 5G iPhones unleash a wave of pent-up demand.

For myself, I regard any future share declines as buying opportunities, and I remain long Apple and rate it a buy.―Seeking Alpha

You must be logged in to post a comment Login