Daily News

And Then There Were 2: India’s Three-Horse Telecom Race Is Set To Change

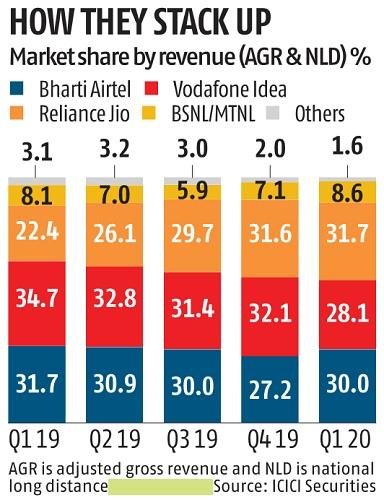

Just a year after Reliance Jio disrupted the country’s mobile services business, a CEO of a leading Indian telco predicted that the telecom sweepstakes will be divided amongst three private sector players. “We expect that once the battle is over Airtel, Jio and Vodafone-Idea will each have 30-31 percent revenue market share, with BSNL/MTNL having the rest,” the CEO said.

Last fortnight, however, the cosy prediction of a three-player market, with each controlling roughly similar revenue market shares, was challenged by Reliance Industries chairman Mukesh Ambani. Ambani announced at his AGM that Jio would be aiming to acquire 500 million customers (currently 340 million with a revenue share of 31 percent, which includes national long distance revenue as of Q1 FY20). Analysts say that, translated into revenue share, this would give them around 43 percent (Morgan Stanley) to 45 percent share (sources close to Jio) of the market within two to three years.

On the other hand, executives at Bharti Airtel say its strategy has been clear: To maintain revenue share at 30 percent. If both Jio and Airtel stick to their guns, the question many analysts are asking is whether the mobile landscape in the next two years will see the emergence of a dominant duopoly market represented by Jio and Airtel with a much smaller number three in Vodafone-Idea (with 17-20 percent of the market compared to 28.1 percent revenue market share in Q1 FY20). The joint venture’s viability could come under serious scrutiny, especially after the dismal financial performance in Q1FY20. State-owned BSNL, thanks to government support, is expected to maintain its revenue share at 7-10 percent.

The future shape of the mobile telecom landscape depends on three parametres: Whether Jio meets its targets; whether Bharti can continue to defend its turf; and whether Vodafone-Idea can, under newly minted CEO Ravinder Takkar, accelarate the integration and 4G rollouts nationawide and ensure that shareholders are willing to put in money to stem falling revenue and market share.

As things stand, Vodafone-Idea’s challenges look formidable. Jio, for instance, requires 160 million more customers to reach ita subscriber targets. Many of these additions have been at the expense of Vodafone-Idea. The company has been adding 10 million plus gross additions every month and, according to Morgan Stanley, expects net additions of 8 million every month in the remaining months of FY20 and 6 million in FY 21 when it expects to hit a revenue share of 42 per cent.

The question, however, is whether Jio has sufficient spectrum to sustain such a huge subscriber base, especially one that uses more and more data. Competitors points out that both Vodafone-Idea and Bharti have a much larger share of the spectrum assets and that is a big disadvantage which they can rectify only by buying more in the upcoming auction. That means Reliance will have to continue to make substantial investments.

The other question is whether Airtel will be able to hold on to its revenue share. If its performance is anything to go by, its revenue market share since FY 2017 has remained stable at 30 percent despite the bruising price war it fought with Jio. And now with tariffs far more stable there is no reason to think it won’t. Airtel is also increasing revenues by upgrading more customers from 2G to broadband, which increases revenue per user metrics or ARPUs. So even though it cleaned up low paying customers (it lost 1.5 customers in the FY20 June quarter), upgrading over 8.4 million subscribers to 4G helped them to increase overall revenues by 2.2 percent.

But can Vodafone-Idea stem the free fall in subscribers and regain the market which it has lost in the process of the merger. Research house Bernstein, which has studied telecom mergers across the world, say that they inevitably lead to a fall in revenue market share of one to 4 percent in the first two years. The largest adverse impact it says was in the merger between Vodafone and Hutchison in Australia which led to a revenue market share loss of 8 percent. But it took five years for the losses to stop and even after a decade it has still not been able to recover its post-merger market share.

To stem the fall in revenue share it has to quickly move more 2G customers to 3G/4G. But in quarter ended June Vodafone-Idea added just 0.3 million broadband customers (3G and 4G) compared to 2.3 million in Q4 2019. That is because its LTE coverage lags both in capacity and coverage behind Jio and Airtel (covers 850 million people compared to 1 billion of Airtel and 1.2 billion of Jio). On top of it, it has also lost 14 million customers, its rise in ARPU has not been able to offset the fact that its revenues declined 4 percent quarter on quarter.

That’s not all: despite the Rs 25,000 crore rights issue Vodafone-Idea’s debt is 20X of Ebidta and a large part of the money will have to go to reduce debt. And Kotak Institutional Equities points out that the Rs 28 billion capex investment in Q1 of 2020 is disappointing given that it needs to put in more money and can ill afford to leave the gap in its LTE coverage and capacity over its rivals. Kotak estimates that the company will continue to bleed till 2024.

Sources close to Vodafone-Idea, however, say that the two shareholders are committed to putting in more money and this point is being underestimated. That apart, the integration process is on track (it has covered districts which constitute 50 percent of their revenues) which will garner substantial cost savings once it is completed by June 2020. “The fact that VIL has the highest 4G spectrum share amongst telcos is being ignored while revenue and subscriber market share are being given so much importance. So with spectrum re-farming we can up speeds by 50 to 70 percent which is already happening. Competitors have to buy additional spectrum to carry 4G services. Plus Vodafone had the best indoor coverage equipment and that will be key to quality,” says a former top executive in the company.

Vodafone-Idea also has monetisation opportunities. The value of its stake in Indus Towers should bring in around Rs 56 billion and it sees opportunities monetising its fibre business. Analysts say the company would require another infusion of cash by the shareholders in the next six quarters. The question is whether they will stand firm to get the company, whose shares have plunged below Rs 10, back on the rails. And then put in the cash to grab lost market share.―Authored by Surajeet Das Gupta, Business Standard

You must be logged in to post a comment Login