CT Stories

An uphill struggle

India’s tower landscape is dominated by four players, Jio Infratel, Bharti Infratel, Indus Tower, and American Tower Corporation. With DoT having recently given the approval for the Bharti Infratel merger with Indus Towers, it becomes a play between three players. The balance is shared among smaller towercos and telcos having captive towers. The revenue from the captive towers, of course, does not flow to the towercos. These players operate 520,481 towers, with roughly 750,000 co-locations across India, in every nook and corner of the country. Since inception, they have collectively invested close to Rs 100,000 crore in this industry.

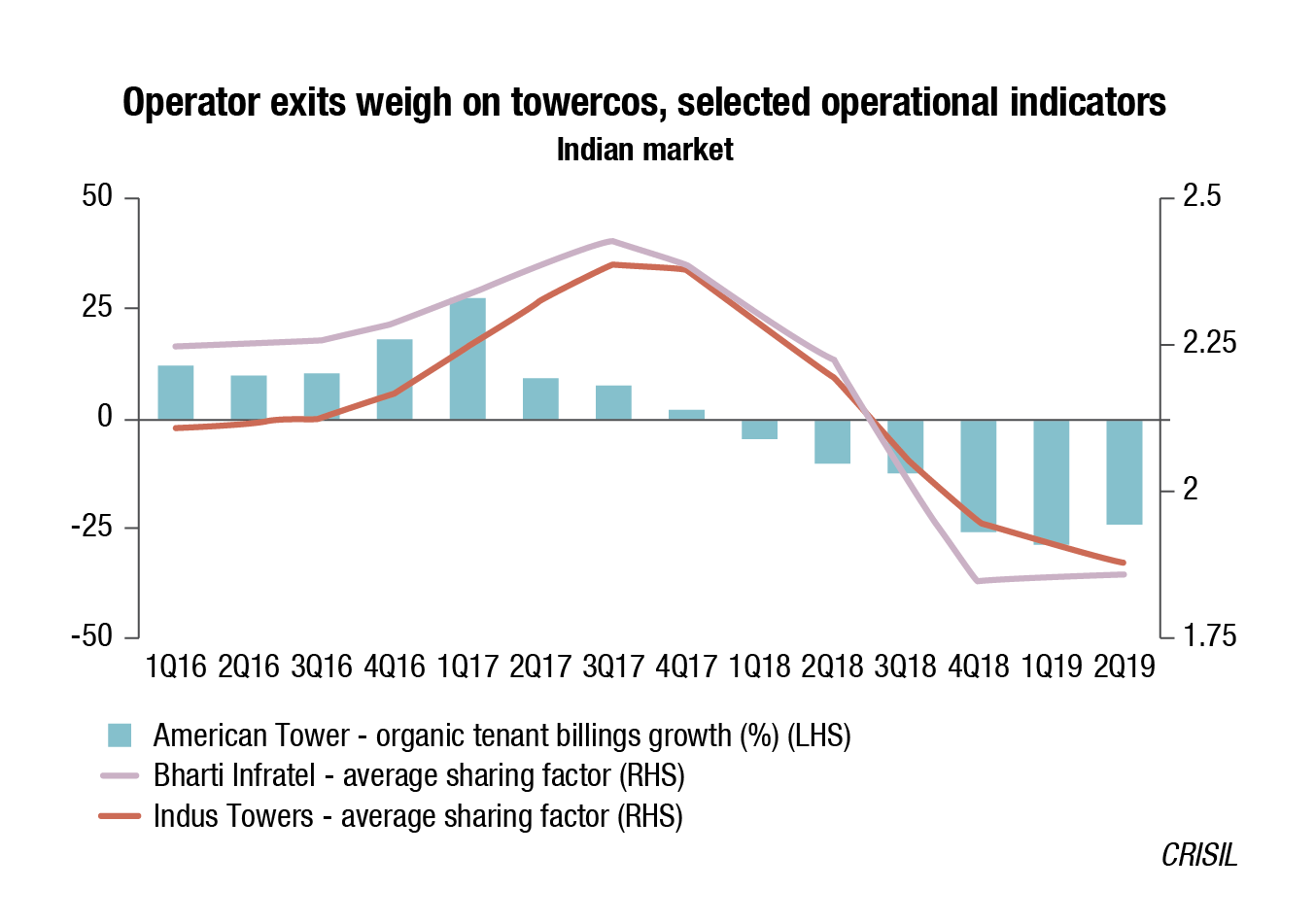

As the telecom industry consolidated to four telecom operators, the operators divested their respective tower assets, shifting the towers industry to pure-play independent towercos from the operator-led model. It also saw the towers industry slip from its comfortable tenancy (number of tenants per tower) ratio of above 2. It takes 5–6 years for a tower to break-even at a tenancy ratio of 1.6. This is on the assumption that the cost of a ground-based tower is Rs 25 lakh.

Tenancy ratio |

|

| Indian market | |

| March 2019 | |

| Jio-Brookfield | 1.30 |

| ATC | 1.50 |

| Bharti Infratel | 1.89 |

| Indus Towers | 1.95 |

| Motilal Oswal> | |

Further, the stressed financial condition of debt-laden telecom incumbents restrained any material hike in rentals, at least over the medium term. On the other hand, the towercos are finding it imperative to explore changes to their master service and rental agreements with Vodafone Idea and Bharti Airtel to ease the financial pressure on the operators, especially after the Supreme Court ruling on dues based on adjusted gross revenue. The tower companies may consider payment holidays for the two telcos for the first 3–6 months on new sites or do away with the lock-in period for new tenancies. On a rough estimate, if one operator shuts down, the impact on a tower company’s revenue could be about Rs 10,000 crore annually.

Indian towers market |

||

June 2019 |

||

| Towerco | Ownership | Towers owned (numbers) |

| Bharti Infratel – Indus Towers (post-merger) | Airtel (37.2% – could be reduced further), Vodafone Group Plc (29.4%), KKR & Canada Pension Plan Invt. Board (10.3%), Providence Equity Partners (1.1%), Public (21.9%) |

164435 |

| Reliance Jio Infratel | Brookfield Asset Management (100%) | 170000* |

| American Tower Company India | American Tower Company (100%) | 74046 |

| GTL Infrastructure | Tirodkar Manoj Gajanan (19.4%), IDBI Trusteeship SER Ltd (16.7%), Central Bank of India (7.7%) |

28000 |

| Others | – | 84000 |

| Total | – | 520481 |

| *Includes an estimated 40,000 monopoles and 45,000 potentially from RCom | ||

| Fitch Solutions | ||

On its part, the towers industry too is in the process of a structural overhaul. Change in the base transceiver station (BTS) technology mix (2G/3G to 4G), consolidation in the industry, and gradual exit of smaller tower operators have changed the landscape.

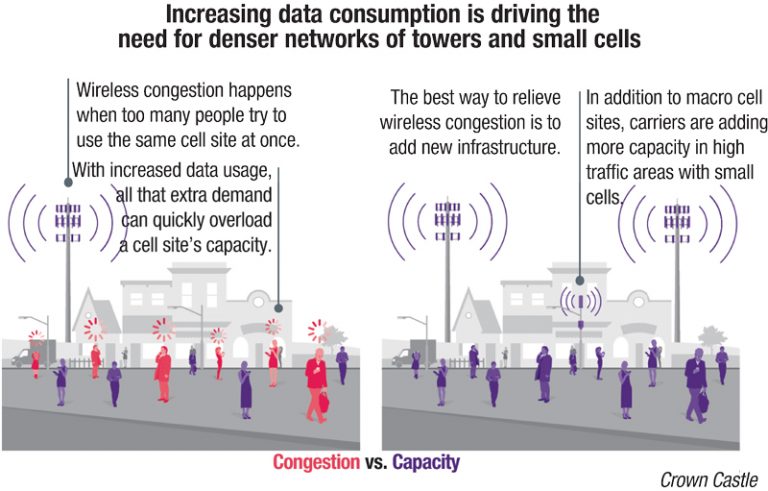

In the last couple of years, telcos focused on densification of 4G networks. The replacement of 2G and 3G BTSs with 4G ones slowed down net BTS additions to ~1.55 lakh in fiscal 2020, against ~2.75 lakh in fiscal 2019. The number of BTSs per tower, however increased marginally to ~3.85, compared with ~3.67 in fiscal 2019, on increased loading by telcos to increase their capacity per site and support existing coverage during high traffic and congestion. This loading results in a discount to telcos (need to pay just 10–15% of rent), which reduces the potential for higher topline of towercos.

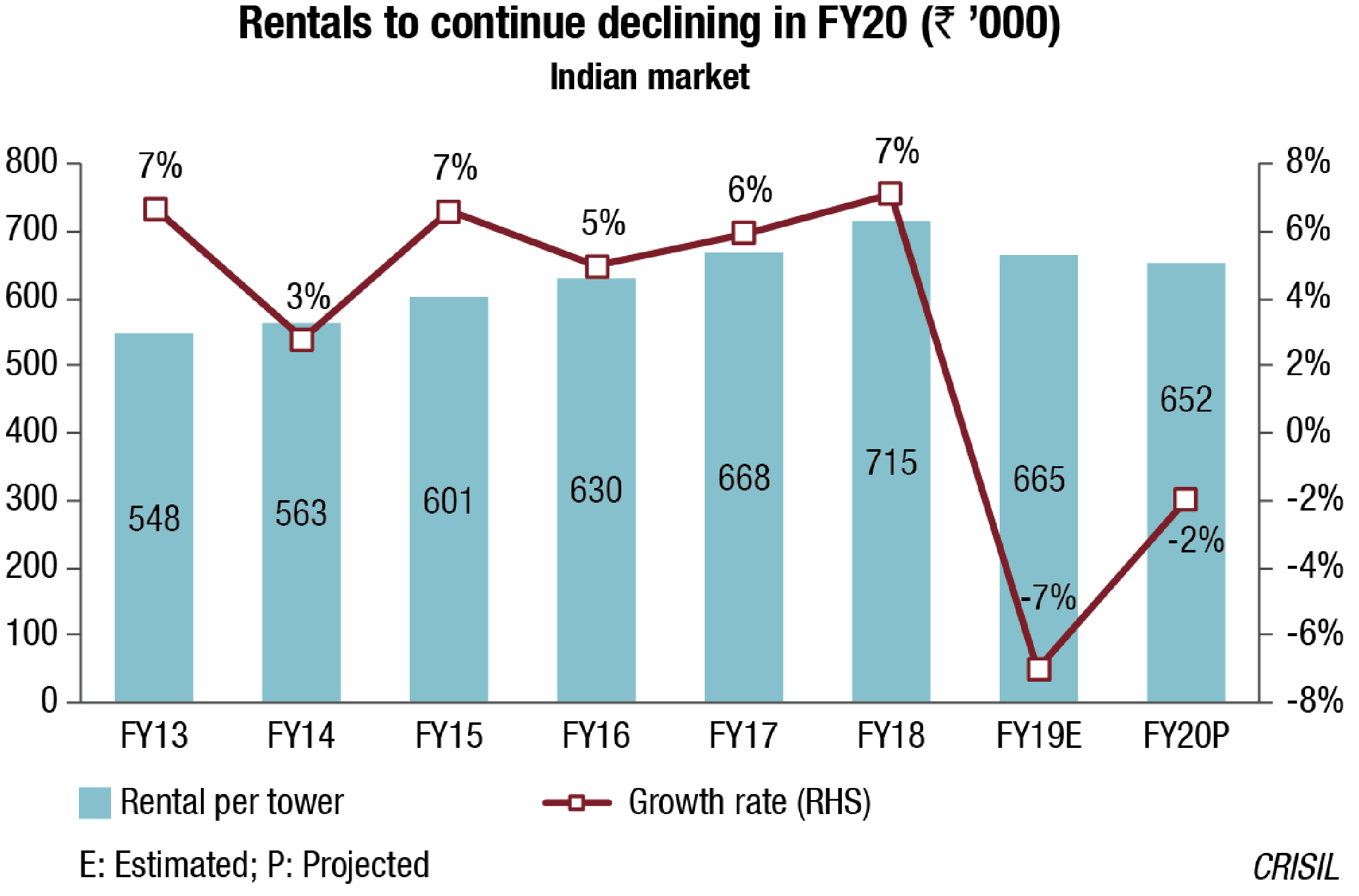

Going forward, loaded sites are expected to account for a higher proportion of incremental tenancies. In addition, rentals might come under pressure during contract renewals as telcos have higher bargaining power. This is because telcos’ return on capital employed (RoCE) is less than ~2 percent, compared with towercos’ RoCE, which is as high as 19–20 percent.

However, the decline in rentals in 2018 seems to have impacted the valuation of towers. CRISIL Research believes the valuations to stay subdued in the near term, as rentals are unlikely to go up. Besides, increased investment in newer technologies like small cells, in-building solutions, massive multiple-input, and multiple-output or MIMO and Wi-Fi hotspots might also keep tower valuations under check.

Fiberization remains low. As of June 2019, only an estimated 31 percent of cell sites have been fiberized, and just over 20 percent of the towers are connected to fiber-optic networks. This suggests that a vast majority of sites are still connected to ageing, lower-capacity copper infrastructure.

The oil ministry is pitching for converting diesel generators, used by telecom towers, to run on natural gas to cut the economy’s carbon footprint by reducing diesel consumption and expanding the clean-burning fuel’s share in India’s primary energy basket. Towercos will also continuously seek to lower operational costs by shifting toward more efficient, renewable sources of energy. As power transmission and distribution infrastructure remains unreliable in rural parts of the country owing to grid bottlenecks, towercos have sought to connect many towers in the countryside to off-grid power sources, namely solar power.

Outlook seems positive

Having said this, the market consolidation may have a short-term impact on tenancies; results should be positive for the Indian market in the long term, leading to healthier competition, wealthier, and an overall more sustainable environment. Also, India has been experiencing an unprecedented jump in data demand as a function of the sharp decline in data tariffs, driven by the decline in data pricing and availability of affordable smartphones. The consumption pattern has shifted from data being an urban phenomenon to mass-market adoption of data services, leading to increase in demand for infrastructure support.

The importance of fiber connectivity to create a high-performing, dense urban network, which is able to sustain the level of data growth has become paramount. Infrastructure ramp ups will be necessary to support the data needs to a bandwidth-hungry consumer. The future technologies also demand infrastructure build-outs at massive scale. 5G has moved from being a buzzword to a strategic advancement expected in the next 4 to 5 years.

In this seismic shift, plenty of opportunities are arising for tower companies to move their attention from a macro tower-focused business, to additional revenue streams, such as fiber, small cells, data centers,

Wi-Fi, and smart cities and beyond. Globally, tower companies are already reaping the fruits of these new areas of investment, and the business case has proved to be successful for multiple global infrastructure companies (infracos). Countries, such as the US, Indonesia, and China, are already seeing infracos diversify into these new assets and services.

In this backdrop, EY in its report, Next-gen infraco unlocking new business opportunities has drawn out the future business landscape for Indian telecom towers industry.

Monetization of adjacencies

Monetization of adjacencies

Fiber. Towercos are well positioned to address the fiber opportunity, with their existing experience of managing distributed-infrastructure assets. Certain use cases that have towers as the central piece of network architecture, are already gaining traction. On the forefront is site fiberization, as it enhances backhaul and increases the valuation of the core tower assets, giving towercos increased control.

Small cells. Coverage and capacity have long been called out as the prerequisites for high-speed data networks, especially with the advent of 4G and 5G. Network densification has already begun in metros with 4G network roll outs, and will further increase with 5G and IoT use cases. Globally, towercos are already adding small cells to their inventory of site typologies – mostly functioning as site acquirers, with the small cells themselves owned by telcos. A bigger opportunity lies where towercos acquire and own their small cells, and offer fiberized small cell sites to the telcos.

Small cells. Coverage and capacity have long been called out as the prerequisites for high-speed data networks, especially with the advent of 4G and 5G. Network densification has already begun in metros with 4G network roll outs, and will further increase with 5G and IoT use cases. Globally, towercos are already adding small cells to their inventory of site typologies – mostly functioning as site acquirers, with the small cells themselves owned by telcos. A bigger opportunity lies where towercos acquire and own their small cells, and offer fiberized small cell sites to the telcos.

Public Wi-Fi. Owning and maintaining distributed assets gives towercos a synergistic playing field in Wi-Fi. Towercos have an opportunity to penetrate this market. They can choose a host of business models – providing Wi-Fi equipment and operations and maintenance (O&M) to clients, or becoming a neutral host public Wi-Fi provider. The latter will need active infrastructure deployment, which is subject to license conditions.

Internet of Things. The IoT ecosystem is expected to grow at a rapid pace with the advent of 5G. IoT connections in India are expected to grow to ~423 million connections by 2023. This presents a unique opportunity for towercos to position themselves as the infrastructure providers for the IoT ecosystem. From deployment and maintenance of sensors to entering the application and hardware value-chain, towercos can explore multiple business directions, based on capability and skill set enhancement.

Smart cities. India’s Smart City initiative has opened a new avenue of growth for infrastructure providers. Digital infrastructure forms the backbone of the Smart City initiative, and towercos are well positioned to create and maintain this infrastructure. The Indian government’s Smart Cities Mission, which was launched in 2015, aims to create 100 smart cities in the country. Under the public-private-partnership (PPP) model, towercos can build the communications infrastructure for the city and in lieu use the RoW and site rights for mounting their own infrastructure for revenue generation. The towercos have already entered smart city projects.

Data centers. In line with the CapEx to OpEx conversion model, supported by towerco’s traditional business of tower rentals, data center is a potential area of business which aligns with this model. Upfront high CapEx investments by towercos in data centers, to lease out space for colocation or to provision of managed hosting services, is a prospective business model. With the increase in data consumption, data centers are witnessing a steep growth trajectory; it is expected that data center market in India will grow at 8.4 percent CAGR during 2018–2023.

Monetization of existing assets. An immediate proposition for towercos is to monetize their existing assets. Towercos can expand their service portfolio beyond tower-based real estate and include provisioning other services on their tower sites. With distributed, power-backed, and increasingly fiberized sites, towercos can explore revenue streams that exploit this dispersed real-estate advantage.

A potential business stream includes setting up of edge computing on tower sites by deploying micro data centers near the network edge. With steady power supply and ready backhaul, tower sites can support edge data centers closer to the user, reducing the need to send backhaul data traffic to a centralized hub.

The location advantage of towercos also renders them fit for serving as storage, warehousing, and delivery centers for various businesses. With availability of power and air-conditioning, even perishable goods storage can be explored as a business stream. As e-commerce companies are trying to penetrate deeper into remote and rural areas of the Indian market, distributed location of tower sites can be leveraged for storage as well as collection point for goods ordered online.

The location advantage of towercos also renders them fit for serving as storage, warehousing, and delivery centers for various businesses. With availability of power and air-conditioning, even perishable goods storage can be explored as a business stream. As e-commerce companies are trying to penetrate deeper into remote and rural areas of the Indian market, distributed location of tower sites can be leveraged for storage as well as collection point for goods ordered online.

Tower structures can also be monetized for out-of-home advertising, with placement of billboards on towers/monopoles. Another service proposition beyond vertical real estate is the provisioning of primary and backup power. This innovation is well established by the powerco towercos (towercos offering power-management solutions) of Sub-Saharan Africa and Southern Asia region. As towercos have significant expertise in managing energy assets, they are well-positioned to provide power-as-a-service.

With advent of electric vehicles, towercos can play an important role in this upcoming opportunity and unlock a new revenue stream. The availability of reliable power and possession of distributed sites makes towercos well-suited to provide EV-charging infrastructure.

In the long run, there is an opportunity for tower companies to play a much larger role in the ecosystem by becoming a shared digital infrastructure provider. This role would include management and sharing of active elements along with passive infrastructure. By assuming the overarching role of a shared infrastructure provider, the tower companies can offer wholesale services to digital service providers, who in turn can focus on their core business. This opportunity would be subject to regulatory approvals, and a much more evolved ecosystem.

The EY report estimated the new revenue potential for infrastructure providers through such a transformation to grow between Rs 21,500 crore and Rs 31,000 crore by 2023, requiring investment of up to Rs 93,000 crore. With the high industry momentum, and government’s push on infrastructure growth, the future is promising for the telecom infrastructure sector.

Global market

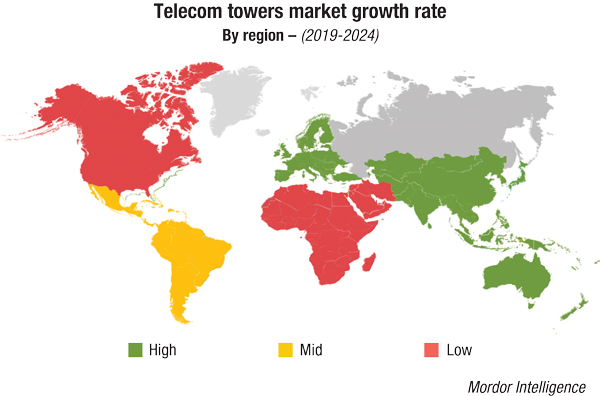

The telecom towers industry was inaugurated just two-and-a-half decades ago. The global towers industry in 2019 is estimated at USD 330 billion, and 71 percent of the total 4.66 million towers are owned by 300 public and private towercos. However, top 15 towercos represent 60 percent of the world towers.

The leading industry players, operating in telecom tower market globally, include American Tower Company, Cellnex Telecom, China Tower Co. Ltd., Crown Castle International Corp., Indus Tower Ltd., IHS Holdings Ltd., SBA Communication Corporation, Te lesites S.A.B. DE C.V, Telxius (Telefonica SA), and PT Tower Bersama Infrastructure TBK.

These major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and profitability. The companies operating in the market are also acquiring startups working on telecom towers to strengthen their product capabilities.

The leasing concept has enabled the MNOs to invest heavily in developing their infrastructure and reach across rural regions, thus bringing new revenues to the tower operators through tower installations. Tower-sharing is one of the major growth drivers for the telecom industry, as it provides benefits like cost reduction and faster data rollout. The telecom towers industry has gained high prominence as an independent industry, mainly in India and the United States. China has the highest number of telecom towers in the world, owned by the state-run China Tower Corporation. It has around 1,948,000 towers and it is estimated that it is leasing over 550,000 towers.

The North American region has been witnessing a significant shift, with the majority of the towers being increasingly transferred from MNOs to independent tower companies. Owing to supporting initiatives by the governments, the region is expected to continually strengthen its position in the global market. For instance, the US Department of State’s global connect initiative (GCI) aims to bring an additional 1.5 billion people online this year, thus creating a demand for more connectivity and network infrastructure. Moreover, aggregate annual wireless capital expenditure in the United States was valued at USD 30 billion, which is expected to augment the market’s growth. Mobile internet penetration is expected to cross 275 million by 2023. Increasing wireless data usage continues to compel wireless service providers to improve their networks’ quality, and make incremental investments on the coverage and capacity of their networks.

The North American region has been witnessing a significant shift, with the majority of the towers being increasingly transferred from MNOs to independent tower companies. Owing to supporting initiatives by the governments, the region is expected to continually strengthen its position in the global market. For instance, the US Department of State’s global connect initiative (GCI) aims to bring an additional 1.5 billion people online this year, thus creating a demand for more connectivity and network infrastructure. Moreover, aggregate annual wireless capital expenditure in the United States was valued at USD 30 billion, which is expected to augment the market’s growth. Mobile internet penetration is expected to cross 275 million by 2023. Increasing wireless data usage continues to compel wireless service providers to improve their networks’ quality, and make incremental investments on the coverage and capacity of their networks.

Subscriber adoption of advanced wireless data applications, particularly for mobile video, advanced devices, and densification of advanced networks by wireless service providers, to satisfy the growing demand for high-bandwidth wireless data, is driving the increased deployment of towers in the region.

The environmental impacts of telecom towers have always been a major concern. Radiation from mobile towers has always been an issue, which is recognized as an unseen and subtle pollutant that may be affecting life forms in multiple ways.

Majority of the telecom tower installations have belonged to the lattice tower category or the monopole tower category. These types of towers provide maximum coverage for the operators and, therefore, serve a wider mass. Also, in the initial years, greenfield towers were mostly observed in the tower installations; however, with space constraints and rising land costs, rooftop towers have found higher attractiveness amongst the telecom tower players as well as the mobile-network operators. The initial implementation of telecom towers that are backbone components and enable rolling out of these technologies incurs high costs; therefore, the market players are adopting different strategies for cost-effective deployments of telecom towers.

Leading towercos outside India

China Tower Corporation Limited. China Tower incorporated on July 15, 2014, has developed into the world’s largest telecommunications tower infrastructure service provider. As of the end of 2018, the company’s total assets amounted to RMB 315.4 billion.

The company has three main business segments. The tower and indoor Distributed Antenna System (DAS) business mainly uses sites resources to provide service to telecommunication service providers (TSPs). The Trans-sector Site Application and Information (TSSAI) business segment mainly uses the sites dispersed nationwide and provides tower-site resource and data information services to different industries. China Tower adheres to the sharing philosophy for business development; it promotes site colocation and provides a wide range of services to fulfil the specific needs of its customers. As of the end of 2018, China Tower managed 1.948 million sites across 31 provinces, municipalities, and autonomous regions in the PRC, and served over 3.009 million tenants with tenancy ratio of 1.55.

The company maintained a stable and healthy revenue growth momentum in 2018, recording an operating revenue of RMB 71.819 billion, up by 4.6 percent year-on-year. The revenue from tower business reached RMB 68.597 billion, accounting for 95.5 percent of total operating revenue, representing an increase of 2.3 percent over 2017. DAS business recorded revenue of RMB 1.819 billion, accounting for 2.5 percent of total operating revenue, representing an increase of 41.7 percent from the previous year, while TSSAI business recorded revenue of RMB 1.222 billion, accounting for 1.7 percent of total operating revenue, representing an increase of more than six times over a year ago. The revenue structure continued to improve.

The company maintained a stable and healthy revenue growth momentum in 2018, recording an operating revenue of RMB 71.819 billion, up by 4.6 percent year-on-year. The revenue from tower business reached RMB 68.597 billion, accounting for 95.5 percent of total operating revenue, representing an increase of 2.3 percent over 2017. DAS business recorded revenue of RMB 1.819 billion, accounting for 2.5 percent of total operating revenue, representing an increase of 41.7 percent from the previous year, while TSSAI business recorded revenue of RMB 1.222 billion, accounting for 1.7 percent of total operating revenue, representing an increase of more than six times over a year ago. The revenue structure continued to improve.

In 2018, the operating revenue of the Group amounted to RMB 71,819 million, up by 4.6 percent over the last year; the operating profit amounted to RMB 9081 million, up by 17.7 percent over the last year; the net profit for the year was RMB 2650 million, up by 36.4 percent over the last year; the EBITDA was RMB 41,773 million, up by 3.5 percent the over last year; the capital expenditures amounted to RMB 26,466 million and the free cash flow amounted to RMB 19,074 million.

The company maintained stable and healthy growth in the first half of 2019, recording an operating revenue of RMB 37,980 million, up by 7.5 percent over the same period last year. Revenue from non-tower business accounted for 5.7 percent of total operating revenue, up by 2.1 percentage points over the same period last year. As of June 30, 2019, the company managed a total of 1,954,000 tower sites, representing an increase of 4.0 percent over the same period last year. The total number of tower tenants increased by 11.8 percent over the same period last year to 3,082,000. Average tenants per tower site increased to 1.58 from 1.55 at the end of 2018, showing further improvement in the level of site colocation.

American Tower is a leading independent owner and operator of telecommunications real estate, and ~98 percent of its revenue generated from leasing its properties, as well as fiber and other urban telecommunications assets in some of the international markets, to its tenants. The company provides the real estate necessary for today’s wireless communications networks.

American Tower has a global portfolio of 171,000+ communications sites. The asset count is ~41,000 towers in USA, ~129,000 international towers, and ~1800 distributed antenna systems (DAS). In India, the company has 75,100 towers (September 2019). The portfolio also includes fiber and fiber-related assets, which are excluded from the site count.

The company’s total revenue increased 11.6 percent to USD 7440 million in 2018, and by 9.4 percent in 3Q19 over 3Q18 from USD 1954 million to USD 1786 million.

Crown Castle International Corp., USA, owns, operates, and leases more than 40,000 cell towers and more than 75,000 route miles of fiber, supporting small cells, and fiber solutions across every major US market. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology, and wireless service – bringing information, ideas, and innovations to the people and businesses that need them. With approximately 70,000 on-air or under-contract small-cell nodes, the company is the market leader in small-cell technology.

Crown Castle International Corp., USA, owns, operates, and leases more than 40,000 cell towers and more than 75,000 route miles of fiber, supporting small cells, and fiber solutions across every major US market. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology, and wireless service – bringing information, ideas, and innovations to the people and businesses that need them. With approximately 70,000 on-air or under-contract small-cell nodes, the company is the market leader in small-cell technology.

Site rental revenues grew approximately 29 percent to USD 4716 million in 2018, inclusive of an increase of approximately USD 207 million in Organic Contribution to Site Rental Revenues, USD 767 million in contributions from acquisitions and other items, and a USD 73-million increase in straight-lined revenues. The USD 207-million in Organic Contribution to Site Rental Revenues represents approximately 5.6 percent growth, comprised of approximately 8 percent growth from new leasing activity and contracted tenant escalations, net of approximately 2.4 percent from tenant non-renewals.

Its outlook for 2019, as announced in November 2019, is site rental revenues of USD 4965 million and USD 5219 million in 2020.

Cellnex was founded in 2015 with the goal of becoming Europe’s leading telecommunications infrastructure manager by providing a secure, high-quality service, tailored to the needs of its customers. As such, Cellnex conducts its business in three main areas of service – telecommunications infrastructure services, broadcasting infrastructure, and other network services.

Cellnex’s business model focuses on the provision of services to mobile network operators (MNOs), broadcasters, and other public and private companies, acting as a neutral infrastructure provider. This business model is based on innovative, efficient, sustainable, independent, and quality management to create value for its shareholders, customers, employees, and all stakeholders.

As of December 31, 2018, Cellnex has successfully become the leading European telecommunications infrastructure operator with more than 25,032 infrastructures located in Italy, Spain, France, the Netherlands, the UK, and Switzerland, including sites and nodes. Cellnex thus provides services, through its customers, to more than 200 million people throughout Europe.

Income from operations for the period ended December 31, 2018, reached EUR 898 million, which represents a 14-percent increase over the same period in 2017. This increase was mainly due to the expansion of the telecom infrastructure services for mobile network operators. Telecom Infrastructure Services’ income increased by 24 percent to EUR 583 million due to both the organic growth achieved and the acquisitions performed in 2017 and 2018. Broadcasting Infrastructure business income amounted to EUR 233 million, and Other Network Services to EUR 82 million. Its operating income increased from EUR 437,106 million in the period January–June 2018 to EUR 486,818 million in January–June 2019.

SBA Communications Corporation (SBA) is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS), and small cells. Founded in 1989 and headquartered in Boca Raton, Florida, USA, SBA has operations and offices in 14 markets throughout the Americas and South Africa. Listed on NASDAQ under the symbol SBAC, the organization is part of the S&P 500. SBA is also one of the top 20 real-estate investment trusts (REITs) based on market capitalization.

SBA Communications Corporation (SBA) is a leading independent owner and operator of wireless communications infrastructure including towers, buildings, rooftops, distributed antenna systems (DAS), and small cells. Founded in 1989 and headquartered in Boca Raton, Florida, USA, SBA has operations and offices in 14 markets throughout the Americas and South Africa. Listed on NASDAQ under the symbol SBAC, the organization is part of the S&P 500. SBA is also one of the top 20 real-estate investment trusts (REITs) based on market capitalization.

The total revenue in 2018 was USD 1727.67 million, contributed by USD 1623.17 million by site leasing, with an increase of 7.2 percent and USD 104.5 million by site development, an increase of 8.3 percent over 2017. The total operating profit was USD 1396.9 million in 2018, a 9 percent increase over 2017.

Total revenues in the third quarter of 2019 were USD 507.5 million compared to USD 467.2 million in the year earlier period, an increase of 8.6 percent. Site-leasing revenue in the quarter of USD 468.6 million was comprised of domestic site-leasing revenue of USD 374.7 million and international site-leasing revenue of USD 93.9 million. During the third quarter of 2019, excluding the sites from the previously announced South Africa investment, SBA acquired 78 communication sites for total cash consideration of USD 27.8 million. SBA also built 98 towers during the third quarter of 2019.

With a solid performance in the third quarter, its customers, domestic and international, continued to stay active primarily with 4G densification work but also, particularly in the US, with early 5G deployment. In the US, the management believes that they are at the beginning of a long-term 5G-deployment cycle that is expected to sustain activity levels for quite some time, with international markets to follow.

IHS Holdings. IHS is one of the largest independent owners, operators, and developers of shared telecommunications infrastructure, or tower operators in the world by tower count with approximately 24,000 towers. IHS is one of the largest independent tower operators in EMEA and the third-largest independent multinational tower operator globally, in both cases by tower count. IHS continues to grow and develop its business with leading market positions in Cameroon, Côte d’Ivoire, Nigeria, Rwanda, and Zambia. IHS has also announced agreements to acquire Zain’s towers in Kuwait and Saudi Arabia, subject to certain regulatory and statutory approvals. Upon completion of the Zain Kuwait and Saudi Arabia transactions, IHS Towers will have approximately 33,100 towers in its portfolio.

The annual results report on the affairs of IHS Towers NG Limited and its subsidiaries, Tower Infrastructure Company limited and IHS Towers Netherlands FinCo NG BV, together referred as the Group. The revenues for 2018 are 22,255,436,000 for the Group and 16,539,051,000 for IHS Towers.

Helios Towers, Africa, owns and operates telecommunications towers and passive infrastructure in five high-growth African markets. A leading independent telecom tower company in Africa, it has 14,226 tenants and a tenancy ratio of 2.06x. The company is a market leader in Tanzania, Democratic Republic of Congo, and Congo Brazzaville. It is a leading operator in Ghana with a strong urban portfolio, and established a presence in South Africa in 2019.

Helios Towers revenue for the 12 months to December 2018 increased by 3 percent year-on-year to USD 356 million. Adjusted EBITDA up 22 percent year-on-year to USD 177.6 million with FY 2018 adjusted-EBITDA margin at 50 percent, up 8 ppts. Increase in colocations of 5 percent year-on-year to 6804 colocations There was an increase in total sites of 3 percent year-on-year to 6745 total sites, and tenancy ratio increased by 0.02x to 2.01x.

In 3Q19, Helios Towers delivered another strong set of results for the third quarter, and continued its trend of 19 consecutive quarters of adjusted-EBITDA growth. The business maintained its momentum through the recent IPO process. The company’s 3Q19 revenue increased by 11 percent year-on-year to USD 97.3 million and operating profit increased by USD 3.1 million to USD 0.1 million. The company plans to continue to invest in the critical mobile and telecoms infrastructure in Africa.

Outlook

The global telecom towers market is anticipated to exhibit high growth in the near future. Increasing number of mobile subscribers, coupled with increasing initiatives taken by the governments in the developing countries of the world to connect the rural areas over the telecom network, is one of the major encouraging factors for the telecom tower market deployments.

You must be logged in to post a comment Login