International Circuit

Airtel Africa plc results for nine-month period ended 31 December 2021

Airtel Africa announced their financial results for nine-month period ending on 31 December 2021 with strong growth across all key metrics, with Nigeria PSB approval in principle to unlock further mobile money opportunity.

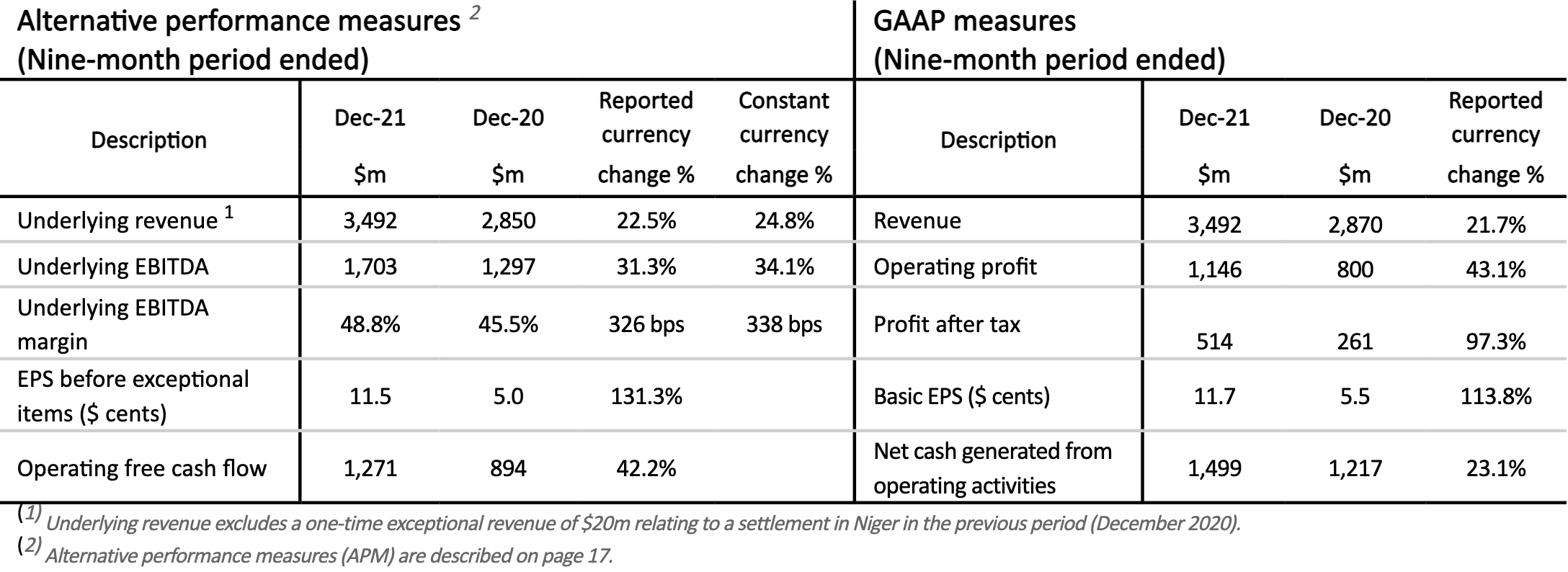

The company’s revenue grew by 21.7% to $3,492m. Constant currency underlying revenue grew by 24.8%. Constant currency underlying revenue growth was recorded across all regions: Nigeria up 29.0%, East Africa up 24.4% and Francophone Africa up 19.0%; and across all key services, with revenue in Voice up 16.1%, and in Data and Mobile Money both up 37.2%.

Underlying EBITDA was $1,703m, growing by 31.3% in reported currency with an EBITDA margin of 48.8%, an increase of 326 basis points led by both revenue growth and improved operational efficiencies.

Operating profit grew by 43.1% to $1,146m in reported currency. Profit after tax almost doubled to $514m as higher profit before tax more than offset associated tax charges.

Basic EPS was 11.7 cents, an increase of 113.8%, largely as a result of higher profit. EPS before exceptional items increased to 11.5 cents, up from 5.0 cents in the previous period.

Operating free cash flow grew by 42.2% to $1,271m and net cash generated from operating activities was up 23.1% to $1,499m.

Leverage ratio improved to 1.4x from 2.1x in the previous period.

The customer base expanded to 125.8 million, growing by 5.8%, with increased penetration across mobile data (customer base up 11.1%) and mobile money services (customer base up 19.6%). Customer base growth was affected by the NIN/SIM regulations in Nigeria but returned to growth in this region in the third quarter; excluding Nigeria the customer base grew by 12.0%.

Segun Ogunsanya, chief executive officer, on the trading update:

“A strong third quarter has contributed to a pleasing nine-month financial performance across all key metrics.

Operationally we have continued to execute on our network and distribution expansion plans, driving continued strong growth in ARPUs across voice, data and mobile money. We have also seen further improvement in our customer growth trends for the Group with Nigeria returning to strong customer growth after a period affected by the implementation of new ‘know your customer’ requirements, posting 1.9 million net additions in the third quarter, taking total Group customer additions to 3.1 million.

I am particularly pleased with developments in Nigeria, where in November we received approval in principle for both a payment service bank (mobile money) licence and a super-agent licence. We are now working closely with the Central Bank to meet all its conditions to receive the final operating licences and commence operations. This will enable us to expand our digital financial products and reach the millions of Nigerians that do not have access to traditional financial services.

We continued to strengthen our balance sheet, with our leverage ratio now 1.4 times underlying EBITDA, thanks both to the continued increases in operating cash flow delivery and to the $550m of cash that has now been received from minority investments into our mobile money business.

We will continue to invest in expanding and evolving our platform to further deepen both financial and digital inclusion across Africa. I continue to see huge growth potential across voice, data and mobile money and our strategy is delivering against this opportunity. Our sustained investments in both network and distribution expansion will help to ensure that both the communities and economies across our footprint will continue to benefit from increased and affordable connectivity and financial inclusion. We are committed to continue to improve the delivery of our services to our customers, with sustainability at the heart of our continued purpose to transform lives across Africa.”

CT Bureau

You must be logged in to post a comment Login