5G

5G spectrum auction concludes

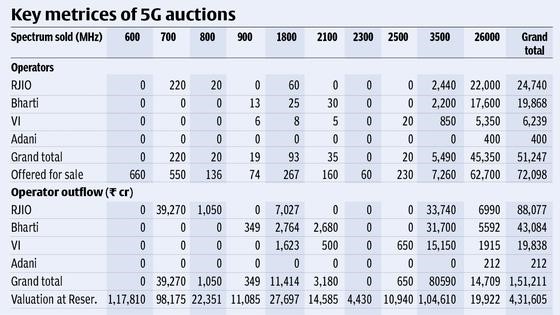

The 5G spectrum auction has concluded successfully on August 1, 2022, on Day 7 with a total bid amount of Rs 1,50,173 crores. 72,098 MHz of spectrum was offered for auction, and out of that 51,236 MHz has been sold.

About 71% of the total spectrum that was bid out has been sold.

The operator wise quantum:

- Reliance Jio Infocomm >24,740 MHz (in 700 MHz, 800 MHz, 1800 MHz, 3300 MHz & 26 GHz);

- Bharti Airtel Ltd >19,867 MHz (in 900 MHz, 1800 MHz, 2100 MHz, 3300 MHz & 26 GHz);

- Vodafone-Idea Ltd> 6228 MHz (in 1800 MHz, 2100 MHz, 2500 MHz, 3300 MHz & 26 GHz); and

- Adani Data Networks Ltd > 400 MHz (in 26 GHz).

The operator wise spend:

- Reliance Jio Infocomm Ltd Rs 88,078 crores;

- Bharti Airtel Ltd Rs 43,084 crores;

- Vodafone-Idea Ltd Rs 18,799 crores and

- Adani Data Networks Ltd Rs 212 crores.

“The auction went off better than the anticipated amount of Rs 80,000 – Rs 110,000 crores. We have received bids worth Rs 150,173-crore for 51,236 MHz of spectrum with mid band of 3300 MHz sold at Rs 80,590 crore alone.

The level of investment now is expected somewhere between Rs 2 to 3 lakh crore (in 4G and 5G) over the next two to three years. I recently met some investors and they are comfortable with the sector. Banks are also open to give credit to telcos now.

We have committed to the industry that we should do annual auctions. We will go back to industry and Trai (Telecom Regulatory Authority of India) and schedule next calendar as per the needs of the industry and as per TRAI advise,” said Ashwini Vaishnaw, Communications, IT & Railways minister.

Analysts Comments

“Jio and Bharti have robust balance sheets, and so their elevated spends on 5G airwaves, though, resulting in higher debt and leverage, won’t cause much financial stress as payment terms under auction rules are attractive. Vi’s higher-than-expected spectrum spends would increase the loss-making telco’s financial challenges and further limit its ability to fight with Jio and Airtel on the 5G stage.”

Nitin Soni, senior director, Fitch Ratings.

“The encouraging response to the just concluded 5G spectrum auctions, in my opinion, was due to:

- First ever 5G spectrum auctions in India, which reminds me of the exuberance in first 3G auctions in 2010;

- Availability of a high quantum and a wide range of spectrum;

- Recent reforms wherein the government has adopted a ‘skin in the game’ approach;

- Relaxed roll out obligations of 5G services spread over five years.

And finally, there is a FOMO on 5G that led operators to bid enthusiastically for the 5G focused mid (3.3 Ghz) and high (26GHz) spectrum bands. Having said that, 4G is going to remain for several years as a mainstay, often coexisting with 5G.”

Jaideep Ghosh, Chief Operating Officer, Shardul Amarchand Mangaldas & Co.

“A low band rollout in rural areas requires 50% less sites than the mid-band, which means lower CapEx and OpEx, leading to overall cost reduction and a better business case. Based on global benchmarks, an operator with 700 Mhz plus C band typically gets 3.5-5% higher market share than an operator which has C band alone.”

Rohan Dhamija. Managing Partner-Middle East and South Asia Region, Analysys Mason

“5G will create more usage of data and that will drive up average revenue per user for the telecom operators. But if the operators want to charge a premium for 5G services then they will have to create differentiation which can happen only with more infrastructure and better service.”

Prashant Singhal, Emerging Markets Technology, Media and Telecommunication (TMT) Leader, EY.

“Estimated significant SUC savings in the offing for Jio, Airtel and ViThey could see $3.7 billion, $3.4 billion and $1.2 billion EV (enterprise value) upsides respectively by winning large quantities of the low-priced high band airwaves (read: 26 GHz).”

IIFL Securities

(On Jio’s interest in the pricier band has made sure that there is no future base price reduction, which means that Bharti Airtel will also pick up this band in future auctions.)

“We view this as a negative for Bharti as we believe this could result in Bharti having to add spectrum in sub-GHz bands in future auctions (and hence increase balance sheet leverage) to keep pace with Jio’s network quality.”

Goldman Sachs said in a note.

Most of the operators have gaps in spectrum, and have taken up airwaves in the 800 MHz, 900 MHz, 1800 MHz, and 2500 MHz, and have taken requisite quantum that will facilitate quality of service (QoS). There has been a significant improvement in tower deployments, right-of-way (RoW) issues, and all states have joined PM Gati Shakti portal for seamless permissions that will add up to improving the quality of service. Moving forward, India can expect good quality services within far flung areas, areas which are marginalised, unconnected, and which have families which are underprivileged.

Also see,

https://www.communicationstoday.co.in/indian-5g-auction-operators-outflow/

https://www.communicationstoday.co.in/present-status-future-roadmap-for-5g/

CT Bureau

You must be logged in to post a comment Login