5G

5G network slicing and the future of connectivity

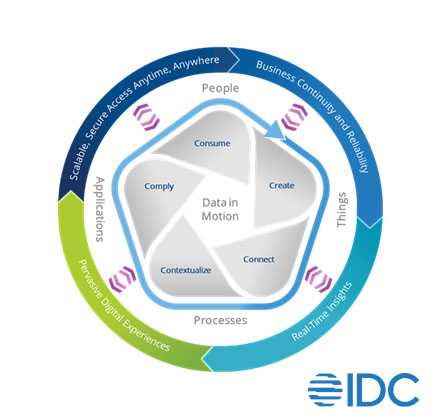

Over the last 12-plus months, one of the major topics here at IDC has been the future of connectivity. IDC’s Future of Connectedness is an evolving framework of technologies, operational goals and business outcomes that transform the way enterprises use connectivity to improve business agility. Investment in connectivity accelerated partially from business continuity requirements during Covid-19 and partially driven by businesses’ desires to take advantage of new digital tools that could improve their operations and increase revenues and profitability. Here at IDC, we look at the elements of the future of connectivity as illustrated below.

Telecommunication service providers, where I spend most of my time doing research, are at an interesting place when it comes to the future of connectivity. Telco transformation, as I covered in a recent report The Future of Connectedness: How Telecom Operators Need to Transform to Remain Relevant, is very similar to that of the broader business segment’s digital transformation.

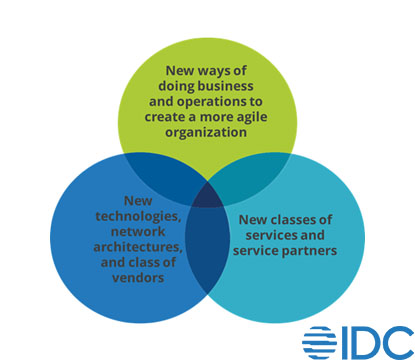

Telco service providers are enterprises, consuming communication services and technologies internally while supplying communication services and technologies externally. The issues and drivers of future connectivity impact telco’s internal communications and processes and guide telco decisions on the future of their external communication networks. The figure below shows the three areas telcos are transforming themselves in their quest for relevance.

- New ways of doing business: Telco service providers need to change their internal processes to deal with increased network and service complexities, while also improving their customer relationship tools. This includes the adoption of collaboration and data intelligence tools that help connect employees, customers-and-partners; increase productivity and data sharing; and help eliminate LOB silos (in particular, between the business/marketing and IT). Also, the adoption of artificial intelligence/machine learning (AI/ML) technologies will help providers better predict outcomes and accelerate decision making around streamlining operations and limiting the possibilities of human errors.

- New technologies, network architectures, and class of vendors: Telecom service providers are deploying new networks like 5G or trialing new architectures, such as OpenRAN, implementing the principles of software-defined networks, and migrating network functions to cloud providers to lower the operational costs and create network platforms to support new types of services. A large portion of this transformation has taken traditional purpose-built network appliances and moved them into virtualized and cloud-native environments. Essentially, this is turning network hardware into software. This network evolution gives telco service providers increased service agility and has opened the way for new vendor partnerships.

- New classes of services and service partners: Ultimately, telco transformation is about remaining relevant to the business end user. This requires the ability to offer new services that increase the value of the telco’s underlying connectivity service and enhance the telco’s role as a transformation partner to the business community. Not all of this can be achieved solely by the telco operator. This requires new partnerships with companies that have different industry vertical and technology expertise to deliver new services. Of three areas of changes, offering new services can be the most difficult and the longest to achieve.

These three areas are interdependent. Delivering new services that will help keep telcos relevant to their customers requires coordinated effort. Telcos cannot not offer new digital services without the proper investments in their networks and their internal business processes. IDC just published its first forecast on 5G network slicing which provides an example of the challenges facing telcos when it comes to transforming themselves to offer new types of connectivity services.

5G network slicing, part of the 3GPP standards developed for 5G, allows for the creation of multiple virtual networks across a single network infrastructure, allowing enterprises to connect with guaranteed low latency. Using principles behind software-defined network and network virtualization, slicing allows the mobile operator to provide differentiated network experience for different sets of end users. For example, one network slice could be configured to support low latency, while another slice is configured for high download speeds. Both slices would run across the same underlying network infrastructure, including base stations, transport network, and core network.

Network slicing differs from private mobile networks, in that network slicing runs on the public wide area network. Private mobile networks, even when offered by the mobile operator, use infrastructure and spectrum dedicated to the end user to isolate the customer’s traffic from other users.

5G network slicing is a perfect candidate for future business connectivity needs. Slicing provides a differentiated network experience that can better match the customers performance requirements than traditional mobile broadband. Until now, there has been limited mobile network performance customization outside of speeds. 5G network slicing is a good example of telco service offerings that meet future of connectivity requirements. However, 5G network slicing also highlights the challenges mobile operators face with transformation in their pursuit of remaining relevant.

For 5G slicing to have broad commercial availability, and to provide a variety of performance options, several things need to happen first.

- Operators need to deploy 5G Standalone (SA) using the new 5G mobile core network. Currently most operators use the 5G non-standalone (NSA) architecture that relies on the LTE mobile core. It might be the end of 2023 before the majority of commercial 5G networks are using the SA mode.

- Spectrum is another hurdle that must be overcome. Operators still make most of their revenue from consumers, and do not want to compromise the consumer experience when they start offering network slicing. This means operators need more spectrum. In the U.S., among the three major mobile operators, only T-Mobile currently has a nationwide 5G mid-band spectrum deployment. AT&T and

- Verizon are currently deploying in mid-band, but that will not be completed until 2023.

- 5G slicing also requires changes to the operator’s business and operational support systems (BSS/OSS). Current BSS/OSS solutions were not designed to support the increased parameters those systems were designed to support.

- And finally, mobile operators still need to create the business propositions around commercial slicing services. Mobile operators need to educate businesses on the benefits of slicing and how slicing supports their different connectivity requirements. This could involve mobile operators developing industry specific partnerships to reach different business segments. All these things take time to be put into place.

Because of the enormity of the tasks needed to make 5G network slicing a commercial success, IDC currently has a very conservative outlook for this service through 2026. IDC believes it will be 2023 until there is general commercial availability of 5G network slicing. The exception is China, which is expected to have some commercial offerings in 2022 as it has the most mature 5G market. Even then, it will take until 2025 before global revenues from slicing exceeds a billion U.S. dollars. In 2026 IDC forecasts slicing revenues will be approximately $3.2 billion. However, over 80% of those revenues will come out of China.

Now this should not discourage mobile operators from investing in 5G network slicing. It can still play a role in helping businesses meet their future connectivity and digital transformation goals. It will, however, take several years for the slicing to mature and become a significant source of revenues for mobile operators.

CT Bureau

You must be logged in to post a comment Login