CT Stories

5G and beyond

The Indian telcos can expect to be allotted the spectrum for 5G testing by September. It will take six months to conduct the trials, after which auctions will be held. Getting rid of an elaborate approval process, DoT has simplified the testing method for 5G wireless products in laboratories; spectrum is now available for demonstration purposes at a set charge. Now, for a miniscule amount, stakeholders can get a license for any amount of spectrum for testing in a non-interference mode.

With the recent decision to shed the Chinese operators-Huawei and ZTE, Bharti Airtel and Vodafone Idea are expected to be on the back foot, as their plans, till very recently, were made with Huawei as their partner. This may increase their procurement costs and reduce competitiveness in the 5G space. Huawei had started roadshows in India and has a lead amongst most of its peers in the global 5G ecosystem. Now the two CSPs will restrict themselves to Nokia, Ericsson, and Samsung.

Bharti Airtel has confirmed that it is in continuous pursuit to upgrade existing 4G base stations with 5G capabilities to be future ready, and is cvonceptualizing 5G trials in association with OEMs and application developers, and help showcase its 5G capability through various enhanced Mobile Broadband (eMBB) and industrial use cases and applications. The service provider is ensuring that its proposed investments in current networks deliver robust connectivity to consumers and lay a strong foundation for 5G services in the near future. In April, the telco announced an agreement with Nokia to deploy its SRAN solution across 9 circles, the rollout of which will also lay the foundation for providing 5G connectivity in the future.

In the words of Sunil Mittal, Chairman, Bharti Enterprises, “It’s the 25 years ahead of us that make us at Bharti really excited. Telecom and ultra-fast, low latency data networks will become all pervasive and be the bedrock of all connected things–from smart factories and grids to smart homes and even flying cars. We are already putting in place several building blocks even beyond 5G and O-RAN with potential satellite-based networks through ventures like OneWeb, where Bharti is a controlling shareholder along with the UK government. As always our focus will be on delivering best-in-class experience to customers. And we will do this by building an open and vibrant digital ecosystem through strategic investments and world-class partnerships.”

Vodafone Idea Limited has expanded OpenRAN based deployments in India with OpenRAN solution providers. VIL’s OpenRAN has been deployed on multiple cell sites and are carrying commercial traffic since December 2019. The deployment has been carried out using Mavenir’s OpenRAN solutions for 4G which provide dis-aggregated solutions using CoTS equipment and new radio partners. The operator has also completed the first phase of the world’s largest deployment of Dynamic Spectrum Refarming technology in the country. Its vendor, Nokia has also deployed more than 5500 TD-LTE massive MIMO cells in the 2500 MHz spectrum band in eight circles. The deployment of DSR and mMIMO technology will help Vodafone Idea to transition to 5G technology.

The 3 large vendors |

|||

| Nokia (Aug’20) |

Ericsson (Aug’20) |

Huawei (Feb’20) |

|

| Commercial 5G engagements | 152 | 100 | – |

| Commercial 5G deals | 85 (67 in Feb. and 73 in June) | 93 (81 in Feb.) |

91 |

| Publicly announced 5G contracts | – | 58 | – |

| Live 5G networks | 33 (23 in June) | 56 (40 in June) | – |

Reliance Jio on the other hand seems to have an edge. Having partnered solely with Samsung for its 4G services, its plans for 5G trials are on track. It has approached the DoT for assigning 800 MHz spectrum in the 26.5–29.5 GHz and 24.25–27.5 GHz in the mmWave band. It has also asked for 100 MHz in the 3.5-GHz band. The operator has asked for spectrum for two years so that it can test its systems in dense urban environments.

After four years of 1000 engineers on the project, acquisition of Radisys and amalgamation of Rancore Technologies, Jio is ready with indigenously developed 5G network solutions. It is planning to build its own 5G software stack and is likely to embrace OpenRAN techniques or possibly even Cloud-RAN as architecture. There will remain external dependence, as most of the semiconductors used to power the radio access networks are likely to be imported.

Jio may also leverage Telecoms Infrastructure Project supported by Facebook, that enables progressive virtualisation of the network. The partnership with Qualcomm will help in rolling out advanced 5G infrastructure and services. This will position the operator to be part of an exclusive club of just a few countries with their own 5G technology that they can sell to the world. It will also bring Jio into direct confrontation with global telecom gear giants, such as Huawei, ZTE, Ericsson, Nokia, and Samsung, which dominate the global telecom market.

For the first time, mobile operators are building their own 5G virtualised networks. They are moving from the current hardware-dependent networks to ones that will be software-centric virtualised, open networks, with hardly any dependency on the underlying hardware, while also saving 40 percent in CapEx and 34 percent in OpEx. And Jio will not use these networks to only power their own mobile services; they are planning to sell their 5G technology to competing mobile players across the globe (assuming competition has no reservation on buying from them) and set it up as a new profit centre. This is based on a huger assumption that this untested technology will commercially deliver as anticipated from year one. (Of course, Samsung, wary of the other suitors, IBM and Tech Mahindra in this case, would be only too happy to oblige, in case things are not hunky-dory for Jio).

BSNL may just piggyback on Tech Mahindra. The vendor, planning its entry into the mobile network space by bidding for the BSNL 4G network has also had discussions on its 5G play. It is positioning itself as a system integrator in the new 5G technology space—the sort of services IBM, NEC and Cisco offer. It is also an investor in Altiostar, which has built cloud native 5G radio access network software in collaboration with Intel which is being deployed on Rakuten Mobile. Besides this, Tech Mahindra has tied up with ITI to build new 4G and 5G radio products leveraging the software the former has built.

Samsung too has made a serious pitch to BSNL. No longer, exclusively tied up with Jio, the vendor is looking to duplicate its feat with BSNL. The Jio order over eight years estimated at USD 5 billion, helped the vendor bridge the huge revenue gap with its counterparts in India, in spite of a smaller R&D budget and the handicap of not having a single RAN technology, where the same base station is used for 2G, 3G, 4G, and 5G.

Having said this, Nokia, once it gets over the huge outstanding payments hump with BSNL, is already one of BSNL’s key partners in developing the 5G ecosystem and has been working with the PSU on a 5G technology roadmap since the last couple of years. It has been planning to test 5G technology with BSNL since early 2019.

Nokia having anticipated what lay ahead, that these 5G alliances may just end up replacing its domination with a new set of dominant players-the mobile operator-cum-technology providers, has joined the O-RAN Alliance and is supporting open platforms, with the pitch that the vendor offers stable 5G networks that have already been deployed, and not untested technology.

The Indian service providers are currently working with Ciena to find new ways to migrate 4G networks, or, in some cases, exploring to build new 5G networks altogether, all the while ensuring the safety of their journey to 5G by eliminating vendor lock-in. For example, with Airtel, the vendor is building one of the world’s largest photonic control plane networks to support 5G. As a pioneer of ‘The Adaptive Network’ vision, the company’s current portfolio spans more than a dozen key technologies, covering areas like 5G, network backhaul and automation.

STL, an integrator of data networks, with core capabilities in optical connectivity and virtual mobile edge solutions continues to strengthen the Make in India 5G ecosystem by investing in technology and assembling an ecosystem of partners in hardware manufacturing, cloud computing, and academia. The ecosystem is creating the Next-Gen Digital Network by bringing together four specialised technological confluences–wired and wireless, software and hardware, connectivity and compute, and open source–all at the edge of the network. This network will bring the scale and quality to bring affordable Internet to the world. Working toward empowering MNOs to build 5G mobile access networks, STL has collaborated with VVDN and VMware, and acquired a 12.8 percent stake in ASOCS.

MediaTek is at the forefront of powering 5G with its advanced 5G chip and modem technology. The vendor has taken a comprehensive approach to 5G product development. Its 5G technologies will be integrated across its product lines, including smartphones, home and automotive, whether integrated into the SoC (single chip), such as its Dimensity Series, or as discrete modem add-on to a platform, such as the MediaTek Helio M-Series. MediaTek has committed over USD 3.3 billion in 5G R&D to date.

5G is a complete overlay on 4G. And it is seamless. There are specifications and architecture designs, that allow different types of implementation and is good to go. There are markets who have launched it and fortunately for India, the band that has been identified for 5G is also used in other markets like Korea and China. The ecosystem is getting better use cases and the learnings will be transferred to India. India is sitting on a very good platform in that aspect. Handsets will need to be changed, but that is so for every upgradation, was so for 2G to 3G, and to 4G too. With the global adoption of 5G, the handsets will become affordable by the time India implements 5G.

The challenges lie elsewhere!

The WPC needs to make adequate spectrum available. With the Defence Ministry’s requirement of 100 MHz in 3300–3400 MHz band, and ISRO’s 25 MHz, it leaves only 175 MHz for telecom operators, which is grossly inadequate. In any case, 5G spectrum is needed across low, mid and high bands. And at affordable prices. The reserve prices of `50,000 crore for 100 MHz is exorbitant.

The service providers need funds to put in place a world class 5G network. While Jio is flush with the `1.52 lakh crore it has raised recently and is under pressure as its 4G spectrum, that it shares within RCom expires within a year in 18 of the 22 circles; Vodafone Idea and Bharti Airtel have huge AGR dues to clear. With BSNL defaulting in its `910 crore dues to Nokia, it is clear that the vendors are in no position to extend credit.

The service providers need to upgrade their presently inadequate network infrastructure, especially with respect to more extensive fiberization, and enhanced download/upload capability, address the RoW challenges, and put in place a trustworthy, security policy.

Of course, as the 5G services are rolled out, use cases will emerge. India will unleash unique use-cases, different from the global ones. But the country is not yet the market for robotic surgery and autonomous cars. The country has yet not achieved 100 percent 4G penetration, the pattern for those rolling out 5G.

And last, but not the least from any angle, the government needs to ensure that India does not get reduced to one single service provider. A fifteen-operator industry in 2013 was poised for disaster but only one in the offing is no less crazy!

The evolution of 5G

5G wireless technologies hold great promise in unleashing an array of ground-breaking digital services that will impact consumers and industries over the next decade.

In addition to more exciting user experiences and new revenue opportunities for service providers, orders of magnitude improvements in network performance related to download speeds, latency, and the number of connected devices, have been promised. However, the end-user experiences and revenue opportunities will only be realized if the network performance goals of both the 5G Radio Access Network (RAN) and the fiber-based Wide-Area Network (WAN) complement each other.

The shift to 5G is both an evolutionary one, where existing 4G architecture is used as a starting point, and a revolutionary one, where the introduction of edge-compute allows whole new classes of services to be supported.

An estimate last year put the total investment in 5G networks by operators, for the period 2018-2025 at a staggering USD 1 trillion. Ericsson, in a recent study, said that industry digitization will generate an estimated USD 700 billion market opportunity for service providers by 2030, equivalent to approximately 35 percent of current industry revenue. And that 70 percent of enterprises are seeking to engage with a non-telecoms service provider, while a third already consider communications service providers as important partners in their digitization efforts.

Operators need to keep up with changing user demands and ensure that networks can handle high traffic while mitigating congestion and QoS issues. There has, thus, been an increase in investment in network infrastructure.

Much of the investment is in smartphones, radios, and antennae related to the wireless part of the mobile network, heavily predicated on the availability of fiber to cell sites. There’s a lot that can be done today to improve current 4G wireline networks and support the transition to 5G. Operators can, for example, install more fiber to small and macro cell sites, which are compatible with both current 4G networks and new 5G networks.

CSPs will need to reassess their economic model

The 5G era will usher in a requirement for CSPs to fundamentally reassess the underlying economics of data traffic transport. 5G will require high-bandwidth, low latency data communications, but the worry is that if CSPs do not reassess their economic model for data transport, 5G itself will become less viable and compromises will need to be made.

The 5G era will usher in a requirement for CSPs to fundamentally reassess the underlying economics of data traffic transport. 5G will require high-bandwidth, low latency data communications, but the worry is that if CSPs do not reassess their economic model for data transport, 5G itself will become less viable and compromises will need to be made.

As the world disconnects from cables and goes wireless, and wireless access points in the network move closer to the user, the need for fiber connectivity supporting that grows substantially. With 5G, there’s an undeniable need for greater bandwidth to support new use cases, as well as the ability of the network to deliver this with minimum latency in diverse locations. And that costs money–on top of the investment CSPs have already made into the radio and mobile network equipment itself, fixed connectivity really counts.

So, CSPs are focused on the cost of mobile front- and backhaul, where traffic is delivered over a terrestrial fiber network, to and from the mobile network, to the user or consumer. The main investment areas are next-generation network equipment, site and power, front- and backhaul fiber/technology, and also spectrum. But without corresponding next-generation data transport for mobile traffic, those investments could fall on stony ground.

Unlike the other costs, front- and backhaul costs are subject to a different economical model. CSPs are not just buying equipment, they’re also paying for fiber routes (physical location) across their footprint, and bandwidth/guaranteed data rate/ultra-low latency (network performance), so it’s a very strategic investment.

5G networks will be dense, much more so than other network technologies. Some estimates suggest that 5G will require on the order of 20 base stations in the area that 4G could serve with one. The network will require deep fiber density in metropolitan locations, combined with connections into the key central and edge data centres where much more of the processing will take place. This type of architecture is based on moving the compute function to the edge of the network, nearest to the consumer of the service. Where fiber already exists, CSPs obviously want to take advantage of that underlying power. But in a lot of instances, the fiber simply doesn’t exist in enough quantity or in the right place to support 5G densification, and therefore needs to be built out or densified.

The interference presented by the physical world coupled with the number of connections and bandwidth requirements will mean that 5G network antenna will need to be more ubiquitous. The typical range of a 5G wavelengths is 300 meters, whereas the average range of a 4G wave lengths is around 16 kilometers–less than 2 percent of the range.

The next episode in the 5G story will see CSPs able to draw down as much bandwidth as they need, wherever they need it, in near real-time–and that in itself has several benefits that could lower costs too. We see a bright future for 5G if CSPs are allowed to properly capitalize on their investments by having a front- and backhaul networks that takes advantage of this new economic model.

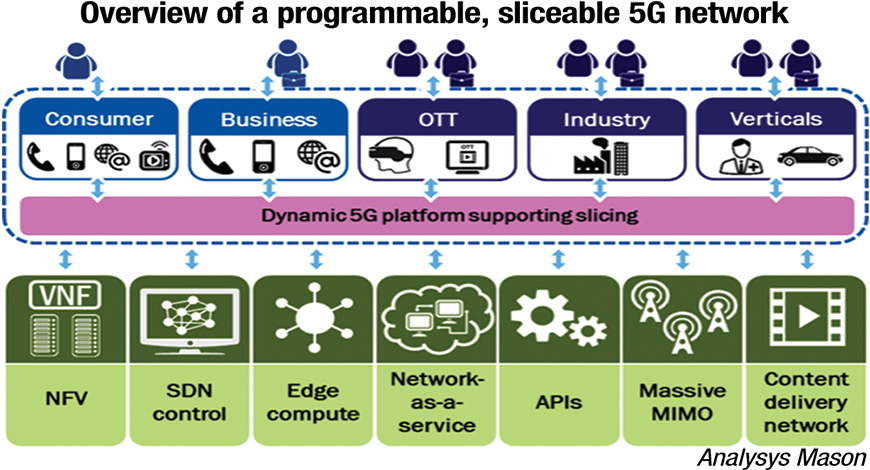

Sliceable network for 5G monetization

To maximize 5G monetization, it’s critical that operators take a dynamic 5G platform approach whilst also transitioning to the 5G core. This platform strategy will transform the network into a set of configurable, programmable functions running on cloud infrastructure. The sliceable platform will give operators the agility they need to launch innovative use cases, as well as to capture the low-hanging fruit of B2B 5G services. Use cases will be extremely diverse, from smart sensor monitoring to fixed wireless access, all the way to autonomous vehicles, automated mining, smart cities, remote surgery and others still to materialize as 5G becomes increasingly prevalent.

5G networks, with their built-in programmability and advanced capabilities, will drive new and exciting monetization opportunities. Until now, the typical approach to technology evolution began with building out the network, and then working on defining the services running on top of it. Network slicing turns this on its head, enabling a top-down approach: first the business requirements are defined and only then is a network slice tuned to the specific service. Each network slice is configured with the network capabilities needed to deliver specific service requirements.

Moving from the traditional 3G/4G one-size-fits-all approach to one based on 5G network slicing will enable services to be configured to the specific needs of disparate customers, applications, and industry verticals. The sliceable platform will give operators the freedom to make critical and individual decisions around their role in the 5G value chain, and where and how they expect to drive most value.

Momentum is building

The latest Ericsson Mobility Report forecasts 190 million 5G subscribers by the end of 2020, with numbers increasing to 2.8 billion by the end of 2025. This will make 5G the fastest scaling technology ever. It also forecasts 160 million fixed wireless access (FWA) connections by the end of 2025, accounting for approximately 25 percent of all traffic.

Also, that most consumers are willing to pay a 20 percent price premium for 5G, but this is dependent on two factors. First, an enhanced consumer experience, in which the differences between 4G and 5G are clear and noticeable. Second, new and unique 5G use cases that are bundled with 5G subscriptions.

US–China, the scales are tilted, for telecom at least

China and USA, each are jockeying for control. Each is eager to lead in this area, as any work on 5G will contribute to countries controlling the intellectual property that will influence the development of future wireless technologies.

As the US squeezes Huawei, it looks like a breakthrough for the other vendors. Currently, only Nokia and Ericsson have the capabilities to build 5G infrastructure. Samsung and NEC are being propped by various countries to enhance their 5G capabilities.

As the US maintains its chokehold on the Chinese vendors, the European vendors too seem to be following suit.

Ericsson has been the most transparent about its recent efforts to shift production closer to customers. The clearest example came last year when it opened a new facility in Texas to serve all North American needs. Another one in Estonia caters to European customers. Of the seven manufacturing sites, only one is in China, along with just one of four service delivery centers. R&D happens across 15 global sites, 14 of which are outside China. This does not mean there would be no damage. Ericsson’s Nanjing facility exports goods to Australia, among other countries. If China blocked those shipments, Ericsson would not be able to serve major customers such as Telstra, Australia’s biggest mobile operator.

Nokia also seems to have limited exposure. Only one of its ten factories is Chinese and that last year accounted for just 18 percent of production capacity for radio frequency systems. Base stations, submarine cables,radio controllers, and transmission systems are all manufactured elsewhere. A global network of 18 R&D centers includes just one inside China.

A Chinese blockade would be a self-harming act in other ways, too, because both Ericsson and Nokia operate their Chinese subsidiaries mainly through joint ventures with local firms.

In the telecom sector, China is not the huge danger it might like to make out. China has never allowed the Nordic firms much of a role in the first place. Huawei and ZTE together commanded about 85 percent of the 5G awards from the Chinese carriers. Ericsson’s percentage of the contracts was in the 10 percent range. And Datang Mobile the remaining 5 percent. Based on the fact that all three Chinese carriers, China Mobile, China Telecom, and China Unicom, awarded their 5G contracts to the same vendors in approximately the same proportions, indicates a coordinated strategy likely coming from the Chinese government. Huawei, on the other hand, derives nearly a quarter of its revenues from Europe, the Middle East, and Africa, and is Europe’s biggest mobile infrastructure supplier.

Huawei has no viable alternatives to US semiconductor expertise, while Ericsson and Nokia would have no shortage of options for new production facilities, even if the move initially proved costly. China is heavily dependent on these electronics tech manufacturers too. Nokia, employs 16,000 in Greater China, and Ericsson has 14,000 in northeast Asia. Any measures that prevent those companies from sending their product out of China would further accelerate the shift in supply chains away from the PRC.

The UK government recently revealed it is seeking help from Japan to meet its 5G requirements. It’s not clear why Japan, or why it has overlooked South Korea’s Samsung, the most plausible alternative non-Chinese vendor.

Samsung has been unable to gain market traction in Europe. After a flying start to 5G in supplying all three South Korean operators, Samsung Networks has since struggled to gain ground. While the Dell’Oro Group has confirmed that Samsung’s 5G mobile equipment share is in the 10 percent to 20 percent range, the research firm also said Samsung’s 5G RAN share was on a downward trend throughout 2019. The vendor has stayed out of the price-sensitive China market. In North America, its prime offshore market, it is targeting smaller operators. Samsung is also eyeing the USD 1 billion the US government has set aside to encourage the telcos–most of them small–to rip and replace Huawei kit.

The Japanese government, spying an opportunity, is tipping 70 billion yen (USD 650 million) into 5G development, which helps a little. The two Japanese vendors, Fujitsu and NEC, are yet small and almost wholly domestically focused. Fujitsu has just landed its first significant international contract with Dish, but it lacks the scale to supply a major rollout, despite a big hike in 5G sales in the first quarter.

Enterprise market

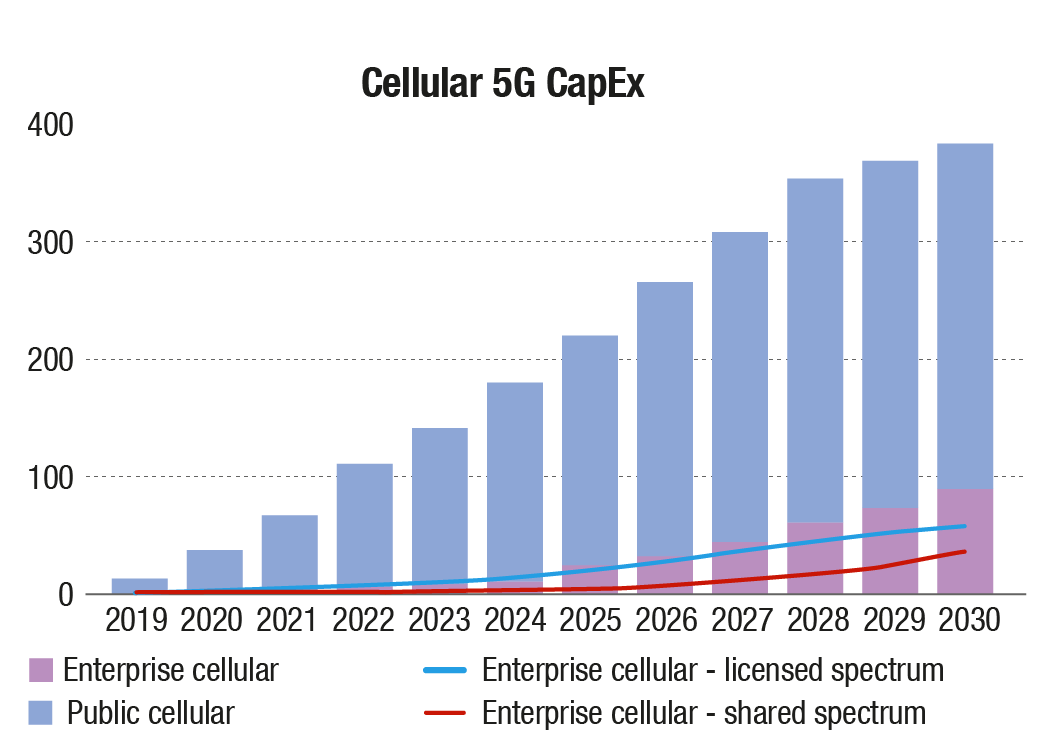

Spending on private and shared enterprise networks will surpass spending on public cellular networks in about 15 years. The traditional operator community has a fight on its hands to guarantee a place at the table, as the new Industry 4.0 networking feast unfolds over the next decade.

According to ABI Research director Dimitris Mavrakis, the balance between spending on consumer and enterprise infrastructure, weighted entirely toward public networks as it stands, will shift decisively toward enterprises in about 2036.

The forecast period in the graph, Cellular 5G CapEx goes into the long-term, covering the tail-end of 4G-LTE, the rise of 5G-NR, and probably the emergence of an entirely new (6G) generation of cellular. But it describes a seismic shift in the core sales and investment strategy for network building in the cellular market.

“The market is starting with licensed spectrum, meaning operators will mostly likely deploy these enterprise business models. But as time goes by, shared and private spectrum will increase in usage, which means either carriers will deploy using shared spectrum or new entrants will come into the market, including even companies like Amazon or Microsoft,” maintained Mavrakis.

The ecosystem for cellular network provision, restricted to a handful of companies with expensive public spectrum licences in each market until now, is suddenly expanding with the development of carrier-grade cellular, alongside the liberalisation of spectrum, disaggregation of network hardware, and virtualisation of network functions.

New challengers to the old guard in cellular network operations may be listed. These include, the traditional vendor set (Nokia, Ericsson, Huawei et al), now selling networking gear directly to enterprises where they can; a tier-two group of small-cell vendors (the likes of Airspan, Ruckus Wireless, Sercomm), most of which have been strong in CBRS re-farming for enterprises in the US; and a bunch of open-RAN players (including Altiostar, Mavenir, Parallel Wireless) that can tackle the enterprise 5G market with greater agility.

The message is clear. Enterprise cellular is a new opportunity, with the foundation to surpass consumer spending on networks. But it is a competitive environment; carriers do not have a guaranteed place in it. Because we see web-scalers, new entrants and vendors all competing for this market.

The pain point is that each vertical has different requirements. Manufacturing has completely different requirements and models to healthcare. The common denominator is carrier-grade networks, which cellular can provide–which means it has consistent appeal (across sectors).

Particularly with the delivery of 3GPP Release 16 (frozen early July 2020) and Release 17 (scheduled for mid-2021), 5G will gain new industrial-grade capabilities, said Mavrakis, notably with the arrival of ultra-reliable low-latency communications (URLLC) and time-sensitive networking (TSN), and be raised above other wireless technologies, notably Wi-Fi, as a connectivity workhorse for Industry 4.0.

Mavrakis had questioned, “Why not Wi-Fi? Because cellular can provide additional features. And if we are talking business critical, mission critical, life critical communications, then cellular can provide the kind of reliability that Wi-Fi cannot. The unique selling point for cellular is it is governed by global standard. Wi-Fi does not include the same carrier-grade features, and mostly introduces reliability by proprietary extensions, which mean enterprises cannot take advantage of global economies-of-scale, and have to utilise specific vendors for reliable communications. This is something cellular has a distinct advantage on.”

COVID-19

COVID may have caused lockdowns in cities across the globe, but not on 5G subscriptions. Ericsson has raised its estimate for 5G subscriptions from China, even as it downgraded the 2020 numbers from 16 million to 13 million subscribers in North America. In any case, 2020 has seen each of the major US wireless carriers, get past the hurdles of deploying thousands of large cell towers and tens of thousands of small cell antennae that need to be deployed in local communities and cities and deploy 5G and fiber across the US in various cities. While, the FCC has amended regulations to pre-empt municipalities, the court cases in some cases and small cell deployments navigating the local bureaucracies have played spoilsport.

In Europe, the COVID-19 pandemic has delayed the rollout of 5G networks by 12 to 18 months, according to a recent study by PwC. European telcos’ investment spending over the next two years is anticipated to fall by €6bn-€9bn ($7.1bn-$10.6bn). PwC noted that delays in 5G deployment carry serious risks and costs for operators, as many of them own time-limited 5G spectrum licenses and will struggle to achieve their return on investment (ROI) targets the longer they delay rolling out services.

Ultimately it depends on the rollout of the new technology, which ultimately depends on four ingredients: popular acceptance and adoption, the ability to install the equipment, access to capital, and the availability of spectrum that will allow vast gobs of data to be transmitted at lightning speeds.

In any case, the tussle is far from over!

You must be logged in to post a comment Login