Headlines of the Day

4G spectrum auction update

The strengthening of spectrum footprints by Bharti Airtel and Reliance Jio in the just-concluded auctions is expected to yield market share gains for the two telcos, arming them with sustainable advantage in the long run and for 5G play, according to analysts.

With the auctions over, the key things to be monitored would be Vodafone Idea Ltd’s balance sheet and its potential capital raise, signals of price hike, launch of a Jio-Google smart phone, and 5G spectrum auctions, they noted.

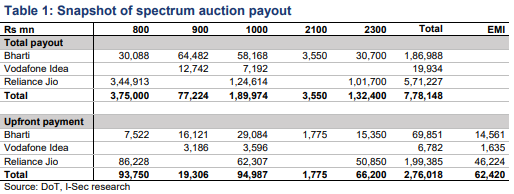

Analysts across-the-board concurred with the government’s view that at Rs 77,814 crore of total bids, the spectrum auction outcome and response had surpassed expectations.

ANALYSTS TAKE

Goldman Sachs

Bharti and Jio had significantly bolstered their spectrum footprints, and strengthening of radiowave holdings could aid their market shares while at the same time keeping CapEx under check.

With the spectrum auctions done, investor focus will now shift to VIL’’s balance sheet and its potential capital raise, signals of tariff hike, launch of a Jio-Google smartphone, and 5G spectrum auction.

While the March ”21 auction was largely a non-event for Vodafone Idea, the company”s limited ability to participate in future 5G spectrum auctions (due to its stretched balance sheet) could result in further erosion of its market share.

Moody’s Investors Service

Spectrum renewals will help incumbents protect their market positions while additional bandwidth purchases will drive improved network coverage.

Indian telcos’ spectrum acquisition can be accommodated in their current ratings, particularly amid the stabilising competitive environment. Some have recently raised funds while others have large cash holdings to support the acquisitions.

BofA Securities

A key question is whether Jio would undertake tariff hikes to help offset the higher bids and investment.

The initiative for tariff hike should largely come from VIL as it is the most in need of it; RIL (Reliance Industries Ltd) management is unlikely to take a knee-jerk reaction of raising tariffs just because it spent more in auctions; while in medium-term RIL is keen to raise tariffs, we believe in the near term, RIL focus could be gaining subscribers (especially on 2G.) In fact, both Jio and Bharti, are expected to focus on improving their market share in the near term given their stronger balance sheets as compared to VIL.

Observing that Bharti and Reliance had taken initial steps to fortify their 5G radiowaves, it reiterated that the two will have “sustainable advantage in the long run, with them fortifying their 5G spectrum. Post this auction, we see risks of VIL having disadvantage in 5G given its weaker balance sheet.

CLSA

Post auctions, there is likely to be a crash in spectrum prices. This is because, with 63 per cent of the spectrum in this auctions unsold, cuts in reserve prices are likely.

Historically, the government has cut spectrum prices by 30-40 per cent if it saw no demand in the previous auction and this will be a significant positive especially for 5G. Also, in the future 5G auctions with the 275 MHz spectrum available in 3.3-3.6GHz bands alone (besides other bands) and only three operators, there will be good supply.

Auction spending has caused RJio spectrum debt burden to jump 144 per cent to Rs 631 billion/ USD 8.6 billion and it is now 10 per cent higher than Bharti Airtel’s Rs 576 billion/ USD 7.9 billion. Still, VIL’s spectrum burden is the highest among the three operators at Rs 95,400 crore.

Credit Suisse

VIL’s muted participation in these auctions was on expected lines and needs to be seen in the context of its cash flow constraints and customer market share already lost.. While Jio is likely to focus on reviving subscriber growth in the near term, over the medium term it will have to take price hikes to support network investments and upcoming 5G roll out.

Axis Capital

The cash outgo will be keenly watched given the high debt level of the incumbents and continued delay in tariff hike. This could lead to funding gap concern for Vodafone Idea given continued delay in raising funds, high debt level, and renewed pricing aggression in some segments.

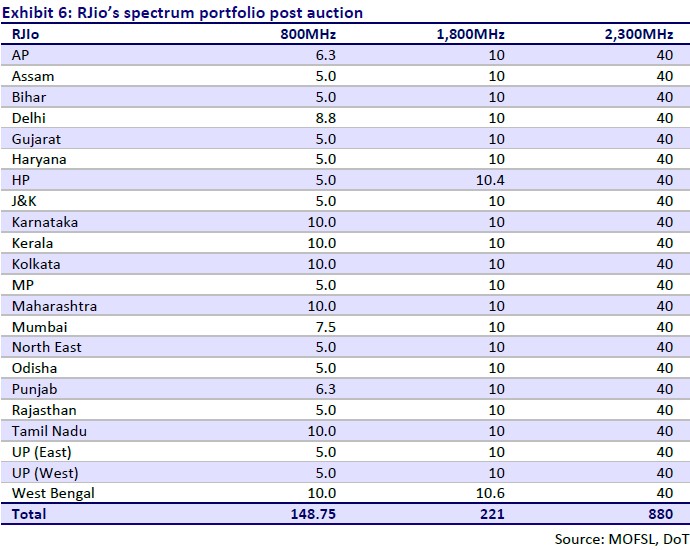

Jio post spectrum acquisition has a minimum of 2×10 MHz in 1800 MHZ band and 40 MHz in 2300 MHz band across circles. With the aggressive spectrum acquisition, Jio seems to reduce the gap with the incumbents. The interest in 2,300 MHz spectrum can be attributable to the increasing popularity of the band for 5G deployment due to its better coverage.

While the 2300 MHz band can be used to increase 4G capacity, it can also play a role in 5G deployment. “Jio has made its intention clear in the release, stating that the acquired spectrum can be used for transition to 5G services at appropriate time where it has developed its own 5G stack.

ICRA

The results of telecom spectrum auctions, that grossed over Rs 77,800 crore, have exceeded initial estimates.

While the value of sales was just 19 per cent of the value of total spectrum on offer, the debt levels of the industry are expected to rise further, post the auctions, and the debt protection metrics would continue to remain weak despite improvement in operating metrics, it said.

The outcome exceeded earlier estimates and have fetched the exchequer around Rs 77,800 crore of which around Rs 28,000 crore will have to be paid upfront.

The telcos not only bid for renewals of the expiring spectrum but focused on consolidating their spectrum holdings in the 800 MHz, 900 MHz and 2300 MHz bands. While the sub-GHz bands will be crucial for 5G technology deployment going forward as well as improvement of indoor coverage, the appetite for 2300 MHz band stems from the rising mobile broadband usage and thus the need for improving network capacity.

Spectrum acquisition for bolstering the data capabilities remained the theme of these auctions. While the value of total spectrum sold is only 19 per cent of the total value of spectrum on offer, post the auctions, the debt levels of the industry would increase further to around Rs 5 lakh crore as on March 31, 2022 and despite the improvement in the operating metrics, the debt protection metrics will continue to remain weak.

Morgan Stanley

The higher spectrum gives Jio flexibility in its 5G rollout and also supports its ambition for 50% subscriber market share as data demand continues to rise on its 4G network.

ICICI Securities- Prudent investment by Bharti Airtel

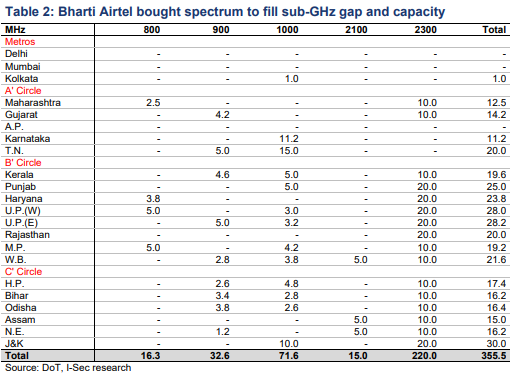

Bharti Airtel – spectrum purchase focus on filling gap in sub-GHz, and capacity spectrum.

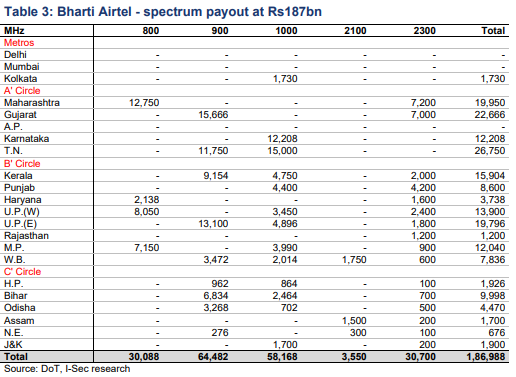

- Bharti has overall bid for 355.5MHz of spectrum with total payout of Rs187bn. It is required to make an upfront payment of Rs70bn, and EMI of Rs14.6bn will kick in from FY24.

- It has invested Rs95bn on sub-GHz (800/900MHz band) for 48.9MHz spectrum. Bharti now has sub-GHz spectrum in all 22 circles, however it does not still have 5MHz spectrum (required for 4G/5G launch) in Gujarat and Kerala.

- It has bought spectrum in four circles where 900MHz spectrum will be up for renewal in CY24 – UP east, WB, Bihar and Odisha. This has led to an additional spectrum payout of Rs27bn.

- It has bought 800MHz spectrum in Maharashtra, Haryana, UP west and MP. This has helped Bharti fill sub-GHz gap at a reasonable investment.

- In 1,800MHz, Bharti has significantly scaled up spectrum holding in Karnataka and TN. It now has 4 carriers each in these two circles in 1,800MHz band, and one carrier in sub-GHz and two carriers in 2,100MHz band. These are Bharti’s strong circles; and now it has total seven carriers in FDD. However, it has skipped adding 2,300MHz in these circles.

- Bharti has been prudent in 2,300MHz spectrum investment. It has skipped expensive circles such as Delhi, Mumbai, Kolkata, AP, Karnataka and TN. It raised spectrum holding to 40MHz in 13 circles in 2,300MHz band.

- With the conclusion of this spectrum auction, Bharti’s net debt has increased to Rs1,340bn. Its net debt to EBITDA (Q3FY20 annualised after adjusting for Ind-AS 116) is 3.2x. Though net debt to EBITDA is within comfortable levels, absolute net debt is much higher than desired.

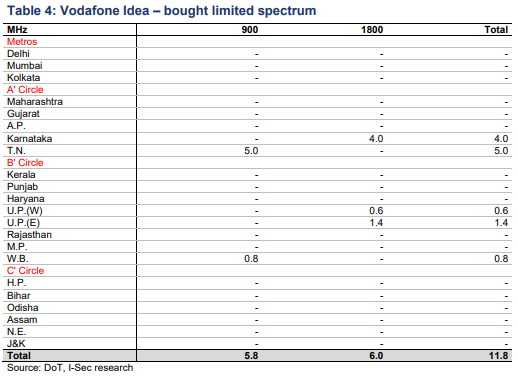

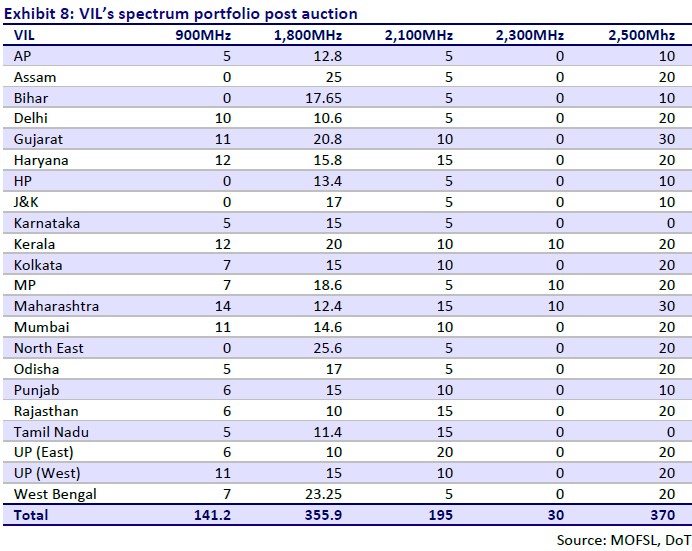

Vodafone Idea (VIL) – Spectrum investment capped by limited requirement.

- VIL has total bid for only 11.8MHz of spectrum with total payout of Rs20bn. VIL will need to make an upfront payment of Rs6.8bn, and EMI of Rs1.6bn will kick in from FY24.

- It has bought 5MHz spectrum in 900MHz band in TN which was up for renewal; and 0.8MHz in WB.

- It has made solid 5MHz (in multiples of 5MHz) block of spectrum in 1,800MHz band in Karnataka, UP west and UP east.

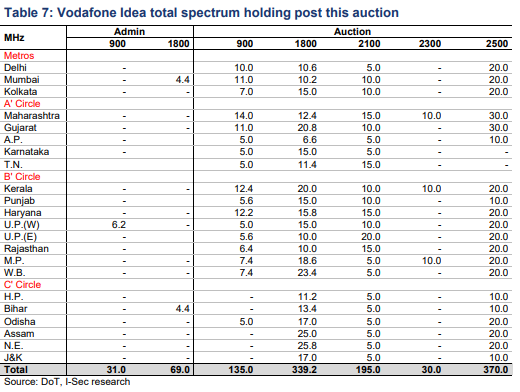

- VIL has strong spectrum holding in mid-band (1,800/2100MHz) and has much lower data throughput. Thus, the spectrum requirement itself was very low and high leverage is also a big barrier for any generous investment.

Motilal Oswal

Spectrum auction ends – telcos on a shopping spree!

The telecom spectrum auction ended after six rounds on Day 2. The key highlights are:

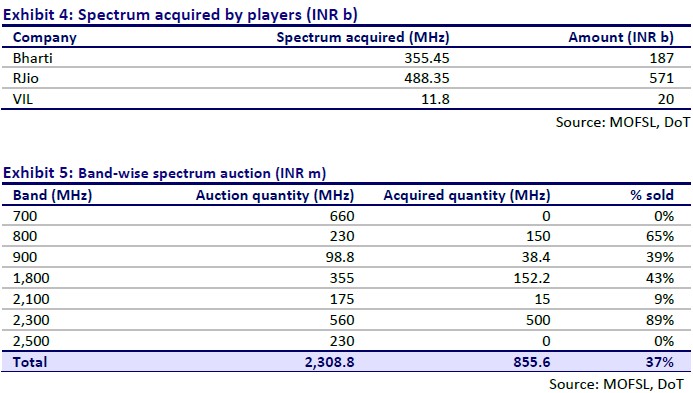

- The government raked in INR778b v/s its expectation of INR450b from the sale of 855.6MHz of spectrum, ~37% of the total 2,308.8MHz put up for auction. This is ~60% higher than the renewal spectrum requirement across telcos.

- This was led by RJio/Bharti, which bought bulk of the spectrum – 35/355.45MHz – for INR571b/INR187b, i.e. 44%/104% higher than that required for renewal. VIL response was muted. It bought spectrum worth INR20b in just five circles (76% lower than that required for renewal).

- The widespread acquisition by RJio/Bharti can be explained by: a) renewal of existing spectrum, b) investment in lower bands to deepen coverage, and c) investment in capacity bands (2,300MHz) to debottleneck networks and prepare for a seamless switch to 5G in the future.

- The government will receive ~INR270b upfront (RJio/Bharti to pay INR199b/INR70b) and the rest after a two-year moratorium.

- Bharti’s commendable execution in the last 12 months, with continued market share gains, gives us confidence that irrespective of a higher-than-expected capex and delayed price increase, it can deliver 18-20% EBITDA CAGR over the next three years, garnering 7-8% FCF generation, led by higher incremental 4G share. Maintain Buy.

- RJio has further strengthened its capabilities. Being the leader, it should benefit as better tariff rates prevail. We maintain our TP of INR900/share.

- VIL’s low participation is evident from its weak liquidity. Its huge debt leaves limited options. Maintain Neutral.

Telcos in shopping mood; response higher than our expectation

- The Department of Telecom received total bids of INR778b (incremental bids of INR6.7b received on 2 Mar’21) v/s the government’s expectation of INR450b.

- This was led by RJio/Bharti, which bought 488.35MHz/355.45MHz of spectrum for INR571b/INR187b. VIL response was muted. It bought spectrum worth INR20b in just five circles.

- Of the total offered spectrum of 2,308.8MHz, right to use has been acquired for 855.6MHz, i.e. 37%. Excluding 700MHz and 2,500MHz, this is ~60% of spectrum.

- In the CY16 auctions, 41%/12% of spectrum was sold by quantity/value to seven bidders, while in this auction 37%/19% was sold to just three participants.

- SUC will be chargeable at 3% of AGR, excluding revenue from wireline services.

Sub-GHz spectrum generated huge interest

- In line with our expectation, the 800MHz band generated the highest interest, with spectrum acquisition of INR375b. This was due to renewal of RJio’s existing spectrum in this band in 19 circles. RJio acquired 133.75MHz v/s expiring spectrum of 115MHz. It renewed higher spectrum in most metro and A circles (Delhi, Mumbai, Maharashtra, Kerala, Karnataka, Kolkata, Tamil Nadu, and West Bengal), while some circles witnessed lesser interest (Gujarat, Punjab, UP East, and UP West).

- Bharti showed interest in sub-GHz spectrum – 800MHz and 900MHz – in line with the management’s guidance. It purchased 16.25MHz spectrum worth INR30b in four circles – Haryana, MP, Maharashtra and UP West – in the 800MHz band.

- It acquired 32.6MHz spectrum across nine circles in the 900MHz band for INR65b. With this, Bharti has established its nationwide coverage using the sub-GHz band, in line with its strategy.

- VIL acquired 5.8MHz in the 900MHz band.

Mid-band raked in over INR180b

- The 1,800MHz band generated significant interest with the acquisition of over 152.2MHz. The higher interest was due to expiring spectrum of both Bharti/VIL and increased interest of RJio. Bharti/RJio/VIL acquired 71.6/74.6/6MHz.

- Bharti purchased spectrum worth INR58b (v/s INR130b required for renewal of spectrum in this band), while RJio spent INR125b. The difference in the amount paid, despite the similar quantity, can be attributed to the higher interest of RJio in metro/Tier I circles like Delhi, Mumbai, Maharashtra, and Gujarat. RJio bought spectrum worth INR69b in these circles – higher than Bharti’s total purchase.

- Bharti has clearly shown restraint where it has sufficient liberalized spectrum available. It did not acquire its expiring spectrum in Gujarat, Haryana, Mumbai, and Maharashtra circles and acquired a lower amount in Kerala, MP, and UP West as it had purchased spectrum in other bands for these circles, except Mumbai where it did not buy any spectrum. Only in Tamil Nadu, it acquired a higher quantity than the expiring spectrum.

- In the 2,100MHz band, Bharti acquired 15MHz across three circles (Assam, North East, and West Bengal) spending INR3.6b.

About 90% of the auctioned capacity sold out

- The 2,300MHz band generated substantial interest, with demand touching ~90% of the auctioned spectrum. The high interest in this band can be explained by: a) need for capacity spectrum as cell site density is at optimum levels for Rjio/Bharti, while data growth continues at an exponential pace, b) Bharti/RJio has a presence in this band, unlike sub-GHz, which is split between 900MHz and 800MHz, c) seamless capability of re-farmed 2,300MHz to 5G, particularly in metros and Tier I circles, which would be the earlier movers to 5G.

- Bharti/RJio bought 220MHz/280MHz of spectrum worth INR30.7b/INR101.7b. The difference in the amount paid is due to RJio’s focus on metro/Tier 1 circles like Delhi, Mumbai, Andhra Pradesh, Karnataka, and Tamil Nadu, where Bharti did not acquire spectrum.

Overall spectrum holding of players

- At the end of the spectrum auction, Bharti holds 27.5/149/303.85/185/790MHz in the 800/900/1,800/2,100/2,300MHz band.

- RJio holds 148.75MHz in the 800MHz band (16% lower than Bharti’s sub-GHz holdings), 221MHz in 1,800MHz (v/s Bharti’s 303.85MHz), and 880MHz in 2,300MHz (v/s Bharti’s 790MHz).

- VIL holds 141.2/355.9/30/195/370MHz in the 900/1,800/2,300/2,100/2,500MHz band.

- Bharti spent INR187b at the auction v/s INR130b required for renewal of spectrum. This would increase its spectrum capex by 44% in FY22E and would reduce its FCF to INR12.6b in FY22E v/s INR75b earlier. Its net debt would increase to INR1,661b from INR1,474b at present (including lease liabilities). We maintain our TP at INR720 per share, ascribing a 10x/6x FY23E EV-to-EBITDA to the India/Africa business. The company’s commendable execution in the last 12 months, with continued market share gains, gives us confidence that in spite of a delayed price increase and higher-than-expected capex it can deliver 18-20% EBITDA CAGR over the next three years, garnering 7-8% FCF generation led by higher incremental 4G share. Maintain Buy with a TP of INR720/share.

- RJio spent INR571b at the auction v/s INR280b required for renewal of spectrum. This would increase its spectrum capex by 103% in FY22E and would reduce its FCF to -INR420b in FY22E v/s -INR133b earlier. Its net debt would increase to INR476b in FY22E v/s current expectations of INR189b. However, the company could easily manage with the amount received through stake sales. We maintain our TP of INR900/share at an FY23E EV-to-EBITDA of 18x. The higher multiple captures an additional revenue opportunity from Digital ventures, which are not factored into our estimates. Maintain Buy.

- VIL spent INR20b at the auction v/s INR86b required for renewal of spectrum (i.e. 76% lower than the renewal amount), given its weak liquidity position. The significant amount of cash required to service its debt, leaves limited upside opportunity for equity holders, despite the higher operating leverage opportunity from any source of ARPU increase. We assign 10x FY23E EV-to-EBITDA to arrive at our target price of INR11/share. Maintain Neutral.

CT Bureau

You must be logged in to post a comment Login