Trends

28% of US smartphone users highly likely to opt for a foldable as next purchase

The foldable smartphone is the latest big innovation in the smartphone space, both in terms of hardware and software. The installed base of foldable smartphones in the US stood at 4.7 million in 2022, according to Counterpoint Research. To better understand opinions and preferences in the US around foldable smartphones, Counterpoint Research conducted a consumer study in the country. Some key insights from the survey:

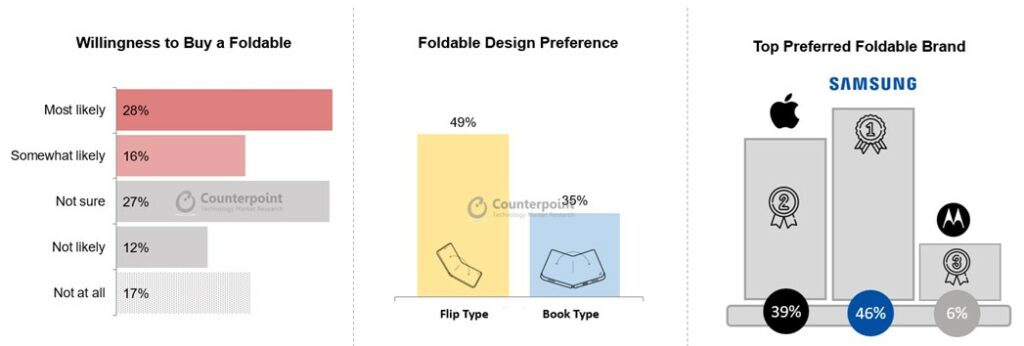

- 28% of current smartphone users are highly likely to prefer a foldable smartphone as their next purchase.

- Samsung is the most preferred brand for foldable purchase for 46% of the respondents, followed by Apple with 39% and Motorola with 6%.

- Samsung has the highest stickiness in terms of foldable preference, with 92% of Samsung users planning to stick with the same brand when making a foldable smartphone purchase.

- 49% of the respondents ranked the flip-type foldable at the top, followed by the book-type foldable.

- More than half of the male respondents prefer the flip-type foldable, whereas the preference for the flip-type foldable is slightly lower among the female respondents at 47%.

- On the other hand, the preference for the book-type foldable is stronger among female respondents (40%) than male respondents (30%).

- Respondents from a higher income bracket are more likely to purchase a foldable phone, with those having a monthly income of $10,000 and above most likely (41%) to opt for a foldable as their next smartphone purchase.

Commenting on the survey findings, Associate Director of North America research Hanish Bhatia said, “Foldables have performed better in controlling the shift from Android to iOS. However, we don’t expect foldables to become the dominant form factor anytime soon in the US. Foldables will continue to co-exist with the candy bar design for years to come. We have seen different experiments with form factor in the past (namely LG Wing and LG G8X Dual Screen), but Samsung’s foldable devices have been the most successful by far.”

Research Director of North America Jeff Fieldhack added, “Samsung remains the first choice for foldable smartphones in the US. However, there is a lot of vacuum and excitement among consumers for a foldable iPhone, which is evident in the survey. Motorola and other Android OEMs are also warming up to the foldable form factor to get a slice of the premium smartphone market in the US. Our US smartphone switcher data shows a large portion of Galaxy foldable users were originally Galaxy Note users, but foldables have not completely replaced the demand for Note series as some Note users shifted toward the Galaxy S series.”

The foldable market is experiencing rapid growth in sales and is expected to continue growing in the coming years with the entry of more OEMs and developments around foldable technology. In 2022, the foldables category occupied 1.1% of global smartphone shipments, but it scored a vital presence in the ultra-premium segment, taking about 7% of shipments of smartphones priced above $800. According to Counterpoint Research’s Global Foldable Smartphone Market Forecast, Q3 2022, the global foldable smartphone market is expected to reach 22.7 million units in 2023.

In the US, the high prices of foldable smartphones have essentially kept out young users from the market. High-income middle-aged American users have been the primary users of foldable smartphones. A more affordable price tag would expand the target user base. Experimentation with quirky colors has also drawn interest from female users, especially in the flip form factor. Although flip and fold remain the most popular foldable form factors, OEMs have showcased foldable prototypes with rollable, expandable and three-fold displays. Apart from the convenience of portability, foldables enhance user experience through immersive display, better selfies through the rear camera, and multitasking. But durability concerns and utility have also resulted in limited adoption of the devices.

Given the US smartphone market’s ASP and foldable phones’ price range, foldables could capture a significant share of the overall US smartphone market. Carrier subsidies remain key to premium device sales in the US, but durability, new features and the entry of other prominent players are important factors to boost the adoption of foldable phones.

CT Bureau

You must be logged in to post a comment Login