CT Stories

2022 – A pivotal year for digital transformation

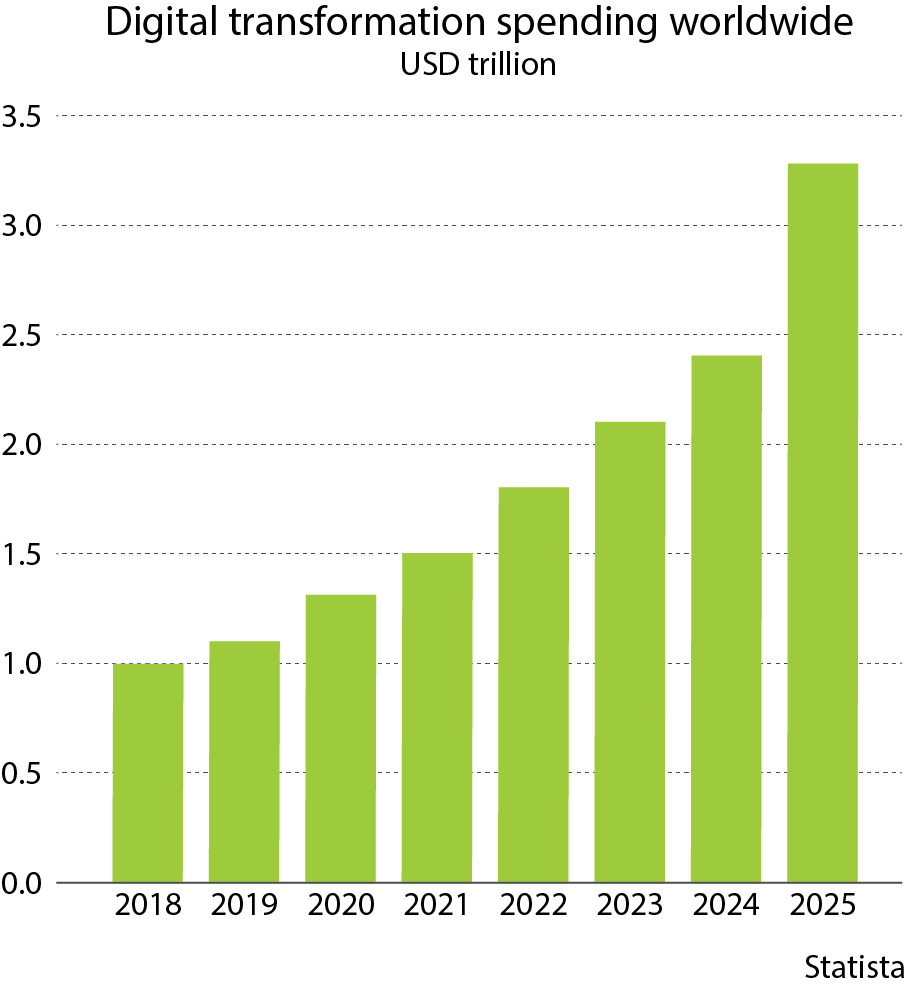

Digital transformation is nothing but embracing the latest technologies and promoting digitization. Right? Wrong! Digital transformation is deeper than we think and broader than we know. It is one of the most prominent strategies that is growing and transforming the conventional landscape of technology. This market is expected to reach USD 3294 billion by 2025. An eye-popper indeed!

The pandemic was a wake-up call, and executives must accept that pandemic-induced changes in strategy, management, operations, and budgetary priorities are here to stay. Accelerated investment is coming in digital tech, transformation, and cloud adoption.

Many manufacturers were blindsided by recent external disruptions to business. Now they are looking to update their systems and processes to become more resilient, more customer-focused, and more profitable.

In a recent survey of manufacturers by Futurum Research, 67 percent of respondents said their organization had to rethink their entire business model in light of the pandemic. Eighty percent said they do not expect a return to business as usual after the pandemic ends.

Industry must now create the recently impossible as they focus on their digital transformation strategies for 2022 and beyond. Decisions need to be purposeful. Digital transformation today must be about synthesizing data and making it dance.

Emerging technologies from two or three years ago are now available. Edge computing, artificial intelligence (AI), 5G data transmission, and other technologies allow manufacturers to rewrite the strategies of digital transformation. What must be done now is to de-risk and complete the transformation.

In Gartner’s words, digital transformation companies and service providers are “strategy and transformation consulting services supporting senior business stakeholders, such as CEOs, COOs, CMOs and other business leaders. DTC particularly helps these leaders in efforts to leverage digital technologies that enable the innovation of their entire business or elements of their business and operating models.”

The digital transformation market is moderately fragmented.Key players include Accenture, Google, Siemens, IBM, Microsoft, Cognex, Hewlett Packard, SAP, EMC, Oracle, and Adobe.

eWeek has ranked the best ten digital transformation companies as Accenture, Boston Consulting Group, Capgemini, Cognizant, Deloitte, EY, HCL, KPMG, McKinsey & Company, and PwC, and recommends hiring these experts that can assist in creating and implementing digital strategy.

The players have adopted various growth strategies, such as partnerships, agreements, and collaborations, and new product launches and product enhancements to further expand their presence in the market and broaden their customer base.

In October 2021, Siemens Smart Infrastructure acquired Wattsense, French hardware and software firm that provides a plug-and-play IoT management system for small and mid-size buildings, bringing Siemens’ building product line to a new level. Wattsense was founded in 2017 and is based in Dardilly, France, near Lyon.

In August 2021, Kubota Corporation formed a strategic partnership with Accenture to accelerate its ongoing digital transformation by evolving its business model to further contribute to food, water, and environmental sustainability solutions.

The partnership will enable the creation of a platform for Kubota, both locally and globally, by incorporating services that combine Accenture’s digital technologies, including AI and the IoT.

In June 2021, Deutsche Bank partnered with Oracle Corporation to modernize its database technology and accelerate its digital transformation. Oracle will help Deutsche Bank to upgrade its existing database systems, and migrate the bulk of its Oracle Database estate to Oracle Exadata Cloud Customer, an on-premises deployment option of the Oracle Exadata Cloud Service to support applications that either will not move to the public cloud or may in the future. This will provide a dedicated platform to support and scale the bank’s existing mission-critical systems and services, including trading, payments processing, risk and capital planning, and regulatory reporting.

In April 2021, Adobe Systems Inc. partnered with FedEx to integrate Adobe Commerce with ShopRunner, a leading eCommerce platform and a subsidiary of FedEx Services. The integration will give Adobe merchants access to FedEx post-purchase logistics intelligence, which will help them drive demand, reduce cost, and gain customer insights.

While most DX projects remained on track in 2020 and into 2021 during the pandemic, IDC forecasts DX technology investments to accelerate in 2022, with a renewed drive toward more long-term strategic digital objectives. Beyond operational DX investments, customer experience is garnering some of the largest DX technology investments from consumer-oriented industries, such as securities and investment services, banking, and retail.

Organizations allocate their DX investments toward a number of strategic priorities that align with what they expect to accomplish over an extended period in pursuit of their digital mission. Many of these priorities coalesce around operational objectives, including back-office support and infrastructure for core business functions, such as accounting and finance, human resources, legal, security and risk, and enterprise IT. Similarly, innovate, scale, and operate priorities refer to a broad area covering large-scale operations, including making, building, and designing activities. Core business functions comprising this area include supply chain management, engineering, design and research, operations, and manufacturing plant floor operations. Finally, customer experience is a specific area covering all customer-related functions and related technologies supported by DX. Core business functions comprising this area include customer services, marketing, and sales. While the back-office support and infrastructure and innovate, scale, and operate priorities will see significantly larger spending totals throughout the forecast, customer experience investments will see faster investment growth.

The DX use-cases – discretely funded efforts that support a particular program objective – that will receive the most spending will be spread across the three strategic priorities. Investment in robotic manufacturing will grow to USD 120.6 billion in 2025, followed by autonomic operations and 360-degree customer and client management at USD 90.9 and USD 74.7 billion, respectively. The DX use-cases with the fastest spending growth will be virtualized student workspaces (43.8 percent CAGR), mining operations assistance (39.1 percent CAGR), and augmented design management (34.5 percent CAGR).

The industries that will see the largest DX spending throughout the period, 2022-2025 are discrete and process manufacturing, followed by professional services and retail. Combined, the two manufacturing industries will account for nearly 30 percent of all DX spending, totaling more than USD 816 billion in 2025. The industries that will experience the fastest growth in DX spending over the three years are construction (21.0 percent CAGR), securities and investment services (19.2 percent CAGR), and banking (19.0 percent CAGR).

By technology, the market may be viewed as industrial robotics, Internet of Things (IoT), 3D printing/additive manufacturing, advanced human machine interface, big data and analytics, ML, and AI.

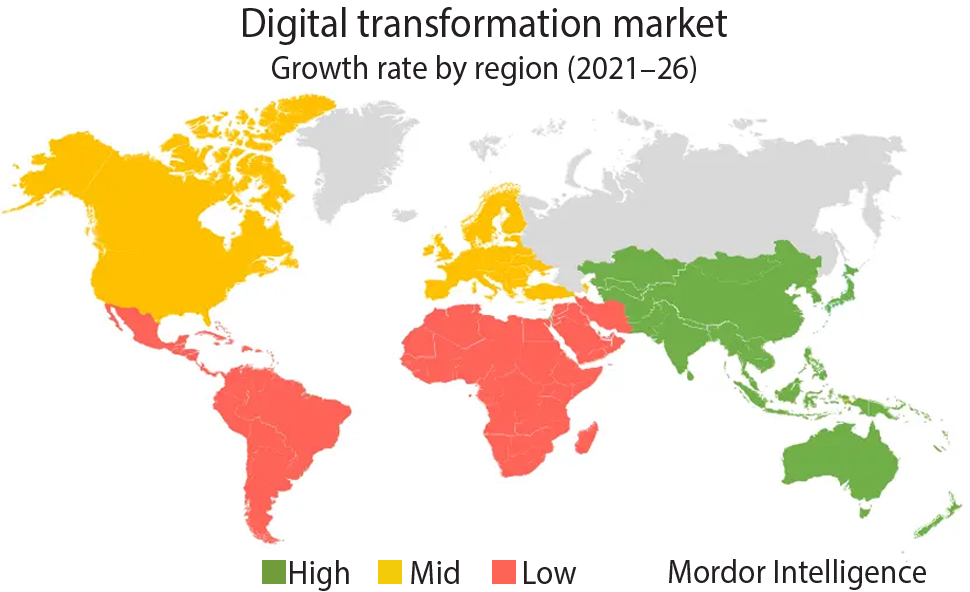

The United States will be the largest geographic market for DX spending, delivering roughly one-third of the worldwide total throughout the forecast. Western Europe will be the second-largest region for DX spending, followed closely by China. China will also deliver the strongest year-over-year (YoY) growth in DX spending with a five-year CAGR of 18.4 percent. Latin America will be the region with the second-fastest growth with a 17.5-percent CAGR.

“By 2025, DX spending in Europe will reach USD 653 billion, which is more than double the amount spent in 2020. Moreover, by 2023, DX spending will overtake non-DX spending, confirming the strong commitment of European companies toward digital transformation,” said Angela Vacca, senior research manager, European Industry Solutions, Customer Insights & Analysis, IDC. “In this context, European finance, healthcare, and professional services companies will grow their DX spending the most with strong variations across use-cases as priorities keep shifting with recovery mostly in place, and companies consequently moving away from emergency needs to more strategic and longer-term bets.”

The only person who can make the desired level of sustained change happen is the CEO. An inconvenient truth for businesses undertaking digital transformations is that without focused and active CEO commitment, there is almost no chance of success. That is because a digital transformation is a business-model reinvention that requires different functions across the organization to work together in new ways, and can happen only through large-scale investments in building an entirely new set of capabilities.

McKinsey has worked with more than 100 large incumbent companies over the past ten years and the work on digital transformations has shown that there is a playbook for success to guide CEOs in focusing their interventions.

Reimagine value and be clear about how to get it. The point of a digital transformation is not to become digital; it is to generate value for the business. Successful CEOs are able to look past their current business to reimagine where transformative value is possible. They spend a lot of time visiting companies and keeping up with trends and emerging business models. That helps them see what is possible and look at their own assets with fresh eyes.

They also focus transformation efforts on domains – a complete core process or user journey, such as opening an account. This guards against the all-too-common pitfall in which a digital transformation devolves into a disconnected set of activities that do not add up to substantive change. In tandem with the company’s top team, the successful CEO works through all the most important elements of a transformation at the domain level – talent, tech and data, operations – to produce a detailed roadmap for action.

Make the company attractive to top talent. Successful CEOs help their organization address the role of corporate culture and purpose in attracting and keeping exceptional talent. While money is important, those with top digital skills also want to hone their craft on cutting-edge technology and solve problems they perceive as meaningful. The CEO can drive changes in the company’s culture and processes to appeal to them, work with the CHRO to create flexible career pathways where they can grow their skills and progress professionally, and – perhaps most crucial – develop and communicate the company’s higher purpose.

Digital CEOs recognize that data and technology are core competitive differentiators, and they run their business that way. The most successful CEOs prioritize tech and data in two ways. First, they obsess about how to apply tech and data to solving business problems or finding new opportunities. Second, they make organizational changes to ensure tech and data are embedded in the business.

Speed matters in digital, and the CEO can set the tempo in many ways, such as through more frequent allocations (of talent and funding, for example) and reviews of progress against the road maps. The best-performing companies, in fact, review data, share findings, and reallocate talent more often than their peers.

But the most challenging CEO task is fomenting a culture that values doers and small teams of top people. A small team of exceptional people working in agile ways delivers significantly more impact than an army of average talent. CEOs are successful in developing this working model when they simplify funding, clarify governance and decision rights, and put in place clear goals but give teams the freedom to determine how best to deliver on them.

Making digital “stick” at scale is challenging because of the knock-on effects, which require the business to continually recalibrate and realign to capture all the available value, something only the CEO can do. It is crucial for the CEO to ensure that business owners, not just the digital and technology leaders, are accountable for the adoption of digital solutions and the delivery of the targeted value. A rule of thumb is that for every dollar spent on digital, another dollar should be spent on adoption.

To help make these interventions, successful CEOs have a clear view of what metrics to track as well as a process for tracking them easily and reporting on progress. One mistake CEOs make is that they address adoption and scaling issues only well after the digital transformation has begun. Successful CEOs, in contrast, are as passionate about adoption as they are about strategy. They invest time upfront in making sure that the people actually using the solutions – from customers to employees on the front lines – have a clear voice in the development process.

IBM agrees. This IBV Trending Insights report makes one overwhelming conclusion – Post-Covid-19, the reality for businesses has radically shifted.

The company’s research suggests five key epiphanies from leading executives for the post-pandemic business landscape, offering new perspectives on digital transformation, the future of work, transparency, and sustainability. Together, they provide a playbook for proactive leaders who understand that old ways of working are gone.

Epiphany 1: Digital transformation was never just about the technology. Anecdotal tales of game-time pivots – moving swarms of workers to remote platforms, rethinking and remaking supply chains, shifting manufacturing to produce in-demand personal protective equipment – are not just near-term business contortions. Adaptability is now a mandatory business competency, and an accelerated pace of change has become normal.

This culture shift is in part defensive – reducing costs is the top benefit attributed to transformation initiatives.

But something bigger and more long-lasting than crisis management is underway. Before the pandemic, many organizations seemingly distrusted their own technological capabilities and doubted the skills of their own workforces. Yet, in the blur of this year’s pandemic-induced reactions, those anxieties proved largely unfounded.

Reliance on tech platforms became more acute, and those platforms – along with the corporate teams who use them – delivered results. It is not that new tech was suddenly discovered and implemented; rather, the tools already at hand were deployed to fuller potential. Previous barriers to implementation were unceremoniously shoved aside, and those who moved first saw nearly immediate results.

The Covid-19 pandemic has forever altered how organizations around the world operate. The pandemic has resulted in permanent changes to organizational strategy, Covid-19 has adjusted the approach to change-management and accelerated process automation, with a shift to more cloud-based business activities.

Defining a different normal. Organizations made big changes in response to the pandemic – and there is no going back. Executives have become more trusting of what technology can do, and they are pushing ahead with digital transformation.

Epiphany 2: The human element is the key to success. While executives plan to expand almost all tech competencies during their future digital transformations, the secret to success lies in human resources.

But remarkably, these factors seem to have eluded executives. More than three-quarters of executives expect changed customer behavior to continue after Covid-19, trading face-to-face contact for more shopping and customer-service interactions online. Customer experience management will be a high priority over the next two years. And yet, improved customer service sits in the bottom-half of the list of benefits that executives seek from digital transformation.

If executives are conflicted about how they are connecting with customers, they are doing even worse with their employees. While workforce safety, skills, and flexibility are important, employee satisfaction has been deprioritized. Executives recognize that their employees have been under intense pressure, and they contend that employee well-being is among their highest priorities.

But research highlights a gaping chasm between what executives think they are offering their employees and how those employees feel – employers significantly overestimate the effectiveness of their support and training efforts. Only about half of the employees say they believe that their employer is genuinely concerned about their welfare. Clearly, there is a massive opportunity for leaders who can get this right, when most seem to be struggling.

Epiphany 3: Traumatic stress has hijacked corporate strategy. Executives are tasked with defining their organizations’ vision. But it can be hard to focus if they are continually putting out fires. While workforce safety and resilience, cost management, and organization agility emerge as top priorities for the short and longer term, the pandemic has amplified old business fears and introduced new ones. The result? Executives are enamored with the priority du jour.

So, everything is important. Everything except improving the customer experience – the one thing that can help drive performance and growth when the competition is lost in the fog.

Epiphany 4: Some will win. Some will lose. But few will do it alone. The Covid-19 pandemic has not impacted all organizations and industries equally. This situation mirrors what some economists have described as a K-shaped consumer environment, where some thrive and others languish. The bifurcation in the stock market – where the biggest consumer tech platforms have steamed ahead while other shares drop – is just one indication of this divide.

Businesses are partnering up. Executives increasingly see platforms, ecosystems, and partner networks as key success factors.

The critical distinction here is that scale alone does not predict above-industry performance. Large enterprises that can operate with agility have been the ones to remain steady (in a troubled sector) or outperform. The melding of size and flexibility is the defining characteristic of those poised for success.

Epiphany 5: Health is the key to sustainability. Before coronavirus, sustainability strategies were largely centered on environmental issues – the risks to planetary health from pollution, climate change, and the like. Consumers were increasingly choosing products and brands that demonstrated authenticity in these areas, inspiring passion and allegiance. Regulators were echoing those concerns and priorities, as well.

Yet, faced with a human health crisis, environmental sustainability became joined with issues of personal safety. Consumers have been wearing disposable masks and gloves and opting for more individual packaging than ever. To protect themselves and their loved ones from the virus, they have been receiving delivered goods to avoid going out in public. These actions seemingly pit protecting human health against protecting the planet.

But consumers’ passion for environmental issues remains. In fact, health and safety have been conjoined in a new, expanded, and more complex definition of sustainability. New burdens are already appearing for corporations, as they must make good on existing sustainability goals – reduced carbon footprints, more efficient waste management, or otherwise – while simultaneously meeting new health-and-safety requirements.

Organizational complexity remains the biggest hurdle to progress. More than twice as many executives mention it as a barrier today as in the past. Another related obstacle – employee burnout. Data indicates that employees feel tired and overloaded, potentially as a reflection of that complexity.

All of this affords a new opportunity to build better businesses and a better world. It starts with enabling a diverse workforce to perform optimally – and building trust and confidence among employees will be critical. How they are treated now will have an outsize impact on perceptions and value in the future.

So how can companies accelerate their digital transformation? The answer lies in creating a vision for the future and steadily building the capabilities – technological and human – that let you achieve it.

It does not happen in one fell swoop. Transformations succeed when they are incremental, cost-effective, and sustainable. That means focusing on outcomes – new products, improved processes, and other use-cases that, one by one, let you build capabilities, business value, and buy-in for the transformation.

Although the term digital transformation has served an important purpose of focusing the attention of business leaders and the IT services and consultancies working with them, it has been among the most overused phrases of the last 10 years in technology. At the start of 2022, no one will need to be reminded that technology – digital – can drive transformation.

Business transformation is returning to the forefront for enterprises as a result of the pandemic, the advantages of emerging technologies, and the generational shift in the C-Suite, with newly promoted decision-makers fully soaked in all the possibilities of technology.

The shift from digital transformation to business transformation will accelerate in 2022, amid the change in buyers and as digitally mature businesses are more inclined to bring technology talent in-house. These trends, along with the return to in-person workplaces and a resurgence of innovation and transformation centers, will create opportunities for leading IT services vendors and consultancies to separate from the pack by expanding managed services, returning clients to in-person creative sessions, and shifting away from technology-first mindsets.

2022 will be a pivotal year for digital transformation… perhaps its last.

You must be logged in to post a comment Login